Learn How to Permanently Delete Your OFX Account in a Few Simple Steps

How to Delete My OFX Account If you are looking to permanently delete your OFX account, you’ve come to the right place. In this article, we will guide …

Read Article

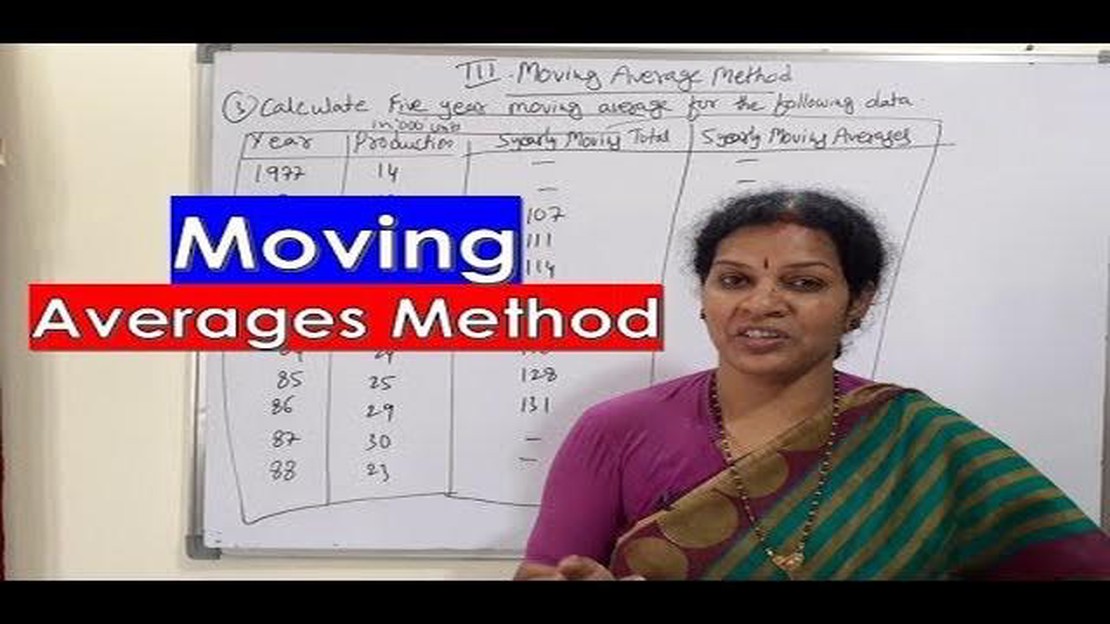

When it comes to calculating moving averages, the “N” stands for the number of periods or time intervals used in the calculation. Moving averages are widely used in technical analysis to smooth out the price data and identify trends. They are a common tool for traders and investors in analysing the stock market, forex market, and other financial markets.

The moving average is calculated by taking the average price over a specified number of periods. The “N” represents this number, which can vary depending on the trader’s preference or the specific strategy being used. For example, a 10-day moving average would use the price data from the last 10 trading days to calculate the average.

The purpose of using moving averages is to filter out short-term fluctuations and noise in the price data, and to focus on the overall trend. It helps traders and investors to make more informed decisions based on the direction of the trend. The longer the time period used in the moving average, the smoother the line representing the average will be, but it will also be slower to react to sudden price movements.

Traders and investors can use moving averages in different ways, such as identifying support and resistance levels, generating buy or sell signals, or confirming the strength of a trend. The “N” in moving average is a crucial parameter that determines the length of the time period used in the calculation, and understanding its meaning is essential for using moving averages effectively in technical analysis.

The moving average is a popular technical analysis tool used by traders and investors to identify trends and make informed investment decisions. It is a mathematical calculation that smoothes out price data over a specific period of time in order to highlight the underlying trend.

The calculation of a moving average involves adding up a series of prices over the chosen time period and dividing the sum by the number of prices in that period. The result is a single data point on the chart, representing the average price over that period.

The “N” in moving average refers to the number of time periods used in the calculation. For example, a 10-day moving average would calculate the average price over the past 10 days. The choice of the number of periods depends on the trader’s or investor’s preference and trading strategy.

Moving averages are often used in conjunction with other technical indicators to confirm or validate trends and signals. For example, a crossover of a shorter-term moving average above a longer-term moving average might be interpreted as a bullish signal, indicating a potential upward trend.

Moving averages can be calculated for different time frames, such as days, weeks, or months, depending on the trader’s or investor’s trading style and the security being analyzed. Shorter-term moving averages react more quickly to price changes, while longer-term moving averages provide a smoother representation of the overall trend.

Overall, moving averages are a valuable tool for traders and investors to analyze price trends and make more informed decisions. By understanding the concept of moving average and its calculation, individuals can incorporate this tool into their trading strategies to potentially improve their trading outcomes.

The “N” in moving average stands for the number of periods or intervals used in the calculation. It determines the smoothing effect of the moving average and how responsive it is to changes in the underlying data.

To calculate a moving average, you need to first determine the number of periods, represented by “N”, that you want to include in the average. This could be days, weeks, months, or any other time period, depending on the data you are analyzing.

Next, you take the sum of the values for the chosen number of periods and divide it by that number. This will give you the average value for that period.

Read Also: How to Calculate Options: A Comprehensive Guide for Investors

As new data becomes available, you update the average by removing the oldest value and including the newest value in the calculation. This creates a moving or rolling average that continually adjusts to the latest data points.

| Period | Data Value | Sum of Values | Moving Average |

|---|---|---|---|

| 1 | 10 | 10 | |

| 2 | 15 | 25 | |

| 3 | 12 | 37 | |

| 4 | 18 | 55 | |

| 5 | 20 | 65 |

For example, let’s consider a simple moving average with N=3. In the table above, we have five periods of data. To calculate the moving average for each period, we take the sum of the current and two previous values and divide it by 3.

For the first period, the moving average is not determined since we don’t have enough historical data. For the second period, the moving average is (10 + 15 + 12) / 3 = 12.3. For the third period, the moving average is (15 + 12 + 18) / 3 = 15. For the fourth period, the moving average is (12 + 18 + 20) / 3 = 16.7. And finally, for the fifth period, the moving average is (18 + 20) / 3 = 12.67.

Read Also: Learn the Best Ways to Trade Forex in the Philippines

By calculating and analyzing moving averages, investors and analysts can identify trends, smooth out short-term fluctuations, and make informed decisions based on the overall direction of the data.

The “N” in Moving Average refers to the number of periods considered when calculating the average. It is an essential parameter that plays a crucial role in determining the accuracy and reliability of the moving average indicator.

The choice of “N” value is contingent upon the timeframe and the specific purpose of the moving average. Shorter “N” values, such as 10 or 20, are commonly used for shorter-term trends, providing a more sensitive and responsive moving average line. On the other hand, larger “N” values, such as 50 or 200, are suitable for long-term trends and can smoothen out noise and volatility, offering a broader perspective.

The importance of finding the right “N” value lies in its ability to capture and highlight significant trends while filtering out noise and insignificant fluctuations. An appropriate “N” value should strike a balance between responsiveness and reliability, ensuring that the moving average accurately reflects the underlying trend.

Moreover, the “N” value also affects the lag in the moving average line. Larger “N” values introduce a more significant lag, representing a delayed response to changes in price or data. Smaller “N” values provide a faster response but may result in more false signals due to the increased sensitivity to price movements.

In summary, the selection of the “N” value in Moving Average is a critical step in technical analysis. Traders and analysts must carefully consider the timeframe, market conditions, and specific requirements to determine the appropriate “N” value that aligns with their trading strategy. By doing so, they can leverage the power of Moving Average as an effective tool for trend identification and analysis.

A moving average is a widely used technical indicator in finance, which helps to identify trends and smooth out price fluctuations. It is calculated by taking the average of a specified number of past data points.

The moving average is important in technical analysis because it helps to filter out noise and identify the overall direction of a price trend. Traders and investors use moving averages to make informed decisions about buying or selling assets.

In moving averages, the letter “N” represents the number of periods over which the average is calculated. It determines the smoothness and responsiveness of the moving average. A smaller value of “N” gives a more responsive average, while a larger value makes the average smoother and slower to respond to changes in price.

The value of “N” affects the accuracy of moving averages by determining how much weight is given to recent data points. A smaller value of “N” gives more weight to recent prices, making the average more sensitive to short-term price movements. On the other hand, a larger value of “N” gives more weight to older data, resulting in a smoother average that is less influenced by short-term fluctuations.

Yes, different values of “N” can be used for different timeframes depending on the trader’s preference and trading strategy. Shorter timeframes usually require smaller values of “N” to capture short-term trends, while longer timeframes may warrant larger values for a smoother and longer-term perspective.

How to Delete My OFX Account If you are looking to permanently delete your OFX account, you’ve come to the right place. In this article, we will guide …

Read ArticleUnderstanding the XE Rate and Its Importance The XE Rate, also known as the XE Currency Exchange Rate, is a vital factor in international money …

Read ArticleEffective Ways to Sell Your Trading Strategy Are you an experienced trader with a successful trading strategy? Do you want to take your trading skills …

Read ArticleNumber of IOB Branches in India If you are someone who is looking for information about the Indian Overseas Bank (IOB) branches in India, you have …

Read ArticleIs forex trading really profitable? Forex, short for foreign exchange, is the largest and most liquid financial market in the world. It’s a …

Read ArticleWhat is VXX trading? Trading in the Volatility Index (VIX) can be a complex endeavor, especially for those new to the world of investing. However, …

Read Article