What is cardstock paper used for? Discover its various applications

Uses of Cardstock Paper Cardstock paper is a thick and durable type of paper that is widely used for a variety of purposes. With its strong and sturdy …

Read Article

Stock options are a popular form of employee compensation that give individuals the right to purchase company stock at a specified price within a certain time period. While many employees are excited to receive stock options as part of their compensation package, they often struggle to understand the true value of these options.

Calculating the worth of your stock options can be a complex task, but it is essential to determine their value accurately. By understanding the factors that influence stock option value and following a few easy steps, you can gain insight into the potential value of your options and make informed financial decisions.

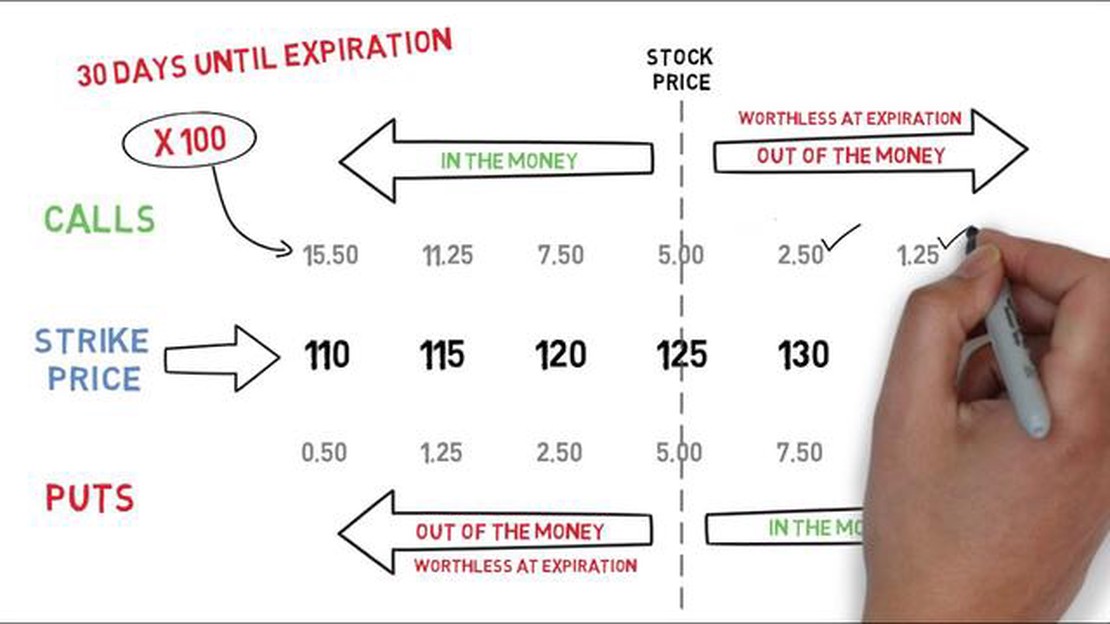

One key factor that affects the value of stock options is the current price of the company’s stock. As the stock price fluctuates, so does the value of your options. Additionally, the expiration date of the options and the strike price, or the price at which you can purchase the stock, also impact their value. Taking these factors into account, calculating the current worth of your options requires a thorough analysis.

In this article, we will guide you through the process of determining the value of your stock options step by step. We will explain the key terms and concepts involved, provide examples, and offer practical tips to help you make sense of this often complex financial calculation. By the end, you will have a clearer understanding of the potential value of your stock options and be equipped to make educated decisions about your financial future.

Stock options are a type of financial instrument that give investors the right, but not the obligation, to buy or sell shares of a particular stock at a specified price within a specified time period.

As an employee, stock options can be a valuable part of your compensation package, offering the potential to participate in the growth and success of the company. Understanding how stock options work can help you to make informed decisions about their value and how to exercise them.

There are two main types of stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). ISOs are typically granted to executives and high-level employees, while NSOs are more commonly offered to all employees.

When you are granted stock options, you are typically given a vesting period, which is the amount of time you must wait before you can exercise your options. Once the options have vested, you have the opportunity to purchase the stock at the strike price, which is the predetermined price at which the stock can be bought or sold.

The value of your stock options can be influenced by a variety of factors, including the current market price of the stock, the strike price, the time remaining until the options expire, and the volatility of the stock price. It is important to consider these factors when evaluating the worth of your options.

Calculating the value of your stock options can be complex, as it involves considering various variables and factors. It is recommended to consult with a financial advisor or utilize online tools and calculators to accurately determine the value of your stock options.

Read Also: Understanding the Weighted Average Market: Everything You Need to Know

Understanding stock options is key to making informed decisions about your investments and maximizing their potential value. By familiarizing yourself with the different types of options, the vesting period, and the factors that can influence their value, you can make strategic decisions about how and when to exercise your options.

Stock options are a form of compensation that companies offer to their employees. They give employees the right to purchase a specific number of shares of company stock at a predetermined price, known as the exercise price or strike price.

Stock options are often seen as a benefit because they provide employees with the opportunity to benefit from the company’s success. If the company’s stock price increases above the exercise price, employees can purchase the stock at a lower price and then sell it for a profit.

There are two main types of stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). ISOs are typically offered to key employees and have special tax advantages. NSOs, on the other hand, are more commonly offered to all employees and do not have the same tax benefits.

Stock options typically have a vesting period, which is the time period an employee must work for the company before they can exercise their options. Once the options are vested, employees can choose to exercise them or hold onto them for a later date.

It’s important to note that stock options are not the same as owning actual stock in the company. They are simply the right to buy stock at a certain price. When employees exercise their options and purchase the stock, they become shareholders and have the potential to earn dividends and participate in company growth.

Overall, stock options can be a valuable form of compensation and incentive for employees. They provide the opportunity to benefit financially from the success of the company and can be an important part of a comprehensive compensation package.

Calculating the value of your stock options is crucial for several reasons:

Read Also: Discover the Most Effective Correlation Strategies for Success

Overall, calculating the value of your stock options provides you with valuable information that can guide your financial decisions and empower you to make the most of your investment opportunities.

Calculating the worth of stock options involves a few steps. First, you need to determine the current price of the stock. Then, you’ll need to calculate the strike price of the options. Subtracting the strike price from the current stock price will give you the intrinsic value of the options. Next, you’ll need to calculate the time value of the options by subtracting the intrinsic value from the market value. Finally, multiply the time value by the number of options you have to get the total worth.

The worth of stock options can be affected by several factors. Firstly, the current price of the stock has a direct impact on the value of the options. Additionally, the strike price of the options and the length of time until they expire also play a role. Finally, market conditions, such as volatility and interest rates, can also affect the worth of stock options.

Calculating the worth of stock options in a non-publicly traded company can be more challenging. In such cases, it may be necessary to estimate the value of the company based on comparable publicly traded companies. Additionally, factors such as the company’s financial performance, growth prospects, and industry trends can also be considered in determining the worth of stock options.

Yes, stock options can become worthless. This can happen if the stock price drops below the strike price of the options, making them “out of the money”. Additionally, if the options have expired and the stock price has not reached the strike price, they will also be considered worthless.

Stock options can be a good form of compensation for employees, as they provide the opportunity to benefit from the growth and success of the company. However, they also come with risks. The value of stock options can fluctuate based on various factors, and there is no guarantee that they will be profitable. It is important for individuals to carefully consider the potential risks and rewards before accepting stock options as compensation.

To calculate the value of your stock options, you need to know the strike price, the current market price of the stock, the time remaining until expiration, and the volatility of the stock. With this information, you can use an options pricing model, such as the Black-Scholes model, to estimate the value of your options.

The Black-Scholes model is a mathematical model used to calculate the theoretical price of options. It takes into account factors such as the strike price, the current market price of the stock, the time remaining until expiration, the risk-free interest rate, and the volatility of the stock. By inputting these variables into the model, you can estimate the value of your stock options.

Uses of Cardstock Paper Cardstock paper is a thick and durable type of paper that is widely used for a variety of purposes. With its strong and sturdy …

Read ArticleThe Turtle Strategy: A Comprehensive Guide for Traders Are you new to trading and looking for a proven strategy to help you navigate the complex world …

Read ArticleBest Indicators for Binary Options Trading Binary options trading is a popular way to make money online, but it can also be a risky endeavor. One of …

Read ArticleWhat is the Value of a Euro Currency Tick? Currency conversion is an essential aspect of international trade and investment. Understanding the value …

Read ArticleIs Pocket Option Available for Use in the Philippines? Pocket Option is a popular online trading platform that offers a wide range of trading options, …

Read ArticleUsing Frozen Chicken for Stock: What You Need to Know When it comes to making chicken stock, many home cooks wonder if they can use frozen chicken …

Read Article