What is JCP Full Form? - Explained | Full Form of JCP

What is JCP full form? Have you ever wondered what the meaning of JCP is? Well, you’re not alone. JCP is an acronym that stands for Java Community …

Read Article

Options are a powerful financial instrument that allows investors to profit from the price movements of stock indices and currencies. They provide flexibility and leverage, allowing traders to control a large amount of underlying assets with a relatively small investment. However, trading options can be complex and carries a high level of risk.

This comprehensive guide will provide you with a deep understanding of options on stock indices and currencies. We will start by explaining the basics of options, including the different types of options and their key terms. We will then delve into the mechanics of trading options on stock indices and currencies, discussing factors that influence their prices and the strategies used to profit from them.

Furthermore, we will explore the benefits and risks of trading options, helping you assess whether options are suitable for your investment goals and risk tolerance. We will also discuss the role of options in hedging and portfolio management, and how they can be used in conjunction with other financial instruments.

Whether you are a novice investor or an experienced trader, this guide will equip you with the knowledge and tools necessary to navigate the complex world of options on stock indices and currencies. By the end of this guide, you will have a solid foundation to start trading options and potentially enhance your investment returns.

An option is a financial instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (known as the strike price) within a specified period of time. Options are commonly used in trading and investing to manage risk and speculate on movements in the price of the underlying asset.

| Call Option | Put Option |

|---|---|

| A call option gives the holder the right to buy the underlying asset at the strike price. | A put option gives the holder the right to sell the underlying asset at the strike price. |

| Profits are made if the price of the underlying asset increases above the strike price. | Profits are made if the price of the underlying asset decreases below the strike price. |

| Buyers of call options are bullish on the underlying asset. | Buyers of put options are bearish on the underlying asset. |

Options can be used for various purposes, including hedging, income generation, and speculation. They are traded on various exchanges and can be customized to meet different investment objectives. It is important to understand the risks and benefits associated with options trading before getting involved in the market.

Options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain time frame. They provide flexibility for investors and can be used for speculative purposes or as risk management tools.

There are two types of options: call options and put options.

A call option gives the buyer the right to buy the underlying asset at the exercise price (also known as the strike price) on or before the expiration date. If the price of the underlying asset is higher than the exercise price, the call option is said to be “in the money” and the buyer can exercise the option to buy the asset at a profit. If the price is lower, the call option is “out of the money” and the buyer may choose not to exercise the option.

A put option, on the other hand, gives the buyer the right to sell the underlying asset at the exercise price on or before the expiration date. If the price of the underlying asset is lower than the exercise price, the put option is “in the money” and the buyer can exercise the option to sell the asset at a profit. If the price is higher, the put option is “out of the money” and the buyer may choose not to exercise the option.

Read Also: Option Repricing: An Example to Understand Its Mechanics

Options can be further categorized based on their expiration date. There are two main types: European options and American options. European options can only be exercised on the expiration date, while American options can be exercised at any time before or on the expiration date.

Understanding the different types of options is essential for investors looking to engage in options trading or incorporate options into their investment strategies. By gaining a thorough understanding of options, investors can effectively manage risk and potentially profit from market movements.

Options on stock indices are financial derivatives that allow investors to speculate on the direction of an entire stock market index, rather than an individual stock. These options give investors the right, but not the obligation, to buy or sell an index at a specified price on or before a specific date.

There are two types of options on stock indices: call options and put options. A call option gives the holder the right to buy the index at a specified price, known as the strike price, while a put option gives the holder the right to sell the index at the strike price.

Read Also: Trading Hours for CET: Everything You Need to Know

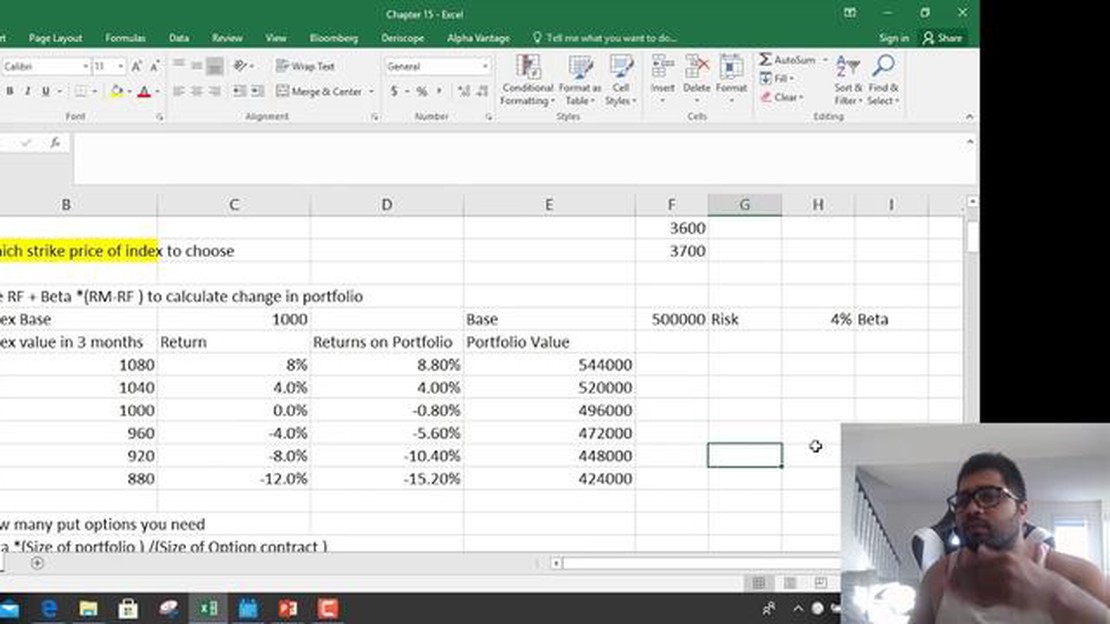

Investors use options on stock indices for various reasons. They can be used to hedge against potential downturns in the stock market, as well as to speculate on the direction of the market. For example, if an investor believes that the stock market will rise, they may purchase call options on a stock index. If the market does indeed rise, the investor can exercise their option and profit from the increase in value.

Options on stock indices have several advantages over options on individual stocks. Firstly, they provide exposure to the entire stock market, rather than just one company. This diversification can help reduce risk. Additionally, options on stock indices typically have less volatility than options on individual stocks, making them potentially less risky.

When trading options on stock indices, it is important to understand the underlying index and its components. Investors should also be aware of the expiration date of the option and the potential risks involved. It is advisable to consult with a financial advisor or broker before engaging in options trading.

In conclusion, options on stock indices are a versatile financial tool that allows investors to gain exposure to the broader stock market. They can be used for hedging or speculation purposes and offer benefits such as diversification and potentially lower volatility. However, it is essential to have a good understanding of the underlying index and the risks involved before trading options on stock indices.

Options on stock indices and currencies are financial derivatives that give the holder the right, but not the obligation, to buy or sell a specific underlying stock index or currency pair at a predetermined price within a specific timeframe.

Yes, options on stock indices and currencies are popular among traders because they provide opportunities for hedging, speculation, and portfolio diversification. They also allow traders to take advantage of market volatility and potentially earn profits with limited risk.

Certainly! Options on stock indices and currencies work similarly to other options contracts. The buyer of the option pays a premium to the seller and receives the right to buy or sell the underlying stock index or currency pair at a specific price (strike price) within a specific timeframe (expiration date). The seller of the option receives the premium and takes on the obligation to fulfill the buyer’s request if the buyer decides to exercise the option.

Traders can use various strategies with options on stock indices and currencies, such as buying call options to profit from an anticipated increase in the underlying index or currency value, buying put options to profit from an anticipated decrease, selling call options to earn premium income while potentially being obligated to sell at a higher price, selling put options to earn premium income while potentially being obligated to buy at a lower price, and using spreads or combinations of different options contracts to create more complex strategies.

Trading options on stock indices and currencies allows traders to benefit from market opportunities with limited risk, as the maximum loss is limited to the premium paid for the option. Options also offer flexibility in terms of investment strategies, including hedging and diversification. In addition, options can provide leverage, allowing traders to control a larger position with a smaller amount of capital.

What is JCP full form? Have you ever wondered what the meaning of JCP is? Well, you’re not alone. JCP is an acronym that stands for Java Community …

Read ArticleHow Long Does it Take to Master Forex Trading? Forex trading is a complex and dynamic field that requires extensive knowledge and experience to …

Read ArticleCalculating Average Value in Simulink: a Step-by-Step Guide In Simulink, average value is a commonly used metric to analyze the performance of a …

Read ArticleDisadvantages of Using Stock Options as Incentives Stock options have long been used as a popular form of employee incentives, offering the potential …

Read ArticleDaily Turnover of the Forex Market Worldwide The foreign exchange market, also known as the forex or FX market, is the largest and most liquid …

Read ArticleContacting ASB Foreign Currency: How to Get in Touch Welcome to ASB Foreign Currency, where we offer a range of convenient services for all your …

Read Article