Is IQ Option Regulated? Exploring the Regulation of IQ Option

Is IQ Option regulated? When it comes to choosing a trading platform, it’s important to consider whether it is regulated or not. Regulation ensures …

Read Article

Insider trading, the illegal practice of trading stocks or other securities based on non-public information, has been a persistent problem in the financial world. Over the years, there have been several high-profile cases that have caught the attention of the media and the public. These cases have not only led to hefty fines and jail time for the individuals involved but have also shed light on the ethical and legal implications of insider trading.

One of the most notorious examples of insider trading is the case of Martha Stewart, the American businesswoman and television personality. In 2001, Stewart sold her shares of ImClone Systems just days before the company’s stock plummeted due to the denial of a key FDA approval. It was later revealed that Stewart had received insider information about the FDA’s decision from her broker, leading to her conviction for obstruction of justice and securities fraud.

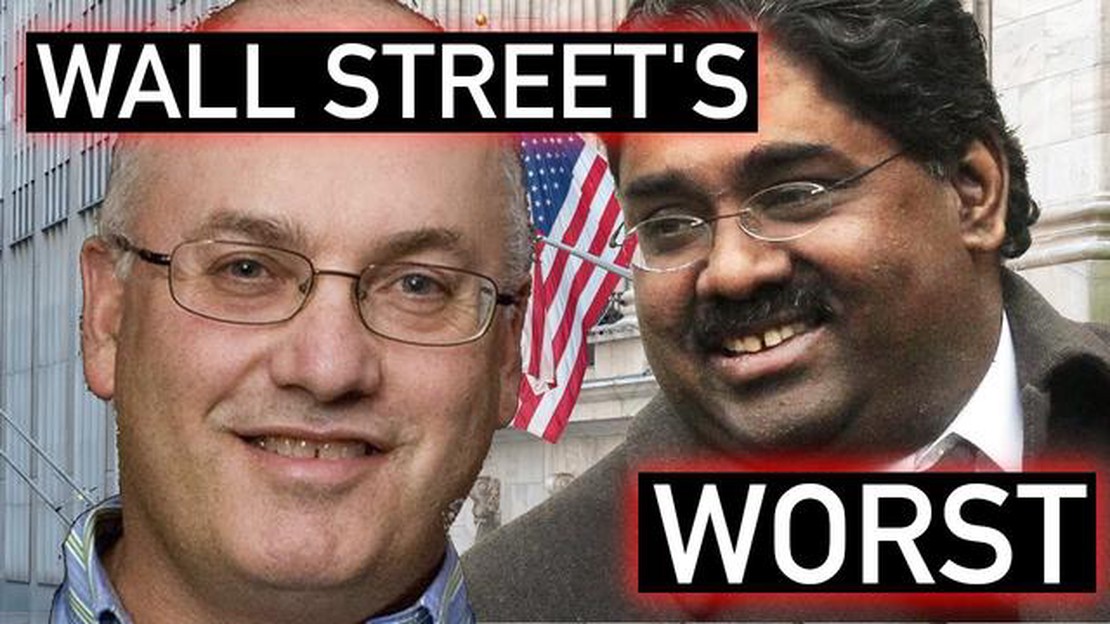

Another famous case is that of Raj Rajaratnam, the founder of the Galleon Group, a prominent hedge fund. In 2011, Rajaratnam was convicted of multiple counts of insider trading, making him one of the highest-profile targets of the government’s crackdown on illegal trading. His actions involved obtaining confidential information from corporate insiders and using it to make profitable trades, resulting in over $60 million in illicit gains.

One of the largest insider trading cases in history involves SAC Capital Advisors, a hedge fund managed by billionaire investor Steven Cohen. In 2014, SAC Capital pleaded guilty to insider trading charges and agreed to pay a record $1.8 billion in fines and penalties. Several of the firm’s former employees were also convicted in connection with the case. The investigation uncovered a widespread culture of insider trading at SAC Capital, where traders and analysts regularly shared confidential information and traded on it for personal gain.

These examples highlight the devastating consequences of insider trading and the importance of maintaining a fair and transparent financial market. Insider trading not only undermines investor confidence but also distorts the playing field for the average investor. The enforcement of strict regulations and the prosecution of individuals involved in illegal trading are crucial to protect the integrity of the financial system.

Insider trading is the illegal practice of trading on the stock exchange using non-public information obtained from a company or organization. Over the years, there have been several high-profile insider trading cases that have captured public attention. These cases involve prominent individuals and companies, and their actions have had a significant impact on the financial markets.

One of the biggest insider trading cases in history is the case of Raj Rajaratnam. He was the co-founder of the hedge fund Galleon Group, and in 2011, he was convicted of insider trading. Rajaratnam used inside information obtained from corporate insiders to make trades that generated millions of dollars in profits. This case was notable for its extensive use of wiretaps and the involvement of high-profile individuals, including executives from major companies like IBM and Intel.

Another noteworthy insider trading case is that of Martha Stewart. In 2004, Stewart, who was a well-known businesswoman and television personality, was accused of insider trading. She was convicted of obstructing justice and making false statements to federal investigators. Stewart had received non-public information about a biotech company and used it to sell her shares before the stock price dropped. Although insider trading charges were not brought against her, her case received widespread media attention due to her celebrity status.

One more prominent insider trading case is the case of SAC Capital Advisors. SAC, a hedge fund founded by billionaire investor Steven Cohen, was accused of engaging in a widespread insider trading scheme. In 2014, the firm pleaded guilty to securities fraud and paid a record-breaking $1.8 billion settlement. Several former employees of SAC were also charged and convicted of insider trading. This case highlighted the level of corruption and illegal activities that can occur within the financial industry.

Read Also: Mastering Ichimoku Indicator: A Comprehensive Guide for Forex Traders

These are just a few examples of the biggest insider trading cases that have occurred in recent history. They serve as a reminder of the importance of maintaining fair and transparent markets, and the severe consequences that individuals and companies can face when engaging in illegal trading practices.

The Martha Stewart scandal is one of the most well-known cases of insider trading. In 2001, Martha Stewart, a prominent businesswoman and television personality, was accused of selling shares of a biotechnology company called ImClone Systems based on inside information she received from her broker.

Stewart had been informed by her broker that ImClone’s CEO, Samuel Waksal, was selling his shares in the company. Acting on this knowledge, Stewart sold her shares just one day before an announcement was made that the Food and Drug Administration (FDA) had rejected ImClone’s new cancer drug. As a result of her actions, Stewart managed to avoid losses of approximately $45,000.

When news of Stewart’s actions broke, public outrage ensued. She was charged with securities fraud, obstruction of justice, and making false statements to federal investigators. In 2004, Stewart was convicted of lying to investigators about her ImClone stock sale and was sentenced to five months in prison. She also faced fines and a period of supervised release after her imprisonment.

Read Also: Calculating Compensation Cost: A Guide to Accurately Determining Employee Compensation

The Martha Stewart scandal had a significant impact on both her personal brand and her business empire. Stewart was forced to resign as CEO of Martha Stewart Living Omnimedia, and the scandal tarnished her reputation as a role model and successful entrepreneur.

Despite the negative consequences, Martha Stewart eventually made a comeback. After serving her prison sentence, she rebuilt her brand and reestablished herself as a trusted lifestyle expert. Today, she continues to be an influential figure in the business and media industries.

The Martha Stewart scandal serves as a reminder of the severe consequences of insider trading and the importance of maintaining integrity in financial markets.

Insider trading refers to the buying or selling of stocks or other financial securities based on non-public information that is not available to the general public. It is considered illegal and unethical.

Some of the most well-known individuals involved in insider trading include Raj Rajaratnam, Martha Stewart, Ivan Boesky, and Michael Milken.

Some of the most notorious cases of insider trading include the Raj Rajaratnam case, the Martha Stewart case, the Ivan Boesky case, and the Michael Milken case.

The legal consequences of insider trading can vary, but individuals found guilty of insider trading can face fines, imprisonment, disgorgement of profits, and civil penalties. Additionally, they may be prohibited from trading in the financial markets in the future.

Is IQ Option regulated? When it comes to choosing a trading platform, it’s important to consider whether it is regulated or not. Regulation ensures …

Read ArticleWhat Drives the Forex Quote? Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in the global …

Read ArticleUnderstanding the Time Indicator in MT4 In the world of trading, time is a critical factor that can significantly impact decision-making and the …

Read ArticleExploring the activities at a World Trade Center Located in the heart of a bustling city, a World Trade Center is a multifunctional complex that …

Read ArticleIs USD CNH deliverable? The USD CNH is a currency pair that represents the value of the United States dollar (USD) against the Chinese offshore …

Read ArticleDiscover the Accuracy of FX Predictions In the volatile world of currency trading, accurate predictions can mean the difference between success and …

Read Article