Understanding Call Activity in Stocks: Everything You Need to Know

Understanding Call Activity in Stocks When it comes to understanding the intricacies of the stock market, one key concept that every investor should …

Read Article

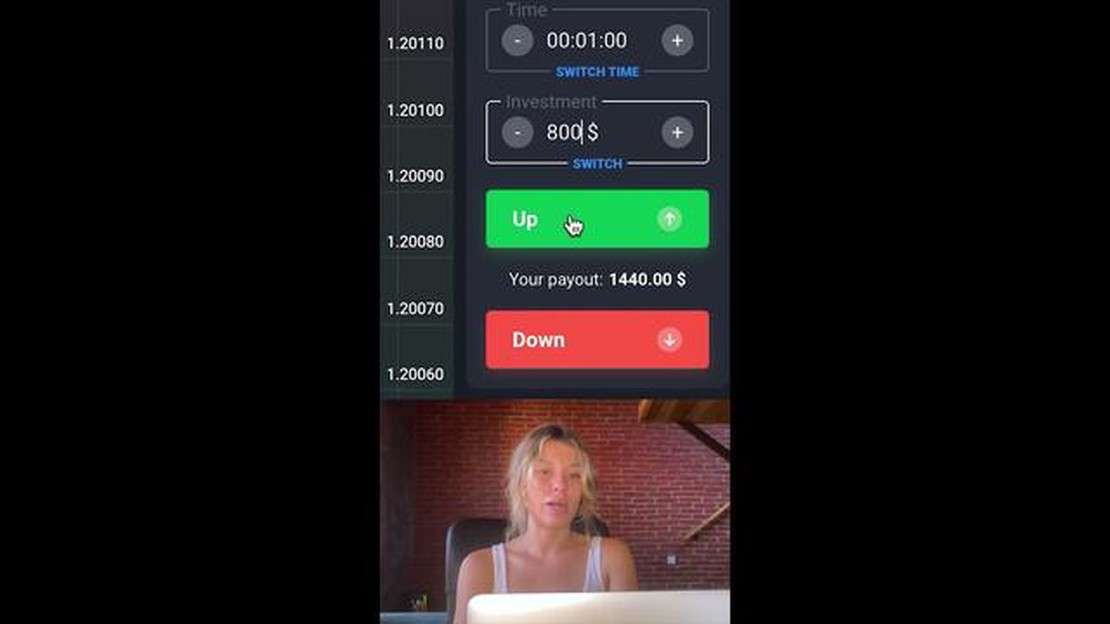

Binary options are a popular form of trading in the financial markets. They offer traders the opportunity to make high returns on their investment in a short period of time. However, in order to be successful in binary options trading, it is crucial to understand the concept of binary option payments.

Binary option payments refer to the amount of money a trader receives if their prediction about the price movement of an asset is correct. The payment is determined by several factors, such as the type of binary option, the time remaining until expiration, and the volatility of the underlying asset.

There are two main types of binary option payments: fixed payout and variable payout. In fixed payout options, the payment is predetermined and does not change regardless of the final price of the asset. On the other hand, in variable payout options, the payment is determined by the difference between the final price of the asset and the strike price.

It is important to note that binary option payments are usually expressed as a percentage of the initial investment. For example, if a trader invests $100 in a binary option with a 80% payout, they will receive $180 if their prediction is correct. However, if their prediction is incorrect, they will lose the entire $100.

Understanding binary option payments is essential for traders to effectively manage their risks and maximize their profits. By carefully analyzing the factors that influence the payment and choosing the right binary option strategy, traders can increase their chances of success in the volatile world of binary options trading.

A binary option is a financial instrument that allows traders to speculate on the price movement of an underlying asset. When trading binary options, it is crucial to understand how payments are calculated and how they can impact your profitability.

The payment structure of binary options is relatively straightforward. When placing a trade, you are required to choose the direction in which you think the price of the underlying asset will move. If your prediction is correct at the time of expiry, you will receive a fixed payout. However, if your prediction is incorrect, you will lose the initial investment.

Binary option payments are typically expressed as a percentage of the initial investment. The payout percentage varies depending on the broker you are trading with and the type of binary option you are trading. In general, the higher the risk involved in the trade, the higher the potential payout. This means that if you are trading a binary option with a higher probability of success, the payout percentage will be lower.

It is important to note that binary options have predefined expiry times, which can range from minutes to months. The payout is only provided if the price of the underlying asset is in the predicted direction at the time of expiry. If the price is not in the predicted direction, the trade is considered out of the money and no payout is provided.

Binary option payments can be a combination of fixed payouts and variable payouts. Fixed payouts have a predetermined payout amount, while variable payouts depend on the price movement of the underlying asset. Variable payouts can be higher or lower than the fixed payout, depending on the outcome of the trade.

Understanding binary option payments is essential for successful trading. It allows you to assess the potential profitability of a trade and manage your risk effectively. By understanding the payout structure and the factors that affect it, you can make more informed trading decisions and increase your chances of success in the binary options market.

Binary option payments are an essential aspect of trading in the binary options market. It is important to understand how these payments work to effectively navigate the world of binary options trading.

Binary option payments are the amounts of money that a trader receives or pays out when trading binary options. These payments are determined by the outcome of the trade, whether the option finishes in the money or out of the money.

Read Also: Choosing the Right Type of Trendline for Your Data Analysis

When a binary option finishes in the money, meaning the trade was successful, the trader will receive a predetermined payout. The payout amount is determined before the trade is executed and is usually expressed as a percentage of the trade amount. For example, if the payout is set at 80% and the trader invests $100 in a binary option trade that finishes in the money, the trader will receive $80 in payout.

On the other hand, if a binary option finishes out of the money, meaning the trade was unsuccessful, the trader will lose the entire amount of their investment. In this case, the trader will not receive any payout.

It is important for traders to carefully consider the payout percentage when selecting binary options trades. A higher payout percentage means the potential for higher profits, but it also often comes with a higher risk. Traders should analyze the payout percentages offered by different brokers and select trades that offer a balance between potential profitability and risk.

In addition to the payout percentage, traders should also consider the return percentage offered by brokers for out of the money trades. Some brokers may offer a small return percentage, such as 15%, for trades that finish out of the money. This can help mitigate losses and is an important factor to consider when selecting a broker.

Overall, understanding binary option payments is crucial for successful trading. Traders should carefully analyze payout percentages, return percentages, and risk levels to make informed decisions and maximize their trading profits.

Binary option payments are influenced by various factors that can have a significant impact on the overall profitability of a trade. Understanding these factors is crucial for traders to make informed decisions and maximize their potential returns.

Read Also: Discover the Ideal Trading Time for EUR JPY: Boost Your Forex Trading Success

1. Asset Price Movement: The most significant factor that affects binary option payments is the movement of the underlying asset’s price. If the price moves in the predicted direction, the payout will be higher. However, if the price moves against the prediction, the payout may be reduced or even result in a loss.

2. Time to Expiration: The time remaining until the option’s expiration also plays a role in determining its payment. As the expiration time approaches, the value of the option can change rapidly. This means that options with longer expiration times generally have higher payouts compared to options with shorter expiration times.

3. Volatility: Volatility refers to the magnitude of the price fluctuations of an asset. Higher volatility typically leads to higher payouts since there is a greater likelihood of significant price movements. Conversely, lower volatility may result in lower payouts due to reduced price fluctuations.

4. Risk Appetite: Each trader has a unique risk appetite, which influences the types of trades they are willing to enter. Traders with higher risk appetites may opt for riskier trades with higher potential payouts. On the other hand, traders with lower risk appetites may choose safer trades with lower potential payouts.

5. Broker Policies: Different binary options brokers may have varying payment structures and policies. It is important to choose a reputable broker that offers fair and transparent payment terms. Some brokers may impose restrictions or additional fees that can affect the actual payment received by the trader.

6. Trade Size: The size of the trade, often referred to as the investment amount or stake, can also impact the binary option payment. Typically, larger trades result in larger potential payouts. However, it is important for traders to manage their risk and ensure they do not risk more than they can afford to lose.

By considering these factors and conducting thorough analysis, traders can enhance their understanding of binary option payments and make better-informed trading decisions to increase their chances of success.

Binary options are financial instruments that allow traders to speculate on the price movement of various underlying assets. Traders have to predict whether the price will go up or down within a specified time frame.

Binary option payments depend on the outcome of the trade. If the trader’s prediction is correct, they will receive a fixed payout. However, if the prediction is wrong, they will lose the initial investment.

The size of binary option payments is determined by several factors. These include the initial investment amount, the percentage payout offered by the broker, and the outcome of the trade (whether it is a win or a loss).

Sure! Let’s say a trader invests $100 in a binary option with a payout of 80%. If their prediction is correct, they will receive a payout of $180 ($100 initial investment + $80 profit). However, if their prediction is wrong, they will lose the entire $100 investment.

Understanding Call Activity in Stocks When it comes to understanding the intricacies of the stock market, one key concept that every investor should …

Read ArticleTips for Creating a Powerful Deck in the Pokemon Trading Card Game Deck building is a crucial skill for any competitive player in the Pokemon Trading …

Read ArticleInvestors of Zocdoc: Who are they? Zocdoc, the online medical appointment booking platform, has attracted significant investment from a wide range of …

Read ArticleIs it Halal to Trade in Binary Options? Binary options trading has become increasingly popular in recent years, offering individuals the opportunity …

Read ArticleBuy Volkswagen Shares in India: A Comprehensive Guide Investing in the stock market can be a lucrative endeavor, especially if you make informed …

Read ArticleShould You Pay for Trading Signals? In the world of trading, one of the biggest challenges is knowing when to buy and sell. This is where trading …

Read Article