Can the options Max Pain theory help predict stock price movements?

Does options Max pain theory work? When it comes to investing in the stock market, understanding and predicting stock price movements can make a big …

Read Article

IFRS 2, also known as the International Financial Reporting Standard 2, is a global accounting standard that deals with share-based payment arrangements. Under this standard, companies are required to account for share-based payment transactions, such as employee stock options or share-based payment awards, in their financial statements.

One important aspect of IFRS 2 is the treatment of non-vesting conditions. Non-vesting conditions are conditions that must be met in order for an employee to receive the shares or options granted to them. These conditions can vary widely, and may include performance targets, service requirements, or specific market conditions.

Understanding non-vesting conditions is crucial for both companies and investors, as they have a direct impact on the recognition, measurement, and disclosure of share-based payments. This comprehensive guide aims to provide a detailed overview of non-vesting conditions in IFRS 2, covering key concepts, accounting treatments, and disclosure requirements.

Throughout this guide, we will delve into the various types of non-vesting conditions, the criteria for recognizing and measuring share-based payments, and the implications of non-vesting conditions on financial statements. We will also discuss the importance of transparent and comprehensive disclosures, and how companies can ensure compliance with IFRS 2.

IFRS 2 is an international accounting standard that focuses on the accounting treatment of share-based payment transactions. One important aspect of IFRS 2 is the recognition and measurement of equity-settled share-based payment transactions.

Equity-settled share-based payment transactions are transactions where an entity receives goods or services as consideration for equity instruments of the entity (e.g., shares or share options). These transactions are typically used as a form of employee compensation.

Under IFRS 2, equity-settled share-based payment transactions are measured at the fair value of the goods or services received. However, the fair value is recognized over the vesting period of the equity instruments, which is the period during which the employees are required to provide services in order to become entitled to the equity instruments.

In some cases, the vesting period for equity instruments may be subject to certain non-vesting conditions. Non-vesting conditions are conditions that must be satisfied for the employees to become entitled to the equity instruments. These conditions may include reaching a specific performance target, the occurrence of a future event, or the continuation of employment for a certain period.

When non-vesting conditions exist, IFRS 2 requires that the fair value of the equity instruments should be recognized over the expected vesting period, taking into consideration the probability of the non-vesting conditions being met. This requires an estimate of the probability of the non-vesting conditions being satisfied based on the best available information at the measurement date.

If it is probable that the non-vesting conditions will be satisfied, the fair value of the equity instruments is recognized over the expected vesting period. If it is not probable, the fair value is recognized as an expense immediately.

Understanding non-vesting conditions in IFRS 2 is essential for entities that use equity-settled share-based payment transactions as a form of employee compensation. Proper recognition and measurement of these transactions is crucial for providing accurate financial information and ensuring compliance with international accounting standards.

Read Also: Understanding Deferred Ordinary Shares: Everything You Need to Know

In this comprehensive guide, we aim to provide a detailed understanding of non-vesting conditions in IFRS 2. Non-vesting conditions refer to the conditions that must be met by employees to be eligible for the vesting of their share-based payment awards.

Under IFRS 2, non-vesting conditions can have a significant impact on the recognition, measurement, and presentation of share-based payment transactions. It is important for companies to properly identify and evaluate non-vesting conditions in order to comply with the requirements of the standard.

Non-vesting conditions can vary depending on the terms and conditions of the share-based payment arrangements. They can include both service conditions and performance conditions. Service conditions typically require employees to complete a specified period of service in order to be eligible for the vesting of their share-based payment awards.

Performance conditions, on the other hand, require employees to achieve certain performance targets or objectives before they can vest their share-based payment awards. These conditions may be related to the performance of the individual employee, the performance of a business unit, or the overall performance of the company.

Read Also: Understanding 1.00 Lot Size in Forex Trading: A Comprehensive Guide

IFRS 2 provides detailed guidance on how to account for non-vesting conditions. The standard requires companies to estimate the probability of meeting non-vesting conditions and consider this probability in the measurement of the share-based payment awards. This can be a complex and judgmental process, as it requires companies to assess the likelihood of meeting the non-vesting conditions based on both historical and future information.

Furthermore, IFRS 2 requires companies to reassess the probability of meeting non-vesting conditions at each reporting date and adjust the measurement of the share-based payment awards accordingly. This ensures that the financial statements reflect the most up-to-date information about the likelihood of the awards vesting.

In conclusion, understanding non-vesting conditions in IFRS 2 is crucial for companies that have share-based payment arrangements. It is important to properly identify and evaluate non-vesting conditions in order to comply with the requirements of the standard and accurately account for share-based payment transactions.

IFRS 2 is an international accounting standard that sets out the requirements for recognizing and measuring share-based payment transactions. It applies to transactions in which an entity receives goods or services in exchange for equity instruments of the entity, or acquires goods or services by incurring liabilities to the supplier of those goods or services that are based on the price of the entity’s equity instruments.

Non-vesting conditions are conditions that must be satisfied before the counterparty has the right to receive equity instruments granted under a share-based payment arrangement. These conditions are typically based on future performance targets, such as achieving specified revenue or profit targets, or on the counterparty remaining in the service for a specified period of time.

Non-vesting conditions impact the recognition of share-based payments because they affect the entity’s assessment of whether the counterparty has received the goods or services in exchange for the equity instruments. If the non-vesting conditions are not satisfied, the entity may need to reverse any previously recognized expense and liability related to the share-based payment.

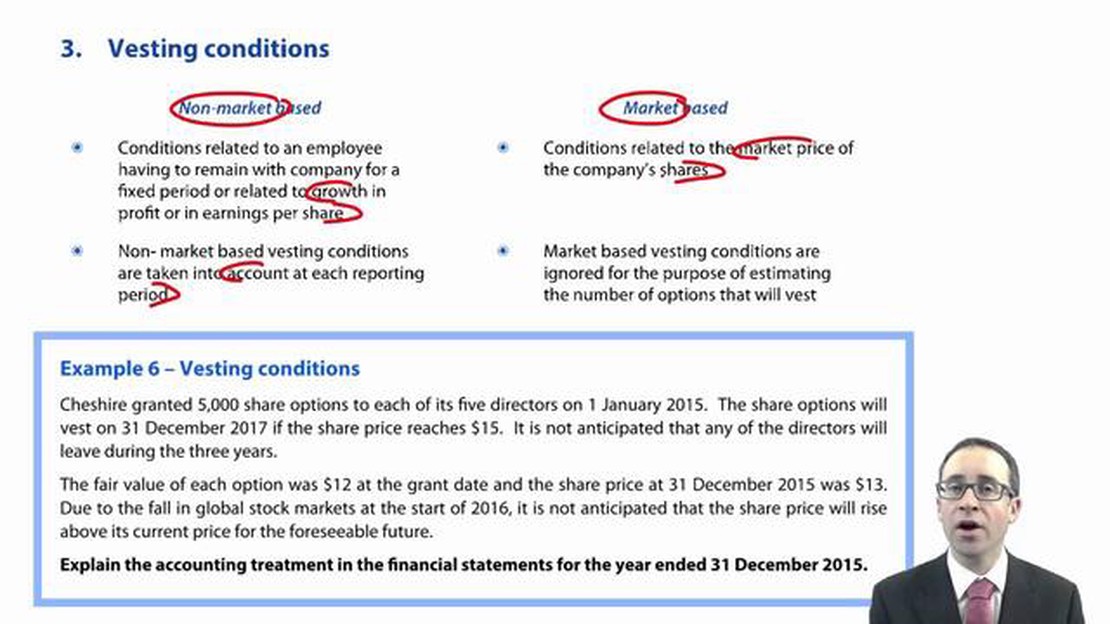

Vesting conditions and non-vesting conditions are two types of conditions that may be included in a share-based payment arrangement. Vesting conditions are conditions that must be satisfied before the counterparty has the right to exercise the equity instruments and become the legal owner of the shares. Non-vesting conditions, on the other hand, must be satisfied before the counterparty has the right to receive the equity instruments, but they do not affect the counterparty’s legal ownership of the shares.

Non-vesting conditions are measured and recognized by assessing the probability of satisfying these conditions and incorporating this probability into the fair value of the equity instruments. If it is probable that the conditions will be satisfied, the fair value of the equity instruments is recognized as an expense over the vesting period. If it is not probable that the conditions will be satisfied, no expense is recognized, and any consideration paid is accounted for as a liability until the conditions are satisfied.

IFRS 2 is a financial reporting standard that deals with share-based payment transactions. It sets out the accounting requirements for such transactions, including the recognition, measurement, and presentation of share-based payment transactions in financial statements.

Does options Max pain theory work? When it comes to investing in the stock market, understanding and predicting stock price movements can make a big …

Read ArticleUnderstanding Forex Investment: A Guide to the Foreign Exchange Market Have you ever wondered what Forex investment is all about? How can people make …

Read ArticleUSD JPY: Is the Currency Pair Going Down? The USD JPY currency pair has seen some significant fluctuations in recent months, leaving many investors …

Read ArticleUnderstanding Autoregressive and Moving Average Models Autoregressive (AR) and Moving Average (MA) models are two commonly used time series models in …

Read ArticleBest Settings for EMA When it comes to trading on the financial markets, having a solid strategy is crucial. One popular indicator that traders use to …

Read ArticleIs AIMS Forex Legit? AIMS Forex, a popular trading platform, has gained attention from both experienced and new traders. However, with the vast number …

Read Article