Can Indians trade in CME: A Guide for Traders in India

Is it possible for Indians to trade on CME? The Chicago Mercantile Exchange (CME) is a global derivatives marketplace that offers a wide range of …

Read Article

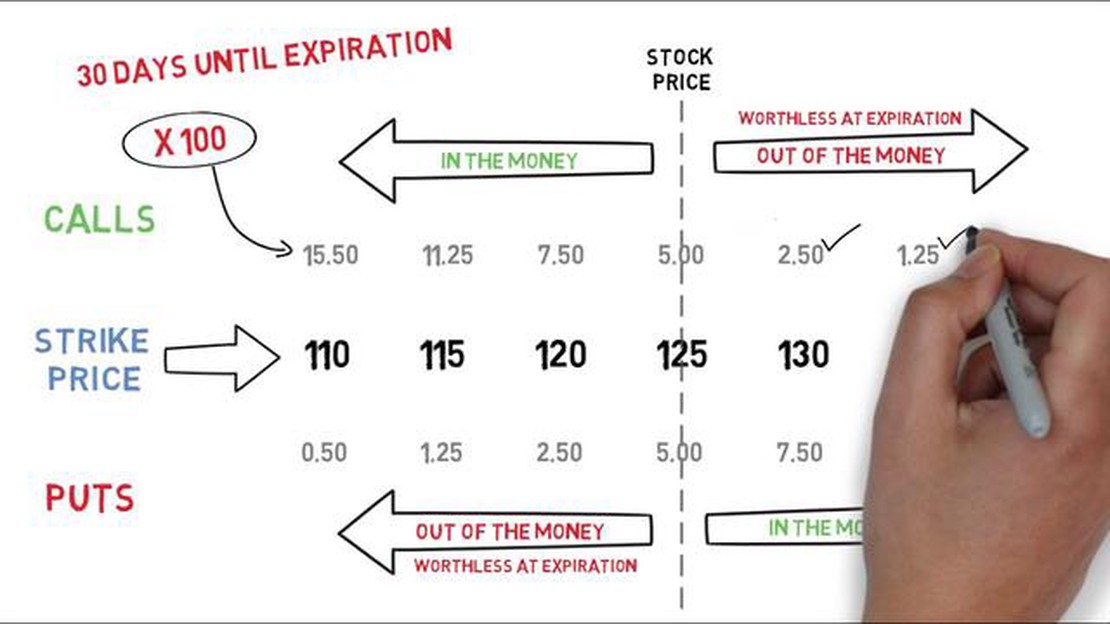

Options trading is a complex and multifaceted market that requires careful planning and strategic decision-making. Whether you’re a novice trader or have been in the game for years, understanding the different order types is crucial to your success. In this comprehensive guide, we will delve into the various order types for options trading and explore how they can be used to maximize your potential gains and minimize your risks.

One of the most commonly used order types in options trading is the market order. This type of order is executed instantly at the current market price. Market orders are ideal for traders who want to enter or exit a position quickly, as they guarantee execution but do not guarantee a specific price. However, it’s important to note that market orders can be subject to slippage, especially during volatile market conditions.

Another popular order type is the limit order. With a limit order, you set a specific price at which you’re willing to buy or sell an option. The order will only be executed if the market price reaches or exceeds your specified limit. Limit orders provide traders with more control over the price at which their order is filled, but there is no guarantee of execution if the market doesn’t reach your limit price.

For traders who want to protect themselves against potential losses, stop orders can be a valuable tool. A stop order becomes a market order once the stock price reaches a specified trigger price, known as the stop price. This type of order is commonly used to limit losses or protect profits. Stop orders can be particularly useful in options trading, where prices can fluctuate rapidly and unpredictably. It’s important to be aware, however, that stop orders can also be subject to slippage, especially during fast-moving markets or gaps in trading.

Understanding the different order types for options trading is essential for any trader who wants to navigate this complex market with confidence and success. By familiarizing yourself with the advantages and limitations of market orders, limit orders, and stop orders, you can develop a trading strategy that aligns with your risk tolerance and investment goals. So, before diving into options trading, take the time to learn about and understand these order types - your portfolio will thank you.

Options trading is a complex and lucrative investment strategy that allows traders to speculate on the future price movement of an underlying asset. To navigate the options market successfully, it’s crucial to understand the various order types that traders can use to execute their trades.

An order type is an instruction given by a trader to a brokerage firm to buy or sell options contracts. Each order type has specific conditions and rules that must be followed to execute the trade successfully. By understanding the different order types, traders can implement effective trading strategies and manage their risk more efficiently.

Market Order:

A market order is a type of order that instructs the broker to buy or sell options at the best available price in the market. The trade is executed immediately at the current market price, regardless of any fluctuations. Market orders are often used when speed of execution is more important than price.

Limited Order:

A limit order is a type of order that specifies the maximum price a trader is willing to pay to buy or the minimum price they are willing to accept to sell an options contract. The trade is executed only when the market reaches or exceeds the specified price, ensuring that the trader gets the desired price or better.

Stop Order:

Read Also: Understanding the Mean Reversion Trading System: A Definitive Guide

A stop order is a type of order that instructs the broker to buy or sell options when the market reaches a specific price level called the “stop price”. Once the market reaches the stop price, the stop order becomes a market order, and the trade is executed at the best available price. Stop orders are commonly used to limit losses or capture profits.

Stop-Limit Order:

Read Also: What is the prediction for MU stock? Expert analysis and forecast

A stop-limit order is a combination of a stop order and a limit order. It functions as a stop order until the stop price is reached, at which point it becomes a limit order with a specified price. This type of order allows traders to have more control over the execution price, but there is a risk that the order may not be executed if the market moves quickly.

Trailing Stop Order:

A trailing stop order is a type of order that is similar to a stop order but with a dynamic stop price. The stop price is set at a certain percentage or dollar amount away from the market price, and it moves along with the market price. This type of order is useful for locking in profits as the market moves in the trader’s favor.

Understanding the different order types in options trading is essential for traders to take advantage of various market conditions and implement effective trading strategies. By carefully selecting the appropriate order type, traders can optimize their trading decisions and achieve their financial goals.

Options trading involves a variety of order types that traders can utilize to execute their strategies. Each order type serves a different purpose and understanding them is essential for successful options trading. In this article, we will explain some of the most common order types used in options trading.

These are just a few examples of the order types available for options trading. It is important to understand how each order type works and to choose the most appropriate one for your trading strategy. By utilizing the right order type, you can enhance your trading effectiveness and achieve better results in the options market.

There are several types of orders in options trading, including market orders, limit orders, stop orders, and stop-limit orders.

A market order in options trading is an order to buy or sell an option at the best available price at the time the order is placed. The trade is executed immediately at the current market price.

A limit order in options trading is an order to buy or sell an option at a specific price or better. The order will only be executed if the market price reaches or exceeds the specified limit price.

A stop order in options trading is an order to buy or sell an option once its price reaches a specified level, called the stop price. Once the stop price is reached, the order becomes a market order and is executed at the best available price.

Is it possible for Indians to trade on CME? The Chicago Mercantile Exchange (CME) is a global derivatives marketplace that offers a wide range of …

Read ArticleHow to Utilize the 8 and 21 Moving Average in Trading When it comes to trading, using moving averages can be a powerful tool. In particular, the 8 and …

Read ArticleUnderstanding Forex Symbols: A Comprehensive Guide When you start trading in the foreign exchange market, also known as Forex, one of the first things …

Read ArticleIs BNO Stock a Good Buy? Investing in the stock market can be a daunting task, especially with the vast array of options available. One stock that has …

Read ArticleCalculating in XLS: A Step-by-Step Guide If you are new to Microsoft Excel or simply need a refresher, this step-by-step guide will help you navigate …

Read ArticleHow much does a forex trader make in the UK? Forex trading has become increasingly popular, especially in the UK, where it has been embraced by a …

Read Article