What Does Forex Mean? A Guide to Understanding Forex Trading

What does Forex mean? If you have ever traveled to another country or seen news about global financial markets, you may have come across the term …

Read Article

The weighted average market is a concept that plays a crucial role in various financial calculations and analyses. Understanding this concept is essential for anyone involved in investing or finance, as it provides valuable insights into market trends and performance. In this article, we will explore what the weighted average market is and why it matters.

The concept of the weighted average market refers to a calculation that takes into account both the values and weights of different components in a market. This calculation allows for a more accurate representation of the overall market performance, as it considers the relative importance of each component. The weights assigned to each component are typically based on factors such as market capitalization, trading volume, or other relevant metrics.

By using the weighted average market, investors and analysts can gain a deeper understanding of market trends and make more informed investment decisions. This calculation helps identify the influence of larger market participants and sectors on the overall market performance, allowing for a more comprehensive analysis. Additionally, the weighted average market can be used to compare the performance of different markets or sectors, providing valuable insights for portfolio diversification strategies.

In conclusion, understanding the weighted average market is essential for anyone involved in investing or finance. This concept provides a more accurate representation of the overall market performance and allows for a deeper analysis of market trends and influences. By incorporating the weighted average market into investment strategies, investors can make more informed decisions and improve their chances of achieving successful outcomes.

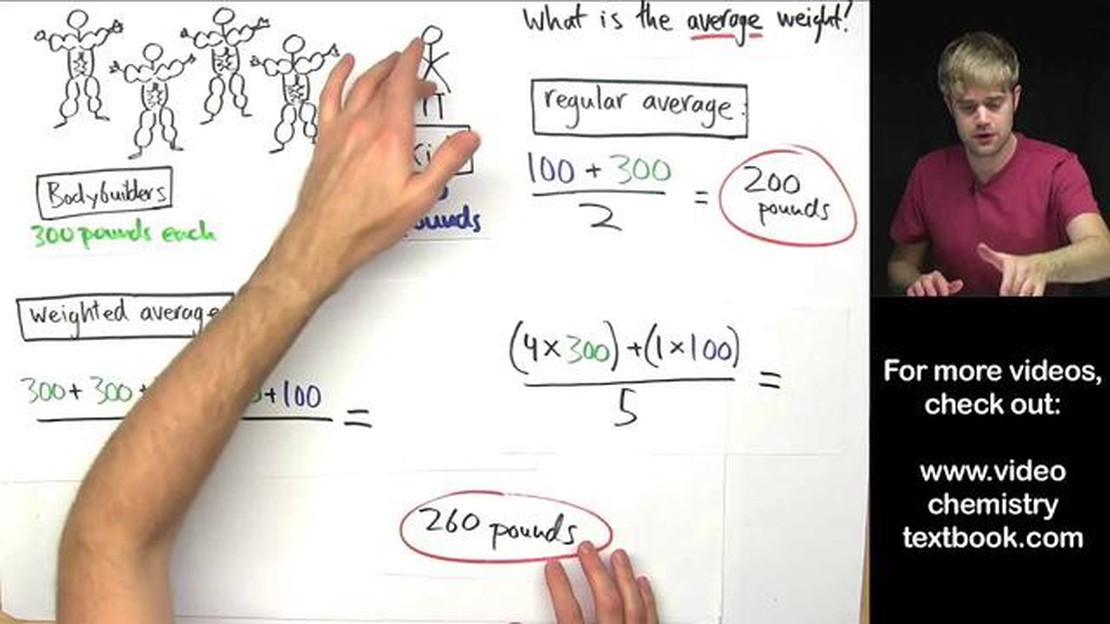

The concept of weighted averages is a mathematical tool used to calculate the average of a set of values, with each value being assigned a specific weight based on its relative importance.

Unlike a regular average calculation, in which each value contributes equally to the overall average, a weighted average takes into account the significance of each value. This means that values with higher weights have a greater influence on the final average.

To calculate a weighted average, you multiply each value by its corresponding weight, sum up these products, and then divide the result by the sum of the weights. The formula for calculating a weighted average is:

Read Also: Discover the Ultimate Platform for Forex Trading: Which One is the Best?

Weighted Average = (Value1 * Weight1 + Value2 * Weight2 + … + Valuen * Weightn) / (Weight1 + Weight2 + … + Weightn)

Weighted averages are commonly used in various fields, including finance, statistics, and economics. They are often used to account for the different significance levels of data points and to give more weight to more reliable or representative values.

For example, in financial markets, the weighted average market index is used to reflect the overall performance of a group of stocks, with the weight of each stock being determined by its market capitalization. By assigning greater weight to larger companies, the weighted average market index provides a more accurate representation of the market.

Overall, the concept of weighted averages is a useful tool in data analysis, allowing for a more nuanced understanding of the underlying data and providing more accurate results in specific scenarios where some values hold greater importance than others.

Weighted averages are a crucial tool in the world of finance. They provide a more accurate representation of market trends and help investors make informed decisions.

One of the key benefits of using weighted averages is that they take into account the importance or significance of each data point. In financial markets, certain stocks or assets may have a higher impact on overall market trends due to their market capitalization or trading volume. By assigning weights to these data points, a weighted average can better reflect the influence of these assets on the market as a whole.

Weighted averages also allow investors to track the performance of specific sectors or industries within the financial market. By assigning different weights to different sectors or industries, investors can get a clearer picture of the overall performance of that particular sector or industry.

Furthermore, weighted averages can help investors identify potential trends and patterns in the market. By calculating the weighted average of certain indicators or data points, investors can spot trends such as moving averages, which can indicate the overall direction of the market. This can be particularly useful for traders who rely on technical analysis to make investment decisions.

Read Also: How to Successfully Sell Binary Options

Overall, weighted averages are an essential tool for understanding the financial markets. They provide a more accurate representation of market trends, help investors track the performance of specific sectors or industries, and identify potential trends and patterns. By incorporating weighted averages into their analysis, investors can make more informed decisions and potentially improve their investment strategies.

A weighted average market is a method of calculating an average where each data point is given a different weight or importance based on certain criteria. This can be used in various financial calculations and analysis to obtain a more accurate representation of the overall market trend.

The weighted average market can be calculated by multiplying each data point by its respective weight and summing them all up, then dividing the result by the sum of the weights. This gives more importance to certain data points and allows for a more accurate representation of the overall market trend.

Some examples of weighted average market calculations include calculating the weighted average price of a stock portfolio, weighted average cost of capital for a company, and weighted average return on investment. These calculations take into account the importance of each data point and provide a more insightful analysis.

The advantages of using a weighted average market include obtaining a more accurate representation of the overall market trend, giving more importance to certain data points based on specific criteria, and providing a more insightful analysis in financial calculations. It helps in making informed decisions based on a more comprehensive understanding of the data.

Yes, the weighted average market can be used in non-financial analysis as well. For example, it can be used in surveys to calculate the weighted average satisfaction level of customers based on different factors. It allows for a more accurate understanding of the overall satisfaction level and the factors influencing it.

What does Forex mean? If you have ever traveled to another country or seen news about global financial markets, you may have come across the term …

Read ArticleMalaysia’s Foreign Reserves: A Closer Look at the Numbers Foreign reserves play a crucial role in the economic stability of a country, and Malaysia is …

Read ArticleDiscover the Most Effective Heiken Ashi Strategy for Successful Trading If you’re an aspiring trader looking for a proven strategy to boost your …

Read Article3 Technical Analysis Approaches You Need to Know Technical analysis is a crucial tool for investors and traders to make informed decisions in the …

Read ArticleCommon mistakes to avoid in options trading Options trading can be an exciting and potentially lucrative venture. However, it is not without its …

Read ArticleWhat time does Eurex close? Knowing the exact closing time of the Eurex exchange can be crucial for successful trading. Eurex is one of the largest …

Read Article