What does CMTA stand for? - Definition and Meaning

What does CMTA stand for? When it comes to understanding complex medical terms, acronyms can be both helpful and confusing. One such acronym that may …

Read Article

Foreign exchange risk is a common concern for companies involved in international trade. Fluctuations in currency exchange rates can significantly impact profits and investment returns. To mitigate this risk, companies often turn to currency options, a financial instrument that provides the right, but not the obligation, to exchange one currency for another at a specified exchange rate within a certain timeframe.

In this article, we will explore an example of how a currency option hedge can be used to mitigate foreign exchange risk. We will consider a hypothetical scenario involving a company based in the United States that imports goods from Japan and needs to pay the supplier in Japanese yen. With the exchange rate between the US dollar and Japanese yen constantly fluctuating, the company faces the risk of paying more US dollars to import the same amount of goods if the yen strengthens against the dollar.

To hedge against this risk, the company decides to purchase a currency option that gives it the right to exchange US dollars for Japanese yen at a predetermined exchange rate. The option has a maturity of three months, which aligns with the company’s payment timeline. By purchasing the option, the company locks in the exchange rate, protecting itself against unfavorable currency movements.

In this guide, we will walk through the steps involved in setting up a currency option hedge. We will discuss how to determine the appropriate strike price for the option, consider the costs involved in purchasing the option, and evaluate the potential outcomes based on different scenarios of the exchange rate movement. By understanding the mechanics of a currency option hedge and considering its advantages and limitations, companies can make informed decisions to mitigate their foreign exchange risk and protect their bottom line.

Exploring an example of a currency option hedge can provide valuable insights into the world of foreign exchange risk management. By understanding the concepts and strategies involved, companies can effectively navigate the challenges posed by currency fluctuations and safeguard their financial stability.

Foreign exchange risk refers to the potential losses that can occur due to fluctuations in exchange rates. It is a risk faced by companies and individuals who engage in international trade or hold foreign assets. Understanding and managing this risk is essential for businesses to protect their financial interests and ensure stability in the face of currency volatility.

When conducting international transactions or investments, currencies are exchanged at prevailing exchange rates. These rates are constantly changing due to various factors, such as geopolitical events, economic indicators, and market sentiment. Fluctuations in exchange rates can lead to gains or losses for businesses and individuals, depending on the movements of the currencies involved.

Foreign exchange risk can affect businesses in several ways. One key aspect is transaction risk, which arises from currency fluctuations between the time a transaction is agreed upon and the actual settlement date. For example, if a company agrees to purchase goods in a foreign currency, but the exchange rate decreases before the settlement date, the company will incur a loss when converting its domestic currency to the foreign currency.

Another aspect of foreign exchange risk is translation risk, which arises from the conversion of financial statements from one currency to another. When a business operates in multiple countries, it may need to consolidate its financial statements into a single reporting currency. Fluctuations in exchange rates can affect the value of assets and liabilities reported, impacting the overall financial position of the company.

To mitigate foreign exchange risk, businesses can employ various risk management strategies. One common strategy is hedging, which involves using financial instruments such as currency options or forward contracts to offset potential losses. By entering into these contracts, businesses can lock in exchange rates and protect themselves from adverse currency movements.

By utilizing these hedging strategies, businesses can effectively manage foreign exchange risk and reduce the impact of currency fluctuations on their financial performance. It is important for businesses to carefully analyze their exposure to foreign exchange risk and implement appropriate risk management strategies to ensure their financial stability and success in the global marketplace.

Currency options are financial instruments that give the holder the right, but not the obligation, to buy or sell a specific currency at a predetermined price within a certain time period. These options can be used as a tool to mitigate the risk of foreign exchange fluctuations and are commonly used by businesses and investors engaged in international trade or investment.

Read Also: Understanding 10 Pips on a Cent Account: A Guide for Forex Traders

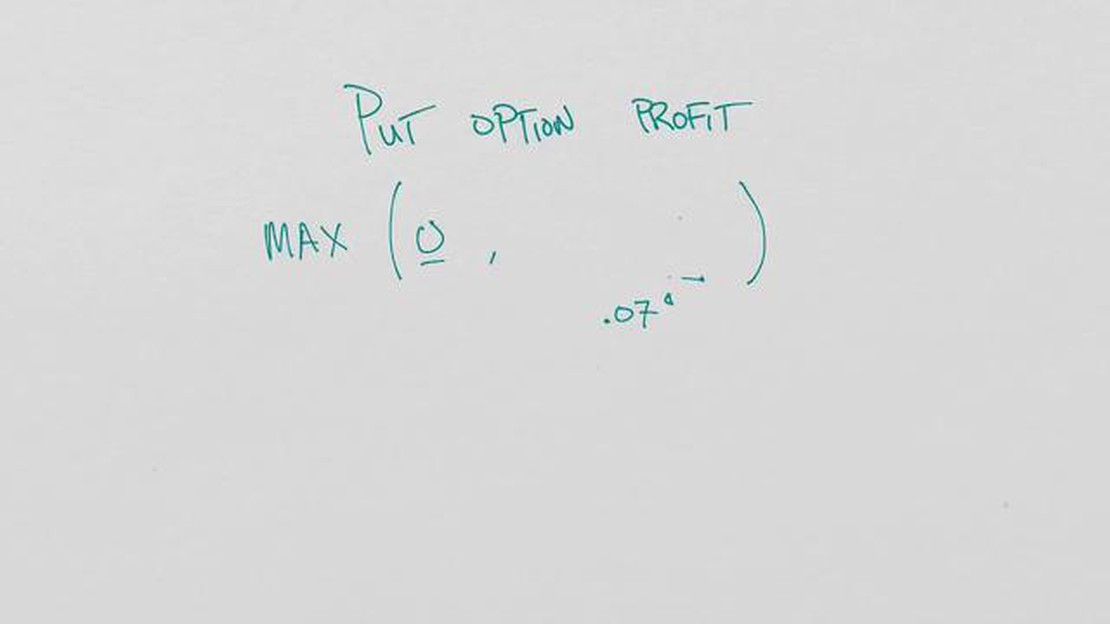

There are two types of currency options: call options and put options. A call option gives the holder the right to buy a specific currency at a predetermined exchange rate, while a put option gives the holder the right to sell a specific currency at a predetermined exchange rate.

By using currency options, businesses can protect themselves from adverse fluctuations in foreign exchange rates. For example, if a company expects to receive a payment in a foreign currency at a future date, they can purchase a put option to lock in a favorable exchange rate. If the exchange rate declines by the time of the payment, the company can exercise the put option and sell the currency at the predetermined rate, thereby avoiding losses.

Read Also: Understanding NSE FX and Its Benefits | Everything You Need to Know

Currency options also provide opportunities for speculation and profit. Investors can take positions in the options market based on their predictions of future exchange rate movements. If their predictions are correct, they can make profits by buying or selling options at favorable rates.

It is important to note that currency options come with costs, such as premiums and transaction fees. The premium is the price paid to purchase the option, and it is determined by factors such as the current exchange rate, the time remaining until expiration, and the volatility of the underlying currency pair. Businesses and investors need to carefully consider these costs and evaluate the potential benefits of using currency options.

In conclusion, currency options are a valuable tool for mitigating foreign exchange risk and providing opportunities for profit. They allow businesses and investors to protect themselves from adverse exchange rate movements and take speculative positions in the market. However, it is important to carefully assess the costs and benefits associated with currency options before engaging in any transactions.

The purpose of a currency option hedge is to mitigate foreign exchange risk, which occurs due to the volatility of exchange rates. By using currency options, companies can protect themselves from unfavorable exchange rate movements and secure a fixed rate for future currency transactions.

In a currency option hedge, a company buys or sells currency options to offset the potential losses or gains on its foreign currency transactions. By purchasing put options, the company can protect against a decline in the value of the currency it is buying, while buying call options can hedge against a rise in the value of the currency it is selling.

Using a currency option hedge can provide several benefits. Firstly, it allows companies to protect themselves from unexpected movements in exchange rates, reducing their exposure to foreign exchange risk. Additionally, it provides flexibility, as companies can choose the specific amounts and currencies they want to hedge.

While currency option hedges can be effective in mitigating foreign exchange risk, they also come with some drawbacks. One drawback is the cost associated with purchasing options, which can be substantial. Additionally, options have an expiration date, so if the exchange rate does not move as anticipated within the specified timeframe, the hedge may not provide the desired protection.

Yes, currency option hedges can be used by individuals as well. For example, individuals who frequently travel abroad or make international investments may use currency options to protect themselves from exchange rate fluctuations. However, it’s important for individuals to understand the risks and complexities associated with currency options before using them.

Currency option hedge is a strategy used by companies to mitigate foreign exchange risk. It involves using currency options to protect against unfavorable movements in exchange rates.

Currency option hedge works by purchasing currency options that give the company the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined exchange rate. If the exchange rate moves unfavorably, the company can exercise the option to protect against losses.

What does CMTA stand for? When it comes to understanding complex medical terms, acronyms can be both helpful and confusing. One such acronym that may …

Read ArticleUnderstanding the Significance of Moving Averages in Trading When it comes to analyzing and forecasting financial markets, one of the most commonly …

Read ArticleDoes Pokemon X and Y Have GTS? Pokemon X and Y were released in 2013 as the first installment in the sixth generation of the Pokemon series. With its …

Read ArticleBenefits and Applications of the Monte Carlo Method When it comes to data analysis, accuracy and precision are of utmost importance. Researchers and …

Read ArticleWhen to Start Trading Forex: Tips and Guidelines Forex trading, also known as foreign exchange trading, is a highly popular and potentially profitable …

Read ArticleAre SMA and MA the same thing? Technical analysis is an essential tool for traders in the stock market, allowing them to make informed decisions based …

Read Article