What time does the market close in Malaysia? Find out the closing hours here!

Market Closing Time in Malaysia Are you planning a visit to Malaysia and wondering what time the market closes? Look no further! In this article, we …

Read Article

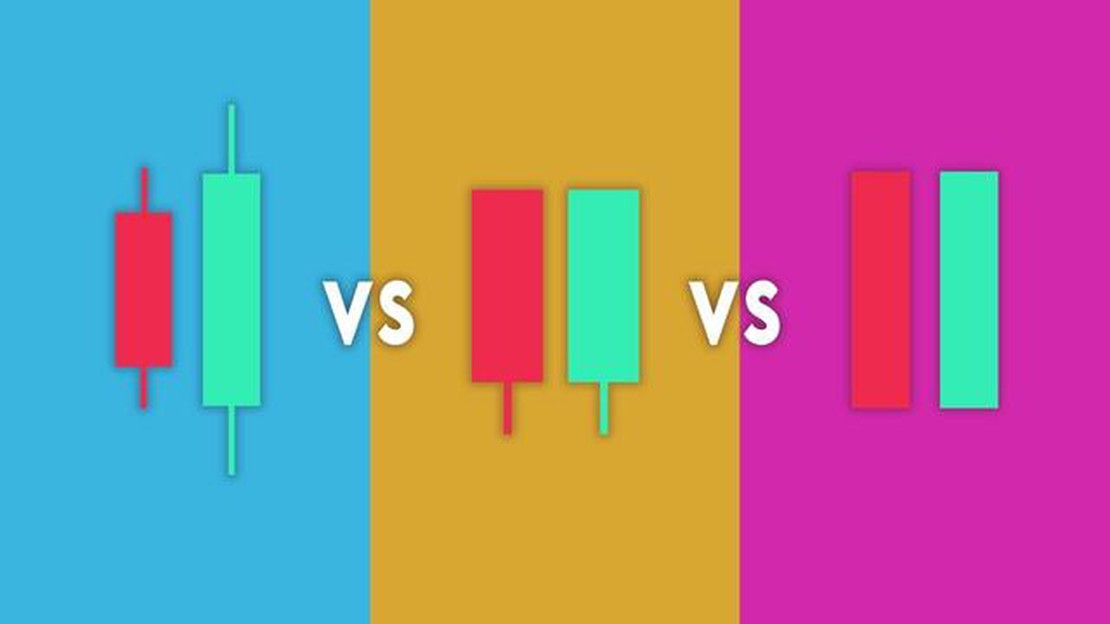

Forex trading is a complex and fast-paced world, where traders are constantly seeking ways to make informed decisions and increase their chances of success. One of the key tools in a trader’s arsenal is the confirmation candle, a powerful indicator that can provide valuable insights into market trends and potential trading opportunities.

A confirmation candle is a specific type of candlestick pattern that confirms or validates the presence of a particular trend. It is used to confirm the strength and direction of a trend and to signal potential entry or exit points for a trade. By analyzing the shape, size, and color of a confirmation candle, traders can gain important information about market sentiment and make more accurate predictions.

Interpreting a confirmation candle involves paying close attention to several key factors. Firstly, the size of the candle can indicate the strength of the trend. A larger candle suggests a more significant trend, while a smaller candle may indicate a weaker or less sustained trend. Secondly, the shape of the candle can provide clues about market sentiment. For example, a long bullish candle with a small wick at the bottom suggests strong buying pressure and a potential uptrend.

It is important to note that confirmation candles should not be interpreted in isolation. Traders should always consider other technical indicators and market factors before making trading decisions.

In addition to size and shape, the color of a confirmation candle is also significant. A green or white candle typically denotes a bullish or upward trend, while a red or black candle indicates a bearish or downward trend. However, it’s important to consider context and look for confirmation from other indicators before making conclusions solely based on candle color.

Ultimately, the interpretation of a confirmation candle requires careful analysis and consideration of multiple factors. Traders should use these candles as one piece of the puzzle in their overall trading strategy and combine them with other indicators and analysis techniques. By doing so, they can make more informed and successful trading decisions in the challenging world of Forex trading.

The confirmation candle is a term that is commonly used in forex trading to identify a specific candlestick pattern that traders consider as a confirmation of a trend reversal or continuation. Candlestick patterns are graphical representations of price movements within a specific timeframe. These patterns provide traders with insights into market sentiment and potential shifts in price direction.

When it comes to interpreting candlestick patterns, the confirmation candle plays a crucial role as it provides confirmation of the validity of a particular pattern or signal. This candle typically occurs after the formation of a reversal or continuation pattern and helps traders confirm their trading decisions.

When analyzing confirmation candles, traders typically look for specific characteristics that validate the strength of the pattern. These characteristics include the candle’s size, shape, location within the pattern, and the volume traded during its formation.

Read Also: Why are forex companies based in Cyprus? - Exploring the benefits and advantages

The size of the confirmation candle is an important factor to consider. If the confirmation candle is larger than the previous candles, it suggests a stronger confirmation of the pattern. On the other hand, if the confirmation candle is smaller, it may indicate a weaker confirmation and potential reversal.

The shape of the confirmation candle also provides insights into the market sentiment. Traders look for bullish or bearish engulfing patterns, doji candles, or other candlestick patterns that indicate a shift in sentiment. These patterns help traders determine whether to enter a trade or to wait for further confirmation.

The location of the confirmation candle within the pattern is another crucial aspect to consider. If the confirmation candle occurs near the pattern’s support or resistance levels, it reinforces the pattern’s validity. Traders also analyze the volume traded during the confirmation candle formation, as higher volumes can provide additional confirmation of the pattern.

It is important to note that the confirmation candle should not be analyzed in isolation. Traders should consider other technical analysis tools, such as trendlines, indicators, and price action, to validate the signal provided by the confirmation candle.

In conclusion, understanding the role of the confirmation candle in forex trading is essential for traders who rely on candlestick patterns to make trading decisions. By analyzing the size, shape, location, and volume of the confirmation candle, traders can gain valuable insights into potential trend reversals or continuations.

In forex trading, a confirmation candle refers to a specific type of candlestick pattern that traders use to validate the occurrence of a trend or a price movement. It provides traders with an important signal to confirm their trading decisions and enhance their trading accuracy.

Read Also: Is Binary Trading Legal in India? Exploring the Legal Status of Binary Options in India

Confirmation candles have several key characteristics that traders should closely examine:

Examining these characteristics helps traders determine the strength and reliability of a confirmation candle. By understanding and interpreting these characteristics correctly, traders can enhance their trading strategies and improve their overall profitability in forex trading.

A confirmation candle in forex trading is a candlestick pattern that provides confirmation of a particular trading signal or price action. It is used by traders to validate their analysis and identify high-probability trading setups.

When interpreting a confirmation candle in forex trading, you should look for specific characteristics such as the size, shape, and color of the candlestick. For example, a bullish confirmation candle may have a long body and a small wick, indicating strong buying pressure and a potential upward price movement.

Some common types of confirmation candles in forex trading include engulfing patterns, harami patterns, and doji patterns. Engulfing patterns occur when a candle completely engulfs the previous candle, indicating a potential trend reversal. Harami patterns occur when a small candle is engulfed by a larger candle, indicating a potential trend continuation. Doji patterns occur when the open and close prices are very close to each other, indicating indecision in the market.

To determine if a confirmation candle is valid, you should consider the context of the candlestick pattern and other supporting indicators or tools. For example, if a bullish confirmation candle occurs after a period of downtrend and is supported by increasing volume and positive divergence on the RSI indicator, it is likely to be a valid signal.

Yes, confirmation candles can be used in conjunction with other technical analysis tools such as trend lines, support and resistance levels, and oscillators. By combining multiple indicators and tools, traders can increase the probability of successful trades and make more informed trading decisions.

Market Closing Time in Malaysia Are you planning a visit to Malaysia and wondering what time the market closes? Look no further! In this article, we …

Read ArticleUnderstanding VSA Volume Spread Analysis Volume Spread Analysis (VSA) is a powerful methodology used by traders to analyze and interpret the …

Read ArticleCan I exchange ripped money at the bank in the Philippines in 2023? Have you ever found yourself with torn or ripped money in the Philippines? Perhaps …

Read ArticleWhat is the share price of H&M? When it comes to investing in the stock market, staying informed about the current share price of a particular company …

Read ArticleUnderstanding the floating exchange rate theory The floating exchange rate theory is a concept that plays a crucial role in the world of international …

Read ArticleUnderstanding the Triangular Trade: A Historical Perspective The Triangular Trade was a historic trading route that linked Europe, Africa, and the …

Read Article