Is the New Zealand Dollar Expected to Rise? | Expert Analysis and Forecasts

Will the NZ Dollar Rise? The New Zealand dollar, also known as the Kiwi, is closely watched by investors and traders around the world. With its unique …

Read Article

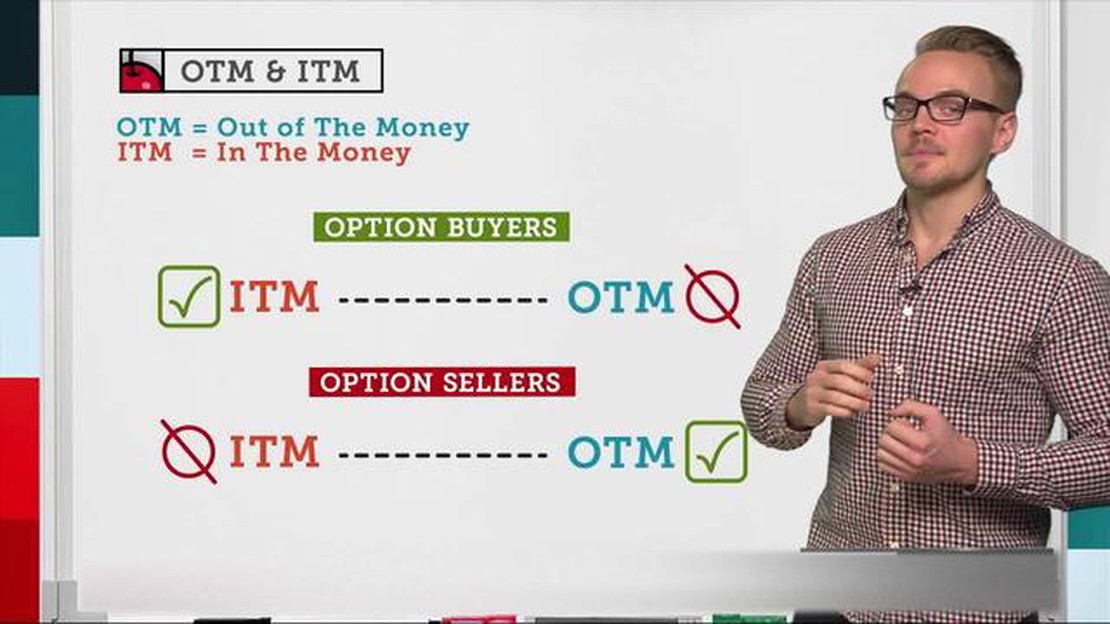

When it comes to options trading, there are various strategies and approaches that investors can take. One such strategy is purchasing out of the money options. While this strategy may carry more risk than other options trading strategies, there are several compelling reasons to consider it.

An out of the money option is an option that has a strike price that is not favorable compared to the current market price of the underlying asset. In other words, the option is not currently profitable if exercised. Despite this, there are a few key reasons why purchasing out of the money options can be an attractive option:

Potential for High Returns: While out of the money options may require a larger price movement in the underlying asset to become profitable, they also offer the potential for higher returns. If the market moves in the desired direction, the value of the option can increase significantly.

Lower Initial Investment: Since out of the money options have a strike price that is not currently favorable, their premiums tend to be lower compared to in the money or at the money options. This means that investors can enter into options positions with a lower initial investment.

Flexibility in Market Direction: When purchasing out of the money options, investors have more flexibility in terms of market direction. They can take advantage of both bullish and bearish market scenarios, depending on their outlook for the underlying asset.

While purchasing out of the money options may not be suitable for every investor or trading situation, it is worth considering for those who are comfortable with higher risk and are seeking potential for high returns.

1. Lower Cost

One of the main benefits of buying out of the money options is that they are typically cheaper than in the money or at the money options. This means you can gain exposure to the underlying asset or security at a lower upfront cost.

2. Greater Leverage

When you buy out of the money options, you can potentially achieve greater leverage compared to in the money options. This is because the strike price of the option is further away from the current market price, which increases the potential percentage gains if the underlying asset moves in your favor.

3. Higher Potential Returns

The lower cost and greater leverage of out of the money options can result in higher potential returns if the underlying asset experiences a significant price movement. Even a small increase in the price of the asset can lead to substantial returns on your investment.

4. Diversification

Buying out of the money options can be a useful strategy for diversifying your investment portfolio. By adding options with different strike prices and expiration dates, you can spread your risk across a range of potential outcomes.

5. Flexibility

When you purchase out of the money options, you have the flexibility to choose from various strike prices and expiration dates. This allows you to tailor your options strategy to your specific investment goals and risk tolerance.

6. Hedging Opportunities

Read Also: Are Foreign Investors Subject to Capital Gains Tax on US Stocks?

Out of the money options can also be used as a hedging tool to offset potential losses in your overall investment portfolio. By purchasing put options, for example, you can protect your investments against a decline in the price of the underlying asset.

7. Learn and Gain Experience

Buying out of the money options can be a valuable learning experience for novice traders. It allows you to gain practical knowledge about how options work and how they can be used to generate profits. As you become more comfortable with options trading, you can then explore more advanced strategies and move on to in the money options.

Conclusion

Read Also: Understanding the Distinction: RSU vs Vested Stock Options

While buying out of the money options carries a higher level of risk compared to other options strategies, it also offers unique benefits such as lower cost, greater leverage, higher potential returns, diversification, flexibility, hedging opportunities, and a valuable learning experience. Before engaging in options trading, it is important to thoroughly understand the risks involved and seek professional financial advice if needed.

One of the main reasons to consider purchasing out of the money (OTM) options is the increased cost efficiency they provide. OTM options tend to have lower premium prices compared to in the money (ITM) and at the money (ATM) options.

By purchasing OTM options, traders and investors can capitalize on potential market movements while minimizing their upfront costs. This cost efficiency is especially beneficial for those with limited capital or risk tolerance.

Furthermore, the lower premium prices of OTM options can result in a higher return on investment (ROI) if the underlying asset’s price moves significantly. This potential for higher ROI is attractive to traders and investors looking for leverage or wanting to maximize their profits.

Another aspect of the increased cost efficiency of OTM options is related to their lower intrinsic value. Since OTM options have strike prices that are typically far from the current market price, they have little to no intrinsic value. This means that the premium price of OTM options is mainly influenced by extrinsic factors, such as time decay and implied volatility.

By understanding and managing these extrinsic factors, traders and investors can take advantage of the increased cost efficiency of OTM options. For example, they can strategically time their purchases to minimize the impact of time decay or profit from changes in implied volatility.

In summary, purchasing OTM options can provide increased cost efficiency due to their lower premium prices and potential for higher ROI. Traders and investors can benefit from this cost efficiency by minimizing upfront costs, maximizing profits, and taking advantage of extrinsic factors. However, it’s important to consider the associated risks and factors that may affect the pricing and profitability of OTM options.

Out of the money options have the potential to offer high returns, making them an attractive choice for certain investors. When an option is out of the money, it means that the strike price of the option is higher than the current market price of the underlying asset for call options, or lower for put options. This means that the option does not have intrinsic value.

Because out of the money options do not have intrinsic value and are purely speculative, they can be purchased for a lower premium compared to in the money or at the money options. This lower cost can potentially result in higher percentage returns if the underlying asset moves in the desired direction.

While the probability of profit is lower with out of the money options compared to in the money or at the money options, the potential for high returns can make them appealing to investors who are willing to take on greater risk. If the underlying asset moves significantly in the right direction, the value of the out of the money option can increase dramatically.

It’s important to note that the potential for high returns with out of the money options also comes with a higher risk of losing the entire premium if the underlying asset does not move in the desired direction. Investors considering purchasing out of the money options should carefully assess their risk tolerance and investment goals before making a decision.

In summary, the potential for high returns is one of the reasons why some investors may choose to purchase out of the money options. While they come with higher risk, they can offer significant percentage returns if the underlying asset moves in the desired direction.

Out of the money options are options contracts where the strike price of the option is higher for call options or lower for put options than the current market price of the underlying asset. This means that if you were to exercise or sell the option at its current price, you would not make a profit.

There are several reasons why someone might consider purchasing out of the money options. Firstly, they are generally cheaper than in the money or at the money options, making them a more affordable choice for traders with limited capital. Additionally, out of the money options have the potential for higher returns if the price of the underlying asset moves significantly in the desired direction. They also offer some downside protection, as the loss is limited to the premium paid for the option.

While purchasing out of the money options can potentially lead to significant profits, they also come with certain risks. One major risk is that if the price of the underlying asset does not move in the direction anticipated by the trader, the option can expire worthless and the trader will lose the entire premium paid for the option. Another risk is that out of the money options generally have a lower probability of being exercised, meaning that they may expire worthless more often.

Yes, there are several options trading strategies that involve purchasing out of the money options. One common strategy is the long call or put strategy, where an investor buys out of the money call or put options with the expectation that the price of the underlying asset will move significantly in the desired direction. Another strategy is the long straddle, which involves buying both a call option and a put option with the same strike price and expiration date, anticipating a large move in either direction. These strategies can be used to profit from volatility or sudden price movements in the underlying asset.

Will the NZ Dollar Rise? The New Zealand dollar, also known as the Kiwi, is closely watched by investors and traders around the world. With its unique …

Read ArticleTrading Forex: Insights into Financial Institutions’ Strategies Forex, short for foreign exchange, is the largest and most liquid financial market in …

Read ArticleWhat is CMD trading? Commodity trading plays a crucial role in the global economy, and one of the most popular forms of commodity trading is CMD …

Read ArticleWhat is S and R in trading? Support and resistance (S&R) are two key concepts in trading that help traders determine potential price levels at which …

Read ArticleUnderstanding the Value of Company Options Company options are a vital tool for businesses, offering a range of benefits that can significantly impact …

Read ArticleExercising Stock Options vs Selling: What’s the Difference? When it comes to stock options, there are several strategies that investors can employ to …

Read Article