Record-High Price of Brent Oil: What is the Highest Price in History?

Historical Highs: The Price of Brent Oil Reaches New Heights The price of Brent oil has been making headlines recently as it continues to climb to …

Read Article

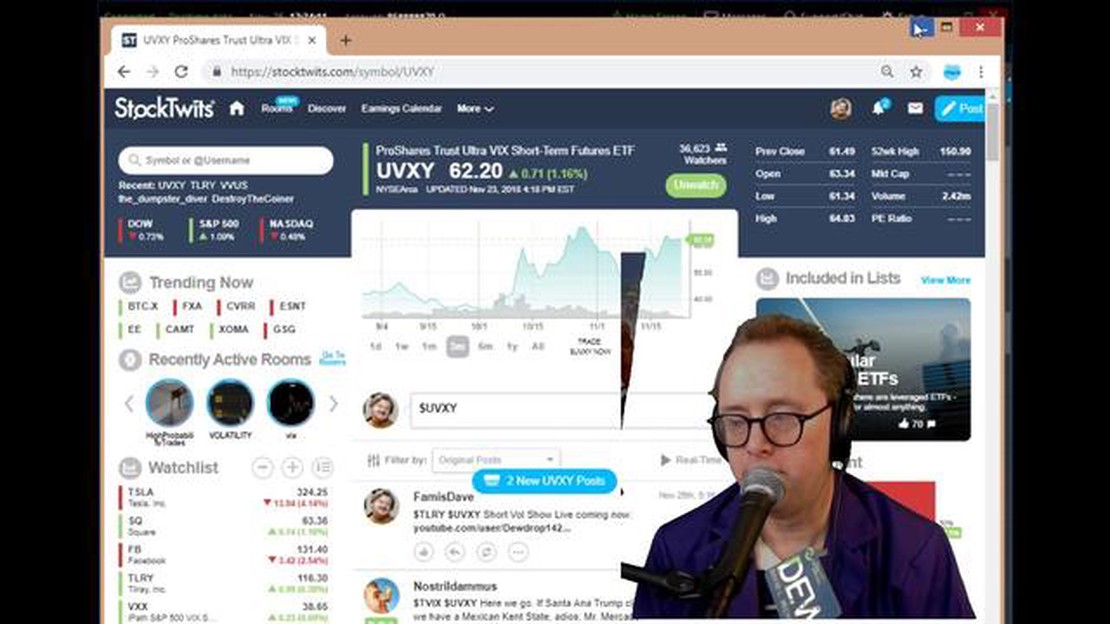

If you’re looking to trade options and want to capitalize on the volatility of the market, UVXY might be the perfect choice for you. UVXY, also known as the ProShares Ultra VIX Short-Term Futures ETF, is an exchange-traded fund that seeks to provide investors with twice the daily performance of the S&P 500 VIX Short-Term Futures index.

Options trading on UVXY can offer a unique opportunity to profit from both the volatility and direction of the market. Whether you’re a seasoned options trader or just starting out, understanding how options work on UVXY is essential to maximizing your potential gains.

When trading options on UVXY, you have the flexibility to choose between call and put options. Call options give you the right, but not the obligation, to buy UVXY shares at a predetermined price (the strike price) by a specific date (the expiration date). On the other hand, put options give you the right, but not the obligation, to sell UVXY shares at the strike price by the expiration date.

It’s important to note that trading options on UVXY can be highly risky, as UVXY is designed to provide leveraged exposure to the VIX futures index. This means that the value of UVXY can be influenced by factors such as the overall volatility of the market and contango in the futures market. Therefore, it’s crucial to have a solid understanding of options trading and the underlying asset before getting started.

In this comprehensive guide, we’ll cover everything you need to know about trading options on UVXY. From understanding the basics of options to implementing different strategies, we’ll equip you with the knowledge and tools necessary to navigate the UVXY options market confidently.

When it comes to trading options on UVXY, there are a few things you should know. UVXY is an exchange-traded fund (ETF) that seeks to provide investors with a way to gain exposure to the Cboe Volatility Index (VIX). The VIX is often referred to as the “fear gauge” and is used by traders and investors to gauge market volatility.

Before diving into trading options on UVXY, it’s important to understand the basics of options trading. Options are derivative contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price (strike price) within a certain period of time (expiration date).

When trading options on UVXY, you can choose to buy call options if you believe that the price of UVXY will increase, or buy put options if you believe that the price of UVXY will decrease. Call options give you the right to buy UVXY at the strike price, while put options give you the right to sell UVXY at the strike price.

It’s important to note that options on UVXY are European-style options, which means they can only be exercised on the expiration date. This is different from American-style options, which can be exercised at any time before the expiration date.

When trading options on UVXY, it’s crucial to consider the factors that can influence the price of UVXY and the VIX. These factors include market volatility, interest rates, geopolitical events, and market sentiment. It’s also important to keep in mind that UVXY is a leveraged ETF, which means it aims to provide a multiple of the daily performance of the VIX. This leverage can amplify both gains and losses.

In conclusion, trading options on UVXY can be a valuable strategy for investors looking to capitalize on market volatility. However, it’s important to understand the basics of options trading and the factors that can impact the price of UVXY and the VIX. With the right knowledge and risk management strategies, options trading on UVXY can be a powerful tool in your investing arsenal.

UVXY is an exchange-traded product (ETP) that allows investors to gain exposure to volatility in the stock market. It is designed to track the performance of the S&P 500 VIX Short-Term Futures Index, which measures the market’s expectation of volatility over the next 30 days.

Volatility is an important aspect of the financial markets, as it represents the amount of uncertainty or risk present in the market. Traditionally, investors have used various techniques to hedge against volatility, such as purchasing options or holding positions in inverse ETFs. UVXY offers a unique way to gain exposure to volatility directly, without having to utilize these traditional methods.

Read Also: Which is a Better Investment: Forex or Binary Options?

UVXY is particularly popular among traders who want to take advantage of short-term spikes in market volatility. By buying shares of UVXY, traders can profit from an increase in the VIX, which often occurs during times of market stress or uncertainty. This can be especially useful for traders who employ short-term trading strategies or have a high-risk tolerance.

It’s important to note that UVXY is an ETP, not an equity or a traditional ETF. This means that it is designed to track the performance of a specific benchmark or index, rather than the performance of a specific group of stocks. As a result, the value of UVXY will fluctuate based on the performance of its underlying index, rather than the overall stock market.

Trading UVXY requires a solid understanding of volatility and the mechanics of the product. It is important for traders to carefully consider their risk tolerance and investment goals before entering into UVXY positions. Additionally, traders should be aware of the unique characteristics of UVXY, such as its leveraged exposure to volatility and potential for decay over time.

In conclusion, UVXY plays a unique role in trading by allowing investors to gain direct exposure to market volatility. By understanding how UVXY works and the risks associated with trading it, investors can potentially profit from short-term spikes in volatility. However, it is important for traders to conduct thorough research and seek professional advice before trading UVXY or any other volatility-related products.

Read Also: Understanding Forex Cycles: Exploring the Concept of Currency Market Cycles

When it comes to trading options on UVXY, there are several types of options available for investors to choose from. These options give traders the right, but not the obligation, to buy or sell shares of UVXY at a specified price (strike price) within a certain time frame (expiration date).

1. Calls: A call option gives the holder the right to buy UVXY shares at the strike price before the expiration date. Traders often buy call options if they believe that the price of UVXY will rise in the future, as it allows them to profit from the increase in the stock price.

2. Puts: A put option gives the holder the right to sell UVXY shares at the strike price before the expiration date. Traders typically purchase put options if they expect the price of UVXY to decrease, as it allows them to profit from the decline in the stock price.

3. Straddles: A straddle involves buying both a call option and a put option on UVXY with the same strike price and expiration date. This strategy is typically used when traders anticipate a significant price swing in either direction but are unsure of the specific direction the price will move.

4. Spreads: Spreads involve simultaneously buying and selling options with different strike prices or expiration dates. The goal of using spreads is often to reduce risk or generate income through the difference in premiums between the options.

5. Covered calls: A covered call strategy involves selling call options on shares of UVXY that the trader already owns. If the price of UVXY remains below the strike price, the trader keeps the premium received from selling the call option. However, if the price exceeds the strike price, the trader may have to sell their shares at the strike price.

It is important to note that options trading carries risks, and traders should carefully consider their investment objectives and risk tolerance before engaging in options trading on UVXY or any other security.

UVXY is an exchange-traded fund (ETF) that aims to track the performance of the VIX short-term futures index. It offers traders exposure to volatility in the market.

To trade options on UVXY, you would need to have an options trading account with a brokerage that offers UVXY options. Once you have the account set up, you can place options trades on UVXY like you would with any other options contract.

Trading options on UVXY carries a number of risks. Volatility can be unpredictable, and the value of UVXY’s options can fluctuate greatly. Additionally, options trading is complex and can involve significant financial losses if not managed properly.

There are several strategies you can use when trading options on UVXY. Some common strategies include buying call options if you expect UVXY to rise in value, or buying put options if you expect UVXY to decline. You can also use more advanced strategies like straddles or spreads to take advantage of volatility.

Historical Highs: The Price of Brent Oil Reaches New Heights The price of Brent oil has been making headlines recently as it continues to climb to …

Read ArticleHow to check stock options Checking your stock options is an essential part of managing your financial portfolio. Whether you’re a seasoned investor …

Read ArticleUnderstanding RSU Compensation at Tesla RSU, or Restricted Stock Units, is a common form of equity compensation for employees in many technology …

Read ArticleCurrency in Switzerland: Everything you need to know Switzerland, a picturesque country nestled in the heart of Europe, is known for its stunning …

Read ArticleCompanies that use endur Endur is a powerful software solution that is used by a wide range of companies across various industries. This innovative …

Read ArticleIs CMC better than CommSec? Choosing the right online trading platform can make a significant difference in your investment journey. With so many …

Read Article