Is it worth it to buy Kroger stock? - A comprehensive analysis

Should I invest in Kroger stock? Investing in the stock market can be a daunting task, especially with the wide array of options available. One …

Read Article

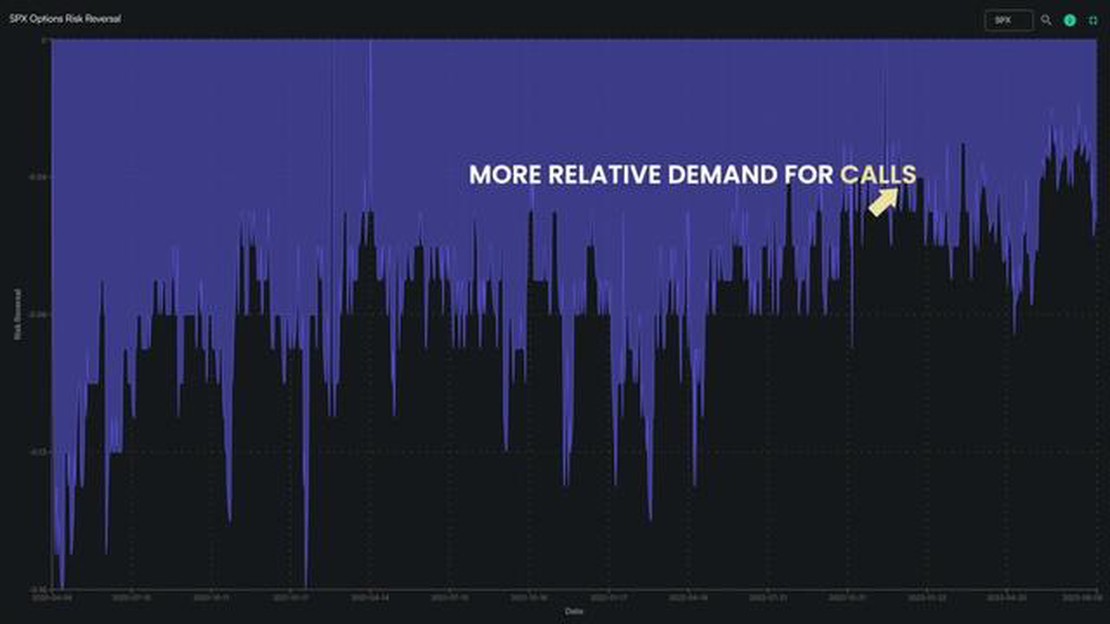

The term “risk reversal” is often used in finance and investment circles to describe a strategy that allows investors to convert potential downside risk into potential upside reward. But how did this strategy come to be known as “risk reversal”? In this article, we will delve into the origins of the term and explore why it has become a popular concept in the world of investing.

The concept of risk reversal can be traced back to the world of options trading. In options trading, a risk reversal strategy involves the simultaneous purchase of a call option and the sale of a put option, typically with the same expiration date and strike price. This strategy allows investors to profit from a rise in the underlying asset’s price while also hedging against potential losses if the price falls.

The term “risk reversal” is derived from the fact that this strategy essentially reverses the traditional risk-reward relationship. In a typical investment, investors bear the risk of losing their invested capital in exchange for the potential reward of making a profit. However, with a risk reversal strategy, investors can potentially limit their downside risk while still benefiting from potential upside gains.

While the term “risk reversal” may initially seem counterintuitive, it aptly describes the nature of this strategy. By utilizing a combination of call and put options, investors are able to reverse the traditional risk-reward dynamic and create a more balanced approach to investing. This strategy has gained popularity among both institutional and retail investors due to its potential to provide downside protection while still allowing for potential gains.

In conclusion, the term “risk reversal” accurately captures the essence of a strategy that seeks to reverse the traditional risk-reward relationship in investing. By understanding the concept and its origins, investors can better grasp the potential benefits and drawbacks associated with this strategy, and make informed investment decisions.

When we talk about risk reversal, we refer to a financial strategy that is employed to mitigate downside risk. This strategy involves the use of options to protect against potential losses in an investment or trading position.

The term “risk reversal” is used because it involves the reversal of risk. Normally, when we invest or trade in financial markets, we assume a certain level of risk. However, by implementing a risk reversal strategy, we aim to switch or reverse the risk from one party to another.

In a risk reversal, an investor or trader takes out an option contract that allows them to reverse the potential risk of their existing position. This is achieved by purchasing a protective put option, which gives them the right to sell an asset at a predetermined price (the strike price) within a certain timeframe.

If the price of the asset falls below the strike price, the investor can exercise their put option and sell the asset at the higher price. This protects them from further losses and limits their downside risk. In this way, the risk associated with the investment or trading position is reversed or switched to the counterparty who sold them the put option.

The concept of risk reversal is rooted in the options market, where it is commonly used to hedge against potential losses. It allows investors and traders to protect their portfolios from adverse price movements and provides them with a level of insurance or safety net.

Overall, risk reversal is a powerful tool that can be employed by market participants to manage risk and protect their investments. By understanding the meaning and mechanics of risk reversal, investors and traders can enhance their risk management strategies and improve their overall profitability.

The term “risk reversal” carries both significance and historical context in the world of finance. Understanding the origins of this term can provide valuable insights into its meaning and importance.

Read Also: What happens to stock options upon termination? | The Ultimate Guide

The term “risk reversal” refers to a financial strategy that involves simultaneously buying and selling options to protect against market fluctuations. The goal of a risk reversal is to limit potential losses while still allowing for potential gains. This strategy is commonly used by investors and traders to manage risk and protect their portfolio.

The term itself originates from the concept of “reversing” the risk associated with a particular investment. By purchasing and selling options, the investor is essentially reversing the potential outcome of the investment. Instead of being exposed to unlimited risk, the investor is able to limit their downside while still maintaining the potential for profit.

The use of the term “risk reversal” can be traced back to the options market, where it became widely recognized as a popular strategy. The concept gained popularity in the 1970s and 1980s as more investors began to recognize the advantages of using options to manage risk. As a result, the term “risk reversal” was coined to describe this specific strategy.

Over time, the term “risk reversal” has become ingrained in the financial industry’s lexicon, with investors and traders using it to describe this specific options strategy. The term has also evolved to encompass a broader meaning, symbolizing the overall concept of managing risk in the world of finance.

In conclusion, the term “risk reversal” carries both historical significance and practical meaning. Exploring its origins helps us to understand the strategy it represents and its importance in managing risk. By reversing the potential outcomes of an investment through the use of options, investors can protect themselves from potential losses while maintaining the potential for profit.

Risk reversal is a popular options trading strategy that aims to protect against potential loss while still allowing for potential gain. The concept behind risk reversal revolves around the idea of shifting the risk from one side to the other.

Read Also: Cost of Withdrawing in FOREX and Essential Tips to Minimize Fees

When implementing a risk reversal strategy, an options trader will typically buy a call option and sell a put option at the same strike price. By doing so, the trader shifts the risk to the downside, where any potential losses will be limited, while still allowing for potential profit to be made on the upside.

The name “risk reversal” stems from the fact that this strategy essentially reverses the traditional risk profile of a typical long position in the underlying asset. In a normal long position, the risk lies to the downside, as the asset’s value can decrease, resulting in potential losses. However, with risk reversal, the trader takes on limited downside risk while still benefiting from potential upside gains.

The concept of risk reversal is appealing to traders looking to protect their investments while still maintaining the possibility of earning profits. It allows traders to shift and manage their risks in a way that aligns with their own risk tolerance and investment objectives.

Risk reversal strategies are commonly used in various markets, including equity, currency, and commodity options trading. Traders may implement risk reversal for different purposes, such as hedging existing positions, taking advantage of market volatility, or speculating on the directional movement of an underlying asset.

Overall, risk reversal provides traders with a flexible and customizable strategy to manage risk and potentially profit from market movements. By understanding the concept behind risk reversal and its origins, traders can make informed decisions when implementing this strategy in their trading activities.

Risk reversal refers to a financial strategy where an investor simultaneously buys and sells options to hedge against potential losses. It is called risk reversal because it helps reverse the risks associated with a particular investment.

Risk reversal involves buying a put option and selling a call option with the same expiration date and strike price. This strategy allows the investor to participate in the upside potential of the underlying asset while limiting the downside risk. If the price of the asset increases, the investor benefits from the call option sold. If the price decreases, the investor is protected by the put option bought.

Risk reversal is commonly used in options trading because it allows investors to hedge against potential losses while still maintaining the opportunity for gains. By using this strategy, investors can protect their portfolios from adverse market movements and limit their downside risk.

The term “risk reversal” originated from the options market. It is derived from the fact that this strategy helps reverse or mitigate the risks associated with a particular investment. By using risk reversal, investors can alter their risk profile and potentially improve their overall risk/reward ratio.

Using risk reversal in options trading can provide several benefits. It allows investors to protect their portfolios from downside risk, provides a hedge against adverse market movements, and still provides the opportunity for potential gains. Additionally, risk reversal can help investors maintain a more balanced risk exposure and potentially improve their overall investment returns.

Should I invest in Kroger stock? Investing in the stock market can be a daunting task, especially with the wide array of options available. One …

Read ArticleUnderstanding the Mechanics of the 1000Pip Climber System Are you tired of the ups and downs in your forex trading? Do you want a reliable system that …

Read ArticleHow to Calculate the 7-Day Moving Average When analyzing data, it can be helpful to calculate moving averages to identify trends and patterns over a …

Read ArticleTrading in the Spot Market: Step-by-Step Guide Trading in the spot market can be an exciting and lucrative venture. Whether you are new to trading or …

Read ArticleHow to Choose the Right Renko Box Size Renko charts are a popular tool for technical analysis in trading. They help traders to filter out market noise …

Read ArticleMastercard Currency Conversion Fees: How Much Does It Charge? When it comes to using your Mastercard for international transactions, one thing you …

Read Article