Understanding the WPR Indicator: A Key Tool for Successful Trading

What is WPR in trading? The Williams Percent Range (WPR) indicator, also known as Williams %R, is a popular technical analysis tool used by traders to …

Read Article

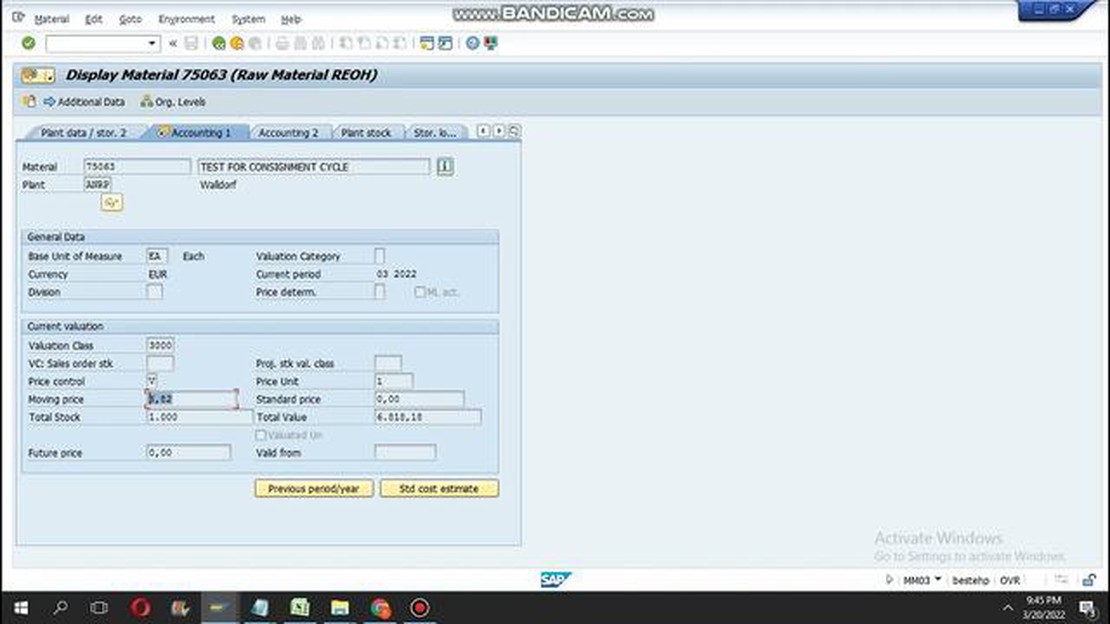

In SAP, the moving average price is a key factor in determining the valuation of inventory items. It represents the average cost of goods based on the quantity and value of goods received and consumed. However, there may be situations where the moving average price needs to be reset to reflect the correct cost. This could be due to errors in the system, incorrect postings, or changes in the market conditions.

Resetting the moving average price in SAP can be a complex process, but with the right steps, it can be done effectively. This step-by-step guide will walk you through the process of resetting the moving average price in SAP, ensuring accurate valuation of your inventory items.

To begin, it is important to understand the impact of resetting the moving average price. This process will recalculate the average cost of goods based on the correct data. It will adjust the valuation of inventory items and may lead to changes in the balance sheet and income statement. Therefore, it is crucial to carefully analyze the need for resetting the moving average price and consider the potential financial implications.

Once you have determined the need for resetting the moving average price, the first step is to identify the inventory items that require adjustment. This can be done by running reports or analyzing the inventory data. Once identified, you can proceed with the necessary steps to reset the moving average price for each item. This may involve adjusting stock quantities, prices, and making appropriate postings in the SAP system.

In conclusion, resetting the moving average price in SAP is a crucial process to ensure accurate valuation of inventory items. By following this step-by-step guide, you can effectively reset the moving average price and maintain accurate financial records in your SAP system.

Moving Average Price (MAP) is a valuation method used in SAP to calculate the average cost of materials or products. It is based on the principle of averaging the purchase or production price over a defined period of time.

Read Also: Can I Withdraw Money from Remittance? | Essential Information for Remittance Users

The MAP is commonly used in industries that experience price fluctuations or where inventory levels change frequently, such as manufacturing or retail. By using the MAP, companies can have a more realistic idea of the actual cost of their inventory, which helps in determining profitability and making informed business decisions.

The MAP is calculated by dividing the total value of stock by the total quantity of stock on hand. This calculation takes into account all materials receipts and issues, including purchases, production orders, sales, and stock transfers. The MAP is regularly updated as new transactions occur, allowing for real-time visibility into the cost of inventory.

One of the key benefits of using the MAP is its ability to provide a more accurate cost of goods sold (COGS) figure. By calculating the average cost, rather than using the actual purchase price, the MAP smooths out any price variances and provides a more stable COGS, allowing for better cost control and financial reporting.

In SAP, the MAP is stored at the material master level and can be viewed or adjusted through various transactions and reports. It is essential to periodically review and update the MAP to ensure it reflects the current market conditions and remains accurate.

Overall, the Moving Average Price in SAP is a powerful tool for businesses to manage their inventory costs and make well-informed decisions based on accurate financial information.

Resetting the moving average price is a crucial step in the SAP system to ensure accurate inventory valuation. The moving average price represents the average cost of an item over a period of time, considering all the purchase and consumption activities.

Read Also: Understanding the Importance of the Moving Range Chart for Quality Control

There are several reasons why resetting the moving average price is necessary:

In conclusion, resetting the moving average price is necessary in the SAP system to ensure accurate inventory valuation, costing control, transparent financial reporting, accurate pricing, and profitability analysis. It is a crucial step that helps businesses make informed decisions, meet compliance requirements, and maintain control over their inventory and financials.

A moving average price in SAP, also known as MAP, is a method used to calculate the average price of a material or product based on all the goods receipts and issues that occur over a specified period of time.

You may need to reset the moving average price in SAP if there are incorrect valuations or if there are issues with the valuation of the material or product. Resetting the moving average price allows you to recalculate the average price based on the correct valuations or resolve any valuation issues.

Yes, you can reset the moving average price for multiple materials at once in SAP by using the “Mass Change” options in the material master transaction. You can select the materials you want to reset the moving average price for and perform the necessary changes in a mass change session.

What is WPR in trading? The Williams Percent Range (WPR) indicator, also known as Williams %R, is a popular technical analysis tool used by traders to …

Read ArticleIG Forex and MT4: What You Need to Know If you are a Forex trader, you have probably heard of MetaTrader 4 (MT4), one of the most popular trading …

Read ArticleUnderstanding Weighted Moving Average: A Beginner’s Guide The weighted moving average is a commonly used tool in technical analysis that helps traders …

Read ArticleUSD ZAR Selling Rate: What You Need to Know Looking to exchange your US dollars for South African Rand (ZAR)? Stay up to date with the latest exchange …

Read ArticleUnderstanding the ETS System: A Comprehensive Guide The ETS system, short for Electronic Toll Collection System, is a technology that is …

Read ArticleCan you buy yuan on forex? As the world becomes increasingly interconnected, the foreign exchange market, or Forex, has gained immense popularity …

Read Article