Is Forex Trading or Affiliate Marketing more profitable and sustainable?

Comparing Forex Trading and Affiliate Marketing: Which is the Better Option? When it comes to making money online, there are many options available, …

Read Article

Forward bid and ask rates play a crucial role in the world of finance, especially in foreign exchange trading. These rates are used to determine the future value of a currency pair and are essential for traders and investors to make informed decisions.

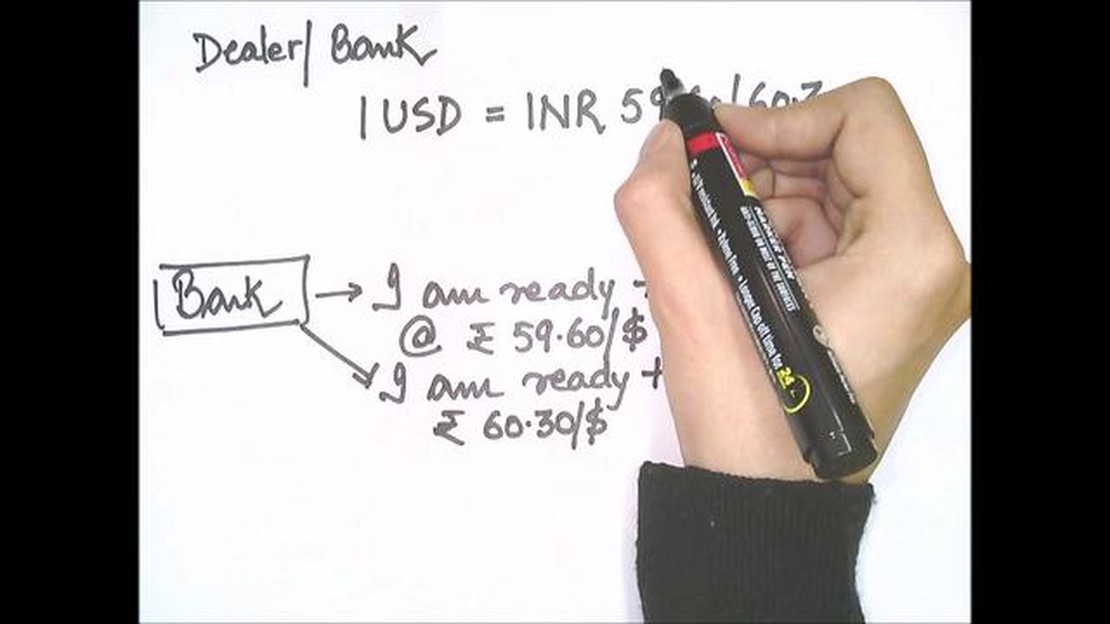

When it comes to foreign exchange trading, bid and ask rates are the prices at which market participants are willing to buy or sell a currency pair. The bid rate represents the price at which a trader is willing to buy the base currency and sell the quote currency, while the ask rate represents the price at which a trader is willing to sell the base currency and buy the quote currency.

However, forward bid and ask rates are slightly different from regular bid and ask rates. Forward rates are determined for a future delivery date, typically beyond the spot date. They take into account the interest rate differentials between the two currencies and any market expectations of future exchange rate movements.

Understanding forward bid and ask rates is essential for traders and investors as it allows them to assess the cost of entering into a forward contract and hedge against potential currency risks. This comprehensive guide will explore the intricacies of forward bid and ask rates, their calculation methods, and their significance in the global financial markets.

Note: It is important to note that forward bid and ask rates are influenced by various factors such as interest rates, inflation, economic indicators, and geopolitical events. Traders and investors should stay updated with the latest news and analysis to anticipate and interpret any potential changes in these rates.

Forward bid and ask rates are terms used in the foreign exchange market to describe the prices at which participants are willing to buy or sell a currency for future delivery. These rates play a crucial role in determining the value of a currency in forward contracts, which involve the exchange of currencies at a future date.

The forward bid rate represents the price at which a market participant is willing to buy a currency for future delivery. It indicates the maximum amount they are willing to pay to acquire the currency at a later date. The forward ask rate, on the other hand, represents the price at which a participant is willing to sell a currency for future delivery. It indicates the minimum amount they are willing to accept in exchange for selling the currency at a later date.

Just like with bid and ask rates in the spot market, the bid rate is typically lower than the ask rate in the forward market. This reflects the spread, or the difference, between the buying and selling prices. The spread represents the profit margin for market participants and can vary depending on various factors such as market conditions, liquidity, and the creditworthiness of the parties involved.

Forward bid and ask rates are determined by supply and demand dynamics in the market and are influenced by a range of factors, including interest rates, inflation expectations, political stability, and economic indicators. Market participants, such as banks, corporations, and institutional investors, use forward rates to manage foreign exchange risk and facilitate international business transactions.

In summary, forward bid and ask rates are the prices at which participants are willing to buy or sell a currency for future delivery. They are influenced by various factors and play a crucial role in foreign exchange markets, enabling participants to manage risk and transact in different currencies.

The forward bid and ask rates are calculated based on a number of factors, including interest rate differentials, exchange rate expectations, and market liquidity.

To calculate the forward bid and ask rates, financial institutions take into account the current spot rate, the interest rates in each of the two currencies, and the time to the forward delivery date. This calculation is typically done using complex mathematical models.

The forward bid rate is the rate at which a financial institution is willing to buy the base currency and sell the quote currency in a forward contract. It is typically lower than the spot rate due to the interest rate differential between the two currencies. If the base currency has a higher interest rate than the quote currency, the forward bid rate will be lower than the spot rate.

Read Also: Understanding Forex Disclaimers: Real-life Examples and Importance

The forward ask rate is the rate at which a financial institution is willing to sell the base currency and buy the quote currency in a forward contract. It is typically higher than the spot rate due to the interest rate differential. If the base currency has a lower interest rate than the quote currency, the forward ask rate will be higher than the spot rate.

Financial institutions also take into account market expectations for future exchange rate movements when calculating the forward bid and ask rates. If the market expects the base currency to appreciate against the quote currency, the forward bid rate may be adjusted higher, while the forward ask rate may be adjusted lower. Similarly, if the market expects the base currency to depreciate, the forward bid rate may be adjusted lower, while the forward ask rate may be adjusted higher.

Market liquidity also plays a role in the calculation of forward bid and ask rates. If there is lower liquidity in the market for a particular currency pair, financial institutions may adjust their bid and ask rates accordingly to account for the higher risk and cost of trading.

Overall, the calculation of forward bid and ask rates is a complex process that takes into account various factors, including interest rate differentials, exchange rate expectations, and market liquidity. These rates are constantly changing in response to market conditions and play a crucial role in international trade and investment.

Read Also: Discover the Effective 1 Hour Time Frame Strategy for Successful Trading

Forward bid and ask rates are essential components of understanding the foreign exchange market and making informed trading decisions. These rates provide insight into the current and future value of a currency pair and play a crucial role in determining exchange rates.

When traders want to exchange one currency for another in the future, they rely on forward bid and ask rates to estimate the price at which the transaction can occur. The bid rate represents the price at which a trader can sell the base currency, while the ask rate represents the price at which a trader can buy the base currency.

By comparing the bid and ask rates, traders can assess the market’s sentiment towards a particular currency pair. If the bid rate is higher than the ask rate, it indicates a more favorable outlook for the base currency, as traders are willing to pay more for it. Conversely, if the ask rate is higher than the bid rate, it signals a weaker sentiment towards the base currency.

Understanding forward bid and ask rates is essential for managing foreign exchange risk. Businesses that engage in international trade or have foreign currency exposure can use these rates to determine the cost of future transactions and mitigate potential losses due to unfavorable exchange rate fluctuations.

Additionally, forward bid and ask rates are valuable tools for financial institutions and investors who engage in currency speculation. By analyzing these rates, traders can identify arbitrage opportunities and potentially profit from the discrepancies between bid and ask rates across different markets.

Overall, forward bid and ask rates provide valuable information about the current and expected future value of a currency pair. They help traders and businesses make informed decisions and manage their exposure to foreign exchange risk. Furthermore, these rates enable currency speculators to identify lucrative trading opportunities. Thus, a comprehensive understanding of forward bid and ask rates is imperative for anyone involved in the foreign exchange market.

A forward bid rate is the exchange rate at which a buyer is willing to purchase a foreign currency for delivery at a specific future date.

A forward ask rate is the exchange rate at which a seller is willing to sell a foreign currency for delivery at a specific future date.

Forward bid and ask rates are determined based on factors such as interest rates, inflation rates, market conditions, and supply and demand for the currencies involved.

The difference between the forward bid and ask rates is known as the bid-ask spread. It represents the profit margin for the market maker and can vary depending on market conditions and liquidity.

Forward bid and ask rates are important for businesses and investors who engage in international trade or foreign currency investments. These rates help them calculate the cost of future transactions and manage currency exchange risk.

Forward bid and ask rates are the rates at which a currency is bought or sold for delivery in the future. These rates are used in foreign exchange markets to calculate the cost of entering into a forward contract to exchange currencies at a future date.

Comparing Forex Trading and Affiliate Marketing: Which is the Better Option? When it comes to making money online, there are many options available, …

Read ArticleUnderstanding the Significance of High Open Interest Compared to Volume on Options Options trading is a complex financial instrument that involves …

Read ArticleUnderstanding the Process of Exercising Stock Options Stock options are a common form of compensation that many employers offer to their employees. …

Read ArticleAMT for Stock Options Exercise: Everything You Need to Know When it comes to stock options, many employees are familiar with the potential for …

Read ArticleUnderstanding Buy and Sell in Exchange Rate When it comes to international travel or conducting business in a different currency, understanding …

Read ArticleUnderstanding the Difference between AOV and RPV When it comes to online advertising and e-commerce, there are a plethora of terms and acronyms that …

Read Article