Understanding the Parameters of FX Options: A Comprehensive Guide

Understanding the Parameters of FX Options FX options are a popular derivative instrument used for hedging and speculative purposes in the foreign …

Read Article

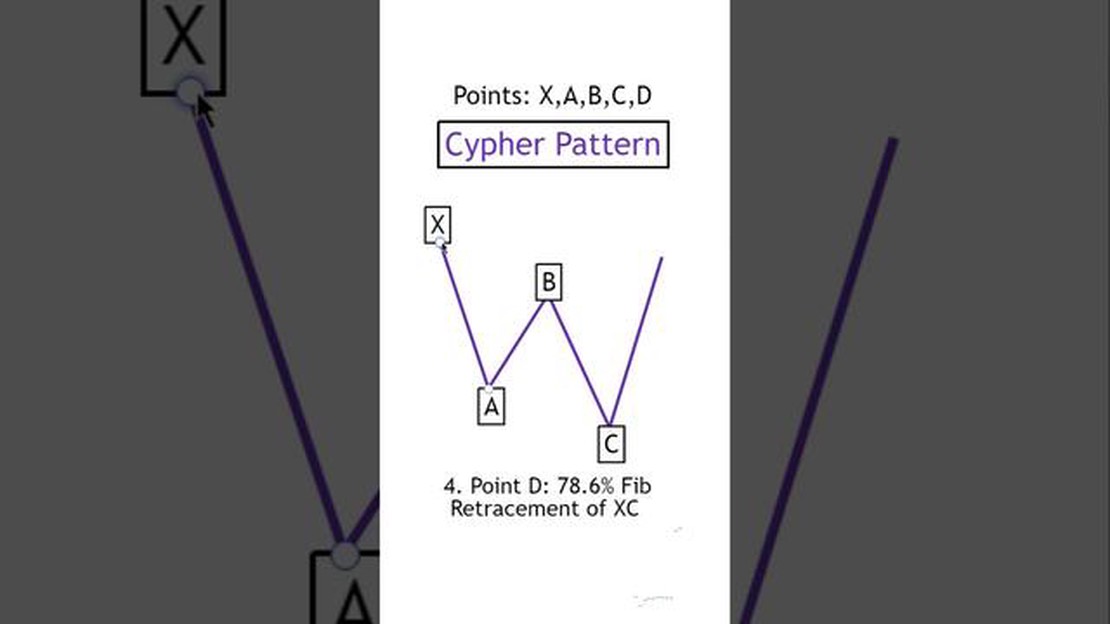

When it comes to the world of financial markets, there is no shortage of patterns and indicators that traders use to try and predict future price movements. One such pattern that has gained popularity in recent years is the Cypher Pattern.

The Cypher Pattern is a harmonic trading pattern that can provide valuable insight into potential trend reversals. This pattern is formed by a series of Fibonacci retracement and extension levels, which are used to identify areas of price reversal. When a Cypher Pattern is complete, it can indicate that a price reversal is likely to occur.

However, it is important to understand that the completion of a Cypher Pattern does not guarantee a price reversal. Instead, it provides traders with a potential area of interest where they can look for additional confirmation signals. These confirmation signals can come in the form of other technical indicators, such as moving averages or trend lines, or through fundamental analysis of the underlying asset.

Traders should also be prepared for the possibility of a false signal. Not every Cypher Pattern will result in a price reversal, and it is important to manage risk accordingly. This can be done by placing stop-loss orders or using proper position sizing techniques.

In conclusion, understanding the aftermath of a Cypher Pattern can help traders make more informed decisions and potentially increase their chances of success in the financial markets. By combining the information provided by the Cypher Pattern with other technical and fundamental analysis techniques, traders can develop a more comprehensive trading strategy.

When analyzing the aftermath of a Cypher Pattern, there are several key elements that traders should consider to make informed decisions. These elements include:

| 1. Fibonacci retracement levels | Traders should look for the price to retrace between 0.382 and 0.618 Fibonacci levels of the XA leg of the pattern. This retracement level validates the validity of the pattern. |

| 2. Price action confirmation | Traders should look for bullish reversal patterns, such as hammer or engulfing candles, along with bullish divergence in the relative strength index (RSI). This can confirm that the pattern is likely to result in a bullish move. |

| 3. Volume analysis | Traders should analyze the volume accompanying the pattern. Higher volume during the pattern’s completion suggests stronger market participation and increases the likelihood of a successful bullish move. |

| 4. Risk management | Traders should always implement proper risk management strategies, such as setting stop loss orders and calculating position sizes based on their risk tolerance. This helps protect against potential losses if the pattern fails. |

| 5. Market context | Traders should consider the overall market context, including trend direction and major support or resistance levels. A bullish Cypher Pattern is more likely to succeed in an uptrending market or at a strong support level. |

Read Also: Do Chart Patterns work in trading? Exploring the effectiveness of chart patterns in financial markets

By considering these key elements, traders can gain a better understanding of the potential outcomes of a Cypher Pattern and make more informed trading decisions.

Trading the financial markets can have a significant psychological impact on traders. The emotions and mindset of a trader can greatly affect their decision-making process and ultimately their success in the market.

One common psychological impact on traders is fear. When prices start to go against their trades, traders may become fearful of losing money and make irrational decisions. This can lead to panic selling or holding onto losing positions for longer than necessary. Fear can cloud a trader’s judgment and prevent them from making logical and well-thought-out decisions.

Another psychological impact is greed. When traders see a potential opportunity for making a profit, they may become overly greedy and take on excessive risk. This can lead to overtrading or placing too much emphasis on one trade, which increases the chances of losses. Greed can cloud a trader’s judgment and prevent them from properly managing their risk.

Patience is also crucial in trading, but it can be challenging to maintain. Traders may become impatient and try to force trades or exit positions prematurely. Impatience can lead to missed opportunities or premature losses. It’s important for traders to develop patience and trust in their trading strategies.

Stress is another psychological impact that traders may face. The constant monitoring of the markets, keeping up with news and economic events, and the pressure to make profitable trades can be incredibly stressful. This stress can lead to burnout, fatigue, and overall mental and physical health issues. Traders should prioritize self-care and implement stress management techniques to maintain their well-being.

Lastly, overconfidence can be a dangerous psychological impact on traders. When traders have a string of successful trades, they may become overconfident in their abilities and start taking unnecessary risks. Overconfidence can lead to complacency and a lack of proper risk management, which can result in significant losses.

In conclusion, understanding the psychological impact on traders is essential. Traders must be aware of the emotions that can influence their decision-making process and take steps to manage them effectively. Developing a sound trading plan, staying disciplined, and practicing self-care are crucial for long-term success in the markets.

Read Also: What is the average return of a hedge fund? Discover the typical performance of hedge funds

A Cypher pattern is a specific chart pattern in technical analysis that indicates a potential reversal in price direction. It is composed of four price swings and is often used by traders to identify potential buying opportunities.

To recognize a Cypher pattern, you need to look for specific price swings. The pattern consists of four price swings labeled XA, AB, BC, and CD. The BC swing should retrace between 38.2% and 61.8% of the AB swing, while the CD swing should also retrace between 127.2% and 141.4% of the XA swing.

The CD swing is crucial in a Cypher pattern as it indicates a potential reversal in price direction. This swing should ideally retrace between 127.2% and 141.4% of the XA swing. Once this level is reached, traders often look for buying opportunities as the price is expected to reverse and move in the opposite direction.

After the completion of a Cypher pattern, you can expect a potential reversal in the price direction. This means that if the pattern is a bullish Cypher, you can expect the price to reverse from a downtrend to an uptrend. Similarly, if the pattern is a bearish Cypher, you can expect the price to reverse from an uptrend to a downtrend.

Cypher patterns, like any other chart patterns in technical analysis, are not foolproof indicators. While they can provide valuable insights into potential price reversals, they should not be relied upon solely for making trading decisions. It is important to consider other factors and use additional technical analysis tools to confirm the signals provided by Cypher patterns.

Understanding the Parameters of FX Options FX options are a popular derivative instrument used for hedging and speculative purposes in the foreign …

Read ArticleUnderstanding the Implications of Gap Up in the Stock Market Gap up is a term that is commonly used in the world of trading and investing. It refers …

Read ArticleUnderstanding the Application of Forex Trading Forex, short for Foreign Exchange, is an international decentralized market where different currencies …

Read ArticleScalping a 15 Minute Chart: Strategies and Techniques Scalping, a popular trading strategy in the forex market, involves making small profits from …

Read ArticleStarting a Forex Trading Company: All You Need to Know If you have a passion for finance and a keen interest in the global currency market, you may …

Read ArticleWhat is the exponentially weighted moving average? The exponentially weighted moving average (EWMA) is a statistical method used to calculate the …

Read Article