Understanding the Basics of Derivatives: How do Derivatives Work? | YourSiteName

Understanding the Mechanics of Derivatives Welcome to YourSiteName, where we explore the world of finance and investments. In this article, we will …

Read Article

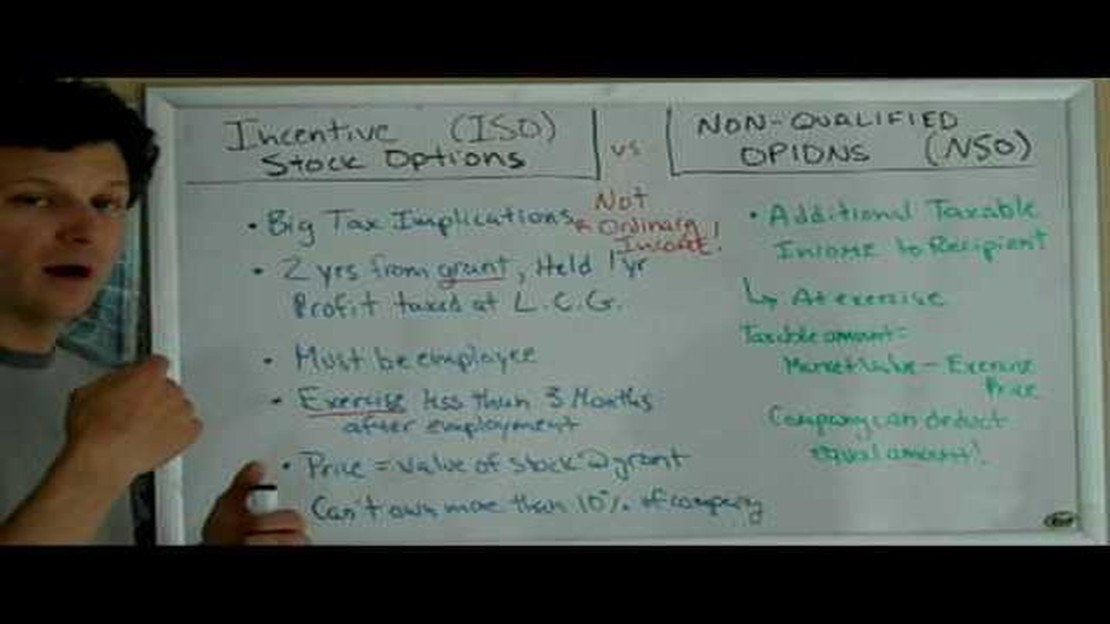

When it comes to options, understanding the difference between qualified and unqualified options is essential. Qualified options refer to those that meet specific criteria or requirements, while unqualified options do not have any specific criteria that need to be met.

Qualified options, also known as eligible options, typically come with certain benefits or advantages. These benefits may include tax advantages, eligibility for employee stock option plans (ESOPs), or the ability to be traded on an options exchange. To be considered qualified, options must meet certain conditions set forth by regulatory bodies or government entities.

On the other hand, unqualified options do not come with the same benefits or advantages as qualified options. They may not meet the necessary criteria set by regulatory bodies or may be subject to additional taxes or restrictions. Unqualified options are often offered by private companies or startups as a way to incentivize employees without having to comply with the strict regulations associated with qualified options.

Understanding the difference between qualified and unqualified options is crucial for investors, employees, and anyone involved in the world of options trading. Qualified options offer certain advantages and benefits, while unqualified options may have their own unique set of risks and limitations. By understanding the distinctions between the two, individuals can make more informed decisions when it comes to investing or participating in options plans.

Qualified options, also known as incentive stock options (ISOs), are a type of stock option that offers certain tax advantages to employees. These options are typically only offered to employees of the company and must meet specific requirements set by the Internal Revenue Service (IRS).

To qualify as an ISO, the option must have an exercise price that is equal to or greater than the fair market value of the stock on the date of grant, and it must be granted under a written plan that specifies the total number of shares that may be issued under the plan. Additionally, the option must be exercisable only within ten years of the date of grant and only by the option holder.

One key advantage of qualified options is that they are eligible for special tax treatment. When the ISOs are exercised, the difference between the exercise price and the fair market value of the stock is not subject to ordinary income tax. Instead, it is treated as a capital gain, which is typically subject to a lower tax rate.

Unqualified options, on the other hand, do not meet the requirements set by the IRS to qualify for special tax treatment. They are often referred to as non-qualified stock options (NSOs) or non-statutory stock options (NQSOs). Unlike qualified options, unqualified options can be offered to a wider range of individuals, including consultants and non-employee directors.

Unlike qualified options, the income from exercising unqualified options is subject to ordinary income tax rates. When the NSOs are exercised, the difference between the exercise price and the fair market value of the stock is treated as ordinary income and is subject to federal, state, and FICA taxes.

Overall, the key difference between qualified and unqualified options lies in their tax treatment. Qualified options offer certain tax advantages by being taxed at lower capital gains rates, while unqualified options are subject to ordinary income tax rates.

It is important to note that the tax implications of stock options can be complex and vary based on individual circumstances. It is always best to consult with a qualified tax professional for guidance on how stock options may affect your specific tax situation.

Read Also: Does BMO offer trading services?

Understanding the difference between qualified and unqualified options is essential for making informed decisions. Knowing whether an option is qualified or unqualified can have significant implications in various contexts, such as education, career choices, and financial planning.

One of the reasons why understanding this difference is important is the impact it can have on one’s long-term goals and aspirations. For example, when considering educational opportunities, knowing whether a certain degree or certification is qualified or unqualified can significantly affect employment prospects. Certain professions may require individuals to have qualified options, such as a degree from an accredited institution or a certification from a recognized governing body. Without this knowledge, individuals may invest time and money into pursuing unqualified options that will not provide the desired opportunities or meet the necessary requirements.

Read Also: Can you trade stock options on eToro? - Explained

Furthermore, understanding the difference between qualified and unqualified options can also have financial implications. In the realm of investments and retirement planning, for instance, it is vital to distinguish between qualified and unqualified options. Qualified options, such as individual retirement accounts (IRAs) or 401(k) plans, offer tax advantages and potentially higher returns compared to unqualified options. Failing to recognize this difference may lead individuals to miss out on potential financial benefits or make ill-informed decisions that could negatively impact their financial well-being in the future.

Additionally, understanding the distinction between qualified and unqualified options is crucial for making informed career choices. Some professions may require individuals to have qualified options in terms of specific qualifications, certifications, or licenses. Being aware of these requirements can enable individuals to pursue the necessary education or training to qualify for their desired career path. On the other hand, pursuing unqualified options may result in limited job opportunities or potential barriers to professional advancement.

In conclusion, understanding the difference between qualified and unqualified options is important for various reasons. It can impact one’s educational choices, career opportunities, and financial decisions. By being aware of this distinction, individuals can make more informed choices that align with their goals and provide them with the best possible outcomes in the long run.

Qualified options are stock options that have tax advantages and are granted under specific conditions, while unqualified options do not have any special tax treatment.

Qualified options can provide employees with a more favorable tax treatment. When the options are exercised, the difference between the exercise price and the fair market value of the stock is taxed as long-term capital gains, which typically carries a lower tax rate than ordinary income tax rates.

In order for stock options to be considered qualified, they must meet several requirements, including being granted with an exercise price at or above the fair market value of the stock, being granted to an employee of the company or a subsidiary, and having a maximum exercise period of ten years.

If stock options do not meet the requirements to be considered qualified, they are classified as unqualified options. Unqualified options do not have the same tax advantages and are subject to ordinary income tax rates when exercised. The difference between the exercise price and the fair market value of the stock is taxed as ordinary income.

Employees generally do not have the ability to choose between qualified and unqualified options. The type of options granted is determined by the company’s stock option plan and the specific terms set by the employer. However, some companies may choose to only grant qualified options to employees.

Qualified and unqualified options are types of employee stock options. Qualified options are subject to special tax treatment and meet specific requirements outlined by the Internal Revenue Code. Unqualified options, on the other hand, do not meet these requirements and are generally subject to more unfavorable tax treatment.

Qualified options are eligible for a more favorable tax treatment. When employees exercise qualified options, they are not subject to immediate taxation. Instead, they are taxed at the capital gains rate when they sell the stock acquired from exercising the options. This can result in significant tax savings for employees.

Understanding the Mechanics of Derivatives Welcome to YourSiteName, where we explore the world of finance and investments. In this article, we will …

Read ArticleDiscover the Method to Determine the Real Exchange Rate The real exchange rate is a crucial measurement in international finance as it reflects the …

Read ArticleHow to Locate Lost Stock Shares If you believe that you have lost track of your stock shares or maybe inherited shares from a relative but unable to …

Read ArticleMinimum Deposit for Quotex: Everything You Need to Know Quotex is a popular online trading platform that offers a range of financial products for …

Read ArticleWhat percentage of option buyers lose money? Options trading is a popular method of investment that provides traders with the opportunity to profit …

Read ArticleWhat is KC in trading? When it comes to trading, understanding KC (Key Concepts) is crucial for success in the financial markets. KC refers to a set …

Read Article