Understanding the Distinction: SMA vs. Exponential Smoothing

Understanding the Distinction Between SMA and Exponential Smoothing Techniques Simple Moving Average (SMA) and Exponential Smoothing are two commonly …

Read Article

Option trading is a versatile and potentially profitable investment strategy that allows traders to capitalize on the movement of underlying assets without actually owning them. With options, investors have the opportunity to speculate on the direction of stock prices, currencies, commodities, and more. However, option trading can be complex and risky, and understanding how it works is essential for success in this market.

Options give traders the right, but not the obligation, to buy or sell a specified amount of an underlying asset at a predetermined price within a specific timeframe. This flexibility makes options a popular instrument among both conservative investors seeking to hedge their portfolios and aggressive traders looking for short-term gains.

One of the key advantages of option trading is leverage, which allows traders to control a large amount of an underlying asset while only investing a fraction of the asset’s value. This leverage magnifies both profits and losses, making option trading inherently risky. It is important for traders to have a solid understanding of the risks involved and to employ risk management strategies to protect their capital.

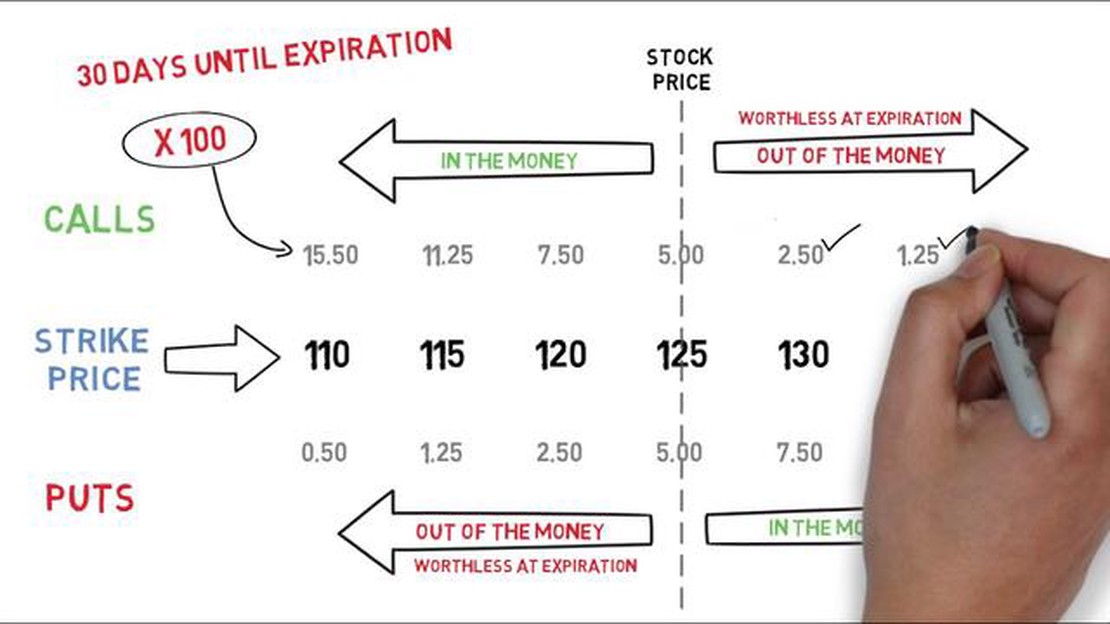

Option trading can be divided into two main types: call options and put options. Call options give the holder the right to buy an underlying asset at a specified price, while put options give the holder the right to sell an underlying asset at a specified price. These options can be bought or sold, allowing traders to take long or short positions depending on their market outlook.

Options are financial derivatives that give traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time period.

They are contracts between two parties – the buyer, known as the holder, and the seller, known as the writer. The holder pays the writer a fee, known as the options premium, in exchange for the right to exercise the option at a future date or let it expire. The writer, on the other hand, receives the premium and is obligated to fulfill the terms of the option if the holder decides to exercise it.

Options come in different forms, including call options and put options. A call option gives the holder the right to buy an underlying asset at the predetermined price, while a put option gives the holder the right to sell an underlying asset at the predetermined price.

Read Also: Who owns QIAGEN? Exploring the Ownership of QIAGEN

Options trading can be a useful tool for investors as they provide opportunities for profit in various market conditions. Traders can use options to speculate on the price movements of underlying assets, hedge existing positions against potential losses, generate income through writing options, or take advantage of other complex strategies.

However, options trading comes with risks. If the market moves unfavorably, the holder may choose not to exercise the option, resulting in the loss of the premium paid. Additionally, options have expiration dates, after which they become worthless. It is important for traders to understand and carefully consider the risks involved in options trading before getting involved.

Options are a type of derivative financial instrument that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price, known as the strike price, within a specific time period. Options can be categorized into several types based on different characteristics and features. Here are some of the most common types of options:

| Type | Description |

|---|---|

| Call Options | A call option gives the holder the right to buy the underlying asset at the strike price before the expiration date. Call options are typically used when the investor expects the price of the underlying asset to rise. |

| Put Options | A put option gives the holder the right to sell the underlying asset at the strike price before the expiration date. Put options are commonly used when the investor expects the price of the underlying asset to fall. |

| American Options | American options allow the holder to exercise the option at any time before the expiration date. This provides more flexibility for the investor, as they can choose to exercise the option when it is most advantageous to them. |

| European Options | European options can only be exercised at expiration. This means that the holder has limited flexibility compared to American options. |

| Binary Options | Binary options have a fixed payout if the underlying asset meets certain conditions. These options have a simple “yes” or “no” outcome, depending on whether the condition is met or not. |

| Long-Term Equity Anticipation Securities (LEAPS) | LEAPS are long-term options that have expiration dates that are more than one year in the future. These options allow investors to take a longer-term view on the underlying asset. |

It’s important for investors to understand the different types of options and their characteristics before engaging in options trading. Each type of option has its own risk and reward profile, and choosing the right option strategy depends on the investor’s risk tolerance and market expectations.

Option trading is a type of investment strategy that allows investors to buy or sell options contracts based on the future performance of an underlying asset, such as stocks, commodities, or currencies.

Read Also: When is the US stock exchange closed? Know the market holidays

Option trading works by giving investors the right, but not the obligation, to buy or sell a specific asset at a predetermined price, called the strike price, within a certain time frame, called the expiration date.

Option trading offers several benefits, including the potential for high returns, the ability to hedge against market risks, and the opportunity to generate income through selling options.

Option trading carries risks, such as the potential loss of the entire investment if the options expire worthless, the possibility of losing money due to the volatility of the underlying asset, and the risk of not being able to execute trades at desired prices.

Some common option trading strategies include buying call options to profit from a rising market, buying put options to profit from a falling market, selling covered call options to generate income, and using spreads to limit risk and maximize returns.

Option trading is a form of investment where traders buy and sell contracts that give them the right, but not the obligation, to buy or sell an underlying asset at a specific price, known as the strike price, on or before a specific date. It allows traders to speculate on the price movement of an asset without actually owning the asset.

Option trading offers several benefits for traders. Firstly, it provides the opportunity to leverage their investments and potentially earn higher returns. It also allows traders to hedge their positions and manage risk more effectively. Additionally, options provide flexibility in terms of trading strategies and can be used in both bullish and bearish market conditions.

Understanding the Distinction Between SMA and Exponential Smoothing Techniques Simple Moving Average (SMA) and Exponential Smoothing are two commonly …

Read ArticleUnderstanding FFMC: What you need to know A Full Fledged Money Changer (FFMC) is a registered financial institution in India that is authorized to …

Read ArticleIs A ggplot the same as a Qplot? When it comes to data visualization in R, there are several popular packages to choose from. Two of the most widely …

Read ArticleComparing the Black-Scholes Model and the Binomial Model The Black-Scholes pricing model is widely used in the field of finance for estimating the …

Read ArticleCan I buy options on Etrade? When it comes to trading options, Etrade is one of the most popular online brokers. Etrade offers a wide range of …

Read ArticleExchange rate of the dollar to the euro The exchange rate between the dollar and euro is an important indicator of the economic relationship between …

Read Article