Trading Futures vs Options: A Comparative Analysis for Better Profits

Choosing Between Trading Futures or Options: Which is Better? For individuals looking to maximize their profits in the financial markets, trading …

Read Article

The currency market, also known as the forex market, is a decentralized market where currencies are traded. For traders, understanding the various factors that influence currency values is crucial to making informed trading decisions. One factor that many traders consider is the concept of currency depreciation (CD) and its impact on forex trading.

Currency depreciation refers to the decrease in the value of one currency relative to another currency. It occurs when there is an increase in the supply of a currency or a decrease in demand. This can be caused by various factors such as economic weaknesses, political instability, or changes in government policies. Understanding CD is important because it can significantly impact the profitability of forex trades.

When a currency depreciates, it means that it is becoming less valuable compared to other currencies. This can have both positive and negative consequences for traders. On one hand, a depreciating currency can make exports more competitive, which can stimulate economic growth. On the other hand, it can make imports more expensive, leading to higher inflation and decreased purchasing power. Traders need to be aware of these implications when trading currencies affected by CD.

In forex trading, traders can profit from currency depreciation by selling a currency that is expected to depreciate and buying a currency that is expected to appreciate. This strategy is known as shorting a currency pair. However, it is important to note that forex trading is highly speculative and involves risks. Traders should always conduct thorough research and analysis before making any trades.

Overall, understanding CD in forex is essential for traders to navigate the currency market effectively. By monitoring and analyzing the factors that contribute to currency depreciation, traders can make more informed trading decisions and potentially profit from market fluctuations. However, it is important to remember that forex trading involves risks, and traders should always be cautious and seek professional advice.

CD, also known as Crawford-Driver, is a popular technical tool used in forex trading to identify potential trend reversals. It is based on the concept of finding the completion of a price pattern and projecting the potential price movement after the pattern.

The basic idea behind CD is to find points on a price chart where price reversals are likely to occur. These points are typically identified by connecting major swing highs or lows using trendlines or channels.

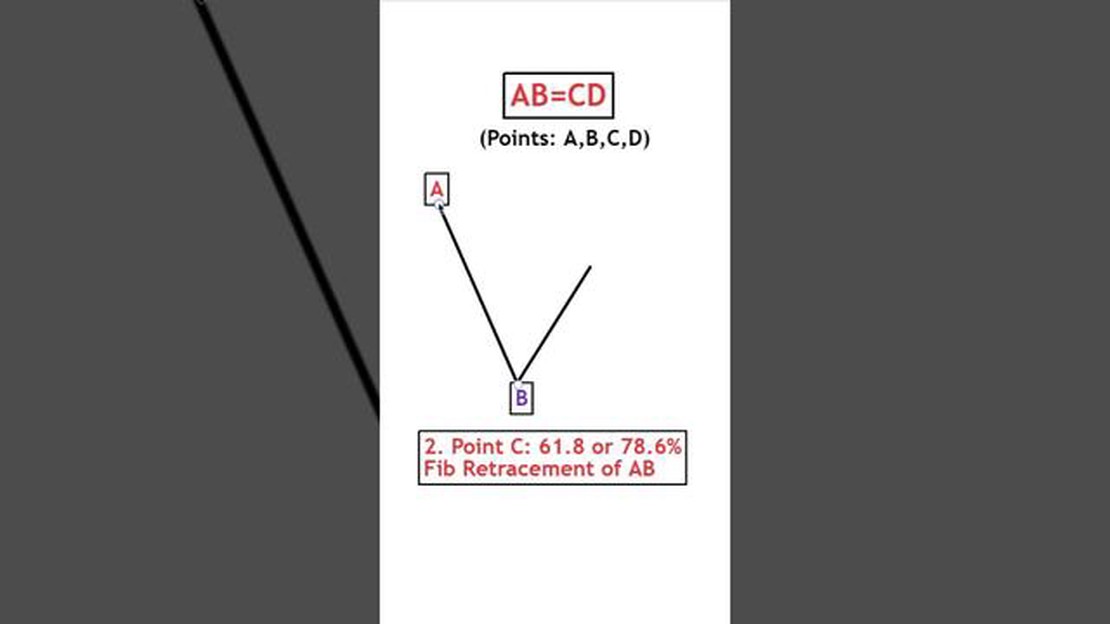

CD patterns can be classified into different types, such as ABCD, Gartley, Butterfly, and Bat patterns. Each pattern has its own set of rules that traders use to define the structure and potential entry and exit points.

One of the key components of CD patterns is the Fibonacci retracement levels. These levels are derived from the Fibonacci sequence and are used to determine potential support and resistance levels where price reversals may occur.

Traders use various tools and indicators to confirm the validity of a CD pattern, such as moving averages, momentum indicators, and volume analysis. These tools help traders gauge the strength and direction of the potential price movement.

Once a CD pattern is identified, traders can enter trades based on the projected price movement. Stop-loss orders are typically placed below or above the pattern to limit potential losses in case the trade goes against the expected direction.

Read Also: ICT ATM Method: Understanding the Benefits and Implementation

It is important to note that CD patterns are subjective and require practice and experience to identify accurately. Traders should also be aware of the limitations of CD patterns and use them in conjunction with other technical analysis tools and risk management strategies for better results.

| Advantages of CD in forex trading | Disadvantages of CD in forex trading |

|---|---|

| Provides potential entry and exit points | Subjective and open to interpretation |

| Can be used in conjunction with other technical analysis tools | Requires practice and experience to identify accurately |

| Helps traders gauge potential price movement | Does not guarantee accurate predictions |

Read Also: Choosing the Most Accurate Indicator for Intraday Trading: A Comprehensive Guide

In conclusion, CD is a valuable technical tool in forex trading that can help identify potential trend reversals. However, it should be used in conjunction with other tools and strategies and requires practice and experience to master.

Contract for Difference (CD) trading in the forex market offers several benefits for traders. Here are some of the key advantages:

Overall, CD trading in forex offers a range of benefits, including leverage, accessibility, diversification, a liquid market, the opportunity to profit from both rising and falling markets, trading tools and resources, as well as lower costs. Traders should, however, also be aware of the risks involved and ensure they have a good understanding of the market before engaging in CD trading.

CD stands for “candlestick pattern” in forex trading. It refers to specific patterns that are formed by the price action on a chart, represented by candlesticks. Traders use CD patterns to predict future price movements and make trading decisions.

To identify CD patterns, traders need to study the different types of patterns and understand the rules for each pattern. Common CD patterns include doji, hammer, engulfing, shooting star, and many more. Traders typically look for specific formations of candlesticks that indicate a potential reversal or continuation of the price trend.

While CD patterns can provide useful insights into price movements, they are not foolproof indicators. Their reliability depends on various factors, including the timeframe being analyzed and the context in which the pattern is formed. It’s important for traders to use CD patterns in conjunction with other technical and fundamental analysis tools to increase the accuracy of their trading decisions.

Yes, CD patterns can be used in various forex trading strategies. Some traders focus solely on CD patterns and use them as their primary trading signals. Others incorporate CD patterns into their existing strategies to provide additional confirmation for their trades. The choice of using CD patterns within a strategy depends on the trader’s personal preference and trading style.

To learn how to use CD patterns in forex trading, it’s recommended to study educational resources on technical analysis. There are numerous books, online courses, and tutorials available that cover CD patterns in detail. Additionally, practicing on demo accounts and analyzing historical price charts can help traders gain a better understanding of how CD patterns work in real trading situations.

In forex, CD stands for “Candlestick Chart Pattern”. It is a graphical representation of price movements in the foreign exchange market. It is used by traders to identify potential trends and reversals in price.

CD patterns are formed through the combination of different candlestick formations. These formations represent the opening, closing, high, and low prices of a given time period. Traders look for specific patterns such as doji, engulfing, hammer, and shooting star, among others, to predict future price movements.

Choosing Between Trading Futures or Options: Which is Better? For individuals looking to maximize their profits in the financial markets, trading …

Read ArticleExploring the 4 unit root tests When analyzing time series data, it is essential to determine if the data exhibits a unit root. A unit root indicates …

Read ArticleIraq 1 Dinar to Bangladesh Taka - Currency Exchange Rate In today’s financial landscape, where global trade and economic interdependence are thriving, …

Read ArticleSalary of Chefs in Cyprus: What is the Average Pay? Being a chef has always been associated with passion and creativity in the culinary arts. But …

Read ArticleIs eToro Binary? Binary options trading is a popular method of financial trading in which traders can choose between two possible outcomes, whether …

Read ArticleGuide to Trading Forex on CMC Markets Forex trading is a popular and potentially lucrative investment opportunity. With the rise of online trading …

Read Article