How Reliable is Ichimoku? A Comprehensive Analysis of its Accuracy and Effectiveness

Is Ichimoku a reliable indicator for trading? The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a popular technical analysis tool used by …

Read Article

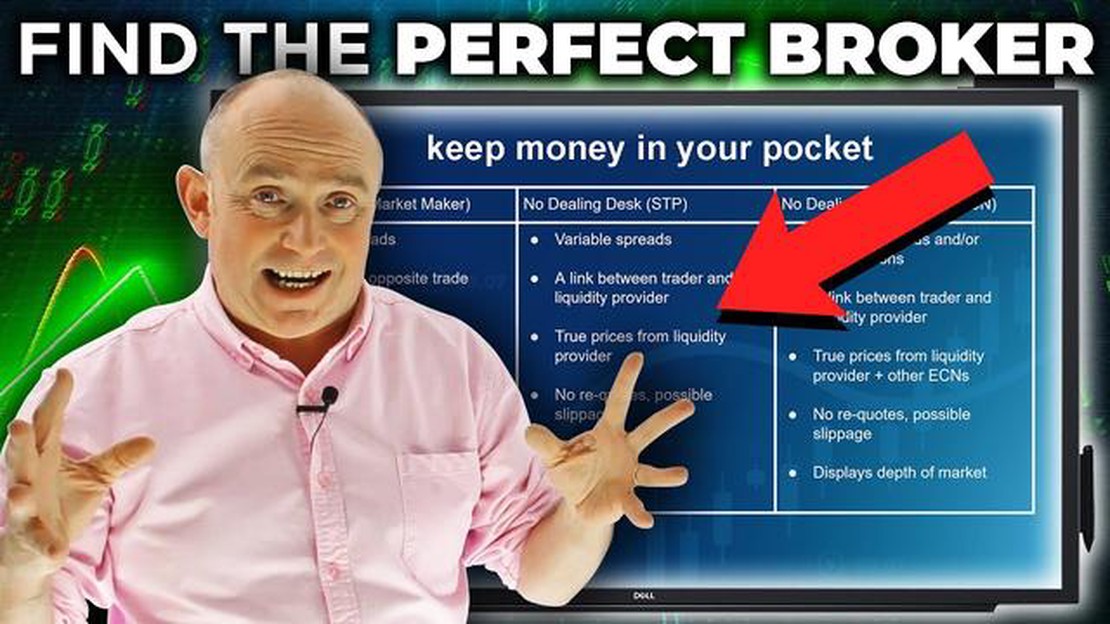

When it comes to trading in the foreign exchange market, choosing the right forex broker is crucial. With so many options available, finding the best one for your needs can be a daunting task. That’s why we’ve done the research for you and created this comprehensive comparison of the top forex brokers.

Our comparison takes into account factors such as trading platform, customer support, fees, and regulation. We’ve evaluated each broker based on their reputation, years of experience, and the services they offer. Whether you’re a beginner looking for a user-friendly platform or an experienced trader seeking advanced trading tools, our comparison will help you find the best forex broker.

In addition to comparing the features and services offered by each broker, we also provide expert analysis and reviews. We’ve interviewed traders who have used these brokers and analyzed their experiences to give you an unbiased assessment of each one. Our goal is to empower you with the knowledge and information needed to make an informed decision.

If you’re serious about forex trading, finding the right broker is essential. The right broker can provide you with the tools, resources, and support you need to succeed in this highly lucrative market. Don’t settle for anything less than the best - use our comprehensive comparison to find the top forex broker for you.

Whether you’re a beginner or an experienced trader, finding the right broker is crucial to your success in the forex market. Our comparison provides you with all the information you need to make an informed decision. Don’t waste your time and money on unreliable brokers - use our comparison to find the best forex broker and start trading with confidence today.

When it comes to trading on the foreign exchange market, finding the right forex broker is essential. With so many brokers to choose from, it can be overwhelming to determine which one is the best fit for your trading needs. This is where a thorough comparison of the top forex brokers can help.

By comparing the features, fees, and customer service of different brokers, you can make an informed decision and choose the one that aligns with your trading goals. Here are some key factors to consider when comparing forex brokers:

1. Regulations: Ensure that the broker is regulated by a reputable authority, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US. This will help protect your funds and ensure fair trading practices.

Read Also: Understanding the N d1 and N d2 in Black-Scholes: The Key to Option Pricing

2. Trading platform: Look for a broker that offers a user-friendly and reliable trading platform. The platform should have advanced charting tools, real-time quotes, and customizable features to suit your trading style.

3. Account types: Consider whether the broker offers different types of accounts to cater to traders with different experience levels and investment sizes. For beginners, a demo account can be useful for practicing trading strategies without risking real money.

4. Spreads and commissions: Compare the spreads and commissions charged by different brokers. Generally, brokers with tighter spreads and lower commissions are more cost-effective for traders.

5. Customer support: Evaluate the quality of customer support provided by the broker. Look for brokers that offer multiple channels of support, such as phone, email, and live chat, and ensure that they have a prompt and helpful customer service team.

6. Educational resources: Check whether the broker provides educational resources, such as tutorials, webinars, and articles, to help traders improve their knowledge and skills. This can be especially beneficial for beginners.

7. Deposit and withdrawal options: Consider the deposit and withdrawal methods offered by the broker. Look for brokers that support convenient and secure payment options, such as bank transfers, credit cards, and e-wallets.

By considering these factors and comparing the top forex brokers, you can find the best one that meets your trading needs and preferences. Remember to carefully read the terms and conditions before opening an account with any broker to ensure that you understand the risks and requirements involved.

When it comes to trading forex, choosing the right broker is crucial for your success. With so many options available, it can be overwhelming to determine which one is the best fit for your trading needs. Here are some factors to consider when selecting a forex broker:

Read Also: Discover the Best Option Traders on YouTube for Superior Trading Insights

By carefully considering these factors and doing thorough research, you can choose the best forex broker that aligns with your trading goals and preferences.

You can compare different forex brokers by looking at their trading platforms, customer support, regulation, fees and commissions, available trading instruments, and user reviews.

Comparing forex brokers before choosing one can help you find a broker that best suits your trading needs, offers competitive spreads and fees, provides a user-friendly trading platform, and has a good reputation in the industry.

No, not all forex brokers are regulated. It is important to choose a regulated forex broker to ensure the safety of your funds and to have recourse in case of any issues or disputes.

When choosing a forex broker, you should look for a trading platform that is user-friendly, has a wide range of trading tools and indicators, provides real-time market data and analysis, and offers mobile trading capabilities.

You can find user reviews about different forex brokers on various online forums and review websites. It is important to read multiple reviews from different sources to get a comprehensive understanding of the broker’s reputation and the experiences of other traders.

A forex broker is a company or an individual that provides access to the foreign exchange market where currencies are traded. They act as intermediaries between traders and the market.

Is Ichimoku a reliable indicator for trading? The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a popular technical analysis tool used by …

Read ArticleWhy is the SEK so weak? The Swedish krona (SEK) has been experiencing a decline in value against major currencies in recent years, prompting …

Read ArticleAre moving expenses tax deductible in New Jersey? Moving can be a stressful and expensive process, and one of the ways to alleviate some of the …

Read ArticleExploring the MCX Market in India: Everything You Need to Know The Multi Commodity Exchange of India, also known as MCX, is the premier commodity …

Read ArticleIs the exchange rate better in Thailand? When planning a trip abroad, one of the factors that travelers often consider is the exchange rate of the …

Read ArticleInvesting in Gold Futures: Should You Do It? Gold has always fascinated investors and traders alike. Its unique properties and undeniable value have …

Read Article