Understanding Moving Averages for a 5 Minute Time Frame

What is the moving average for a 5 minute time frame? When it comes to analyzing data in the financial markets, moving averages are a popular and …

Read Article

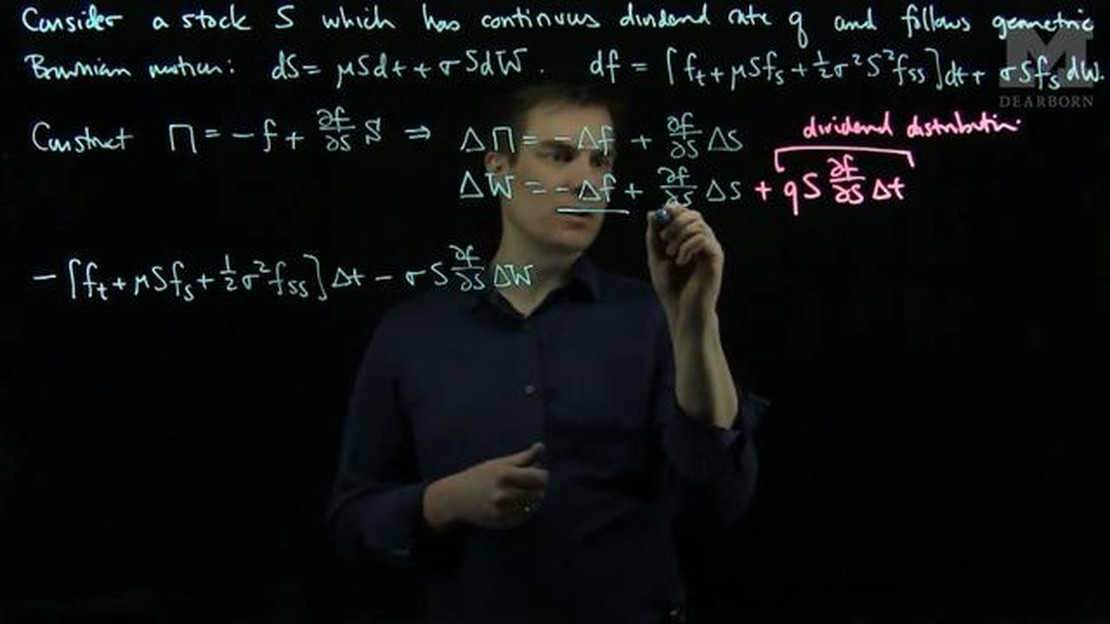

The Black Scholes Model is a mathematical formula used to calculate the price of financial derivatives, particularly options. It was developed by economists Fischer Black and Myron Scholes in 1973 and builds upon the work of economist Robert C. Merton.

The model assumes a log-normal distribution of stock prices and takes into account the variables of stock price, time to expiration, strike price, risk-free rate of interest, and volatility. By inputting these variables, the model is able to determine the fair value of an option.

One of the key assumptions in the Black Scholes Model is that dividends are not paid during the life of the option. However, in reality, many companies pay dividends regularly. This assumption can significantly impact the accuracy of the model’s predictions.

To address this, a dividend adjustment can be made to the Black Scholes Model. This adjustment takes into account the present value of anticipated dividends throughout the life of the option. By factoring in the expected dividends, the model provides a more accurate estimate of the option’s value.

For example, if a stock is expected to pay a dividend of $1 per share during the life of a one-year option, the Black Scholes Model would subtract $1 from the stock price before calculating the option’s value. This adjustment recognizes that the investor would receive the dividend and therefore the stock price would decrease by the dividend amount.

It is important to note that the dividend adjustment in the Black Scholes Model is just an estimate based on expected dividends. The actual dividends paid during the life of the option may differ from the estimated values, leading to potential discrepancies between the predicted and actual option values.

Understanding the Black Scholes Model and its adjustment for dividends is crucial for options traders and investors. By considering the impact of dividends, they can make more informed decisions when trading options and better manage their investment portfolios.

The Black-Scholes model, also known as the Black-Scholes-Merton model, is a mathematical model used to calculate the price of options. It was developed by economists Fischer Black and Myron Scholes in 1973, and further expanded upon by Robert Merton.

Read Also: Is Sirius XM Stock a Good Buy? Expert Analysis and Market Trends

The model assumes that financial markets operate efficiently and that the price of the underlying asset follows a geometric Brownian motion with constant volatility. This assumption allows for the calculation of the fair value of an option by considering factors such as the current price of the underlying asset, the strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset’s returns.

The Black-Scholes model has become a widely used tool in options valuation, as it provides a framework for pricing options and managing risk. It offers insights into how options prices are influenced by various factors, allowing investors to make informed decisions regarding their options trading strategies.

However, it is important to note that the Black-Scholes model has its limitations. It assumes that the underlying asset follows a lognormal distribution, which may not always accurately reflect reality. In addition, it assumes constant volatility, which may not hold true in practice. These assumptions can lead to inaccuracies in the calculated option prices.

Despite its limitations, the Black-Scholes model revolutionized the field of option pricing and remains a fundamental tool in finance. It has paved the way for further advancements in quantitative finance and has been instrumental in the development of various derivative products.

The Black Scholes model, also known as the Black Scholes-Merton model, is a mathematical model used to calculate the theoretical price of options. It is based on several key assumptions that are important for understanding the model and its limitations. These assumptions include:

| Assumption | Description |

| Efficient markets | The model assumes that financial markets are efficient, meaning that there are no arbitrage opportunities and all available information is immediately reflected in the prices of financial assets. |

| Constant volatility | The model assumes that the price volatility of the underlying asset, which is a measure of the asset’s price fluctuations, is constant throughout the life of the option. |

| Lognormal distribution of asset returns | The model assumes that the distribution of asset returns follows a lognormal distribution, which means that the returns are normally distributed when observed on a logarithmic scale. |

| No transaction costs or taxes | The model assumes that there are no transaction costs or taxes associated with trading the underlying asset or the option itself. |

| Risk-free interest rate | The model assumes that there is a risk-free interest rate available for borrowing and lending money, which is used to discount the future expected cash flows associated with the option. |

| No dividends | The model assumes that the underlying asset does not pay any dividends during the life of the option. |

It is important to note that these assumptions may not always hold true in real-world markets and may introduce inaccuracies in the calculated option prices. Therefore, it is crucial to consider the limitations of the Black Scholes model and its adjustments, such as accounting for dividends, when applying it to real-world situations.

The Black Scholes model is a mathematical model used to calculate the theoretical price of options. It was developed by economists Fischer Black and Myron Scholes in 1973.

Read Also: Discover the Prices of Trading Courses and Choose the Right One for Your Budget

The Black Scholes model takes into account factors such as the current stock price, the strike price of the option, the time until expiration, the risk-free interest rate, and the volatility of the underlying stock. It uses these factors to calculate the probability of the option being exercised and the expected value of the option at expiration.

The adjustment for dividends in the Black Scholes model takes into account the payment of dividends by the underlying stock. Dividends can affect the price of options because they reduce the value of the underlying stock. The adjustment involves subtracting the present value of expected future dividends from the current stock price in the Black Scholes formula.

The adjustment for dividends is necessary in the Black Scholes model because dividends can significantly affect the price of options. By including the adjustment, the model takes into account the reduced value of the underlying stock due to dividends, resulting in a more accurate estimate of option prices.

The adjustment for dividends in the Black Scholes model generally reduces the theoretical price of call options and increases the theoretical price of put options. This is because dividends reduce the value of the underlying stock, making the options less valuable. The adjustment accounts for this reduction in value, resulting in lower call option prices and higher put option prices.

The Black-Scholes model is a mathematical model used to calculate the theoretical value of options. It takes into account factors such as the current price of the underlying asset, the strike price of the option, the time to expiration, interest rates, and volatility.

The Black-Scholes model does not directly account for dividends. However, there is a formula called the Black-Scholes-Merton model which does take dividends into consideration. This modified model adjusts the calculations by subtracting the present value of expected dividends from the stock price.

What is the moving average for a 5 minute time frame? When it comes to analyzing data in the financial markets, moving averages are a popular and …

Read ArticleHow much is 1,000,000 Korean Won to Indian Rupees? Are you planning a trip to India from South Korea? Or do you have any other reason to convert …

Read ArticleIs equity trading a lucrative career choice? Equity trading is a fast-paced and dynamic career that involves buying and selling stocks on the stock …

Read ArticleWhat is 1000 standard lot size in forex? Forex trading is a fascinating and complex market that offers significant opportunities for profit. One …

Read ArticleBest Histogram Indicator for MT4: A Comprehensive Guide Do you want to enhance your trading performance on MT4? Look no further! In this article, we …

Read ArticleAre forex gains taxed? Foreign exchange trading, or Forex, has become increasingly popular among individuals and businesses looking to capitalize on …

Read Article