Job Description of a Money Changer: What to Expect and Responsibilities

What Does a Money Changer Do: Job Description and Responsibilities Working as a money changer can be an exciting and rewarding career choice for those …

Read Article

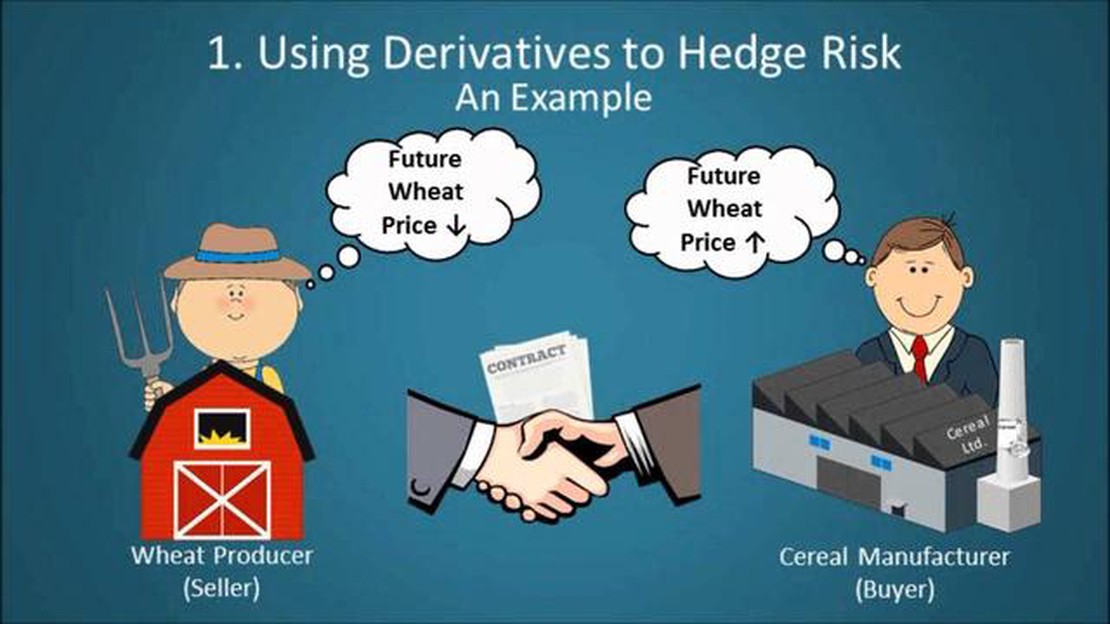

Foreign exchange and derivative transactions are integral parts of the global financial markets. These complex financial instruments allow investors and businesses to hedge risks, speculate on exchange rate movements, and manage their exposure to market volatility. However, conducting these transactions involves a multitude of legal and operational complexities, which can lead to disputes and financial risks if not properly managed.

One crucial tool for mitigating these risks is the master agreement. A master agreement is a legally binding contract that sets out the terms and conditions under which multiple transactions will be executed between two parties. It provides a framework for the parties to negotiate and execute future transactions, without the need to negotiate and sign individual agreements for each trade.

The use of master agreements is especially important in foreign exchange and derivative transactions due to their high volume and fast-paced nature. Without a master agreement in place, parties would need to negotiate the terms and conditions of each transaction separately, leading to significant delays and operational inefficiencies. Moreover, disputes arising from the interpretation of individual agreements can often result in costly litigation.

Master agreements also provide a standardized set of terms and conditions that govern the rights and obligations of the parties. This helps to streamline the execution and settlement processes, reduce legal and administrative costs, and promote greater transparency and understanding between the parties. Furthermore, master agreements often include provisions for netting and close-out netting, which allow parties to consolidate their obligations and reduce credit and liquidity risks.

In conclusion, master agreements play a vital role in facilitating foreign exchange and derivative transactions. They provide a structured and efficient framework for conducting these complex transactions, while also reducing legal, operational, and financial risks. By establishing clear terms and conditions, master agreements help to improve transparency, enhance market stability, and promote confidence in the global financial system.

Master Agreements play a crucial role in the world of foreign exchange and derivative transactions. These agreements are legal contracts established between parties involved in these types of financial transactions to govern their relationship and provide a framework for their future dealings.

One of the main reasons why master agreements are essential is that they help to streamline and standardize the trading process. By having a pre-defined set of terms and conditions, both parties can save time and resources by not having to negotiate and draft new agreements for each transaction. This allows for more efficient and faster execution of trades.

Another significant advantage of master agreements is that they provide clarity and consistency in terms of the rights and obligations of the parties involved. These agreements outline the terms for various aspects of the transaction, such as payment, delivery, and settlement. By having these terms clearly defined, potential disputes and misunderstandings can be minimized.

Additionally, master agreements also help to mitigate counterparty risk. Counterparty risk refers to the risk that one party will default on its obligations. By having a master agreement in place, parties can include provisions for collateral and margin requirements, as well as mechanisms for dispute resolution. These provisions can help protect the parties against potential losses and ensure that they have recourse in case of a default.

In conclusion, master agreements play a significant role in the world of foreign exchange and derivative transactions. They provide a standardized framework for these transactions, ensure clarity and consistency in terms of rights and obligations, and help to mitigate counterparty risk. By establishing these agreements, parties can have greater confidence in their trading relationships and facilitate more efficient and secure transactions.

Master agreements for foreign exchange and derivative transactions play a crucial role in enhancing legal protection and risk management for market participants. These agreements establish a clear framework and set of rules governing the rights and obligations of the parties involved in the transactions.

Read Also: Reporting Stock Options on a T4: Essential Information and Guidelines

By entering into a master agreement, market participants can benefit from standardized terms and conditions, which help to reduce the risk of misunderstandings and disputes. The agreement typically includes provisions related to the netting of transactions, close-out netting, and the application of set-off rights. These provisions provide a legal mechanism for the parties to calculate their obligations and to mitigate the impact of a default or insolvency event.

Furthermore, master agreements often include clauses related to the choice of law, jurisdiction, and dispute resolution. These clauses help to ensure that the agreements are enforceable and provide a clear mechanism for resolving any disputes that may arise between the parties.

Read Also: How Much Does It Cost to Move a 3-Bedroom House in the UK? | [Your Company Name]

In addition to legal protection, master agreements also facilitate risk management. They allow market participants to effectively hedge their exposure to foreign exchange and derivative transactions by providing a standardized framework for entering into such transactions. The agreements typically include provisions for the calculation and settlement of margin requirements, which help to reduce the risk of counterparty default.

| Benefits of Master Agreements for Legal Protection and Risk Management: | Risks and Challenges: |

|---|---|

| Standardized terms and conditions | Complexity of the agreements |

| Clear framework for rights and obligations | Potential for disputes |

| Netting and close-out provisions | Counterparty default |

| Choice of law and jurisdiction clauses | Insolvency risk |

| Effective risk management | Regulatory compliance |

In conclusion, master agreements for foreign exchange and derivative transactions are essential for enhancing the legal protection and risk management of market participants. These agreements provide a clear framework, standardized terms and conditions, and mechanisms for resolving disputes. They also facilitate risk management by providing a standardized framework for entering into transactions and managing counterparty default.

Master agreements for foreign exchange and derivative transactions are legal contracts that set out the terms and conditions for multiple transactions between two parties. They are used to standardize the documentation and provide a framework for future transactions.

Master agreements are important for foreign exchange and derivative transactions because they help establish a common understanding between parties, reduce legal and operational risks, and provide a basis for dispute resolution. They also streamline the process of future transactions by eliminating the need to negotiate individual contracts each time.

Two commonly used types of master agreements for foreign exchange and derivative transactions are the International Swaps and Derivatives Association (ISDA) Master Agreement and the International Foreign Exchange Master Agreement (IFEMA). These agreements provide a standardized framework for the terms and conditions of transactions.

Using master agreements for foreign exchange and derivative transactions has several advantages. Firstly, they provide a standardized framework that simplifies the negotiation and execution of transactions. Secondly, they help reduce legal and operational risks by outlining the rights and obligations of both parties. Lastly, they enable easier dispute resolution by providing clear guidelines for resolving any disagreements that may arise.

Yes, master agreements for foreign exchange and derivative transactions are legally binding contracts. Once they are signed by both parties, they establish the terms and conditions under which transactions will be conducted. They are enforceable in a court of law in case of any disputes.

In the context of foreign exchange and derivative transactions, master agreements are legal documents that govern the terms and conditions of these transactions between two parties. They outline important details such as the rights and obligations of each party, the types of transactions that can be executed, and the processes for settling disputes.

Master agreements are important for foreign exchange and derivative transactions because they provide a standardized framework for conducting these transactions. They help to clarify the rights and obligations of the parties involved, reduce the risk of disputes, and provide a foundation for efficient and smooth transactions. Additionally, master agreements often include provisions for netting, which can help to simplify the settlement process and reduce credit risk.

What Does a Money Changer Do: Job Description and Responsibilities Working as a money changer can be an exciting and rewarding career choice for those …

Read ArticleWhat are the fees for currency exchange at banks? When it comes to exchanging currencies, banks are often a popular choice for individuals and …

Read ArticleOpening hours of the London forex market in the United Kingdom The foreign exchange market, also known as Forex, is the largest and most liquid …

Read ArticleOverview of the MA 1 Model MA (Moving Average) models are a popular tool in the field of time series analysis. They are used to analyze and forecast …

Read ArticleUnderstanding the Brent Oil Benchmark: Key Facts and Insights The Brent Oil benchmark is one of the most widely recognized and influential measures of …

Read ArticleForex Market Statistics for 2023 The Forex market, also known as the foreign exchange market, is the largest and most liquid financial market in the …

Read Article