Discover a Clear Example of 10 Pips and its Importance

What is an example of 10 pips? When it comes to trading in the foreign exchange market (Forex), understanding key concepts such as pips is crucial. A …

Read Article

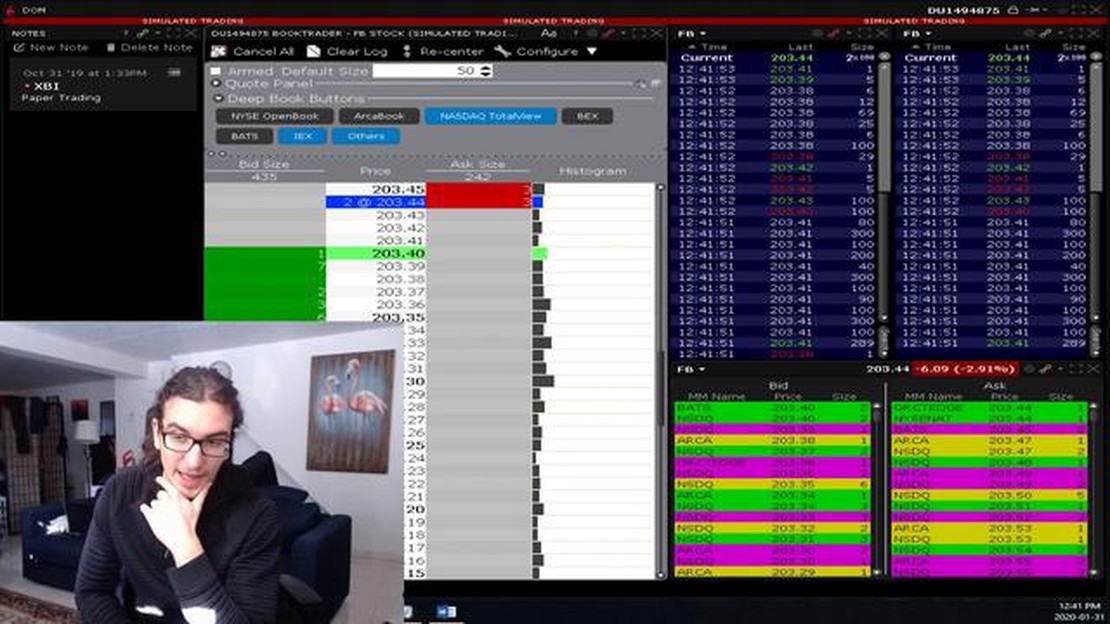

Level 2 market data is a more advanced form of market data that provides traders with detailed information about the current bid and ask prices for a particular security. This data includes the number of shares available at each price level, allowing traders to make more informed decisions.

IBKR (Interactive Brokers) is a popular online brokerage firm that offers a wide range of trading services and tools. One of the key features of IBKR is its provision of Level 2 market data to its clients. This means that IBKR clients have access to the most up-to-date and detailed information about the market, which can be crucial for making profitable trades.

In addition to providing Level 2 market data, IBKR also offers a variety of other market data and research tools to assist traders in their decision-making process. These tools include real-time streaming quotes, news feeds, and technical analysis tools. With these resources, traders can analyze market trends and identify potential trading opportunities.

Overall, IBKR’s offering of Level 2 market data sets it apart from many other brokerage firms and makes it a popular choice among active traders who require access to detailed market information. By providing this valuable data, IBKR helps its clients make more informed and potentially more profitable trading decisions.

IBKR offers a comprehensive range of market data to its clients, providing them with the information they need to make informed investment decisions. The market data offered by IBKR includes:

| Data Type | Description |

|---|---|

| Level 1 Data | This data type provides real-time streaming quotes and other basic market information, such as bid/ask prices and volumes. |

| Level 2 Data | IBKR offers Level 2 market data that provides a deeper level of insight into market activity. This data includes real-time quotes for each market participant and their respective order sizes. |

| Historical Data | IBKR provides access to historical market data, allowing clients to analyze past price movements and trends. |

| Advanced Charting | IBKR’s market data offerings include advanced charting tools that enable clients to visually analyze market trends and patterns. |

| News Feeds | IBKR offers real-time news feeds from various sources, helping clients stay informed about market events and news that may impact their investments. |

By providing access to a wide range of market data, IBKR empowers its clients to make data-driven investment decisions and stay ahead of market trends.

Level 2 Market Data refers to the additional market information that is available beyond the basic Level 1 data. It provides traders with a deeper understanding of market conditions and allows them to make more informed trading decisions.

With Level 2 Market Data, traders can see the full order book for a particular security, including the bid and ask prices and sizes. This information is crucial for understanding the current supply and demand dynamics in the market. Traders can also see the market depth, which shows the number of shares available at each price level. This helps traders gauge market liquidity and identify potential support and resistance levels.

IBKR offers Level 2 Market Data to its clients, allowing them to access real-time market information from major exchanges around the world. Traders can use this data to analyze market trends, monitor the activity of specific stocks, and identify potential trading opportunities. IBKR also provides tools and resources to help traders interpret and analyze Level 2 Market Data effectively.

| Benefits of Level 2 Market Data |

|---|

| 1. Enhanced market transparency |

| 2. Deeper understanding of supply and demand |

| 3. Ability to identify potential support and resistance levels |

| 4. Access to real-time market information |

| 5. Improved ability to make informed trading decisions |

Read Also: 2023 Dollar to MYR Forecast: What to Expect

Level 1 market data is the basic price information provided by the exchanges. It includes the bid and ask prices, along with the last traded price. This data is typically available to all traders and investors, as it is necessary for making informed trading decisions.

Level 1 market data provides real-time updates on the current market conditions, allowing traders to see the current bid and ask prices for a particular security. This information is crucial for executing trades at the desired price and understanding the overall market sentiment.

While Level 1 data is sufficient for most traders, it does have some limitations. It does not provide information about the individual orders in the order book, so traders cannot see the depth of the market or the size of the orders. Additionally, Level 1 data does not include the historical trading data, such as the volume and price movements over time.

Many brokers, including IBKR, provide access to Level 1 market data for a wide range of securities. This data can be accessed through trading platforms and APIs, allowing traders to analyze the current market conditions and make informed trading decisions.

Read Also: Find the Lowest Exchange Rate for MYR to USD

Overall, Level 1 market data is a valuable tool for traders looking to stay informed about the current market conditions. By providing real-time price information, it helps traders execute trades at the desired price and react quickly to market changes.

Level 2 market data provides investors with more detailed insights into the market than traditional Level 1 market data. Here are some of the advantages of using Level 2 market data:

Overall, Level 2 market data offers valuable insights into the market’s depth and liquidity, which can help traders make more informed decisions and potentially improve their trading outcomes.

Yes, IBKR offers Level 2 market data for free for active traders who generate a certain amount of trading activity each month. However, for non-active traders, there may be a fee for accessing Level 2 market data.

Level 2 market data provides more detailed information about the bids and asks for a particular stock or security. It includes the best bid and ask prices, as well as the number of shares available at those price levels. This information can be useful for traders looking to analyze market depth and make more informed trading decisions.

To access Level 2 market data on IBKR, you would need to subscribe to the appropriate data feed. This can be done through the IBKR Trader Workstation (TWS) platform. Once subscribed, you will be able to view Level 2 market data for the stocks or securities you are interested in.

Level 2 market data is typically available for most actively traded stocks and securities. However, there may be some stocks or securities that do not have Level 2 data available. It is always best to check with your broker, such as IBKR, to see if Level 2 data is available for the specific stocks or securities you are interested in.

Using Level 2 market data can provide several benefits for traders. It can help them see the current bid and ask prices, as well as the depth of the market at those price levels. This can be useful for identifying potential support and resistance levels, as well as for executing trades at the most favorable prices. Additionally, Level 2 data can help traders identify large buyers or sellers in the market, which can be an indication of potential price movements.

Yes, IBKR offers Level 2 market data for stocks, options, futures, and forex. Level 2 market data provides more detailed information about a security’s trading activity, including the bid and ask prices, the size of orders at different price levels, and the market depth. This data is useful for traders who want to analyze the current liquidity and trading patterns of a particular security.

What is an example of 10 pips? When it comes to trading in the foreign exchange market (Forex), understanding key concepts such as pips is crucial. A …

Read ArticleIs Stock Option Income Considered Earned Income? Stock options are a popular form of compensation for employees, particularly in the high-tech …

Read ArticleTransfer Money Abroad with RBL: A Step-by-Step Guide Transferring money abroad can be a complex and time-consuming process, especially when dealing …

Read ArticleUnderstanding Margin Level in Forex Trading Margin level is a crucial concept in trading, encompassing the amount of available funds in your account …

Read ArticleIs Trading Binary Options Easy? Trading binary options is often portrayed as an easy and quick way to make money. With just a few clicks, you can …

Read ArticleHow Long Do You Have to Hold a Forex Trade? As a forex trader, one of the most important decisions you will make is how long to hold a trade. This …

Read Article