Understanding the Basics of a Stock Option Plan | Your Complete Guide

Understanding a stock option plan When it comes to investing in the stock market, many people are familiar with the concept of buying and selling …

Read Article

Exercising stock options can be an exciting experience, especially when it comes to maximizing your financial gains. However, understanding the cost basis of your exercised stock options is crucial in order to make informed financial decisions and comply with tax regulations.

When you exercise a stock option, you gain the right to buy company stock at a predetermined price, known as the strike price. The cost basis of your exercised stock options is the total amount you paid to exercise those options, including any fees or commissions. It is important to keep track of these costs, as they will affect your tax obligations and potentially impact your overall financial picture.

The cost basis of your exercised stock options plays a significant role in determining the amount of taxable income you may incur when you sell the shares. By subtracting the cost basis from the sale proceeds, you can calculate your capital gain or loss. It is essential to accurately determine your cost basis in order to report your taxes correctly and avoid any potential penalties.

Properly documenting and keeping records of your exercised stock options is crucial in determining your cost basis. This includes maintaining records of the exercise date, the number of shares exercised, the strike price, and any associated fees or commissions.

By understanding the cost basis of your exercised stock options, you can make smart financial decisions and ensure compliance with tax regulations. This comprehensive guide will delve into various aspects of the cost basis calculation, including the impact of stock splits, mergers, and dividend reinvestment plans. Whether you are a novice investor or an experienced professional, this guide will provide you with the necessary knowledge to navigate the complex world of exercised stock options.

Stock options are a type of financial instrument that give individuals the right to buy or sell shares of a company’s stock at a predetermined price, known as the strike price, within a specified time period. This right is granted to employees as part of their compensation packages, providing them with the opportunity to benefit from any increase in the company’s stock price.

There are two types of stock options:

Stock options can be an attractive form of compensation for employees because they have the potential to provide significant financial gains if the company’s stock price rises. This can create a strong incentive for employees to contribute to the company’s success and align their interests with those of the shareholders.

When an employee exercises their stock options, they purchase the shares at the strike price. If the market price of the stock is higher than the strike price at the time of exercise, they can sell the shares for a profit. However, if the market price is lower than the strike price, they may choose not to exercise the options and let them expire worthless.

It is important to understand the tax implications of exercising stock options. Depending on the type of stock options and the holding period, employees may be subject to income tax, capital gains tax, or both. Consulting with a tax advisor or financial professional can help individuals navigate the complexities of stock option taxation and make informed decisions.

Overall, stock options can be a valuable tool for both companies and employees. They provide employees with the opportunity to participate in the company’s success and can serve as a powerful motivator. Understanding the basics of stock options is essential for individuals considering this type of compensation.

Stock options are a type of financial instrument that give individuals the right to buy or sell a specific stock at a predetermined price within a specific timeframe. They are commonly used as part of an employee compensation package or as investment tools for individuals.

Read Also: Is Forex a Good Broker? | Expert Analysis and Reviews

There are two main types of stock options:

Stock options can be granted to employees of a company as part of their compensation package. This allows employees to profit from the future growth of the company by purchasing its stock at a discounted price. The exercise price, or strike price, is the price at which the employee can buy the stock. This price is typically set at the fair market value of the stock at the time the options are granted.

Read Also: Understanding the Concept of a 21st Century School: Key Features and Innovations

When an employee exercises their stock options, they purchase the stock at the exercise price. If the stock price has increased since the options were granted, the employee can sell the stock at the higher market price and make a profit. However, if the stock price has decreased, the employee may choose not to exercise the options and the options will expire worthless.

It’s important to note that stock options have expiration dates, meaning they can only be exercised within a specific timeframe. This timeframe is usually set by the company and can range from a few years to several decades.

Overall, understanding the concept and types of stock options is essential for both employees and investors, as they can provide opportunities for financial growth and diversification.

The cost basis of exercised stock options is the amount paid to purchase the shares plus any additional fees or taxes incurred.

Yes, you will typically have to pay taxes on stock options when you exercise them. The amount of tax you owe will depend on the difference between the exercise price and the fair market value of the stock.

The cost basis of stock options can be determined by adding the exercise price to any additional fees or taxes incurred when exercising the options.

If you sell the shares acquired through exercising stock options, the cost basis will be used to calculate the capital gains or losses on the sale. The cost basis will be subtracted from the selling price to determine the taxable gain or loss.

Yes, there are strategies that can help minimize the tax consequences of exercising stock options. These include holding the stock for at least one year to qualify for long-term capital gains rates, using a tax-advantaged account such as an IRA or 401(k) to exercise the options, and implementing tax-loss harvesting to offset any capital gains.

The cost basis of exercised stock options is the amount that an employee must report as income on their tax return when they exercise their stock options. It is typically the difference between the strike price or exercise price of the options and the fair market value of the underlying stock at the time of exercise.

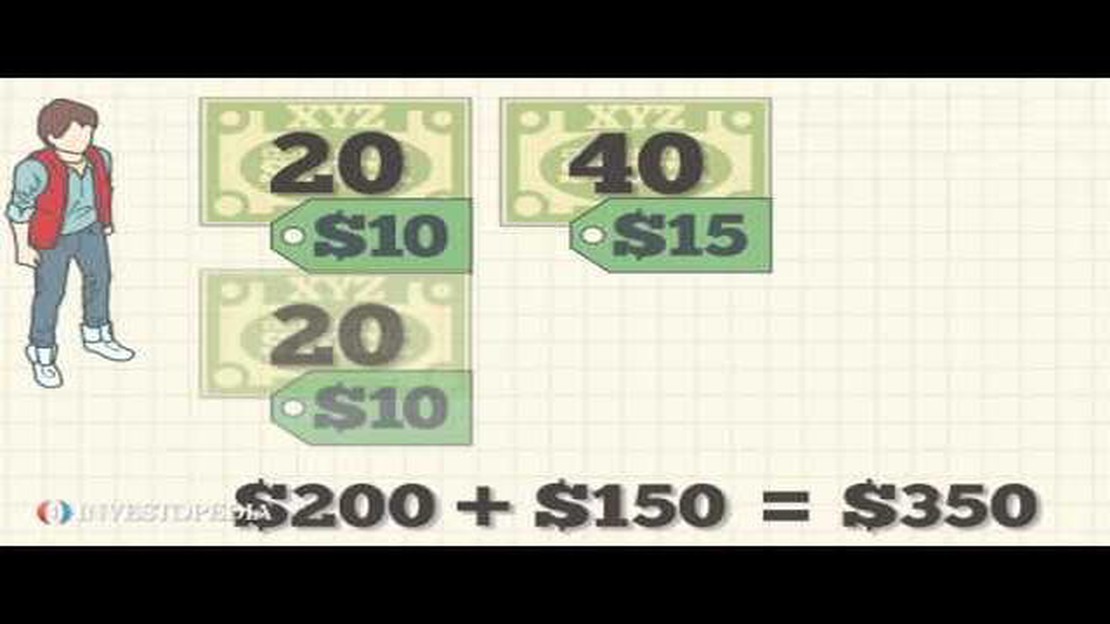

The cost basis for exercised stock options is calculated by subtracting the strike price or exercise price of the options from the fair market value of the underlying stock at the time of exercise. For example, if the strike price is $10 per share and the fair market value at the time of exercise is $20 per share, the cost basis would be $10 per share.

Understanding a stock option plan When it comes to investing in the stock market, many people are familiar with the concept of buying and selling …

Read ArticleHow to Create a Quant Strategy Quantitative trading strategies have become increasingly popular in recent years, as investors look for ways to …

Read ArticleReasons why option selling is not profitable Option selling may seem like an attractive investment strategy in the financial markets, offering the …

Read ArticleUnderstanding the most common employee stock option Employee stock options (ESOs) have become a popular form of compensation in today’s corporate …

Read ArticleWhat time zone is FBS MT4? When it comes to trading on the FBS MT4 platform, understanding the time zone can be crucial. The FBS MT4 platform follows …

Read ArticleWhere to Get Level 2 Market Data Forex Forex trading is a highly competitive market that requires access to accurate and timely data. Level 2 market …

Read Article