What Happens if Nobody Buys My Option? | Understanding the Consequences

What Happens If No One Buys My Option? Options trading can be an exciting and potentially profitable endeavor, but it’s important to understand the …

Read Article

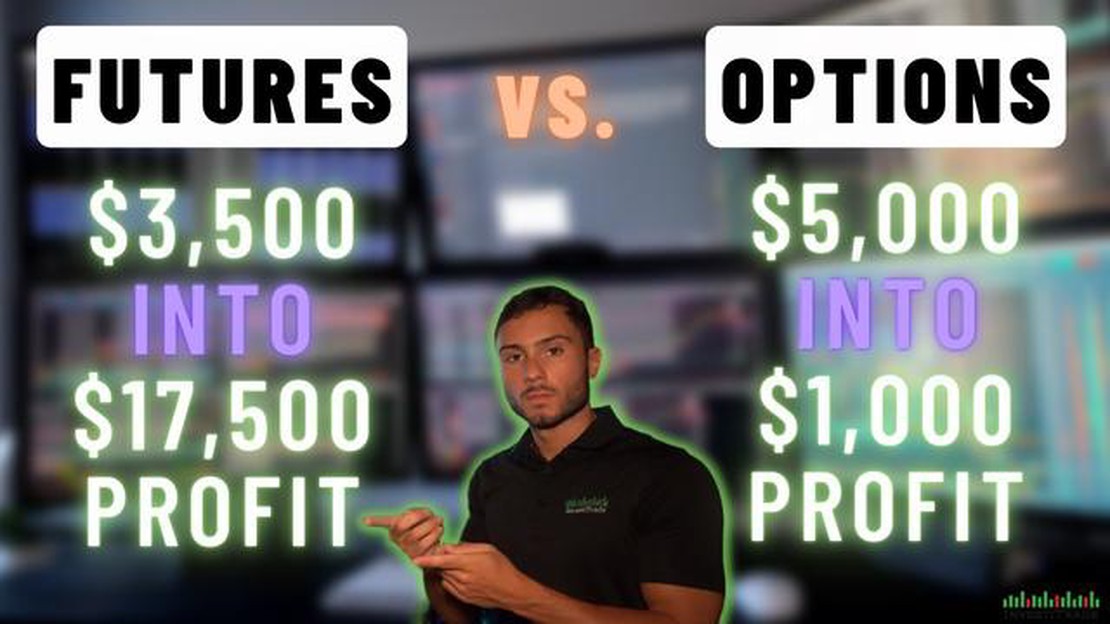

For individuals looking to maximize their profits in the financial markets, trading futures and options are two popular strategies. Both futures and options are derivative instruments that allow traders to speculate on the price movements of underlying assets, such as stocks, commodities, or currencies. However, there are significant differences between the two, and understanding these differences is crucial for making informed trading decisions.

Futures contracts are standardized agreements to buy or sell an asset at a predetermined price and date in the future. By entering into a futures contract, traders can speculate on the direction of price movements and potentially profit from both rising and falling markets. This provides flexibility and the opportunity to hedge against potential losses. Futures trading often requires a higher capital outlay and is considered more suitable for experienced traders.

On the other hand, options are financial instruments that give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price and date. Unlike futures, options provide traders with the flexibility to choose whether to exercise the contract or not. They offer potential profits from price movements while limiting the risk to the premium paid for the option. Options trading is often preferred by less experienced traders due to the lower capital requirements and the ability to tailor risk management strategies.

While both futures and options can be used for speculation, hedging, and income generation, it is essential to evaluate the pros and cons of each strategy based on individual trading goals, risk tolerance, and market conditions. This article provides a comparative analysis of trading futures and options, aiming to assist traders in making more informed decisions and achieving better profits in the financial markets.

Futures trading is a popular form of investment that allows traders to speculate on the price movement of various financial instruments such as commodities, currencies, and indexes. It involves entering into a contract to buy or sell an asset at a predetermined price on a future date. This contract is legally binding and standardized, which ensures transparency and reduces the risk of default.

One of the key features of futures trading is leverage. Traders are required to deposit a small percentage of the contract value known as the margin. This allows traders to control a large position with a relatively small amount of capital. However, it is important to note that while leverage amplifies the potential profitability, it also increases the potential losses. Therefore, it is crucial to carefully manage risk when engaging in futures trading.

Futures contracts come with a predetermined expiration date. This means that traders need to decide whether they want to hold the contract until expiration or close it out before. If a trader holds the contract until expiration, they will be obligated to buy or sell the underlying asset at the agreed-upon price. However, it is common for traders to close out their positions before expiration by entering into an opposite transaction in order to realize profits or limit losses.

The futures market operates on exchanges, which are regulated platforms that facilitate the trading of futures contracts. These exchanges bring together buyers and sellers, ensuring liquidity and fair pricing. Some well-known futures exchanges include the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE).

Read Also: A Beginner's Guide: How to Read Nifty Option Chain Data | Nifty Option Chain Analysis

| Advantages of Futures Trading | Disadvantages of Futures Trading |

|---|---|

| - Leverage potential | - High risk due to leverage |

| - Ability to hedge against price fluctuations | - Requires knowledge and expertise |

| - Liquidity and transparency | - Potential for significant losses |

| - Diverse range of assets to trade | - Market volatility |

Futures trading can be an effective tool for both hedging and speculation. Hedgers use futures contracts to protect against price volatility and manage risk, while speculators aim to profit from price fluctuations. It is important to understand the fundamentals of futures trading, including the contract specifications, margin requirements, and risk management strategies, before getting involved in this highly dynamic and potentially rewarding market.

Options trading is a popular and versatile form of investment that allows traders to speculate on the price movement of various underlying assets, such as stocks, commodities, and currencies. As the name suggests, options trading involves the trading of options contracts, which give the holder the right but not the obligation to buy or sell the underlying asset at a predetermined price within a specified time period.

One of the key advantages of options trading is the ability to leverage your investment. With options, traders can control a larger position in the market with a smaller amount of money. This leverage can potentially lead to higher returns, but it also comes with increased risk.

Another advantage of options trading is the ability to profit in both rising and falling markets. Traders can take bullish positions by buying call options, which allow them to profit when the price of the underlying asset goes up. On the other hand, traders can take bearish positions by buying put options, which allow them to profit when the price of the underlying asset goes down.

Options trading offers traders a wide range of strategies to choose from, depending on their risk tolerance and market outlook. Some popular options trading strategies include covered calls, protective puts, straddles, strangles, and iron condors.

It’s important to note that options trading involves significant risks, including the potential loss of the entire investment. Therefore, it is crucial to thoroughly understand the mechanics of options trading, as well as the risks involved, before engaging in this form of investment.

Overall, options trading can be a profitable and flexible investment strategy. However, it requires careful analysis, risk management, and a deep understanding of the market. By exploring options trading and implementing effective strategies, traders can potentially enhance their profits and diversify their investment portfolio.

Read Also: Is Forex Trading Safe? Exploring the Risks and Benefits of Forex Investing

Futures trading refers to buying or selling financial contracts known as futures contracts. These contracts obligate the buyer to purchase an asset or the seller to sell an asset at a predetermined price and date in the future.

Options trading involves buying and selling options contracts. An options contract grants the buyer the right, but not the obligation, to purchase or sell an asset at a specific price within a certain time period.

Futures trading offers several benefits, including high liquidity, leverage, and the ability to hedge against price changes. It also provides potential for high returns and the ability to trade various asset classes.

Options trading provides flexibility, as it allows investors to profit from both rising and falling markets. It also offers limited risk, as the maximum loss is predetermined. Options can be used for hedging or generating income through premium collection.

When deciding between futures and options trading, you should consider factors such as your risk tolerance, trading capital, investment goals, market conditions, and the level of complexity you are comfortable with. It’s important to understand the characteristics and risks associated with each before making a decision.

Trading futures involves buying or selling a contract to buy or sell a particular asset at a predetermined price and future date. On the other hand, options give the buyer the right, but not the obligation, to buy or sell an asset at a specific price within a certain time period.

What Happens If No One Buys My Option? Options trading can be an exciting and potentially profitable endeavor, but it’s important to understand the …

Read ArticleDiscovering the Heiken Ashi Ma T3 new Indicator Forex trading can be a complex and challenging endeavor. Traders are constantly seeking new tools and …

Read ArticleBest Devices for Trading If you are an active trader or someone who wants to get into trading, having the right device is crucial for success. In …

Read ArticleMastering Price Action in Forex: Strategies and Techniques Forex trading is a complex and dynamic market, where success often hinges on the ability to …

Read ArticleRules for Trading in an IRA: What You Need to Know Individual Retirement Accounts, or IRAs, are a popular tool for saving and investing for …

Read ArticleUnderstanding the Role of N in the Moving Average Calculation When it comes to calculating moving averages, the “N” stands for the number of periods …

Read Article