What is the current movement of the dollar today in Pakistan?

Today’s Dollar Movement in Pakistan The movement of the dollar today in Pakistan is subject to various factors such as the global economic situation, …

Read Article

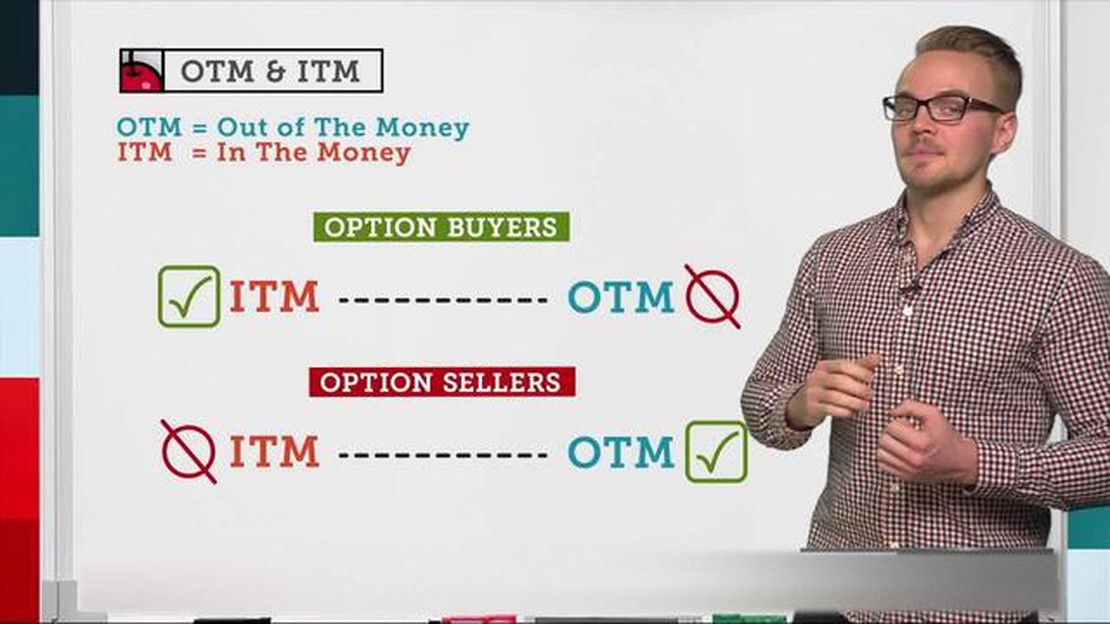

Options trading is a popular way for investors to diversify their portfolio and potentially earn significant returns. One important concept that traders need to understand is the probability of out of the money (OTM) options. In simple terms, OTM options are contracts that have a strike price that is higher (for call options) or lower (for put options) than the current market price of the underlying asset. These options are considered out of the money because they have no intrinsic value at the current moment.

Calculating the probability of OTM options involves assessing the likelihood that the market price of the underlying asset will not reach the strike price before the option expires. This probability is influenced by various factors, including the time until expiration, market volatility, and the distance between the current market price and the strike price. Traders use different mathematical models, such as the Black-Scholes model, to estimate the probability of OTM options.

Understanding the probability of OTM options is crucial for options traders, as it can help them make more informed trading decisions. Traders need to assess the risk-reward profile of these options and determine if the potential returns justify the probability of the option expiring worthless. By analyzing the probability of OTM options, traders can adjust their strategies and position themselves for potential profits while managing their risk effectively.

It’s important to note that the probability of OTM options is not a guarantee of the option expiring worthless. Market conditions and unforeseen events can significantly impact option prices and change the probability of the option ending in or out of the money. Traders need to continuously monitor the market and adjust their trading strategies accordingly.

In conclusion, understanding the probability of OTM options is essential for options traders. By assessing the likelihood of the option expiring out of the money, traders can make more informed decisions and manage their risk effectively. It’s crucial to consider various factors that influence the probability, such as time until expiration, market volatility, and the distance between the current market price and the strike price. With a clear understanding of the probability of OTM options, traders can enhance their trading strategies and potentially improve their overall trading performance.

Out of The Money (OTM) options are a type of financial derivative that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price (known as the strike price) on or before a certain date (known as the expiration date).

An OTM option is considered “out of the money” when the price of the underlying asset is currently below the strike price for a call option, or above the strike price for a put option.

For example, let’s suppose you own a call option for a stock with a strike price of $50. If the current market price of the stock is $45, the call option is considered OTM because there is no immediate benefit in exercising the option to buy the stock at $50 when it is currently cheaper on the open market.

The main advantage of OTM options is that they can be purchased at a lower cost compared to in the money (ITM) or at the money (ATM) options. This lower cost can provide investors with an opportunity for potential high returns if the price of the underlying asset moves favorably.

Read Also: Who is the best forex trading platform in India?

However, it’s important to note that OTM options have a higher risk of expiring worthless compared to ITM or ATM options. This is because the price of the underlying asset needs to move significantly in the desired direction in order for the option to become profitable.

Traders and investors use OTM options for various strategies, such as speculation, hedging, or generating income through writing options. They can also be used as part of more complex strategies, such as spreads or straddles, where multiple options are combined to manage risks and potentially maximize returns.

| Advantages of OTM Options | Disadvantages of OTM Options |

|---|---|

| - Lower cost compared to ITM or ATM options | - Higher risk of expiring worthless |

| - Potential for high returns if the underlying asset moves favorably | - Limited profit potential |

| - Various strategies can be implemented using OTM options | - Requires a significant move in the underlying asset for the option to become profitable |

Options trading involves buying and selling options contracts, which give the holder the right to buy or sell an underlying asset at a specific price within a specified time frame.

When it comes to options trading, there are two types of options - call options and put options. A call option gives the holder the right to buy the underlying asset, while a put option gives the holder the right to sell the underlying asset.

Options are classified based on their relationship to the current market price of the underlying asset. An out of the money (OTM) option refers to an option that has a strike price that is above (for call options) or below (for put options) the current market price of the underlying asset. In other words, an OTM option does not have intrinsic value and would not be profitable if exercised immediately.

The probability of an option expiring out of the money can be calculated using various statistical models and option pricing formulas. Some factors that can affect the probability of an option expiring OTM include the volatility of the underlying asset, time remaining until expiration, and the distance between the strike price and the current market price of the underlying asset.

Understanding the basics of options trading and the concept of out of the money options is important for making informed investment decisions. By knowing the probability of an option expiring OTM, investors can assess the risk and potential profitability of their options positions.

Read Also: Understanding HNS in Forex Trading: A Comprehensive Guide

Key Points to Understand

| 1. | Options are contracts that give the holder the right to buy or sell an underlying asset at a specific price within a specified time frame. | | 2. | Out of the money (OTM) options have strike prices that are above (for call options) or below (for put options) the current market price of the underlying asset. | | 3. | The probability of an option expiring OTM can be calculated using statistical models and option pricing formulas. | | 4. | Factors such as volatility, time remaining until expiration, and the distance between the strike price and the current market price can influence the probability of an option expiring OTM. |

Out of the money (OTM) options are options contracts where the strike price is above (for call options) or below (for put options) the current market price of the underlying asset. In other words, OTM options have no intrinsic value and would not result in a profit if exercised immediately.

The probability of an OTM option expiring in the money can be estimated using different methods, such as the Black-Scholes model or option pricing calculators. These models take into account factors like the current price of the underlying asset, the strike price, the time until expiration, volatility, and interest rates.

Some investors choose to trade OTM options because they can offer a higher potential return on investment compared to in the money options. This is because OTM options are cheaper to purchase, and if the underlying asset moves in the desired direction, the percentage gain can be significant. However, it’s important to note that OTM options also have a higher risk of expiring worthless.

The main risks associated with trading OTM options are the higher probability of the options expiring worthless. As OTM options have no intrinsic value, they rely on the movement of the underlying asset to become profitable. If the underlying asset does not move in the desired direction before the expiration date, the options may expire worthless, leading to a loss of the initial investment.

Yes, out of the money (OTM) options have some advantages over in the money options. OTM options are generally cheaper to purchase, which allows investors to control a larger amount of the underlying asset with less capital. Additionally, if the underlying asset moves in the desired direction, the percentage gain on OTM options can be higher compared to in the money options.

Today’s Dollar Movement in Pakistan The movement of the dollar today in Pakistan is subject to various factors such as the global economic situation, …

Read ArticleWhat is a good RR ratio? The RR ratio, also known as the risk-reward ratio, is a key concept in trading and investing. It is a measure of the …

Read ArticleHow to Register as a Forex Trader in South Africa Welcome to our step-by-step guide on how to register as a forex trader in South Africa. As the …

Read ArticleUnderstanding the Vortex Indicator: A Comprehensive Guide If you are a trader looking to improve your trading strategy, one tool that you should …

Read ArticleStockholm Currency to Indian Rupees Conversion If you’re planning a trip to Stockholm, Sweden, it’s essential to be aware of the exchange rate between …

Read ArticleGetting Started with Options Day Trading Day trading options can be a lucrative venture for those who are willing to put in the time and effort to …

Read Article