What is the minimum deposit for QuickTrade?

What is the minimum deposit for QuickTrade? If you’re interested in using QuickTrade, one of the first questions you might have is: What is the …

Read Article

If you’re new to trading, candlestick charts might seem intimidating at first. However, once you understand how to read them, they can be a powerful tool in your trading arsenal. In this step-by-step guide, we’ll walk you through the basics of candlestick charts and show you how to interpret them on the IQ Option platform.

Candlestick charts originated in Japan and have been used for centuries in trading. They provide a visual representation of price movement over a given period of time, making it easier to identify trends and patterns.

Each candlestick on the chart represents a specific time frame, such as one minute, five minutes, or one hour. The body of the candlestick shows the opening and closing prices, while the wicks (also called shadows) represent the highest and lowest prices reached during that time frame.

To interpret candlestick charts, you need to understand the different patterns that can form. For example, a bullish candlestick with a long lower wick and little to no upper wick indicates that buyers are in control and the price is likely to go up. On the other hand, a bearish candlestick with a long upper wick and little to no lower wick indicates that sellers are in control and the price is likely to go down.

It’s important to note that candlestick patterns are not foolproof indicators and should be used in conjunction with other technical analysis tools and indicators to make informed trading decisions.

On the IQ Option platform, you can easily switch to candlestick charts by selecting the “Candle” option in the chart type menu. You can also customize the candlestick chart by changing the time frame and adding indicators for more advanced analysis.

By learning how to read candlestick charts, you’ll be able to identify trends, reversals, and potential entry and exit points in your trading. Practice analyzing different patterns and use them to your advantage in your trading strategy.

Candlestick charts are a popular type of chart used in technical analysis to analyze price movements in financial markets. They provide valuable information about the price action, showing the open, close, high, and low prices for a given period of time.

Here is a step-by-step guide on how to read candlestick charts on IQ Option:

Step 1: Understanding the basic components of a candlestick

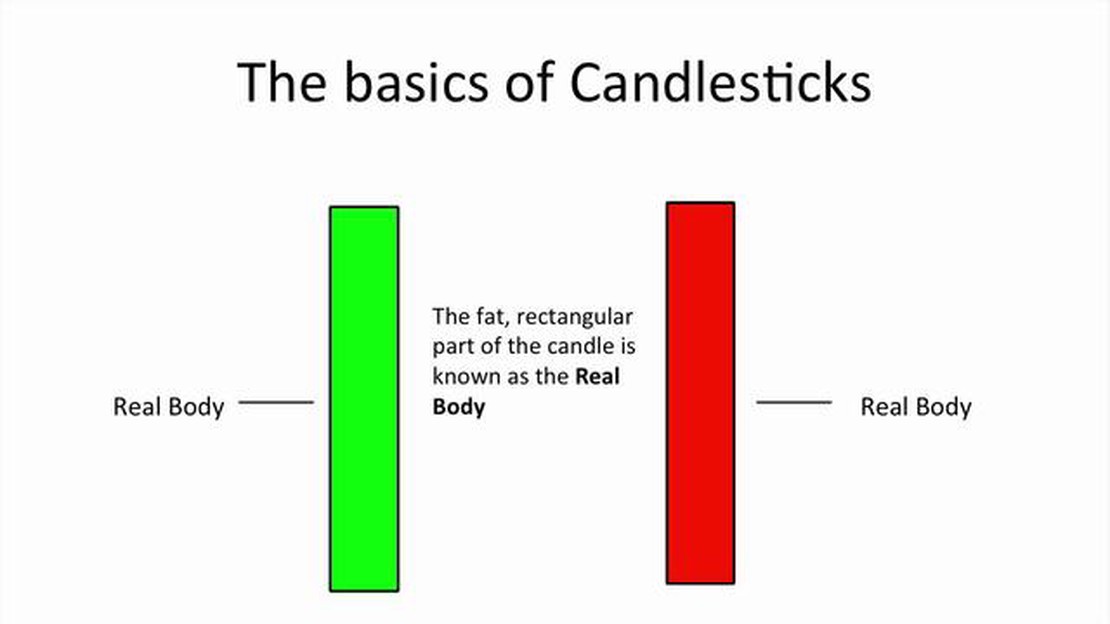

A candlestick is composed of two parts: the body and the wick. The body represents the price difference between the open and close of a particular period, while the wick (also known as shadow or tail) represents the price range between the high and low of that period.

Step 2: Recognizing bullish and bearish candlestick patterns

Bullish candlesticks indicate a higher closing price compared to the opening price, while bearish candlesticks indicate a lower closing price compared to the opening price. By recognizing various candlestick patterns such as doji, hammer, engulfing, and shooting star, traders can gain insights into market trends and potential price reversals.

Step 3: Analyzing the length and color of candlesticks

The length of the body and wick of a candlestick can provide additional information about market sentiment. Longer bodies indicate more significant price movements, and longer wicks suggest increased market volatility. Additionally, candlesticks with different colors (e.g., green for bullish and red for bearish) help traders visually distinguish between positive and negative price movements.

Step 4: Using candlestick patterns to make trading decisions

Read Also: Understanding the Mechanism of Emissions Trading Systems: A Comprehensive Guide

By combining candlestick patterns with other technical indicators and chart analysis techniques, traders can develop trading strategies and make informed decisions. For example, a bullish engulfing pattern followed by a strong uptrend may signal a buying opportunity, while a bearish shooting star pattern at a resistance level may indicate a potential selling opportunity.

By mastering the art of reading candlestick charts, traders can effectively analyze market trends, identify patterns, and make accurate predictions. IQ Option provides a user-friendly platform with advanced charting tools and indicators to assist traders in their analysis and decision-making process.

Disclaimer: Trading carries a high level of risk and may not be suitable for all investors. Before making any investment decisions, it’s important to understand the risks involved and seek professional advice if needed.

A candlestick chart is a popular type of chart used in technical analysis to visually represent the price movement of an asset. It provides traders with valuable information about the market sentiment and potential future price trends. Understanding the basics of candlestick charts is essential for successful trading on the IQ Option platform.

Candlestick Structure:

A candlestick consists of three main components: the body, the upper shadow (wick), and the lower shadow (wick). The body represents the price range between the opening and closing prices of the asset during a specific time period. If the closing price is higher than the opening price, the body is usually filled or colored green, indicating a bullish (upward) trend. Conversely, if the closing price is lower than the opening price, the body is empty or colored red, indicating a bearish (downward) trend.

Read Also: Call of Duty Black Advanced Warfare System Requirements: Find out if your PC can handle the game

The upper shadow represents the highest price reached during the chosen time period, while the lower shadow represents the lowest price. These shadows can provide valuable information about the price range and volatility of the asset. The length of the shadows compared to the length of the body can indicate the strength or weakness of a trend.

Types of Candlestick Patterns:

Candlestick charts display various patterns that can help traders identify potential trend reversals or continuations. Some common candlestick patterns include:

Using Candlestick Charts for Trading:

By analyzing candlestick charts, traders can gain insights into market sentiment and make informed trading decisions. Traders often use candlestick patterns to identify entry and exit points for their trades. For example, if a trader sees a hammer candlestick after a downtrend, they might consider opening a buy position. Conversely, if a shooting star candlestick appears after an uptrend, it may be a signal to sell.

It’s important to note that candlestick analysis should be used in conjunction with other technical indicators and analysis methods to confirm trading signals and reduce the risk of false signals.

Conclusion:

Candlestick charts provide a visual representation of price movement and are widely used by traders for technical analysis. By understanding the basics of candlestick charts and recognizing different patterns, traders can improve their decision-making process and increase their chances of successful trading on the IQ Option platform.

Candlestick charts are a popular form of technical analysis used in financial markets. They display the price movement of an asset over a specific time period and provide information about the opening, closing, high, and low prices during that period.

Reading candlestick charts on IQ Option involves analyzing the different components of each candlestick, such as the body, shadows, and color. Traders can use this information to identify patterns and trends in the market and make informed trading decisions.

Candlestick charts are important because they provide a visual representation of price movement and help traders identify potential trading opportunities. By understanding the patterns and trends reflected in candlestick charts, traders can anticipate future price movements and make profitable trading decisions.

Some common candlestick patterns to look for include doji, hammer, engulfing, and shooting star. Each pattern has its own significance and can provide signals of potential price reversals or continuations.

Yes, there are various trading strategies that can be based on candlestick chart analysis. Some popular strategies include using candlestick patterns to identify entry and exit points, utilizing support and resistance levels in conjunction with candlestick analysis, and combining candlestick patterns with other technical indicators for confirmation.

A candlestick chart is a popular tool used in technical analysis to visually represent the price movement of an asset over a specific period of time. It consists of individual “candles” that have a body and “wicks” or “shadows” at the top and bottom.

To read a candlestick chart on IQ Option, you need to understand the different components of a single candle. The body of the candle represents the price range between the opening and closing prices. The color of the body indicates whether the price has increased (green or white) or decreased (red or black). The wicks or shadows represent the highest and lowest prices reached during the specified time period.

What is the minimum deposit for QuickTrade? If you’re interested in using QuickTrade, one of the first questions you might have is: What is the …

Read ArticleChoose a Brokerage with No Option Fees Choosing the right brokerage for your option trading needs is crucial to your success. One of the important …

Read ArticleEstimating AR Model in Matlab: A Step-by-Step Guide Autoregressive (AR) models are widely used in time series analysis to forecast future values based …

Read ArticleExploring D3 Analysis: A Comprehensive Overview D3 (Data-Driven Documents) is a JavaScript library that is widely used for creating dynamic and …

Read ArticleUnderstanding the Significance of Option Volume Surpassing Open Interest When it comes to trading options, understanding volume and open interest is …

Read ArticleArt of Living: Who is the Owner? The Art of Living is a global organization that offers programs to help individuals lead a more fulfilling and …

Read Article