What is a good exchange rate for CAD to GBP?

What is considered a favorable exchange rate for converting Canadian dollars (CAD) to British pounds (GBP)? When it comes to exchanging Canadian …

Read Article

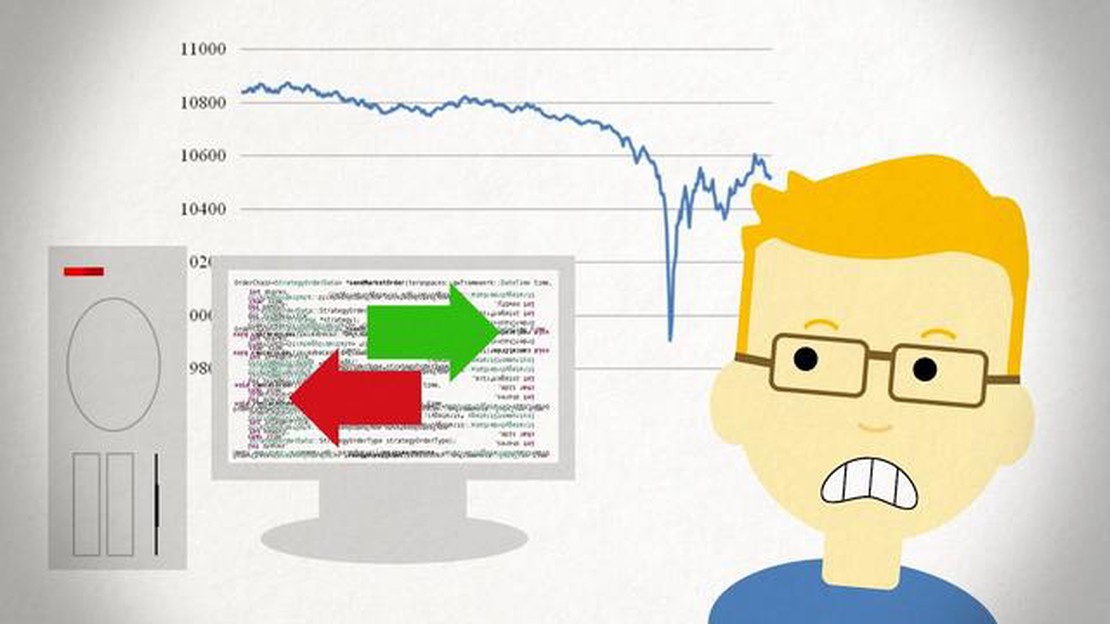

High-frequency traders (HFTs) have had a significant impact on the foreign exchange (FX) market in recent years. These traders use powerful computers and algorithms to execute trades at incredibly fast speeds, often within fractions of a second. This has led to a dramatic increase in trading volumes and liquidity in the FX market.

One of the main advantages of high-frequency trading is its ability to react quickly to market conditions. HFTs can analyze large amounts of data in real-time and make split-second decisions based on this information. This allows them to take advantage of even the smallest price discrepancies and profit from short-term market movements.

The presence of HFTs in the FX market has also led to a more efficient price discovery process. By constantly analyzing market data and executing trades at lightning-fast speeds, high-frequency traders help to ensure that prices reflect all available information. This can benefit all market participants, as it leads to tighter bid-ask spreads and more accurate pricing.

However, there are also concerns about the impact of HFTs on the FX market. Some argue that their fast-paced trading strategies can create volatility and increase the risk of market instability. Others worry that their dominance in the market may lead to a lack of diversity and the concentration of power in a few hands.

In conclusion, high-frequency traders have had a profound impact on the FX market. While they bring improved liquidity and efficiency, there are also valid concerns about their potential negative effects. As technology continues to advance and HFTs become even more prevalent, it is important for regulators and market participants to carefully monitor and manage their impact to ensure a fair and stable FX market.

High-frequency traders (HFTs) play a significant role in the foreign exchange (FX) market. With their advanced technology and sophisticated algorithms, they have the ability to execute trades at extremely high speeds and volumes. This has led to a number of impacts on the FX market.

| **Liquidity Providers:**HFTs act as liquidity providers in the FX market, constantly making both buy and sell quotes. Their large trading volumes and fast execution times help to ensure that there is always liquidity available for other participants in the market. |

| **Price Efficiency:**By continuously monitoring market conditions and analyzing incoming data, HFTs are able to quickly identify and exploit pricing inefficiencies. They can capitalize on small price disparities and execute trades before other market participants, leading to increased price efficiency in the FX market. |

| **Market Fragmentation:**The presence of HFTs has led to an increase in market fragmentation in the FX market. HFTs often prefer to trade on electronic platforms that offer low latency and direct market access. This has resulted in a shift away from traditional exchange-based trading and towards more fragmented trading venues. |

| **Volatility:**The trading activities of HFTs can contribute to increased volatility in the FX market. Their rapid-fire trading strategies and ability to quickly react to market conditions can amplify price movements, especially during periods of market stress or unexpected events. |

| **Regulatory Challenges:**The rise of HFTs has posed regulatory challenges for market authorities. The speed and complexity of HFT strategies make it difficult to monitor and regulate their activities effectively. Regulators have had to adapt and implement new rules and technologies to ensure fair and orderly markets. |

In conclusion, high-frequency traders have a substantial impact on the FX market. They provide liquidity, increase price efficiency, contribute to market fragmentation, affect volatility, and pose regulatory challenges. As technology continues to advance, the role of HFTs in the FX market is likely to evolve further, shaping the dynamics of currency trading.

High-frequency trading (HFT) is a type of algorithmic trading that utilizes advanced computer programs to execute trades at incredibly fast speeds. It is characterized by its use of complex algorithms, low latency infrastructure, and high-speed data connections. HFT enables traders to take advantage of small price discrepancies and fluctuations in the market to make quick profits.

Read Also: Is Infosys a good buy now? Expert analysis and recommendations

One of the key aspects of HFT is the use of automated trading strategies. These strategies are executed by computer systems that are capable of analyzing large amounts of data and making trades in fractions of a second. This allows high-frequency traders to react to market conditions faster than traditional traders, who typically rely on manual decision-making processes.

To execute trades quickly, high-frequency traders often co-locate their trading servers in close proximity to the exchange’s data center. This minimizes the time it takes for trade orders to reach the exchange, reducing latency and improving execution speeds. Furthermore, HFT firms invest significant resources in building robust and low-latency infrastructures to ensure they can react to market changes instantaneously.

Read Also: Can I trade profitably without using indicators?

Another important feature of HFT is the use of high-speed data connections. High-frequency traders require access to real-time market data, news feeds, and order book information to make informed trading decisions. They often subscribe to direct data feeds from exchanges or use specialized data providers to gain an edge in the market.

Critics argue that high-frequency trading creates an unfair advantage for those with the fastest technology and access to the best data sources. They believe that HFT can contribute to market instability and volatility, as well as increase the risk of market manipulation. On the other hand, proponents of HFT argue that it enhances market liquidity and efficiency, as it provides continuous buying and selling pressure and narrows bid-ask spreads.

Overall, understanding high-frequency trading is crucial for investors, market regulators, and policymakers. It is important to monitor and regulate HFT activities to maintain a fair and transparent marketplace and mitigate any potential risks associated with this trading practice.

High-frequency traders have a significant impact on the FX market. They use complex algorithms and powerful computers to execute trades at lightning-fast speeds, often in microseconds. This speed advantage allows them to take advantage of even the smallest price fluctuations and make profits. However, their presence in the market can also lead to increased volatility and liquidity issues.

There are several advantages of high-frequency trading in the FX market. Firstly, it increases market efficiency as high-frequency traders help to narrow bid-ask spreads and improve price discovery. Secondly, it provides liquidity to the market, allowing for easier and faster execution of trades. Finally, high-frequency trading can enhance market transparency as it requires traders to constantly monitor and analyze large amounts of data.

While high-frequency traders play a crucial role in providing liquidity and improving market efficiency, there have been instances where their activities have been accused of contributing to market manipulation. The fast and automated nature of their trades can sometimes create artificial price movements or exacerbate existing market trends. Regulators closely monitor high-frequency trading activities to ensure fair and orderly markets.

High-frequency traders can have both positive and negative effects on smaller market participants in the FX market. On one hand, they provide liquidity and improved price discovery, which benefits all market participants. On the other hand, their trading strategies and rapid speed can create volatility and make it difficult for smaller participants to compete. It is crucial for smaller traders to adapt their trading strategies and use technology to stay competitive in this high-speed environment.

What is considered a favorable exchange rate for converting Canadian dollars (CAD) to British pounds (GBP)? When it comes to exchanging Canadian …

Read ArticleIs BHEL a debt free company? Bharat Heavy Electricals Limited (BHEL) is one of the leading engineering and manufacturing companies in India. It is …

Read ArticleCalculating Option Price: How to Determine the Value of an Option Options are a popular financial instrument that give investors the opportunity to …

Read ArticleBeginner’s guide to trading options on ICICIdirect Options trading can be a lucrative investment opportunity if you have the right knowledge and …

Read ArticleWhat is the AT& AT&T, one of the leading telecommunications companies in the world, has recently released its forecast for the year 2023. This …

Read ArticleHow much do forex scalpers make? Forex trading has become increasingly popular in recent years, with more and more individuals looking to make profits …

Read Article