Choosing the Best Trading Room for Forex: Expert Recommendations and Analysis

Top Forex Trading Rooms: Choosing the Best Option for Success When it comes to forex trading, having access to a reliable and efficient trading room …

Read Article

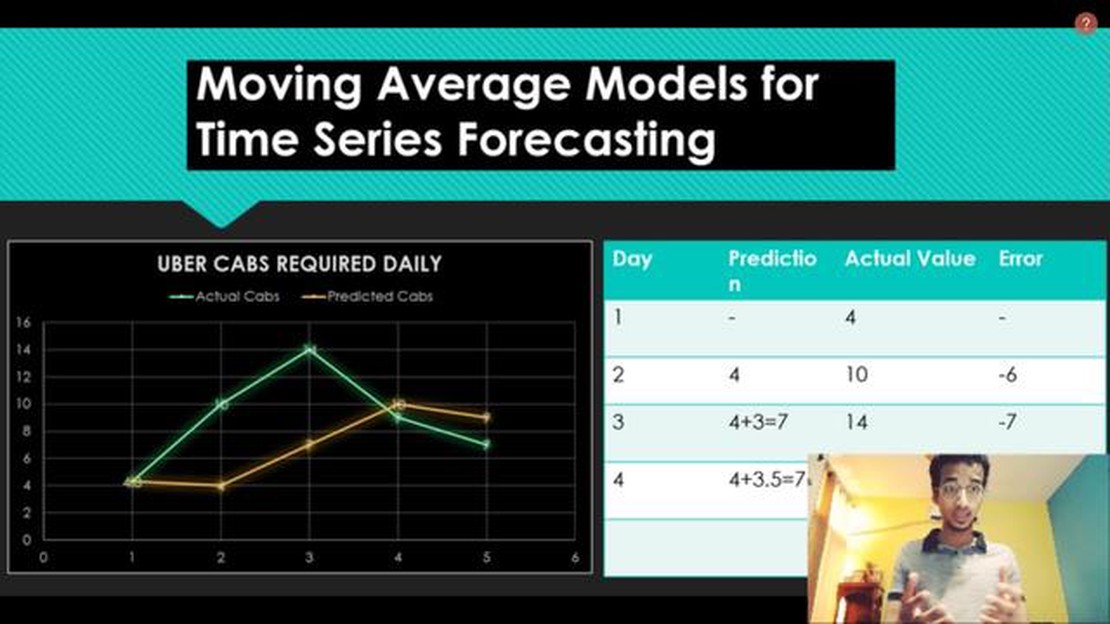

When it comes to analyzing time series data, one of the most commonly used techniques is the Moving Average. This simple yet powerful tool helps to smooth out the noise in the data and highlight underlying trends.

In this comprehensive guide, we will take a deep dive into the concept of Moving Average in the context of machine learning. We will explain what Moving Average is, how it works, and why it is an essential tool in any data analyst’s toolkit.

We will cover various types of Moving Average, including simple moving average (SMA), weighted moving average (WMA), and exponential moving average (EMA). We will explore their differences and advantages in different applications.

Furthermore, we will discuss the importance of selecting the appropriate window size for the Moving Average, and the potential pitfalls of using Moving Average in certain scenarios. We will also provide practical examples and code snippets to demonstrate how to implement Moving Average in Python.

By the end of this comprehensive guide, you will have a solid understanding of Moving Average and how to effectively use it in your machine learning projects. Whether you are a beginner or an experienced data analyst, this guide will serve as a valuable resource to enhance your analytical skills.

Moving Average, also known as rolling average or running average, is a commonly used statistical calculation that helps in analyzing trends and patterns in time series data. It is a method to smooth out noisy data and identify the underlying trends.

In simple terms, moving average calculates the average value of a dataset over a specific window of time. The window can be of any size, such as days, weeks, or months, depending on the problem at hand. The moving average is calculated by summing up the values in the window and dividing it by the number of data points in that window.

For example, let’s say we have a dataset of daily stock prices for a particular company. To calculate the 7-day moving average, we would take the average of the stock prices for the previous 7 days. This moving average value will give us a smoothed representation of the stock price trend over the past week.

Moving averages are widely used in various areas, including finance, economics, signal processing, and machine learning. They are particularly useful in financial analysis to identify long-term trends and patterns in stock prices, currencies, and other financial indicators.

There are different types of moving averages, such as simple moving average (SMA), exponential moving average (EMA), and weighted moving average (WMA), each with its own calculation method and characteristics. These different types of moving averages offer flexibility in analyzing different types of data and can be used based on the specific requirements of the analysis.

In summary, moving average is a statistical technique that helps in smoothing out noisy data and analyzing trends and patterns in time series data. It is commonly used in various fields to analyze and interpret data for decision-making purposes.

Moving averages are a powerful mathematical tool that can be applied to various aspects of machine learning. Here are some of the key applications:

Read Also: What is the most profitable Forex strategy? Find out the secret to maximizing your profits

In conclusion, moving averages have a wide range of applications in machine learning. Whether it is analyzing time series data, smoothing noisy signals, creating new features, forecasting future values, or detecting anomalies, moving averages are a versatile tool that can help improve the accuracy and performance of machine learning models.

A moving average is a popular method used in time series analysis to smooth out data and identify trends. There are various types of moving averages that can be used depending on the specific needs of the analysis.

Read Also: Beginner's guide: How to read forex analysis step by step

Each type of moving average has its own advantages and disadvantages, and the choice of which type to use depends on the specific requirements of the analysis. It is important to understand the characteristics of each type to make an informed decision.

A moving average is a technique used in time series analysis to smooth out fluctuations and reveal underlying trends or patterns. It is calculated by taking the average of a predefined number of data points within a sliding window.

A moving average is calculated by taking the average of a predetermined number of data points within a sliding window. For each data point, the window is moved one step forward, and the average of the data points within the window is calculated.

The purpose of using a moving average in machine learning is to smoothen out noisy or erratic data points and reveal the underlying trends or patterns. It can be used for various purposes such as forecasting, anomaly detection, or filtering out noise from signals.

There are several types of moving averages, including simple moving average (SMA), exponential moving average (EMA), weighted moving average (WMA), and triangular moving average (TMA). Each type has its own unique characteristics and is suited for different applications.

The choice of window size is important in calculating a moving average as it determines the level of smoothing and the sensitivity to changes in the data. A larger window size will result in a smoother average but with a diminishing sensitivity to recent changes, while a smaller window size will provide a more responsive average but with less smoothing.

Top Forex Trading Rooms: Choosing the Best Option for Success When it comes to forex trading, having access to a reliable and efficient trading room …

Read ArticleMastering Forex Chart Patterns: Expert Tips and Strategies When it comes to forex trading, understanding and analyzing chart patterns is crucial for …

Read ArticleTarget Price for CSIQ: What Investors Need to Know As an investor, it is important to stay informed about the target price for stocks in order to make …

Read ArticleDeciding on the Best Forex Broker: The Ultimate Guide When it comes to trading in the foreign exchange market, choosing the right forex broker is …

Read ArticleHow to Trade on a 4-Hour Chart Trading on a 4-hour chart can be a powerful tool for traders looking to capitalize on short-term market movements. This …

Read ArticleIs Olymp trade halal in Islam? Islamic finance is guided by the principles of Shariah law, which prohibits certain activities such as usury and …

Read Article