Which Simple Moving Average is Best? Find out Now

Choosing the Best Simple Moving Average If you’re a trader or investor, you’ve probably heard about the simple moving average (SMA) and its importance …

Read Article

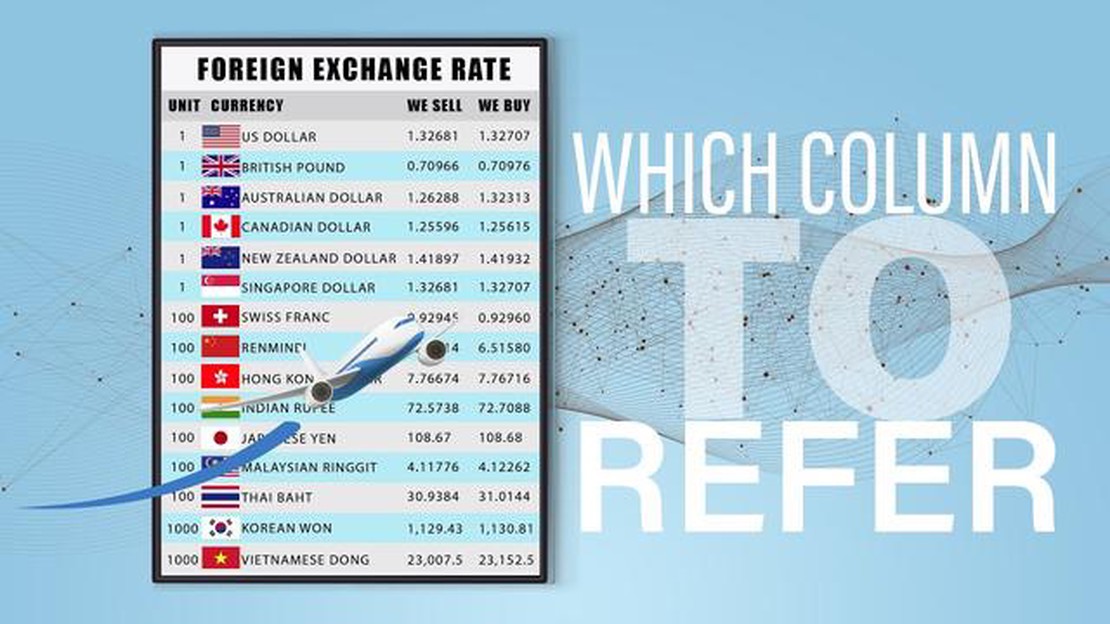

When it comes to international travel or conducting business in a different currency, understanding exchange rates is essential. Exchange rates determine the value of one currency in relation to another and fluctuate constantly due to various economic factors. One important concept to comprehend is the difference between buy and sell rates, as it can greatly affect the cost of exchanging currencies.

The buy rate refers to the rate at which a bank or currency exchange buys a foreign currency from individuals or businesses. This rate is typically lower than the sell rate, as the institution needs to make a profit. Banks and exchanges buy foreign currency at a lower rate and then sell it at a higher rate to individuals who need it for travel or other purposes.

On the other hand, the sell rate is the rate at which a bank or currency exchange sells a foreign currency to customers. The sell rate is higher than the buy rate because it includes the institution’s profit margin. When individuals or businesses need to acquire foreign currency, they must pay the sell rate to obtain it from a bank or currency exchange. The difference between the buy and sell rates is known as the spread, and it represents the profit made by the institution.

It’s important to note that the buy and sell rates offered by different banks and currency exchanges may vary. The spread can differ depending on the institution and may also fluctuate throughout the day. It’s advisable to compare rates from multiple sources to ensure you get the best exchange rate possible.

Understanding the difference between the buy and sell rates is crucial for anyone engaging in foreign currency exchange. It allows individuals and businesses to calculate the cost of exchanging currencies accurately and determine which institution offers the best rates. By being aware of these rates, individuals can save money and make informed decisions when dealing with foreign currencies.

Exchange rates are the prices at which one currency can be exchanged for another. They represent the value of one currency in terms of another currency. Exchange rates are influenced by a variety of factors, including interest rates, inflation, political stability, and economic conditions.

Exchange rates are constantly changing and are quoted as two rates: the buy rate and the sell rate.

The buy rate is the rate at which a bank or currency exchange will buy one unit of a foreign currency in exchange for the domestic currency. It is typically lower than the sell rate and is used when individuals or businesses want to convert their domestic currency into a foreign currency.

The sell rate, on the other hand, is the rate at which a bank or currency exchange will sell one unit of a foreign currency in exchange for the domestic currency. It is typically higher than the buy rate and is used when individuals or businesses want to convert their foreign currency into the domestic currency.

Exchange rates are important for international trade and investment. They affect the prices of imported and exported goods and services, as well as the cost of travel and tourism. Fluctuations in exchange rates can have a significant impact on the profitability of businesses operating in multiple countries.

It is important to note that exchange rates can vary between different banks and currency exchanges, as they are determined by supply and demand in the foreign exchange market. It is recommended to compare rates and fees before exchanging currencies to get the best possible deal.

An exchange rate is the rate at which one currency can be exchanged for another currency. It represents the value of one currency in terms of another currency.

Read Also: Does Citibank charge fees for currency conversion?

Exchange rates can be either fixed or floating. A fixed exchange rate is determined by the government or central bank and remains constant over time. In contrast, a floating exchange rate is determined by the foreign exchange market, where the value of one currency is influenced by supply and demand factors.

The buy rate and sell rate are two important components of an exchange rate. The buy rate is the rate at which the bank or foreign exchange provider buys a foreign currency, while the sell rate is the rate at which they sell the foreign currency to customers.

Typically, the sell rate is higher than the buy rate, as the provider adds a margin or markup to cover their costs and make a profit. The difference between the buy rate and sell rate is known as the spread.

Exchange rates are influenced by factors such as interest rates, inflation, political stability, economic performance, and market speculation. Changes in exchange rates can have significant impacts on international trade, investment, and tourism.

It is important to understand exchange rates when conducting international transactions or traveling to foreign countries. By monitoring exchange rates, individuals and businesses can optimize their foreign currency transactions and minimize costs.

When dealing with foreign exchange rates, it is important to understand the concept of buy and sell rates. Buy rate refers to the rate at which a person can purchase a foreign currency from a bank or an exchange service. Sell rate, on the other hand, refers to the rate at which a person can sell their foreign currency back to the bank or exchange service.

Read Also: Examples of E-commerce Systems: A Comprehensive Guide

The buy rate is always higher than the sell rate, as banks and exchange services need to make a profit from the transactions. The difference between the buy and sell rates is known as the spread. The spread exists to cover the costs and risks associated with trading foreign currencies. It also acts as a profit margin for banks and exchange services.

It is important to note that the buy and sell rates can vary depending on the institution and the currency being exchanged. Banks and exchange services may have different spreads and fees, so it is crucial to shop around for the best rates before making any currency exchange transactions.

Furthermore, it is essential to understand that exchange rates are influenced by various factors, such as interest rates, inflation, political stability, and economic performance. These factors can cause fluctuations in exchange rates, leading to changes in the buy and sell rates over time.

Overall, understanding the buy and sell rates is crucial for anyone involved in foreign currency exchange. Being aware of the spread and shopping around for the best rates can help individuals and businesses make informed decisions and potentially save money when exchanging currencies.

The buy rate is the rate at which the bank or currency exchange will buy a foreign currency from you, while the sell rate is the rate at which they will sell foreign currency to you. The difference between the two rates is known as the spread.

Buy and sell rates differ because banks and currency exchanges need to make a profit. They buy currency at a lower rate and sell it at a higher rate to cover their costs and earn a profit.

In most cases, the buy and sell rates are fixed by the bank or currency exchange and cannot be negotiated. However, some places offer more competitive rates or may be willing to negotiate for larger transactions.

To get the best exchange rate, compare rates from different banks and currency exchanges. Look for places that offer low spreads, as this means they have a smaller difference between their buy and sell rates. Additionally, consider using online currency exchange services for potentially better rates.

Some factors that can influence buy and sell rates include the current economic and political climate, interest rates, inflation, and market demand for certain currencies. These factors can cause fluctuations in exchange rates and impact the buy and sell rates offered by banks and currency exchanges.

The buy rate is the rate at which a bank or currency exchange will buy a foreign currency from a customer, while the sell rate is the rate at which they will sell a foreign currency to a customer. The buy rate is typically lower than the sell rate, allowing the bank or exchange provider to make a profit on the transaction.

Choosing the Best Simple Moving Average If you’re a trader or investor, you’ve probably heard about the simple moving average (SMA) and its importance …

Read ArticleBest Website for Option Chain Analysis When it comes to trading options, having access to reliable and accurate data is crucial. Option chain analysis …

Read ArticleAR-30 Barrel Twist Rate: Everything You Need to Know When it comes to precision shooting, the barrel twist rate of your rifle can make all the …

Read ArticleWhat is a master password key? In the digital age, where we rely on various online services and platforms for communication, banking, and …

Read ArticleWhich option carries the least risk? When it comes to making decisions, assessing and managing risk is crucial. It is important to carefully weigh the …

Read ArticleHow to Predict Forex Trends Forex trading is a highly volatile and ever-changing market. Traders who are able to accurately forecast the trends are …

Read Article