Understanding the Significance of Binary Options: What is the Value?

Understanding the Value of Binary Options Binary options have gained immense popularity in the financial market due to their ease of use and potential …

Read Article

If you want to learn more about investment strategies and financial instruments, call options are an important topic to explore. Understanding how call options work and how to use them can give you an edge in the market and potentially increase your profits.

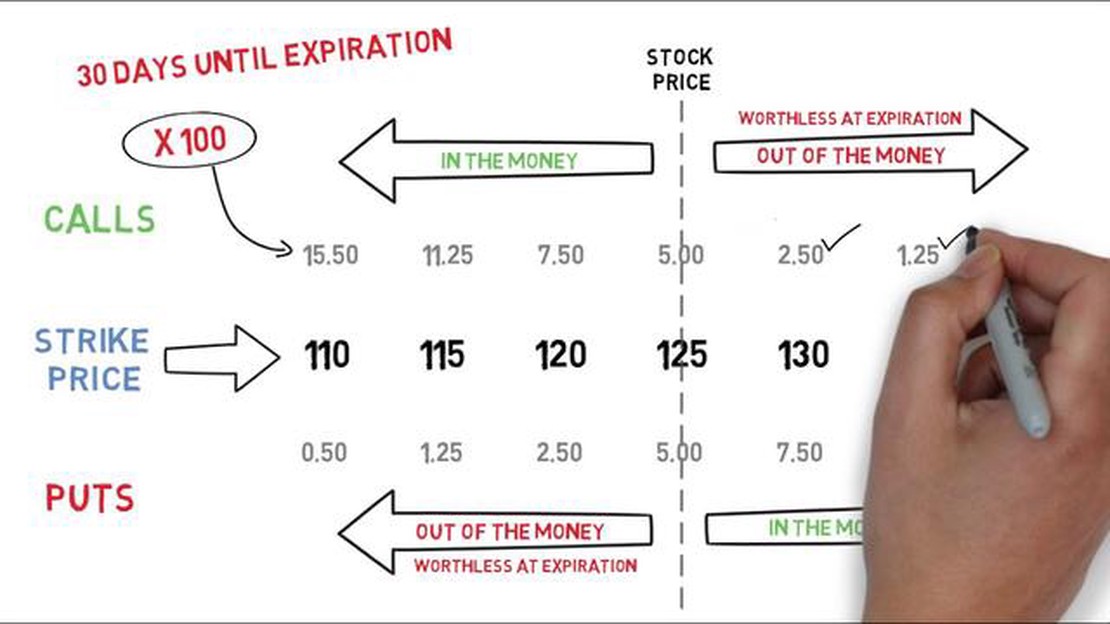

A call option is a financial contract that gives the buyer the right, but not the obligation, to buy a specified quantity of an underlying asset at a predetermined price (known as the strike price) within a specific timeframe. Call options are commonly used in the stock market to speculate on the price movement of a particular stock.

To illustrate how call options work, let’s consider a fictional scenario. Imagine you believe that the price of ABC Company’s stock, currently trading at $50 per share, will increase in the next few months. You can purchase a call option for 100 shares of ABC Company at a strike price of $55. This means that within the specified timeframe, you have the right to buy 100 shares of ABC Company at $55 per share, regardless of the actual market price at that time.

Example: Suppose the price of ABC Company’s stock rises to $60 per share before the expiration date of the call option. By exercising your call option, you can buy 100 shares of ABC Company at $55 per share, even though the market price is higher. You can then sell these shares at the market price of $60 per share, making a profit of $5 per share.

On the other hand, if the price of ABC Company’s stock does not increase or even decreases below the strike price of $55, you are not obligated to exercise the call option. In this case, your loss is limited to the premium (or the price) you paid for the call option.

Call options can be a powerful tool in your investment strategy, allowing you to benefit from the potential upside of an underlying asset while limiting your risk. However, it’s essential to understand the various factors that can affect the value of a call option, such as the underlying asset’s price, volatility, time remaining until expiration, and interest rates.

In this article, we will explore practical examples of call options and how to use them effectively in different market scenarios. By understanding these examples, you will gain valuable insights into the mechanics of call options and how they can be used to maximize your investment opportunities.

Before diving into practical examples of call options and how to use them, it’s important to have a clear understanding of the basics. A call option is a financial derivative that gives the buyer the right, but not the obligation, to purchase a specified quantity of a security or asset at a specific price within a predetermined time period.

The key components of a call option include:

Read Also: What is the highest USD to MYR exchange rate? | Currency Converter

Call options provide the buyer with the opportunity to profit from an increase in the price of the underlying asset. If the price of the asset rises above the strike price before the option expires, the buyer can exercise the option and buy the asset at a lower price, thus making a profit. On the other hand, if the price of the asset does not increase or falls below the strike price, the buyer can let the option expire and limit their loss to the premium paid.

It’s important to note that the seller of a call option, also known as the writer, is obligated to sell the underlying asset at the strike price if the buyer decides to exercise the option. The seller receives the premium as compensation for taking on this obligation.

Read Also: Learn how to add an indicator to your Forex tester and boost your trading skills

Overall, call options can be a valuable tool for investors and traders looking to profit from price movements in the financial markets. By understanding the basics of call options, you can begin to explore the different strategies and techniques to effectively use them in your investment portfolio.

Call options are a type of financial derivative that give the holder the right, but not the obligation, to buy an underlying asset at a specific price (known as the strike price) within a certain time frame. Here are some key features of call options:

Understanding the key features of call options is essential for investors to make informed decisions about whether to buy or sell these financial instruments. By knowing the expiration date, strike price, premium, and the potential risks and rewards, investors can assess the suitability of call options for their investment strategies.

A call option is a financial contract that gives the buyer the right, but not the obligation, to buy a specific asset (such as stocks or commodities) at a specific price within a specific period of time.

When you buy a call option, you pay a premium to the seller. This premium gives you the right to buy the underlying asset at the strike price until the expiration date. If the price of the underlying asset goes above the strike price, you can exercise your option and make a profit.

When you buy a call option, you have the potential to profit from the increase in the price of the underlying asset, while limiting your downside risk to the premium paid. If you were to buy the underlying asset directly, your profit potential would be unlimited, but so would your downside risk.

Sure! Let’s say you believe that the price of a certain stock, XYZ Corp, will increase in the next month. Instead of buying the stock, you can buy a call option with a strike price of $50 and an expiration date of one month. If the stock price goes above $50 within that month, you can exercise your option and buy the stock at the strike price. If the stock price doesn’t reach $50, you can simply let the option expire without exercising it.

One potential risk of using call options is that if the price of the underlying asset doesn’t reach or exceed the strike price before the expiration date, the option can expire worthless and you would lose the premium paid. Additionally, the price of options can be volatile and can fluctuate based on factors such as market conditions, implied volatility, and time decay.

Understanding the Value of Binary Options Binary options have gained immense popularity in the financial market due to their ease of use and potential …

Read ArticleCan You Buy a Ticket on a Cargo Ship? If you’re someone who loves adventure and wants to explore the world in a unique way, you may have wondered if …

Read ArticleWhat is the best indicator to pair with RSI? The Relative Strength Index (RSI) is a popular technical indicator used by traders to identify overbought …

Read ArticleThe Key Difference Between an FX Forward and an FX Futures Contract Foreign exchange (FX) markets offer a range of derivative products for hedging or …

Read ArticleWhy is the moving average 200 days? The moving average, specifically the 200-day moving average, is a commonly used technical analysis tool in the …

Read ArticleCan AI replace human traders? Artificial intelligence (AI) is revolutionizing various industries, and the trading industry is no exception. With its …

Read Article