Understanding the Probability of Out of The Money (OTM) Options

Understanding the Probability of Out of the Money (OTM) Options Options trading is a popular way for investors to diversify their portfolio and …

Read Article

Replacing a credit card can be inconvenient and frustrating, especially when you’re not sure about the charges involved. SBI Card, one of the largest credit card issuers in India, has a detailed policy regarding card replacement charges. By understanding these charges, you can make better decisions about when and how to replace your SBI Card.

Annual Fee: SBI Card replacement charges include an annual fee that varies depending on the type of card you have. This fee is charged every year and covers the cost of maintaining your account and providing you with a replacement card if needed.

Replacement Fee: In addition to the annual fee, SBI Card also charges a replacement fee for issuing a new card. This fee is charged only when you request a replacement due to loss, theft, or damage. The amount of this fee may vary depending on the type of card you have and the reason for replacement.

Replacement Process: To replace your SBI Card, you need to follow a simple process. First, you need to report the loss, theft, or damage of your card to SBI Card’s customer service. They will guide you through the necessary steps, including providing the required documents and paying the replacement fee. Once the process is complete, your new card will be issued and delivered to your registered address.

It’s important to note that the replacement charges mentioned above are subject to change at the discretion of SBI Card. Therefore, it’s advisable to stay updated with the latest information on their website or by contacting their customer service.

Remember, understanding the SBI Card replacement charges can help you plan better and avoid any surprises when you need to replace your card. By knowing the fees involved, you can make informed decisions and minimize any inconvenience caused by the replacement process.

When your SBI credit card is lost, stolen, or damaged beyond repair, you will need to go through the card replacement process. Here is a step-by-step guide on how SBI card replacement works:

Contact SBI Card Customer Service: As soon as you realize that your card is missing or damaged, you should contact the SBI Card Customer Service helpline at XXX-XXX-XXXX. They will guide you through the process and help you with the necessary steps.

Report Lost or Stolen Card: If your card is lost or stolen, you must immediately report it to the SBI customer service helpline. They will block your card to prevent any unauthorized transactions. It is important to report the loss as soon as possible to minimize the risk of fraudulent activity on your account.

Complete the Card Replacement Application: After reporting the loss, you will be required to complete an application for a card replacement. This can usually be done online or by visiting an SBI Card branch office. The application will ask for details such as your card number, personal information, and a brief description of the circumstances.

Submit Necessary Documents: Along with the application form, you will need to submit certain documents, such as a copy of your identity proof (e.g., passport, PAN card, Aadhar card), address proof, and an FIR (First Information Report) in case of theft. Make sure to provide all the required documents to speed up the replacement process.

Pay Card Replacement Fee: SBI charges a fee for card replacement, which may vary depending on the type of card and the circumstances. The fee is typically deducted from your credit card account balance. Ensure that you have enough available credit to cover the replacement fee.

Receive Your Replacement Card: Once your application has been processed and the fee has been paid, you will receive your replacement card at the address registered with the bank. The new card will have a different card number but will retain all your existing cardholder details and credit limit.

Activate and Use Your New Card: Upon receiving your replacement card, you must activate it by following the instructions provided. Once activated, you can start using your new card for transactions, just like you did with the original card.

Please note that the exact process and requirements for SBI card replacement may vary. It is recommended to refer to the official SBI Card website or contact their Customer Service for the most up-to-date information.

Read Also: Understanding the Moving Average Method: How it Works and How it Can Improve Your Trading Strategy

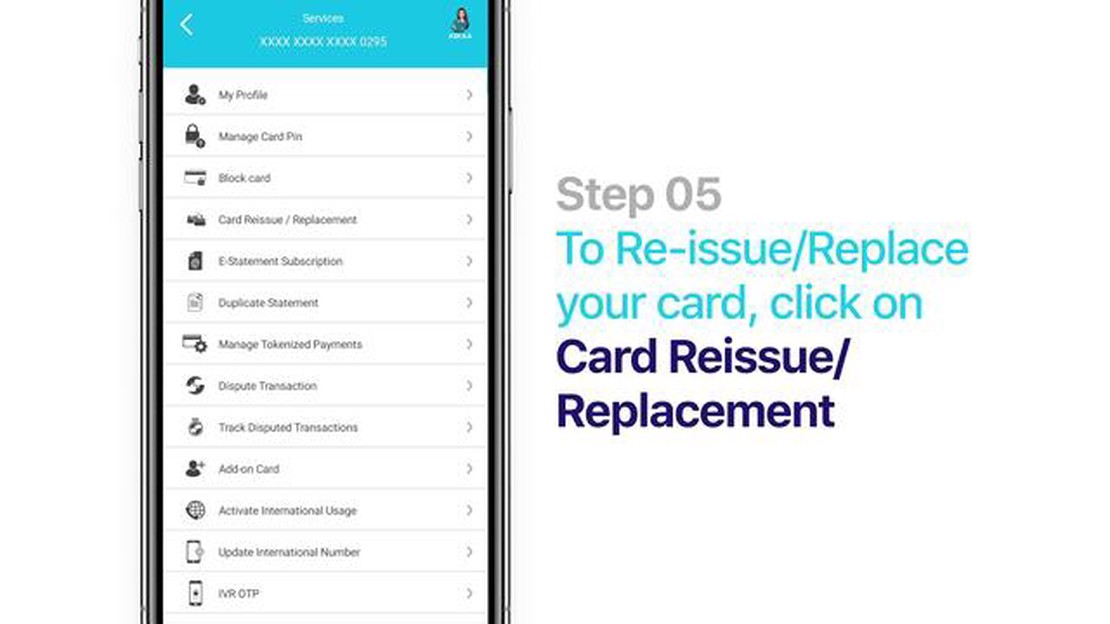

If you need to request a card replacement for your SBI card, you can do so by following these easy steps:

4. You will be prompted to select the reason for the card replacement. Choose the appropriate reason from the given options. 5. Provide any additional details or instructions related to the card replacement request. 6. Review the information provided and click on the “Submit” button to complete the request. 7. Once your request is submitted, you will receive a confirmation message with further instructions.

Read Also: What is the current exchange rate of GBP to EUR?8. You may be required to visit your nearest SBI branch to complete the card replacement process. Follow the instructions provided in the confirmation message for further guidance.

By following these steps, you can easily request a card replacement for your SBI card when needed. It is important to keep your card information secure and to promptly request a replacement in case of loss, theft, or damage.

If you ever lose your SBI credit card or it gets stolen, you will need to get it replaced. However, SBI charges a fee for card replacements, which you should be aware of. The card replacement charges vary depending on the type of card you have and the reason for replacement.

For regular SBI credit cards, the card replacement charges are as follows:

For SBI premium credit cards, such as SBI Prime, SBI Elite, and SBI Signature, the card replacement charges are slightly higher:

Please note that these charges are subject to change, and it is always best to check with SBI directly for the most up-to-date information. Also, keep in mind that these replacement charges are separate from any fees you may incur for reissuing a PIN or for courier services.

It is important to report the loss or theft of your SBI credit card as soon as possible to avoid any unauthorized transactions. You can do this by contacting SBI’s customer service hotline or through the SBI Card mobile app. Once you report the loss or theft, SBI will block your card to prevent any further misuse.

Remember to keep your SBI credit card safe and secure to minimize the risk of loss or theft. If you do need to get your card replaced, make sure to review the card replacement charges and follow the necessary steps to get a new card.

If you lose your SBI card, you should immediately report it to the bank’s customer service helpline. They will block the card and guide you through the process of getting a replacement card.

Yes, there is a cost associated with getting a replacement SBI card. The charges for a replacement card vary depending on the type of card you have and the reason for replacement. The charges can range from a few hundred to a few thousand rupees.

There are several reasons for card replacement such as loss of card, damage to card, expiry of card, and upgrading to a higher variant of the card. Each of these reasons may have different charges associated with them.

The time taken to get a replacement SBI card depends on various factors such as the location of the cardholder, the type of card being replaced, and the current backlog of card replacement requests. In general, it may take anywhere from a few days to a couple of weeks to receive the replacement card.

Yes, you can get a replacement SBI card delivered outside of India. However, there may be additional charges associated with international delivery. It is recommended to check the bank’s policies and charges for international delivery before requesting a replacement card to be delivered outside of India.

Understanding the Probability of Out of the Money (OTM) Options Options trading is a popular way for investors to diversify their portfolio and …

Read ArticleForeign Currency Options Trading Locations Foreign currency options have become an increasingly popular investment tool for traders looking to …

Read ArticleUnderstanding the Meaning of TND Currency The TND currency, also known as the Tunisian Dinar, is the official currency of Tunisia. It holds great …

Read ArticleOpening an Islamic Account for Forex Trading: Everything You Need to Know Forex trading is a popular investment option for individuals looking to make …

Read ArticleDo Employee Stock Options Expire? Employee stock options are a popular form of compensation that companies offer to their employees. Stock options …

Read ArticleWhat is the N point average filter? The N point average filter is a digital signal processing technique used to reduce noise in a signal. It is …

Read Article