Discover the Best Binary Trading Platforms for Maximum Profit

Which is the best binary trading platform? Binary trading has become increasingly popular in recent years, as it offers a quick and potentially …

Read Article

Binary options have gained immense popularity in the financial market due to their ease of use and potential for high returns. This investment tool offers traders a unique opportunity to trade on various assets with a fixed risk and reward. Unlike traditional options, binary options have a simple payoff structure, making them ideal for both novice and experienced traders.

So, what is the value of binary options? One of the key advantages is the ability to generate significant profits in a short period of time. With binary options, traders can earn up to 90% profit on their investment within minutes. This quick turnaround time attracts traders who are looking for immediate gains and are willing to take calculated risks.

Another crucial aspect of binary options is their accessibility. Traders can participate in the market with a minimal investment, as low as $10, making it an affordable option for individuals with limited funds. Additionally, binary options provide an opportunity for traders to speculate on the movement of various financial assets, including stocks, currencies, commodities, and indices.

However, it is important to note that the value of binary options also comes with risks. The fixed risk associated with these options means that traders can lose their entire investment if their prediction is incorrect. Therefore, it is imperative for traders to have a thorough understanding of the underlying assets and market conditions before entering into binary options trading.

In conclusion, binary options offer a unique and accessible way for traders to profit from the financial market. The potential for high returns and the simplicity of the payoff structure make binary options an attractive investment tool. However, it is essential for traders to approach binary options trading with caution and conduct proper research to mitigate risks. With proper knowledge and strategy, binary options can be a valuable addition to any trader’s portfolio.

Binary options are a type of financial derivative that allows investors to speculate on the price movement of an underlying asset. Unlike traditional options, which have a range of possible payouts based on the price movement of the asset, binary options have a fixed payout that is determined at the time the option is purchased.

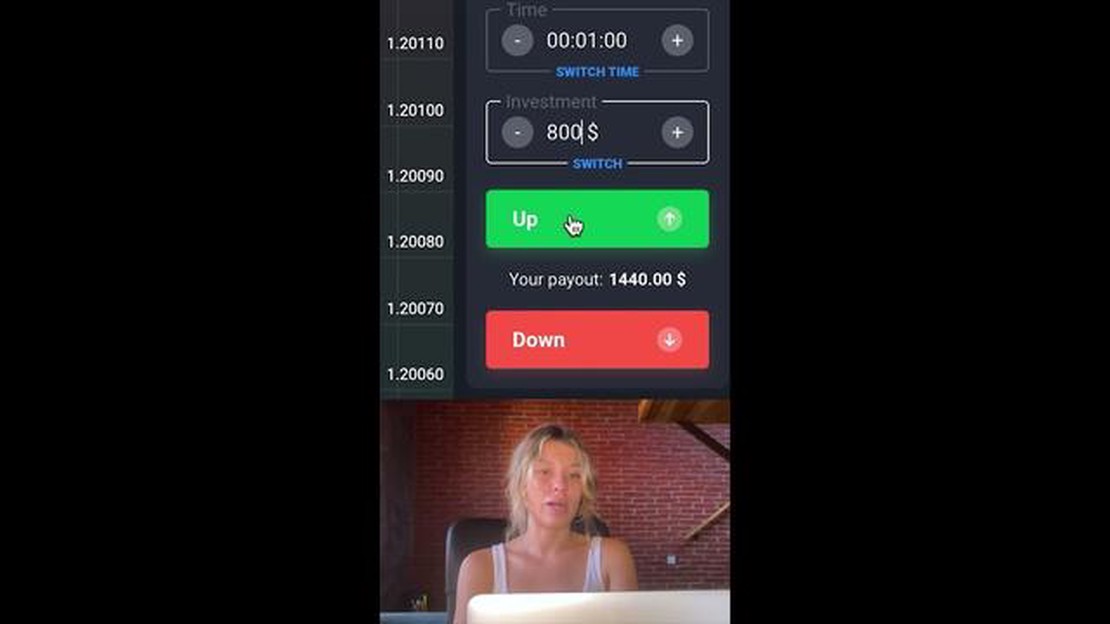

When trading binary options, investors must predict whether the price of the underlying asset will be above or below a certain strike price at a specified time in the future. If the investor’s prediction is correct at the time of expiration, they will receive the predetermined payout. However, if their prediction is incorrect, they will lose the initial amount invested.

Binary options offer a simplified approach to trading, making them accessible to both beginner and experienced investors. With binary options, investors do not need to own the underlying asset to participate in the market. Instead, they can profit from price movements by speculating on the direction of the asset’s price.

There are two main types of binary options: call options and put options. Call options are purchased when an investor believes the price of the underlying asset will rise above the strike price. Put options, on the other hand, are purchased when an investor believes the price of the underlying asset will fall below the strike price.

Binary options can be traded on a variety of assets, including stocks, currencies, commodities, and indices. They offer a range of expiration times, from as short as a few minutes to as long as several months. This flexibility allows investors to tailor their trading strategies to their specific goals and timeframes.

Read Also: Why is it called vanilla option? | Explanation and origin of the term

Overall, binary options provide a straightforward way for investors to participate in the financial markets and profit from price movements. However, it is important for investors to understand the risks involved and to carefully consider their investment goals before trading binary options.

Binary options are a type of financial derivative that are becoming increasingly popular among traders. They are called “binary” because there are only two possible outcomes: a trader either makes a profit or loses their investment. This simplicity is one of the main reasons for their appeal.

The mechanics of binary options are straightforward. Traders choose an underlying asset, such as a stock, currency pair, or commodity, and predict whether its price will rise or fall within a given time frame. They then place a “call” option if they believe the price will increase, or a “put” option if they believe it will decrease.

Once the option is placed, traders wait for the expiration time to see if their prediction was correct. If it was, they receive a fixed payout, usually in the range of 70-90% of their investment. If their prediction was incorrect, they lose the entire amount they invested.

Read Also: Understanding the Distinctions between an FX Forward and an FX Futures Contract

Binary options offer several advantages over other forms of trading. Firstly, they have a defined risk-reward profile, allowing traders to know exactly how much they stand to gain or lose before entering a trade. This removes the uncertainty associated with traditional trading methods.

Secondly, binary options have a relatively low barrier to entry, making them accessible to traders with different levels of experience and capital. Additionally, the short-term nature of binary options allows for quick results, with trades typically lasting from seconds to hours.

However, it is important to note that binary options also carry certain risks. The outcome of a binary options trade is binary, meaning traders can only win or lose. There is no potential for partial profit or loss. Furthermore, the fixed expiration times can limit traders’ flexibility and ability to respond quickly to market changes.

In conclusion, binary options are a simple and accessible form of financial trading that offer defined risk and quick results. Understanding their concept and mechanics is crucial for traders who want to explore this type of investment.

Binary options are a type of financial instrument that allows investors to predict the price movement of an underlying asset within a predetermined time frame. They offer a simple “yes or no” proposition, where traders speculate on whether the price of the asset will be above or below a certain level at the expiration time.

Binary options work by giving traders the opportunity to make a fixed profit or loss based on their correct or incorrect prediction of the price movement of an underlying asset. If a trader predicts that the price will be above a certain level at the expiration time and it turns out to be true, they will receive a predetermined payout. If their prediction is wrong, they will lose the amount they have invested in the trade.

The value of binary options lies in their simplicity and potential for high returns. They offer traders a fixed payout if their prediction is correct, which allows for better risk management. Additionally, binary options have a short-term nature, with expiry times ranging from a few minutes to several hours, making them suitable for traders looking for quick profits.

Binary options can be a good investment for experienced traders who have a solid understanding of the financial markets and are willing to take calculated risks. However, they also carry a high level of risk, as the outcome of a trade is binary – either a fixed profit or a total loss. It is important to conduct thorough research, develop a trading strategy, and manage your risk effectively before investing in binary options.

Which is the best binary trading platform? Binary trading has become increasingly popular in recent years, as it offers a quick and potentially …

Read ArticleWays to Enhance Your Forex Market Performance Forex trading is a highly competitive and volatile market, where traders aim to make profits by buying …

Read ArticleDiscover the 20 EMA 50 EMA Strategy and Its Benefits The 20 EMA 50 EMA strategy is a popular trading strategy that utilizes two moving averages to …

Read ArticleIs Nairobi CBD Safe Now? Nairobi CBD (Central Business District) is one of the most vibrant areas in the capital city of Kenya. It is the economic hub …

Read ArticleCentral Bank Intervention in Foreign Exchange Markets: Explained Central bank interventions in foreign exchange markets have long been a topic of …

Read ArticleIs AI Forex Trading Profitable? Artificial intelligence (AI) has revolutionized various industries, and the forex market is no exception. With its …

Read Article