Latest bank rate for INR to CAD

Bank Rate for INR to CAD: Exploring the Currency Exchange Options The exchange rate between the Indian Rupee (INR) and the Canadian Dollar (CAD) is an …

Read Article

In the world of financial markets, options are a popular investment tool that allow traders to speculate on the future price movement of an asset. One key aspect of options trading that often confuses beginners is option dates. Understanding the different types of option dates is crucial for successful trading. In this article, we will delve into the world of option dates and explore everything you need to know.

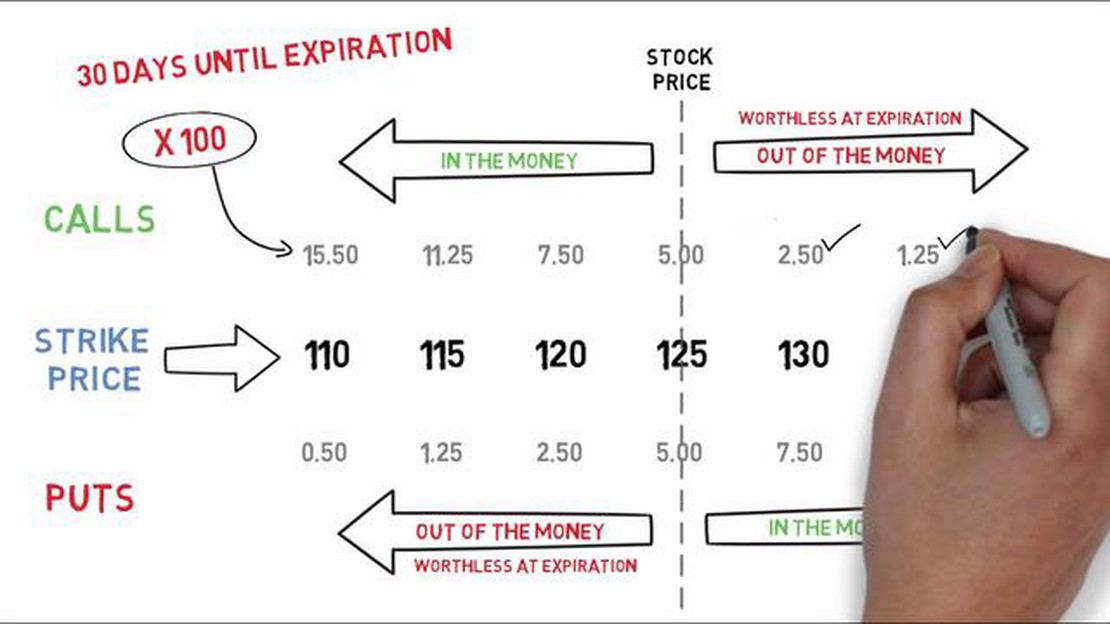

When it comes to options trading, there are three important dates to keep in mind: the expiration date, the strike date, and the settlement date. Each of these dates plays a critical role in determining the value and execution of an option contract.

The expiration date is perhaps the most well-known date in options trading. It is the date on which an option contract becomes void and the right to buy or sell the underlying asset expires. Traders must carefully consider the expiration date when selecting options, as it directly impacts the potential for profit. Additionally, traders can choose between weekly, monthly, or quarterly expiration dates, each offering its own advantages and risks.

The strike date, also known as the exercise date or the maturity date, is the date on which the option can be exercised. This is the date at which the trader either buys or sells the underlying asset at the predetermined strike price. Traders must keep a close eye on the strike date, as it determines when they can take advantage of their option contract.

The settlement date, on the other hand, is the date on which the financial transaction between the buyer and the seller is settled. This is when the actual exchange of the underlying asset and the payment for the option contract take place. Traders must be aware of the settlement date to ensure they have the necessary funds or shares in their account to fulfill the obligations of the contract.

Overall, understanding option dates is crucial for successful trading. By being aware of the expiration date, strike date, and settlement date, traders can make informed decisions and maximize their profits. Whether you are a beginner or an experienced trader, mastering option dates is a key step in navigating the complex world of options trading.

Option dates are an essential aspect of trading options. They refer to specific dates on which an option contract can be exercised or traded. These dates are important as they dictate when an option can be bought or sold and when the underlying asset can be purchased or sold at the strike price.

There are three types of option dates: expiration date, exercise date, and assignment date.

The expiration date is the last day on which the option can be exercised. After this date, the option becomes invalid, and the right to exercise it is lost. It is important for options traders to keep track of expiration dates to avoid any unnecessary losses.

The exercise date refers to the date on which the option contract holder can exercise their right to buy or sell the underlying asset at the strike price. If the option is not exercised by this date, it will expire worthless.

The assignment date is the date on which the options contract seller is notified of their obligation to deliver the underlying asset to the contract buyer if the buyer chooses to exercise their option.

Read Also: Understanding the Relationship Between Share Quantity and Option Prices

Option dates are predetermined and are specified in the option contract. It is important for options traders to carefully consider these dates and how they align with their trading strategy. It is also crucial to keep track of any changes or updates to these dates, as they can impact the outcome of the options trade.

| Date | Definition |

|---|---|

| Expiration Date | The last day on which the option can be exercised. |

| Exercise Date | The date on which the option contract holder can exercise their right to buy or sell the underlying asset. |

| Assignment Date | The date on which the options contract seller is notified of their obligation to deliver the underlying asset. |

Understanding option dates is crucial for options traders to make informed trading decisions and manage their risk effectively. By keeping track of these dates and understanding their implications, traders can enhance their trading strategies and minimize potential losses.

Option dates refer to specific dates that are associated with options contracts. An options contract is a financial derivative that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. These specific dates are known as option dates.

There are two main types of option dates: expiration dates and exercise dates.

Expiration dates are the dates when options contracts expire. After the expiration date, the options contract becomes null and void. The expiration date is crucial as it determines the period of time during which the holder of the options contract can exercise their right to buy or sell the underlying asset. It’s important for traders and investors to be aware of the expiration date when they are trading options.

Read Also: Understanding the TSI Indicator for Amibroker: A Comprehensive Guide

Exercise dates, also known as strike dates, are the dates when the holder of the options contract can exercise their right to buy or sell the underlying asset. These dates are determined by the terms of the options contract and can vary. The holder of the options contract has the flexibility to choose the exercise date based on their trading strategy and market conditions.

It’s important to note that options contracts can have multiple option dates, allowing the holder to choose from different expiration dates and exercise dates. These multiple option dates provide flexibility and allow traders and investors to tailor their options strategies to their specific needs and market conditions.

Understanding option dates is crucial for trading options effectively. Traders and investors need to consider the expiration date and exercise date when deciding whether to enter into an options contract, as well as when and if to exercise their rights to buy or sell the underlying asset.

Option dates refer to the specific dates when option contracts expire. They determine when an option can be exercised or traded on the market.

Option dates play a crucial role in trading as they provide a timeframe within which option contracts can be bought or sold. Traders need to keep track of the expiration dates to make informed decisions.

If you do not exercise an option before the expiration date, it becomes worthless and you lose any potential profit or investment made in that option.

No, option dates cannot be extended. Once an option reaches its expiration date, it cannot be traded or exercised anymore.

Yes, there are different types of option dates including monthly options, weekly options, and quarterly options. These options have different expiration dates and cater to different trading strategies.

Option dates are important because they set the timeline for when an option can be exercised. They determine when the option contract expires and when the holder can buy or sell the underlying asset at the specified strike price. Understanding option dates is crucial for options traders as it helps them plan their trading strategies and make informed decisions.

There are three main types of option dates: the expiration date, the strike date, and the settlement date. The expiration date is the last day when the option can be exercised. The strike date is the date on which the strike price is determined. The settlement date is the date when the underlying asset is delivered or settled after the option is exercised.

Bank Rate for INR to CAD: Exploring the Currency Exchange Options The exchange rate between the Indian Rupee (INR) and the Canadian Dollar (CAD) is an …

Read ArticleBest Range for RSI: Finding the Ideal Value The Relative Strength Index (RSI) is a popular technical indicator used in stock trading and other …

Read ArticleExchange Rate Policy in Azerbaijan: Is it Fixed? Azerbaijan, a country located at the crossroads of Eastern Europe and Western Asia, has a currency …

Read ArticleUnderstanding the 10 20 EMA Indicator in Trading Exponential Moving Averages (EMAs) are a popular technical analysis tool used by traders to analyze …

Read ArticleGrowth Forecast for HPQ HPQ, also known as Hewlett Packard Enterprise, is one of the largest technology companies in the world. As a leader in the …

Read ArticleWhy choose weighted average over average? When it comes to calculating averages, there are different methods to consider, such as the weighted average …

Read Article