Top Examples of Insider Trading: Uncovering the Most Notorious Cases

Top Insider Trading Examples That Shocked the Financial World Insider trading, the illegal practice of trading stocks or other securities based on …

Read Article

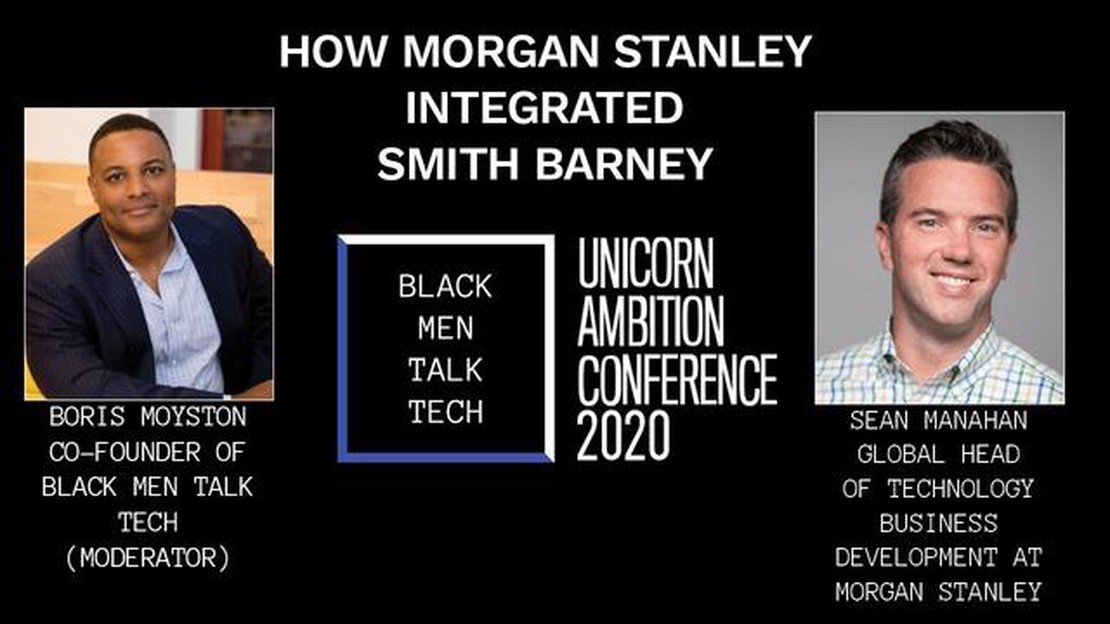

Morgan Stanley’s acquisition of Smith Barney marked a significant milestone in the financial industry. The deal, which was announced in 2009, resulted in Morgan Stanley becoming the majority owner of Smith Barney, a leading retail brokerage firm. This move was part of Morgan Stanley’s strategy to strengthen its wealth management division and position itself as a top-tier player in the industry.

The acquisition of Smith Barney allowed Morgan Stanley to expand its client base and increase its assets under management. Smith Barney’s extensive network of financial advisors provided Morgan Stanley with access to a wider range of customers, including high-net-worth individuals and institutional clients. This acquisition also gave Morgan Stanley the opportunity to diversify its revenue streams and reduce its dependence on volatile trading activities.

The integration of Morgan Stanley and Smith Barney was a complex process that involved combining two different organizational cultures, systems, and processes. However, the benefits of the merger were evident in the years that followed. The combined entity, known as Morgan Stanley Smith Barney, became one of the largest wealth management firms in the world, with a presence in over 40 countries and a strong foothold in key markets.

In conclusion, Morgan Stanley’s acquisition of Smith Barney was a strategic move that allowed the company to strengthen its wealth management division, expand its client base, and diversify its revenue streams. The successful integration of the two firms solidified Morgan Stanley’s position as a global leader in the financial industry and set the stage for future growth and success.

Morgan Stanley is a renowned global financial services firm founded in 1935 by Henry S. Morgan and Harold Stanley. Initially, the firm operated as an investment banking company, providing services such as securities underwriting, mergers and acquisitions advisory, and capital market activities.

Over the years, Morgan Stanley expanded its operations to include various financial services, such as asset management, wealth management, and trading. The firm grew in size and reputation, becoming one of the leading investment banks in the world.

In 2009, Morgan Stanley made a significant move in its history by acquiring a majority stake in Smith Barney from Citigroup. Smith Barney is a well-established wealth management firm that traces its roots back to the late 19th century.

Smith Barney was originally founded in 1873 by Charles D. Barney. It grew through various mergers and acquisitions and eventually became a subsidiary of Citigroup. The firm offered a wide range of financial services, including investment advice, brokerage services, and portfolio management.

The acquisition of Smith Barney by Morgan Stanley was part of a strategic partnership between the two firms. The deal allowed Morgan Stanley to strengthen its position in the wealth management sector and expand its client base. It also provided an opportunity for Citigroup to focus on its core banking activities.

Following the acquisition, Morgan Stanley and Smith Barney merged their wealth management businesses to create Morgan Stanley Smith Barney. The new entity became one of the largest wealth management firms in the world, with a significant presence in both the United States and international markets.

In 2013, Morgan Stanley acquired the remaining stake in Morgan Stanley Smith Barney from Citigroup, completing the full integration of the two firms. The acquisition solidified Morgan Stanley’s position as a leading global financial services provider and further enhanced its wealth management capabilities.

Read Also: Understanding Options Trading: A Beginner's Guide

Today, Morgan Stanley continues to be a dominant player in the financial services industry, offering a wide range of services to clients worldwide. The acquisition of Smith Barney played a crucial role in shaping the firm’s growth strategy and expanding its wealth management division.

Morgan Stanley, one of the leading investment banks in the world, successfully completed its acquisition of Smith Barney, a prominent wealth management firm. The acquisition, which was finalized in 2013, marked a significant milestone for Morgan Stanley and solidified its position in the wealth management industry.

Read Also: Discover the secrets of the M15 forex strategy and boost your trading success

The acquisition of Smith Barney allowed Morgan Stanley to expand its client base and strengthen its wealth management capabilities. With Smith Barney’s extensive client network and experienced financial advisors, Morgan Stanley was able to offer a broader range of services and expertise to its high-net-worth clients.

Throughout the acquisition process, Morgan Stanley demonstrated its strategic and operational excellence. The bank’s management team carefully analyzed the potential benefits and risks of the deal, ensuring that it aligned with the company’s long-term growth strategy. Additionally, Morgan Stanley successfully navigated the regulatory and legal complexities associated with the acquisition, further showcasing its commitment to a smooth integration.

This acquisition not only provided Morgan Stanley with a competitive edge in the wealth management industry but also offered significant synergies and cost-saving opportunities. The combination of Morgan Stanley and Smith Barney’s operations resulted in increased efficiency, improved technology infrastructure, and enhanced productivity.

Furthermore, the acquisition enhanced Morgan Stanley’s brand and reputation. By acquiring a renowned wealth management firm like Smith Barney, Morgan Stanley was able to strengthen its position as a trusted advisor and partner for its clients. This strategic move also boosted investor confidence and contributed to the growth of Morgan Stanley’s client base.

In conclusion, Morgan Stanley’s successful acquisition of Smith Barney was a transformative step that propelled the bank’s wealth management business to new heights. Through this strategic move, Morgan Stanley solidified its position as a leader in the industry, expanded its client base, and further strengthened its brand and reputation.

Morgan Stanley’s acquisition of Smith Barney refers to the purchase of the brokerage unit of Citigroup, known as Smith Barney, by Morgan Stanley. This acquisition provided Morgan Stanley with a significant presence in the wealth management industry and allowed them to offer a wide range of financial services to their clients.

Morgan Stanley acquired Smith Barney to expand its presence in the wealth management industry. By acquiring Smith Barney, Morgan Stanley gained access to a large network of financial advisors and a broad client base. This allowed them to strengthen their position in the market and increase their ability to generate revenue from wealth management services.

The acquisition of Smith Barney by Morgan Stanley was structured as a joint venture, with Morgan Stanley initially acquiring a 51% stake in the business for $2.7 billion. Over time, Morgan Stanley increased its stake to 100% by purchasing the remaining shares from Citigroup for an additional $13.5 billion.

The acquisition of Smith Barney provided several benefits for Morgan Stanley. It allowed them to expand their wealth management business and gain access to a larger client base. It also provided them with a more stable source of revenue, as wealth management tends to be less volatile than other areas of investment banking. Additionally, the acquisition helped Morgan Stanley diversify their business and reduce their reliance on the more volatile trading and investment banking activities.

The acquisition of Smith Barney had a positive impact on Morgan Stanley’s financial performance. It allowed them to generate a more stable and predictable stream of revenue, as wealth management is generally less affected by market fluctuations than other areas of the financial sector. Additionally, the acquisition helped Morgan Stanley increase its overall assets under management and improve its profitability in the long term.

Top Insider Trading Examples That Shocked the Financial World Insider trading, the illegal practice of trading stocks or other securities based on …

Read ArticleUnderstanding Testing in Forex: A Comprehensive Guide Forex trading is a complex and highly volatile market. It involves the buying and selling of …

Read ArticleHow to Calculate Moving Average for 3 Months Are you looking to analyze trends or identify patterns in your data? One useful tool to achieve this is …

Read ArticleAmex exchange rates: are they good? When it comes to exchanging currency, finding the best rates is crucial. American Express, a renowned financial …

Read ArticleFinding the Strongest Support and Resistance Support and resistance levels are important concepts in technical analysis that help traders identify …

Read ArticleHow to Add EMA to RSI Indicator If you are a trader or investor looking to analyze market trends and make informed decisions, you may already be …

Read Article