Exploring Ways to Recover Stock Losses: Strategies and Tips

How to Recover Stock Losses: Tips and Strategies Investing in the stock market can be a roller-coaster ride, with unpredictable ups and downs. It’s …

Read Article

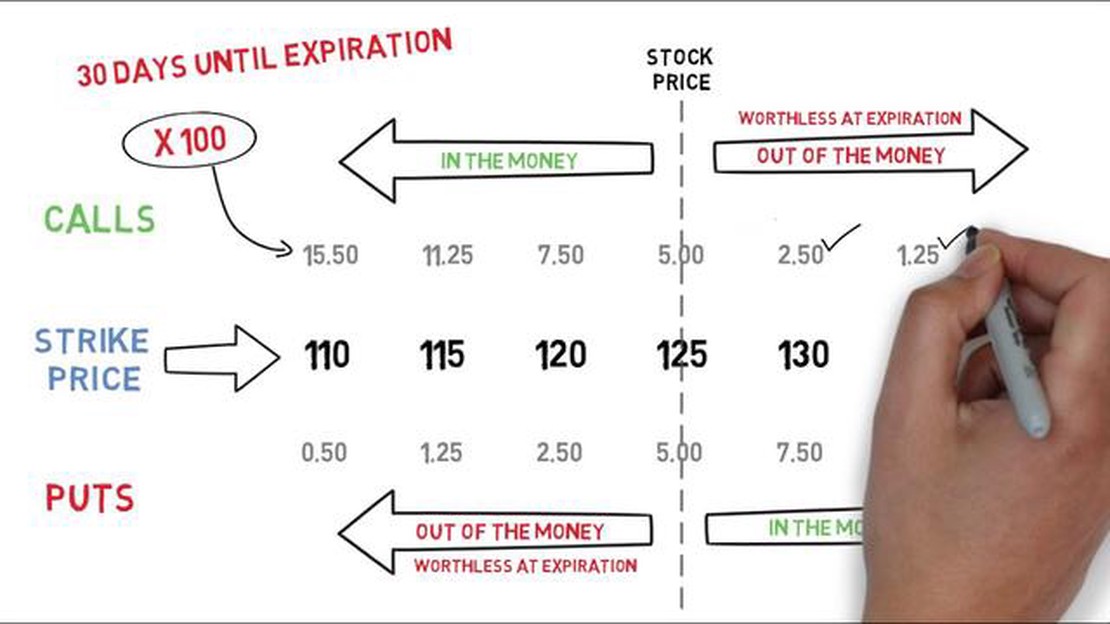

When it comes to options trading, understanding the relationship between share quantity and option prices is crucial for making informed and profitable decisions. Options are financial instruments that give traders the right, but not the obligation, to buy or sell shares at a predetermined price within a specific timeframe. The price of an option is influenced by various factors, one of which is the quantity of shares tied to the option contract.

The quantity of shares, also known as the contract size, is a key consideration when trading options. Each option contract typically represents 100 shares of the underlying stock. This means that when trading options, the quantity of shares will have a direct impact on the cost of the option. For example, if an option contract is priced at $5, the total cost of the contract would be $500 ($5 x 100 shares).

Furthermore, the quantity of shares can also affect the potential profit or loss for an options trader. When the option expires, if the trader exercises the option, they will either buy or sell the underlying shares at the predetermined price, depending on the type of option. The profit or loss will depend on the price of the shares at that time, as well as the quantity of shares involved in the transaction. Therefore, understanding the relationship between share quantity and option prices is essential for assessing potential risks and rewards.

It is important to note that the relationship between share quantity and option prices is not the only factor to consider when trading options. Other factors, such as the strike price, time to expiration, and market volatility, also play a significant role in determining option prices. Traders must carefully analyze these factors and understand their interplay to make well-informed trading decisions.

One important factor that affects option prices is the quantity of shares being traded. The relation between share quantity and option prices can be complex, and it depends on various factors such as market liquidity, supply and demand dynamics, and investor sentiment.

In general, an increase in share quantity can lead to higher option prices. This is because a larger quantity of shares being traded indicates a higher volume of market activity, which can result in greater volatility. Higher volatility is typically associated with higher option prices, as there is a greater probability of significant price movements.

Another way share quantity can impact option prices is through changes in market liquidity. If there is a high quantity of shares available for trading, it indicates a liquid market with ample supply and demand. In such a market, options are more likely to be priced efficiently, reflecting the true value of the underlying shares. On the other hand, if share quantity is low, it can lead to a less liquid market, which may result in wider bid-ask spreads and higher option prices.

Furthermore, the impact of share quantity on option prices can also depend on investor sentiment. If there is high demand for a particular stock, reflected in a large quantity of shares being traded, it can indicate positive investor sentiment. This can lead to increased call option buying and higher option prices, as investors expect the stock price to rise. Conversely, a large quantity of shares being traded due to negative sentiment can lead to increased put option buying and potentially lower option prices.

It’s important to note that the relationship between share quantity and option prices is not always linear or straightforward. Other factors, such as time until expiration, strike price, and interest rates, also play a significant role in determining option prices. Therefore, it’s essential for investors to consider all these factors and conduct thorough analysis before making any investment decisions involving options.

In conclusion, share quantity can have a significant impact on option prices. An increase in share quantity can lead to higher option prices due to increased market activity and volatility. Additionally, changes in market liquidity and investor sentiment can also influence option prices. However, it’s crucial to consider all relevant factors and conduct proper analysis when evaluating the relationship between share quantity and option prices.

Read Also: Is GDX a good fund? Expert analysis and performance review

The relationship between share quantity and option prices can be influenced by various factors that affect the supply and demand dynamics of the options market. These factors include:

4. Dividend Payments: Dividends paid on the underlying shares can impact option prices, especially for options on stocks that are known for regularly paying dividends. The expectation of dividend payments can increase the value of call options and decrease the value of put options. 5. Market Sentiment: Investor sentiment can also play a role in the relationship between share quantity and option prices. Positive market sentiment can increase demand for options, driving up their prices, while negative sentiment can have the opposite effect.

Overall, it is important for investors to consider these factors and the potential impact they may have on the relationship between share quantity and option prices. By understanding these influences, investors can make more informed decisions when trading options.

Understanding the relationship between share quantity and option prices can provide valuable insights for developing investment strategies. By analyzing how changes in share quantity can impact option prices, investors can make informed decisions regarding their investment portfolio.

Read Also: Is Etrade owned by Morgan Stanley? | What You Need to Know

One strategy that can be implemented is buying options on stocks with a high share quantity. When a stock has a large number of shares outstanding, it can indicate that the company is well-established and has a strong market presence. This can make the stock more attractive to investors and potentially lead to higher option prices.

Another strategy is to look for stocks with a low share quantity and high option prices. A low share quantity can indicate that the stock is less liquid and may have lower trading volume. However, if the stock has high option prices, it could indicate that there is a high demand for options on that stock. This could be due to factors such as anticipated volatility or upcoming events that may impact the stock’s price. By identifying these opportunities, investors can potentially profit from the difference between the option price and the stock’s actual performance.

Additionally, understanding the relationship between share quantity and option prices can help investors assess the risk-reward profile of certain investment strategies. Higher option prices can indicate a higher degree of uncertainty or volatility in the underlying stock, which can result in greater potential gains or losses. By considering the share quantity, investors can gain a better understanding of the level of market interest and sentiment towards a particular stock.

It is important to note that investment strategies based on share quantity and option prices should be implemented with caution and thorough analysis. Factors such as market conditions, company fundamentals, and external events can all impact the relationship between share quantity and option prices. Therefore, it is advisable for investors to conduct thorough research and consult with financial professionals before making any investment decisions.

| Advantages | Disadvantages |

|---|---|

| - Higher potential returns from stocks with high share quantity and option prices | - Higher risk associated with stocks with high option prices |

| - Opportunity to profit from the difference between option prices and stock performance | - Limited liquidity for stocks with low share quantity |

| - Insight into market sentiment and interest towards certain stocks | - Volatility and uncertainty in option prices |

| - Assessing risk-reward profile of investment strategies | - Market conditions and external factors can impact share quantity and option prices |

The number of shares can affect option prices in different ways, depending on whether you are buying or selling options. When buying options, a larger number of shares can potentially increase the cost of the options, as you would need to buy more contracts to cover your desired exposure. When selling options, a larger number of shares can potentially decrease the price of the options, as there would be more potential buyers for your contracts.

No, option prices do not increase linearly with the number of shares. Option prices are influenced by various factors such as the underlying stock price, time remaining until expiration, implied volatility, and interest rates. While a larger number of shares can have an impact on option prices, it is just one of many factors that contribute to the overall price of an option.

Trading options based on share quantity can involve certain risks. If you buy options based on a large number of shares, you may be exposed to larger potential losses if the market moves against you. Additionally, buying a large number of options contracts can be costly in terms of commissions and fees. Selling options based on a large number of shares can also have risks, as you may need to deliver the shares if the options are exercised.

Yes, even a small number of shares can have a significant impact on option prices. This is especially true for options on stocks with low trading volumes, as a small number of shares may represent a relatively large percentage of the total available shares. In such cases, the scarcity of shares can result in higher option prices, as there may be limited liquidity in the options market.

How to Recover Stock Losses: Tips and Strategies Investing in the stock market can be a roller-coaster ride, with unpredictable ups and downs. It’s …

Read ArticleShould I sell my FedEx stock? Investing in the stock market requires keen decision-making and the ability to identify the right time to buy or sell …

Read ArticleWhen Does the Forex Market Open? When it comes to forex trading, understanding the trading hours is crucial. The forex market is known for its 24-hour …

Read ArticleUnderstanding the Tax Implications of Options Trading Options trading can be a lucrative venture, but it’s important to understand the tax …

Read ArticleTrading Systems in Forex: A Comprehensive Guide Forex trading is a complex and dynamic market that offers enormous opportunities for both financial …

Read ArticleUnderstanding the Position Ratio in Forex Trading In the world of forex trading, understanding the importance of position ratio is crucial for …

Read Article