Is MetaTrader 4 available on PC? Get all the details here explained!

Is MetaTrader 4 available on PC? MetaTrader 4, commonly known as MT4, is a popular trading platform that is widely used by forex and CFD traders …

Read Article

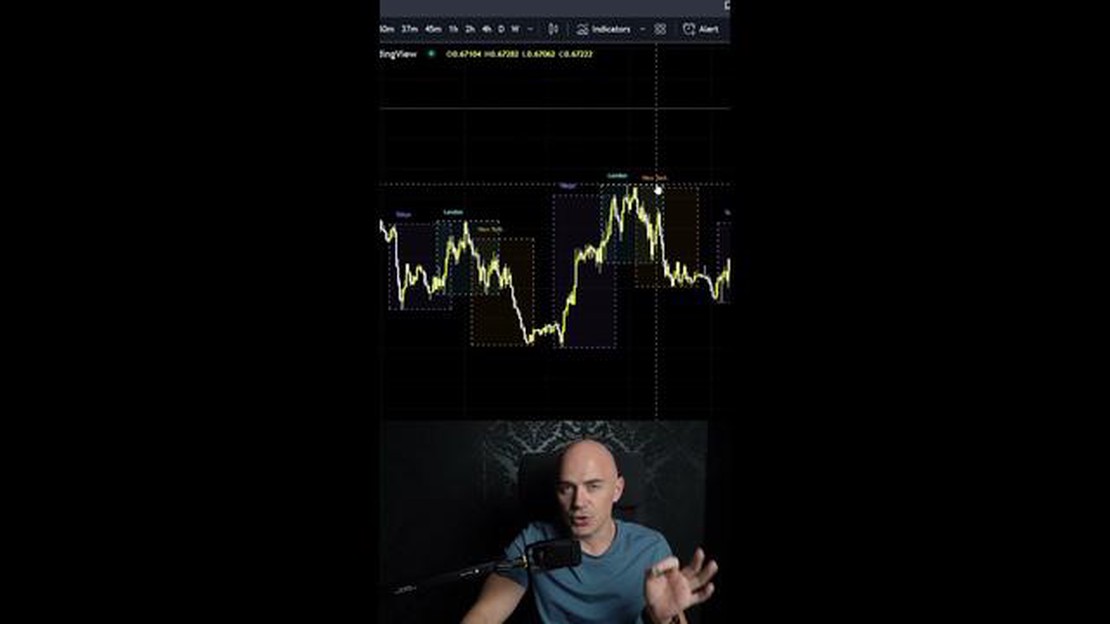

The Forex market is open 24 hours a day, allowing traders to participate in trading activities at any time. However, there are certain times throughout the day when the market is most active and offers the best trading opportunities. Two of the most significant trading sessions are the London and New York sessions, which account for a significant portion of the daily trading volume.

The London session, also known as the European session, is considered the most important session due to its high trading volume and liquidity. It starts at 8:00 AM GMT and continues until 4:00 PM GMT. During this time, major financial centers in Europe, such as London, Frankfurt, and Paris, are active. Traders can benefit from increased volatility and liquidity during this session, making it an ideal time to trade major currency pairs involving the Euro (EUR), British Pound (GBP), and Swiss Franc (CHF).

The New York session, also known as the North American session, overlaps with the London session for a few hours and is considered the second most important session. It starts at 1:00 PM GMT and continues until 9:00 PM GMT. During this session, major financial centers in the United States, such as New York and Chicago, are active. Traders can take advantage of the high liquidity and volatility during this time, particularly for currency pairs involving the US Dollar (USD) and Canadian Dollar (CAD).

By knowing the schedule and characteristics of the London and New York sessions, traders can plan their trading activities accordingly. It is recommended to trade during the overlapping hours of the two sessions when both sessions are active, as this offers the highest trading volume and liquidity. This information can help traders improve their chances of success in the Forex market and make more informed trading decisions.

The London session is one of the most active and volatile trading sessions in the forex market. It starts at 8:00 AM GMT and ends at 4:00 PM GMT. The London session overlaps with the Asian session for a few hours, which leads to increased trading volume and liquidity.

London is known for being the financial capital of the world, and during this session, major financial institutions, banks, and hedge funds are active in the market. The session is characterized by high volatility, especially during the first few hours, known as the London open.

The London session is dominated by the British pound (GBP), but also sees significant trading activity in other major currency pairs, such as the euro (EUR), US dollar (USD), Japanese yen (JPY), and Swiss franc (CHF). Economic news and reports from the UK and the Eurozone often have a strong impact on market movements during this session.

Traders looking to take advantage of the London session should closely monitor key economic indicators, such as the UK’s GDP, inflation, and employment data, as well as central bank announcements and geopolitical developments that may affect the pound and other major currencies.

The New York trading session, also known as the US session, is one of the most active sessions in the forex market. It starts at 8:00 AM EST (Eastern Standard Time) and closes at 5:00 PM EST.

Read Also: Why is risk reversal called risk reversal? Unraveling the concept and its origins

The New York session overlaps with both the London and Asian sessions, which leads to increased volatility and liquidity in the market. This makes it an ideal time for traders looking to capitalize on short-term price movements.

The New York session is dominated by market participants from North America, including traders, banks, and financial institutions. The US dollar, being the world’s reserve currency, is the most actively traded currency during this session.

Some of the major economic indicators released during the New York session include the US nonfarm payrolls, GDP figures, and inflation data. These releases often have a significant impact on the forex market and can lead to sharp price movements.

Overall, the New York session offers ample trading opportunities for traders around the world. It is characterized by high liquidity, volatility, and market activity, making it an important session to watch for forex traders.

Read Also: What is the Formula for Profit? Learn How to Calculate Profit

The trading sessions in London and New York are two of the most important sessions in the forex market. The London session starts at 8:00 AM GMT and ends at 4:00 PM GMT, while the New York session starts at 1:00 PM GMT and ends at 9:00 PM GMT.

The London and New York forex sessions are important because they have the highest trading volumes and liquidity in the market. These sessions also overlap with other major sessions, allowing for increased volatility and trading opportunities.

The currency pairs that are most active during the London session are GBP/USD, EUR/USD, and USD/CHF. These pairs tend to have higher volatility and tighter spreads during this session.

Yes, you can still trade during the London and New York sessions even if you live in a different time zone. You just need to adjust your trading schedule according to the GMT time zone and the trading hours of these sessions.

The benefits of trading during the London and New York sessions include higher trading volumes, increased liquidity, and more trading opportunities. These sessions also offer greater price fluctuations, which can lead to potentially higher profits for traders.

The London and New York Forex sessions have overlapping trading hours. The London session opens at 8:00 AM GMT and closes at 4:00 PM GMT, while the New York session opens at 1:00 PM GMT and closes at 9:00 PM GMT. During the overlapping hours from 1:00 PM GMT to 4:00 PM GMT, there is increased market activity as traders from both sessions are actively trading.

The London and New York Forex sessions are important for traders because they are the most active and liquid times in the Forex market. These sessions have the highest trading volume and volatility, providing traders with more opportunities for profit. The overlapping hours between the London and New York sessions are especially important, as they offer increased market activity and liquidity.

Is MetaTrader 4 available on PC? MetaTrader 4, commonly known as MT4, is a popular trading platform that is widely used by forex and CFD traders …

Read ArticleCompetitors of LMAX When it comes to foreign exchange trading platforms, LMAX is often considered a leader in the industry. However, it’s always …

Read ArticleTaxability of Employee Stock Options Employee stock options can be a valuable part of a compensation package, providing employees with the opportunity …

Read ArticleWhat is the Euro equivalent to? The euro is the currency used by the European Union and it is represented by both coins and banknotes. Euro coins are …

Read ArticleThe difference between buy limit and sell limit in forex When it comes to forex trading, understanding the distinction between a buy limit and a sell …

Read ArticleUnderstanding the Meaning of Restricted Stock Restricted stock is a popular compensation tool that companies use to attract and retain key employees. …

Read Article