Is Forex Trading Legal in Turkey? Find Out Here!

Is Forex Trading legal in Turkey? Forex trading, also known as foreign exchange trading, is a global decentralized market where the currencies of …

Read Article

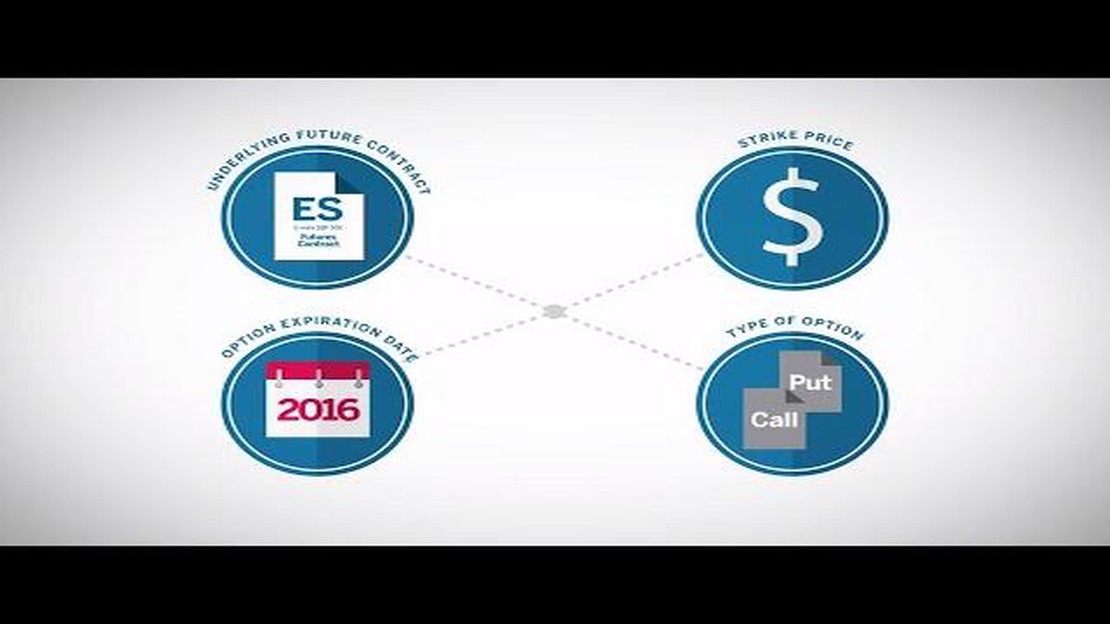

Options on futures contracts are derivative contracts that give investors the right, but not the obligation, to buy or sell an underlying futures contract at a specific price, known as the strike price, before the expiration date. These financial instruments offer several advantages for traders and investors who are looking to manage risk and enhance their trading strategies.

One key advantage of using options on futures contracts is the ability to limit downside risk. Unlike buying or selling the actual futures contract, options provide a level of protection against unfavorable price movements. By purchasing a put option, an investor can hedge against a decline in the futures price, while buying a call option allows them to benefit from a potential increase in the price. This flexibility can help traders mitigate losses and protect their capital.

Another advantage is the leverage provided by options on futures contracts. With a relatively small investment, traders can control a large position in the underlying futures contract. This allows for potentially higher profits compared to trading the futures contract directly. However, it’s important to note that leverage also amplifies potential losses, so proper risk management is crucial when trading options on futures.

Options on futures contracts also offer the benefit of flexibility in terms of trading strategies. Traders can use options to speculate on the direction of the market, hedge their existing positions, or generate income through option selling strategies. This versatility allows traders to adapt their strategies to different market conditions, enhancing their chances of making profitable trades.

In conclusion, options on futures contracts provide several advantages for traders and investors. They offer downside risk protection, leverage for higher potential profits, and flexibility in trading strategies. However, it’s important to fully understand the risks involved and employ proper risk management when utilizing options on futures contracts.

Options on futures contracts offer several advantages for traders and investors. These benefits include:

| Hedging | Options on futures contracts provide a valuable tool for hedging against price fluctuations in the underlying commodity. Traders can use options to protect their positions and minimize risk. |

| Leverage | Options on futures contracts allow traders to gain exposure to the underlying asset with a smaller investment. This leverage can amplify potential returns. |

| Diversification | By trading options on futures contracts, investors can diversify their portfolios across different asset classes and markets. This helps spread risk and potentially increase returns. |

| Flexibility | Options on futures contracts offer a variety of strategies and trading opportunities. Traders can use options to speculate on price movements, generate income through option writing, or protect existing positions. |

| Efficiency | Options on futures contracts provide a cost-effective way to gain exposure to the underlying asset. The upfront premium paid for the option is usually smaller than the margin requirement for a futures contract. |

| Liquidity | Options on futures contracts are actively traded on exchanges, which ensures a high level of liquidity. Traders can easily enter and exit positions without worrying about finding a counterparty. |

Read Also: Can you earn a living from trading? Exploring the potential of making a full-time income through trading

In conclusion, options on futures contracts offer numerous benefits, including hedging capabilities, leverage, diversification, flexibility, efficiency, and liquidity. Traders and investors can take advantage of these benefits to manage risk, increase potential returns, and navigate various market conditions.

One of the main advantages of utilizing options on futures contracts is the increased flexibility and versatility they offer to traders and investors. Options provide the opportunity to customize trading strategies to meet specific needs and objectives.

With options on futures contracts, traders have the ability to choose from a wide range of strike prices and expiration dates. This allows them to tailor their positions to capitalize on anticipated market movements within a specific timeframe.

Additionally, options on futures contracts can be used to hedge positions in the underlying futures contract. This provides traders and investors with a way to protect against potential losses associated with adverse market movements.

Options on futures contracts also offer the advantage of limited risk. Unlike futures contracts, where traders are obligated to fulfill the terms of the contract, options allow traders to control a larger amount of the underlying asset for a fraction of the cost.

Furthermore, options on futures contracts can be used to generate income through writing options. By selling options, traders receive premiums, which can provide a steady stream of income.

Read Also: Is Copy Trading Forex Worth It? Find Out Here

In conclusion, options on futures contracts provide increased flexibility and versatility to traders and investors. They offer customizable trading strategies, the ability to hedge positions, limited risk, and the opportunity to generate income. These advantages make options on futures contracts a valuable tool in the financial markets.

Options on futures contracts are derivative instruments that give the holder the right, but not the obligation, to buy or sell a futures contract at a specific price within a specific time period.

There are several advantages of utilizing options on futures contracts. Firstly, they provide flexibility as they allow traders to take advantage of both bullish and bearish market conditions. Secondly, they offer leverage, allowing traders to control a larger contract size with a smaller capital investment. Additionally, they provide risk management benefits, allowing traders to limit their potential losses. Lastly, options on futures contracts can be used for hedging purposes, helping traders to protect their positions against price fluctuations.

Yes, options on futures contracts can be used for risk management in various ways. For example, a farmer who is worried about a potential decrease in the price of their crops can buy put options on futures contracts to protect the value of their crops. Similarly, a company that needs to purchase a specific commodity in the future can buy call options on futures contracts to secure a favorable price. In both cases, the options provide a form of insurance against adverse price movements.

Yes, there are certain risks associated with utilizing options on futures contracts. One of the main risks is that options have an expiration date, which means that if the anticipated price move doesn’t occur within the specified time period, the options can expire worthless. Additionally, options trading involves paying a premium, which can be considered a loss if the options are not exercised. Furthermore, options trading can be complex and requires a good understanding of market dynamics and pricing models.

Yes, options on futures contracts can be used by individual investors. While they may require a higher level of knowledge and expertise compared to traditional options trading, they can offer individual investors the opportunity to diversify their investment strategies and potentially achieve higher returns. However, it is important for individual investors to carefully evaluate their risk tolerance and conduct thorough market research before engaging in options trading.

Is Forex Trading legal in Turkey? Forex trading, also known as foreign exchange trading, is a global decentralized market where the currencies of …

Read ArticleBest Forex Analysis Websites for Traders When it comes to forex trading, having access to accurate and up-to-date analysis is crucial. In 2021, with …

Read ArticleWhy do options traders lose money? Options trading can be a lucrative endeavor, but it also carries significant risks. Unfortunately, many traders …

Read ArticleWhat is the current value of gold? Gold has always captivated humans with its timeless beauty and rarity. From ancient civilizations to modern times, …

Read ArticleUnderstanding the Purpose and Function of Indices Indices are mathematical tools that play a fundamental role in various fields. They are used to …

Read ArticleIs IBKR good for options? When it comes to options trading, the choice of broker can make a significant impact on your overall trading experience. One …

Read Article