The Ultimate Guide to Finding the Best Swing Trading Strategy

What is the Best Swing Trading Strategy? Swing trading is a popular trading style that involves capturing short-term price movements in the financial …

Read Article

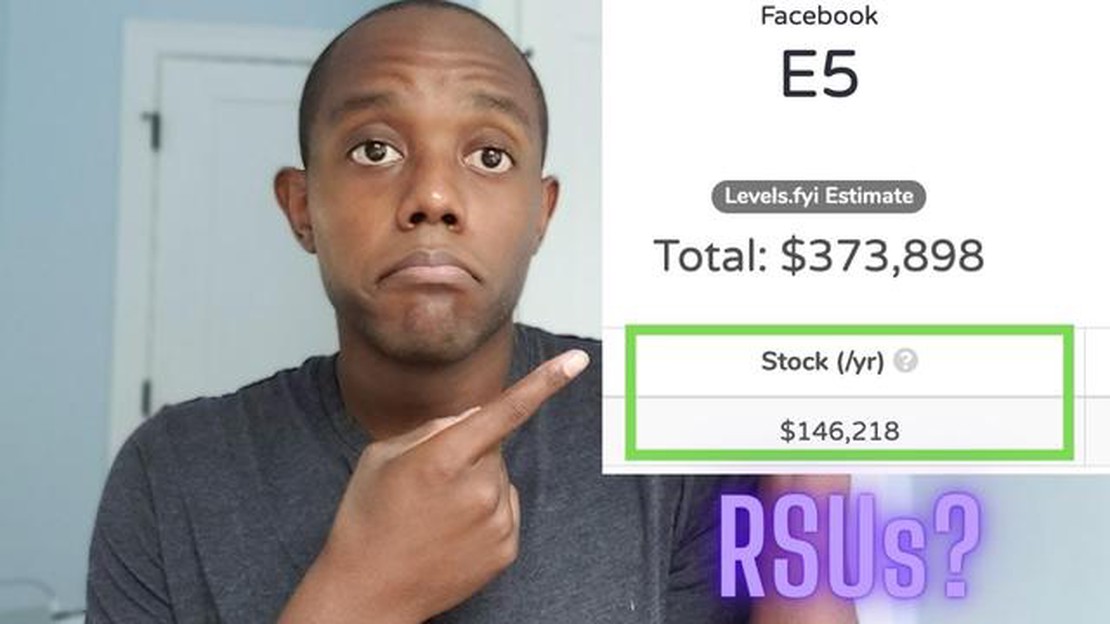

RSU, or Restricted Stock Units, is a common form of equity compensation for employees in many technology companies, including Tesla. RSUs are a type of stock grant, which means that employees receive shares of the company’s stock as a form of compensation. However, unlike traditional stock options, RSUs come with certain restrictions on when and how the shares can be sold or transferred.

When an employee is granted RSUs, they are not immediately given ownership of the shares. Instead, the shares are “restricted” and subject to a vesting period, during which the employee must meet certain conditions in order to fully own the shares. These conditions typically include continued employment with the company for a specified period of time.

Once the RSUs have vested, the employee is free to sell or transfer the shares. However, many employees choose to hold onto their shares for a longer period of time in order to benefit from potential future increases in the company’s stock price. This can be a risky strategy, as the value of the shares can also decrease.

Overall, RSUs can be a valuable form of compensation for Tesla employees, as they provide an opportunity to share in the company’s success. However, it is important for employees to understand the restrictions and risks associated with RSUs before making any decisions regarding their stock grants.

A Restricted Stock Unit (RSU) is a form of compensation offered by companies to their employees, typically in the form of company stocks. Unlike traditional stock options, RSUs do not require an upfront payment from the employee.

When an employee is granted RSUs, they receive a certain number of shares that will vest over a specific period of time. The vesting period can vary, but it is usually around three to four years. Once the RSUs vest, the employee becomes the legal owner of the stocks and can choose to sell them or hold onto them.

One of the key benefits of RSUs is that they provide employees with an ownership stake in the company. This can create a sense of motivation and loyalty among employees, as they have a vested interest in the company’s success.

Another benefit of RSUs is that they can provide employees with a valuable source of income. When RSUs vest, the employee has the option to sell the stocks, potentially generating a significant amount of money. This can be especially advantageous if the company’s stock price has increased since the RSUs were granted.

Additionally, RSUs are often considered a tax-efficient form of compensation. Since the employee does not receive the stocks until they vest, they are not required to pay taxes on them until that time. This can allow employees to defer their tax liability and potentially pay at a lower tax rate when the stocks are eventually sold.

In summary, RSUs are a form of compensation that offer several benefits to employees. They provide an ownership stake in the company, the potential for significant income, and can be a tax-efficient form of compensation.

RSU, or Restricted Stock Units, are a form of equity compensation provided to Tesla employees. When a Tesla employee receives RSUs, they are granted a certain number of company shares, but they do not actually receive those shares immediately. Instead, the RSUs “vest” over a period of time. This means that the employee will gain ownership of a certain percentage of the RSUs over a predetermined schedule.

At Tesla, RSUs typically vest over a four-year period, with a “one-year cliff.” This means that after the first year of employment, the employee will be granted 25% of their total RSU grant. After the one-year cliff, the remaining RSUs will vest monthly or quarterly, depending on the specific schedule outlined in the employee’s grant agreement.

Once the RSUs vest, the employee has the choice to sell the shares or hold onto them. If they choose to sell, they will receive the monetary value of the shares at the current market price. If they choose to hold onto the shares, they will become a shareholder of Tesla and will be able to benefit from any increase in the company’s stock price.

It’s important to note that RSUs are a form of compensation and are subject to income tax. When RSUs vest, the employee will need to report the value of the vested shares on their income tax return. The company may also withhold a portion of the shares to cover the employee’s tax liability.

Read Also: Is Stock Considered an Investment? Exploring the Benefits and Risks

RSUs serve as a way to incentivize and reward Tesla employees for their contribution to the company’s success. By providing employees with a stake in the company, Tesla aims to align their interests with those of the shareholders and drive long-term value for everyone involved.

RSU, or Restricted Stock Units, are a popular form of employee compensation at Tesla, and come with a number of advantages for employees:

Read Also: Is Crypto Forex Legit? Discover the Truth About Cryptocurrency Trading

1. Ownership in Tesla: RSUs give employees the opportunity to own a stake in the company. This can create a sense of loyalty and motivation, as employees are not just working for a paycheck, but also have a vested interest in the success of Tesla.

2. Potential for Financial Growth: As Tesla’s stock price increases, the value of RSUs also increase. This means that employees have the potential to earn additional income through the appreciation of their RSUs.

3. Long-Term Incentives: RSUs are often granted with a vesting period, meaning that employees must remain with the company for a certain period of time before they can fully own their RSUs. This encourages long-term commitment to the company and can help to retain top talent.

4. Tax-Advantaged: RSUs are generally taxed as capital gains when they are sold, which can result in a lower tax rate compared to ordinary income. This can be advantageous for employees in terms of tax planning and overall financial gain.

5. Flexibility in Conversion: RSUs can typically be converted into Tesla’s common stock or cash. This provides employees with flexibility in how they choose to utilize their RSUs, whether it be to hold onto the stock for potential future gains or to cash out for immediate financial needs.

Overall, RSUs offer Tesla employees a unique opportunity to benefit from the company’s success and align their financial interests with that of the company. This can be a powerful incentive and contribute to a positive work environment and culture of ownership.

RSU stands for Restricted Stock Units. It is a form of stock-based compensation that companies offer to their employees.

When an employee is granted RSUs, they receive a promise from the employer to receive a certain number of company shares at a future point in time, typically after a vesting period.

Companies offer RSUs as a way to incentivize employees and align their interests with those of the company. It can be seen as a way to reward employees for their performance and loyalty.

Vesting period is the length of time an employee must wait before they are able to exercise their right to receive the company shares. Typically, vesting periods range from 1 to 4 years.

After the vesting period, the employee can choose to sell the company shares they received as part of their RSUs or hold onto them. The value of the shares will depend on the performance of the company’s stock.

RSU stands for Restricted Stock Unit. It is a form of compensation commonly used by companies, including Tesla, to reward and incentivize employees.

When a company grants RSUs to an employee, it promises to give the employee a certain number of company shares at a future date. These shares are usually subject to vesting requirements and other conditions.

What is the Best Swing Trading Strategy? Swing trading is a popular trading style that involves capturing short-term price movements in the financial …

Read ArticleChoosing the Appropriate Risk-Free Rate for Options When trading options, it’s crucial to consider the risk-free rate in order to accurately price and …

Read ArticleThe Turtle Trading Rules: What You Need to Know In the 1980s, Richard Dennis and William Eckhardt developed a trading experiment known as the Turtle …

Read ArticleUnderstanding the Value of 1 Volume in the Forex Market When it comes to understanding the intricacies of forex trading, one of the key concepts that …

Read ArticleLearn how to analyze candlestick patterns and make informed trading decisions Interested in trading? Want to take your investing skills to the next …

Read ArticleUnderstanding the Accuracy of Renko Charts in Trading Renko charts have gained popularity among traders for their ability to filter out market noise …

Read Article