Who Did the Cubs Get in the Trade: Unveiling the New Additions

Who did the Cubs get in the trade? The Chicago Cubs have been busy this offseason, making several key trades to bolster their roster for the upcoming …

Read Article

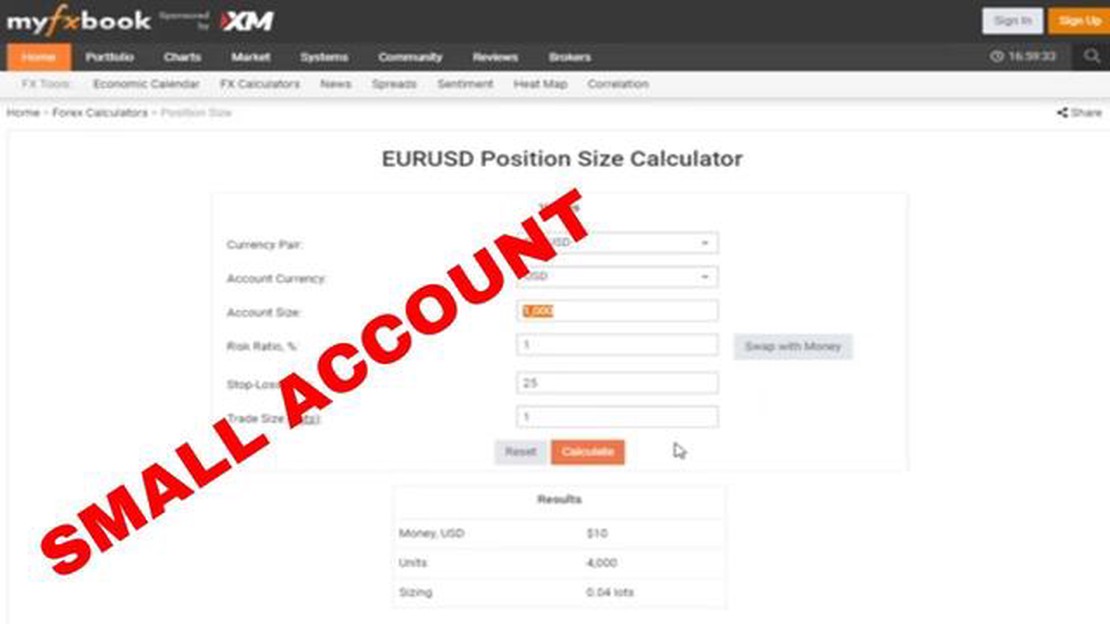

If you are new to trading and want to dip your toes into the world of forex, cent accounts can be a great place to start. These accounts are designed for beginners and allow you to trade with small amounts of money, typically in the range of a few cents to a few dollars. In this guide, we will explore what cent accounts are, how they work, and the benefits they offer to new traders.

A cent account is a type of trading account that uses “cents” as the base currency instead of the more traditional “dollars.” This allows traders to open positions with smaller lot sizes and therefore with lower risk. For example, if you have $10 in your cent account, you can trade with 1,000 cents instead of 10,000 cents. This makes it easier for beginners to manage their risk and learn the ropes of trading without risking large sums of money.

One of the main benefits of cent accounts is that they offer a realistic trading experience with real money, but on a smaller scale. This can be particularly helpful for beginners who are still building their confidence and skills. With cent accounts, you can experience the joy of making successful trades and the frustration of losses, but with minimal financial impact. It’s like a training ground where you can practice and experiment without the fear of significant financial losses.

In addition to lower risk, cent accounts also offer lower transaction costs. Since the lot sizes are smaller, the commissions and spreads charged by brokers are often reduced. This can make a significant difference, especially for traders who make frequent trades. Lower transaction costs mean more money in your pocket and less money going to the broker.

In conclusion, if you are a beginner looking to get started in trading, cent accounts can be a valuable tool. They offer a low-risk environment for learning and experimenting, while still providing a realistic trading experience. With cent accounts, you can start small and gradually increase your trading size as you gain experience and confidence. So take the plunge and start your micro trading journey today!

Cent accounts, also known as micro accounts, are a type of trading account that allow beginners to start trading with minimal investments. These accounts are called “cent” accounts because they are denominated in cents rather than dollars or other major currencies.

Cent accounts are popular among new traders who want to gain experience in the forex market without risking a significant amount of capital. With cent accounts, traders can place trades with smaller lot sizes, allowing them to get a feel for the market and test their trading strategies.

One of the key advantages of cent accounts is that they provide a low-cost entry point into the world of trading. Traders can deposit a small amount of money, such as $10 or $50, and start trading with just a few cents per trade. This makes trading more accessible to a wider range of individuals who may not have the financial means to open a standard trading account.

In addition to being affordable, cent accounts also come with other features that make them attractive to beginners. Many brokers offer demo versions of their cent accounts, allowing traders to practice trading in a risk-free environment before committing real money. This can help traders build confidence and develop their skills without the fear of losing their investment.

Overall, cent accounts are a great option for beginners who want to dip their toes into the world of trading without risking a large amount of money. They provide an affordable and low-risk way to learn about the forex market and develop trading skills. As traders gain experience and confidence, they can gradually move on to larger trading accounts with higher capital investments.

1. Lower Risk: One of the main benefits of cent accounts is that they allow traders to minimize their risk. With cent accounts, you can trade with smaller lot sizes, which means that even if you make a mistake, the potential loss will be significantly smaller compared to trading with standard accounts. This can be especially useful for beginner traders who are still learning the ropes and want to gain experience without risking too much of their capital.

2. Cost-effective: Cent accounts are also cost-effective, as they allow traders to start trading with a small deposit. This means that you don’t need a large amount of capital to begin trading, making it accessible to a wider range of individuals. Additionally, cent accounts often have lower transaction costs and spreads compared to standard accounts, which can help you save money on trading fees.

3. Psychological benefits: Trading with cent accounts can also have psychological benefits, especially for those who are new to trading or prone to making impulsive decisions. With smaller lot sizes and lower potential losses, traders may feel less pressured and more in control of their trades. This can help reduce stress and emotional trading, allowing traders to make more rational decisions based on analysis and strategy.

4. Learning tool: Finally, cent accounts can serve as an excellent learning tool for traders of all skill levels. By trading with smaller lot sizes and lower risk, traders can experiment with different strategies, test their skills, and gain valuable experience in the market without incurring significant losses. Cent accounts can help traders build confidence and develop a solid trading plan before transitioning to larger trading accounts.

Read Also: Understanding the MT5 Currency Meter and its Benefits

In conclusion, cent accounts offer several benefits to traders, including lower risk, cost-effectiveness, psychological advantages, and a valuable learning opportunity. Consider opening a cent account if you are a beginner or if you want to practice and refine your trading skills without risking a substantial amount of capital.

Cent accounts provide a great opportunity for beginner traders to enter the forex market with limited risk. These accounts allow you to trade in smaller lot sizes, typically 1% of a standard lot, which means you can trade with much smaller amounts of capital.

Read Also: Is IC Markets a Legit Trading Platform? Unveiling the Truth

To get started with cent accounts, you will need to choose a broker that offers this type of account. Look for brokers that specifically mention cent accounts in their account options. Once you have chosen a broker, you will need to open an account and deposit funds.

After opening your cent account and funding it, you will need to download and install a trading platform. Most brokers offer popular trading platforms like MetaTrader 4 or MetaTrader 5. These platforms provide all the necessary tools and features for trading on cent accounts.

Once you have installed the trading platform, you can log in to your account and start trading. It’s important to note that trading on cent accounts is similar to trading on standard accounts, but with smaller lot sizes. This means that the profit and loss potential is also reduced, but it allows you to gain valuable experience in real market conditions without risking too much capital.

When trading on cent accounts, it’s essential to carefully manage your risk. Start by defining your risk tolerance and setting a stop-loss level for each trade. Remember that even though the lot sizes are smaller, the percentage of your account at risk should remain the same as with a standard account.

Additionally, it’s crucial to develop a trading strategy and stick to it. Whether you prefer technical analysis, fundamental analysis, or a combination of both, having a well-defined trading plan can help you make more informed trading decisions.

As you gain experience and confidence, you can gradually increase your lot sizes and move on to standard accounts. But cent accounts will always serve as a great learning tool and an opportunity to test new strategies or trading ideas.

In conclusion, getting started with cent accounts is relatively straightforward. Choose a broker, open an account, deposit funds, download a trading platform, and start trading. Remember to manage your risk, develop a trading strategy, and use cent accounts as a way to improve your trading skills.

A cent account is a type of trading account that allows traders to trade in smaller amounts using small incremental units of currency called “cents”. It is especially suited for beginners or those with a limited amount of trading capital.

A cent account works by allowing traders to trade in smaller units of currency, such as cents, instead of the standard lots or units. The trading platform converts the regular currency units into cents, allowing traders to make smaller trades and manage their risk more effectively.

There are several advantages of using a cent account. Firstly, it allows traders to start trading with a smaller amount of capital, making it more accessible for beginners. Secondly, it allows traders to practice their trading strategies and skills without risking a significant amount of money. Lastly, it allows traders to manage their risk more effectively by trading in smaller units of currency.

While there are advantages to using a cent account, there are also some disadvantages. One of the main disadvantages is that the profits and losses made in a cent account are smaller compared to a standard account, as the trading amounts are reduced. Additionally, some brokers may have higher spreads or commissions for cent accounts, which can affect the overall trading costs.

Yes, experienced traders can also use cent accounts. While cent accounts are often recommended for beginners, experienced traders can also benefit from using smaller trading units to test new strategies or trade in more volatile markets. It can also be useful for experienced traders who want to practice new trading techniques without risking a significant amount of capital.

A cent account is a type of trading account that allows traders to trade with smaller position sizes or lower trade volumes. It is called a cent account because the base currency in the account is denominated in cents rather than dollars or euros.

Who did the Cubs get in the trade? The Chicago Cubs have been busy this offseason, making several key trades to bolster their roster for the upcoming …

Read ArticleHow to Calculate 20 Pips in Forex: A Step-by-Step Guide Forex trading is a popular way to invest in the global currency market and potentially earn …

Read ArticleUnderstanding Candlestick Charts on IQ Option If you’re new to trading, candlestick charts might seem intimidating at first. However, once you …

Read ArticleHow to Set Multiple Take-Profit Levels in Forex In forex trading, take profit levels play a crucial role in managing your trades and maximizing your …

Read ArticleUnderstanding Global FX Trading Welcome to our comprehensive guide on global foreign exchange (FX) trading. In this guide, we will explore the …

Read ArticleCurrent exchange rate: $1 USD to NZD The exchange rate between the United States Dollar (USD) and the New Zealand Dollar (NZD) is an important …

Read Article