Forex code for Russian ruble: Find it here!

Forex Code for Russian Ruble: RUB Are you interested in trading the Russian ruble on the foreign exchange market? If so, you’ll need to know the forex …

Read Article

Investing in financial markets can be a complex and daunting task. With numerous investment strategies available, it is crucial to understand the different methods and their potential risks and rewards. One such method is the averaging method, also known as dollar-cost averaging.

The averaging method is a strategy where an investor regularly invests a fixed amount of money into a particular investment over a period of time. This approach allows the investor to buy more shares when the price is low and fewer shares when the price is high, averaging out the overall cost.

By following the averaging method, investors can mitigate the impact of short-term market volatility and potentially reduce the risk of making poor investment decisions based solely on market fluctuations. This method promotes discipline and consistency, as investors commit to investing a predetermined amount regularly, regardless of the market conditions.

“The main advantage of the averaging method is that it takes advantage of market downturns by allowing investors to accumulate a larger number of shares at lower prices.”

Over the long term, the averaging method has the potential to deliver favorable returns, particularly in a volatile and unpredictable market. However, it is important to note that the averaging method does not guarantee profits and may not be suitable for all investors. One must carefully consider their risk tolerance, investment goals, and time horizon before implementing this strategy.

Overall, understanding the averaging method can help investors make informed investment decisions and manage their portfolios effectively. By spreading their investments over time, investors can potentially minimize the impact of market fluctuations and capitalize on long-term growth opportunities.

The averaging method is a common investment strategy that involves spreading out the purchase or sale of stocks or other securities over a period of time. This approach helps reduce the impact of short-term market fluctuations on the overall investment performance.

When you use the averaging method, you divide the total investment amount into smaller portions and make regular purchases or sales at predetermined intervals. This way, you avoid investing a large sum of money all at once, which could be detrimental if the market is volatile.

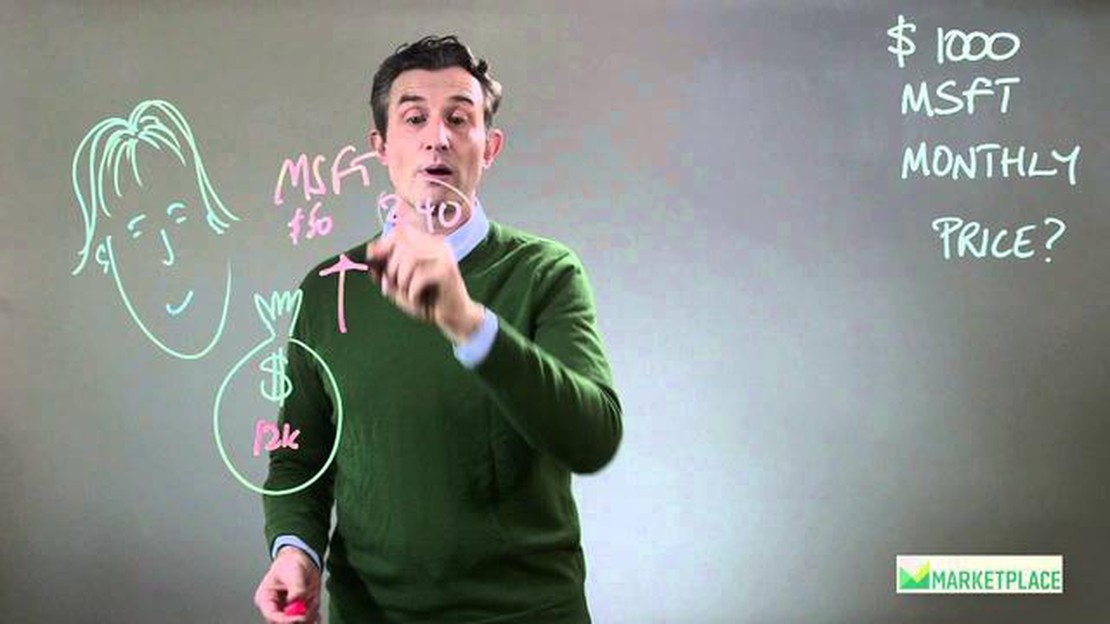

For instance, let’s say you have $10,000 to invest in a particular stock. Instead of investing the entire amount at once, you decide to use the averaging method. You divide the $10,000 into ten equal portions of $1,000. Over the course of ten weeks, you buy one portion of the stock each week, regardless of its price.

By employing this strategy, you can take advantage of dollar-cost averaging. When the stock price is low, you buy more shares with the same amount of money. On the other hand, when the stock price is high, you buy fewer shares. Over time, this averaging approach can help smooth out the overall cost per share.

The averaging method is often used to minimize the impact of emotional and irrational decision-making. Instead of trying to time the market and make large investments based on short-term trends, averaging focuses on consistent and disciplined investing.

However, it’s important to note that there are also potential downsides to the averaging method. For instance, if the stock price significantly increases after your initial purchases, you may miss out on potential gains by spreading out your purchases over time.

In conclusion, understanding the averaging method is crucial for any investor looking to manage their risk and make informed decisions. By spreading out investments over time, you can reduce the impact of short-term market fluctuations and take advantage of dollar-cost averaging.

Read Also: Ways to Decrease Break Even Point in Options Trading

The averaging method is an investment strategy that involves spreading out the purchase or sale of securities over a period of time. It is a systematic approach that aims to reduce the impact of market volatility and minimize the risk of making poor investment decisions based on short-term market fluctuations.

When using the averaging method, an investor buys or sells a fixed amount of a particular security at regular intervals. For example, instead of investing a large sum of money all at once, an investor may choose to invest a fixed amount every month or quarter over a specified period of time.

Read Also: Where to Find Outstanding Options for Any Occasion

The averaging method is based on the principle that it is difficult to predict short-term market movements with consistency. By buying or selling securities at regular intervals, investors can mitigate the risk of making poor investment decisions based on short-term market fluctuations.

There are two main types of averaging methods: dollar-cost averaging and value averaging. Dollar-cost averaging involves investing a fixed dollar amount at regular intervals, regardless of the security’s price. Value averaging, on the other hand, involves adjusting the amount invested based on the security’s performance over time. Both methods aim to reduce the impact of market volatility and allow investors to take advantage of market downturns.

The averaging method is particularly suitable for long-term investors who are more concerned with the overall performance of their portfolio rather than short-term market movements. By spreading out their investments over time, investors can minimize the risk of making a large investment at an unfavorable market price.

However, it is important to note that the averaging method is not without its drawbacks. Since the investments are made at regular intervals, the investor may miss out on potential gains if the market continually rises. Additionally, transaction costs can add up over time, especially for smaller investment amounts.

In conclusion, the averaging method is an investment strategy that involves spreading out the purchase or sale of securities over a period of time. It aims to reduce the impact of market volatility and minimize the risk of making poor investment decisions based on short-term market fluctuations. While it may not be suitable for all investors, it can be an effective strategy for long-term investors looking to mitigate risk and achieve consistent returns.

The averaging method in investment is a strategy where an investor buys a fixed investment at regular intervals, regardless of the current price. This helps to mitigate the impact of market volatility and reduce the risk of making a poor investment decision based on short-term market fluctuations.

The averaging method is considered a comprehensive guide because it provides a systematic approach to investing that can be applied across different investment vehicles. It takes into account the principles of diversification and long-term investing, and helps investors avoid emotional decision-making during times of market uncertainty.

The advantages of using the averaging method in investment include reducing the impact of market volatility, ensuring regular investing regardless of market conditions, and potentially lowering the average cost of investment over time. It also helps to alleviate the pressure of trying to time the market and allows investors to take a long-term perspective on their investments.

While the averaging method can be an effective strategy for many investors, there are some potential drawbacks to consider. By investing at regular intervals, investors may miss out on potential opportunities for quick gains if the market experiences a sudden upswing. Additionally, the averaging method requires a long-term commitment and discipline, which may not be suitable for all investors.

Yes, the averaging method can be applied to different types of investments, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The key is to identify a regular interval for investing and stick to it consistently over time. However, it’s important to consider the specific characteristics of each investment and how they may affect the effectiveness of the averaging method.

The averaging method in investment is a strategy where an investor buys a fixed amount of shares at regular intervals, regardless of the price. This helps to reduce the impact of market volatility and allows the investor to benefit from both high and low prices.

The averaging method works by dividing the investment amount into equal parts and investing them at regular intervals. For example, if an investor wants to invest $1000 in a particular stock, they can choose to invest $100 every month for 10 months. This way, they buy more shares when the price is low and fewer shares when the price is high, resulting in an average cost per share.

Forex Code for Russian Ruble: RUB Are you interested in trading the Russian ruble on the foreign exchange market? If so, you’ll need to know the forex …

Read ArticleUnderstanding the Fair Value of an ESOP for Effective Management and Decision Making An Employee Stock Ownership Plan (ESOP) is a beneficial …

Read ArticleTrading with ROC: A Complete Guide Trading can be an exciting and profitable venture if done correctly. One tool that traders often use is the Rate of …

Read ArticleUnderstanding MQL in Forex Trading Forex, or foreign exchange, is a decentralized global market where participants exchange one currency for another. …

Read ArticleWhat day is the exchange rate? The exchange rate is an important factor that affects international trade and financial transactions. It determines the …

Read ArticleSmart Options Trading: What You Need to Know Options trading is a popular investment strategy that allows traders to generate profit by speculating on …

Read Article