Choosing the Best Moving Average: A Comprehensive Guide

Which Moving Average is the Best to Use? When it comes to technical analysis, moving averages are a popular tool used by traders and investors to …

Read Article

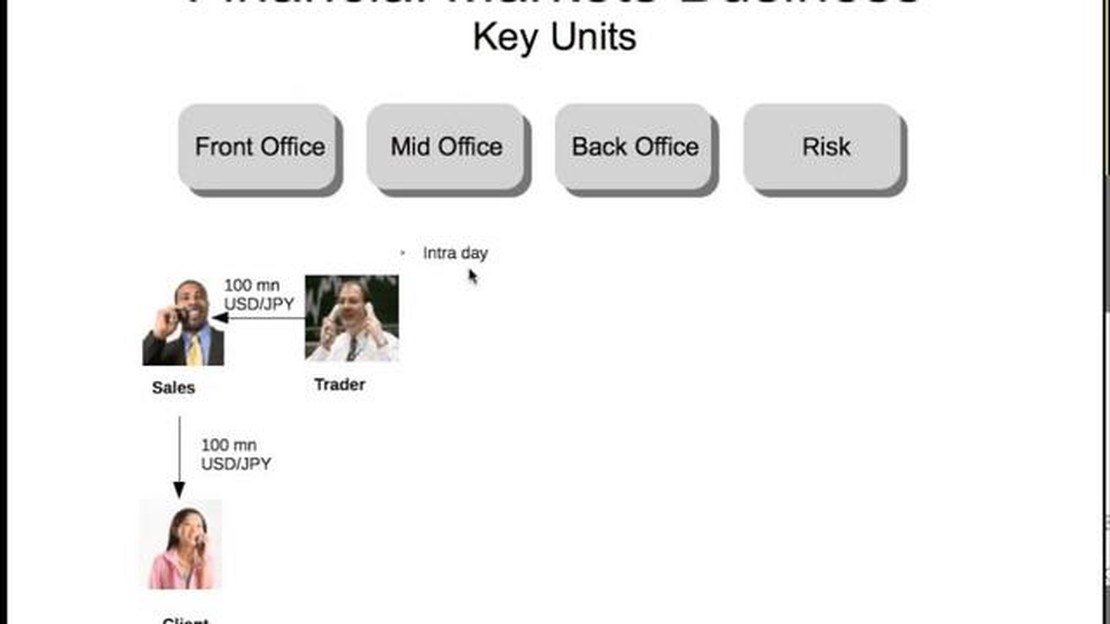

When it comes to trading in financial markets, the front office plays a crucial role in executing trades and generating revenues for firms. The front office is responsible for various tasks such as market research, trade execution, risk management, and client relations. It is the face of the firm to clients and plays a vital role in driving profitability.

The front office is composed of different departments, including sales, trading, and research. The sales team is responsible for building and maintaining relationships with clients, while the trading team executes trades on behalf of the clients. The research team provides valuable insights and analysis on market trends and trading opportunities.

In order to succeed in the front office, professionals need to have a strong understanding of financial markets, an ability to analyze data and trends, and excellent communication and negotiation skills. They need to stay updated with the latest market news and be able to provide clients with actionable investment advice.

Moreover, the front office operates in a highly regulated environment, and professionals need to comply with various rules and regulations enforced by regulatory bodies. They need to ensure that all trades are executed in a fair and transparent manner, and that clients’ interests are protected.

Overall, the front office is an essential part of trading operations and plays a critical role in generating revenues for financial firms. Its responsibilities range from executing trades to maintaining client relationships and managing risks. The individuals working in the front office need to possess a unique set of skills and knowledge to excel in this fast-paced and highly competitive industry.

In the trading industry, the term “front office” refers to the department or team responsible for the direct revenue-generating activities of a financial institution. It is often considered the “face” of the company as it directly interacts with clients and executes trades on their behalf.

The front office is primarily focused on four key functions:

Overall, the front office plays a crucial role in trading by facilitating smooth and profitable transactions for clients and the firm. Its effectiveness and efficiency are crucial for maintaining the firm’s reputation, attracting and retaining clients, and generating revenue.

The front office plays a crucial role in trading activities. It is responsible for executing trades, managing client relationships, and generating revenue for the trading desk. Without a strong front office, a trading operation would struggle to operate efficiently and effectively.

Read Also: How do I report F& related issues? - A comprehensive guide on reporting F& issues

One of the primary roles of the front office is to execute trades. This involves entering trade orders into the system, monitoring their execution, and ensuring that trades are completed in a timely manner. The front office also works closely with traders to provide them with the necessary information and support to make informed trading decisions. By executing trades efficiently, the front office helps to maximize trading profits and minimize losses.

In addition to executing trades, the front office is responsible for managing client relationships. This involves engaging with clients, understanding their needs and preferences, and providing them with personalized service and support. Building and maintaining strong relationships with clients is essential for a trading operation, as it helps to attract and retain clients, and ultimately drive revenue.

The front office also plays a key role in generating revenue for the trading desk. This is done through various activities, such as identifying and pursuing new trading opportunities, analyzing market trends and conditions, and implementing trading strategies to capitalize on market opportunities. By generating revenue, the front office contributes to the profitability of the trading operation.

In summary, the front office is integral to the success of a trading operation. It is responsible for executing trades, managing client relationships, and generating revenue. Without a strong front office, a trading operation would struggle to operate efficiently and effectively, making the front office a crucial component of the trading process.

The front office in trading plays a crucial role in the overall functioning of financial institutions. It is responsible for all the revenue-generating activities and acts as a bridge between the clients and other departments within the organization.

One of the primary responsibilities of the front office is to ensure smooth and efficient trading operations. This involves executing trades on behalf of clients, monitoring market conditions, and making timely decisions to maximize profits. The front office also handles order flow management, which involves routing client orders to the appropriate trading desks.

Read Also: How to Manually Draw a Trend Line: Step-by-Step Guide

In addition to executing trades, the front office is also responsible for providing clients with market information and analysis. This helps the clients make informed investment decisions and enhances their trading experience. The front office also acts as a point of contact for clients, addressing any queries or concerns they may have.

Moreover, the front office is involved in risk management by closely monitoring market volatility and exposure to different types of risks. It collaborates with the risk management department to develop and implement risk mitigation strategies. This ensures that the organization is protected from potential losses and can operate in a secure and sustainable manner.

Overall, the front office plays a pivotal role in trading by ensuring efficient execution of trades, providing market information and analysis to clients, managing risk, and optimizing profitability. Its ability to effectively communicate and collaborate with clients and other departments within the organization is crucial in achieving successful trading operations.

The front office is responsible for executing trades and generating revenue for the company. They work closely with clients and make decisions based on market analysis. They also manage risk and set trading strategies.

Working in the front office of a trading firm requires strong analytical and quantitative skills, along with a deep understanding of financial markets. Good communication and interpersonal skills are also important, as front office professionals frequently interact with clients.

The front office plays a crucial role in a trading firm’s success by executing trades, generating revenue, and managing risk. They are responsible for identifying profitable trading opportunities and making quick decisions in a volatile market.

The front office faces various challenges, such as market volatility, regulatory changes, and competition. They need to stay updated with market trends and regulations and be able to adapt their trading strategies accordingly.

Technology has greatly impacted the front office in trading. It has made trading faster, more efficient, and has enabled the use of complex trading algorithms. However, it has also increased competition and the need for continuous technological innovation.

Which Moving Average is the Best to Use? When it comes to technical analysis, moving averages are a popular tool used by traders and investors to …

Read ArticleForex Code for Russian Ruble: RUB Are you interested in trading the Russian ruble on the foreign exchange market? If so, you’ll need to know the forex …

Read ArticleUnderstanding the X12 Seasonal Adjustment Model Accurate data analysis is crucial in many fields, from economics and finance to marketing and …

Read ArticleDeposit Cash Money: Step-by-Step Guide Depositing cash money is a convenient and secure way to manage your finances. Whether you need to deposit money …

Read ArticleIs forex a skill or luck? Forex trading is a complex and highly competitive financial market where traders buy and sell currencies in the hopes of …

Read ArticleLearn How to Use ADX If you are a trader in the financial markets, you know how crucial it is to have a reliable and efficient trading strategy. One …

Read Article