When is the most profitable time to trade euro dollars?

When is the Best Time to Trade Euro Dollars? Trading euro dollars can be a lucrative endeavor, but like any investment strategy, timing is everything. …

Read Article

Lock-up option refers to a contractual agreement between a buyer and a seller, typically in the context of a merger or acquisition, where the buyer has the option to prevent the seller from selling their shares for a specified period of time after the transaction. This option is commonly used to ensure the buyer’s control of the company and maintain stability during the integration process.

During the lock-up period, which can range from a few months to several years, the seller is restricted from selling their shares on the open market or to other potential buyers. This restriction aims to prevent a sudden influx of shares into the market, which could potentially negatively impact the company’s stock price or dilute the buyer’s ownership stake.

Lock-up options are often included in agreements to protect the value of the buyer’s investment and provide a measure of stability during a critical transition period. They are particularly common in cases where the buyer is acquiring a majority stake in a company or when the transaction involves sensitive or strategic assets.

It is important for both buyers and sellers to carefully negotiate the terms of the lock-up option, taking into consideration the specific circumstances and objectives of the transaction. The duration of the lock-up period, any exceptions or conditions, and the consequences for breaching the agreement should all be clearly defined to ensure a fair and successful deal for both parties involved.

In conclusion, lock-up options play a crucial role in mergers and acquisitions by providing the buyer with the ability to control the selling activities of the seller after the transaction. They serve as a protective measure to safeguard the buyer’s investment and maintain stability during the integration process. By understanding the definition and intricacies of lock-up options, parties involved can make informed decisions to maximize the value and success of their deals.

A lock-up option is a contractual provision that prevents shareholders from selling their shares of a company within a specified period of time. This period, known as the lock-up period, typically occurs after an initial public offering (IPO) or other significant event, such as a merger or acquisition.

Lock-up options are commonly used by companies to maintain stability and control over their stock price during a critical period. By preventing shareholders from immediately selling their shares, the company can avoid a sudden influx of shares into the market, which could potentially drive down the stock price and negatively impact market reputation.

During the lock-up period, shareholders are typically prohibited from selling their shares to external investors, although limited exceptions may apply in certain situations. Once the lock-up period is over, shareholders are free to sell their shares in the open market.

Lock-up options are often negotiated between the company and its shareholders as part of the overall investment agreement. The length of the lock-up period can vary, but it is typically between 90 and 180 days.

While lock-up options restrict shareholders’ ability to sell their shares, they can provide certain benefits to shareholders as well. By limiting the supply of shares in the market, lock-up options can potentially support a higher stock price, which may benefit both existing shareholders and the company itself.

In summary, a lock-up option is a contractual provision that temporarily restricts shareholders from selling their shares of a company. It is designed to maintain stability and control over the stock price during a critical period, such as an IPO or merger. While there are restrictions on selling shares during the lock-up period, the provision can provide certain benefits to shareholders and the company.

A lock-up option is a contractual provision that gives an investor the right to prohibit the sale or transfer of specified securities for a certain period of time. This period of time, known as the lock-up period, is typically agreed upon between the investor and the issuer of the securities.

The purpose of a lock-up option is to provide stability and control to the issuer during a specific period, such as an initial public offering (IPO) or a private placement. By imposing restrictions on the transfer of securities, the issuer can limit the potential volatility that may occur in the market immediately following the issuance of the securities.

During the lock-up period, the investor is generally not allowed to sell or transfer the locked-up securities. This restriction can help prevent a flood of securities in the market, which could drive down the price and negatively impact the issuer’s reputation and financial performance.

Lock-up options are commonly used in situations where the securities being issued are considered highly desirable, such as in the case of an IPO for a popular tech company. By implementing a lock-up option, the issuer can create scarcity and increase demand for the securities, potentially leading to higher prices.

Read Also: Best BTST Strategy: Maximizing Profits with Overnight Stock Trades

Lock-up options can also be beneficial for investors. By agreeing to a lock-up period, investors may gain access to securities that may otherwise be difficult to obtain, such as shares in a highly anticipated IPO. Additionally, the lock-up period ensures that insiders or large shareholders cannot quickly exit their positions, which may provide reassurance to other investors.

Once the lock-up period expires, the investor is free to sell or transfer the securities. This can lead to increased liquidity in the market and provide an opportunity for investors to realize their gains.

Read Also: Can You Trade Binary Options in the US? | A Guide for US Traders

In conclusion, a lock-up option is a contractual provision that restricts the sale or transfer of securities for a specified period of time. It is designed to provide stability and control to the issuer and may also benefit investors by creating scarcity and increasing demand for the securities.

A lock-up option is a contractual provision that restricts the sale or transfer of a specific asset, usually company shares, for a certain period of time. This period is typically referred to as the lock-up period.

During the lock-up period, the owner of the asset is not allowed to sell or transfer it to another party. This restriction is put in place to prevent market volatility and ensure stability in the ownership structure of the company. It is commonly used in the context of an initial public offering (IPO) or a merger and acquisition (M&A) transaction.

The lock-up option is typically agreed upon between the issuing company and the potential buyer or investor. It provides the company with some level of control over the ownership of its shares and prevents insider trading or a sudden flood of shares into the market, which could negatively impact the share price.

Once the lock-up period expires, the owner of the locked-up asset is free to sell or transfer it as they please. This often leads to increased trading activity and can have an impact on the stock price, as a large number of shares suddenly become available for sale.

It’s important to note that the terms of a lock-up option can vary from one transaction to another. The lock-up period can range from a few months to several years, depending on the agreement between the parties involved. Additionally, there may be certain exceptions or conditions under which the owner of the locked-up asset can sell or transfer it before the lock-up period expires.

In summary, a lock-up option is a contractual provision that restricts the sale or transfer of a specific asset for a certain period of time. It is commonly used in IPOs and M&A transactions to ensure stability in the ownership structure of the company and prevent market volatility.

| Key Points |

|---|

| A lock-up option restricts the sale or transfer of a specific asset for a certain period of time. |

| It is commonly used in IPOs and M&A transactions to prevent market volatility. |

| The lock-up period can vary and there may be exceptions or conditions for selling or transferring the locked-up asset. |

A lock-up option refers to an agreement between shareholders and a company that restricts the sale of a certain number of shares for a specified period of time after an initial public offering (IPO).

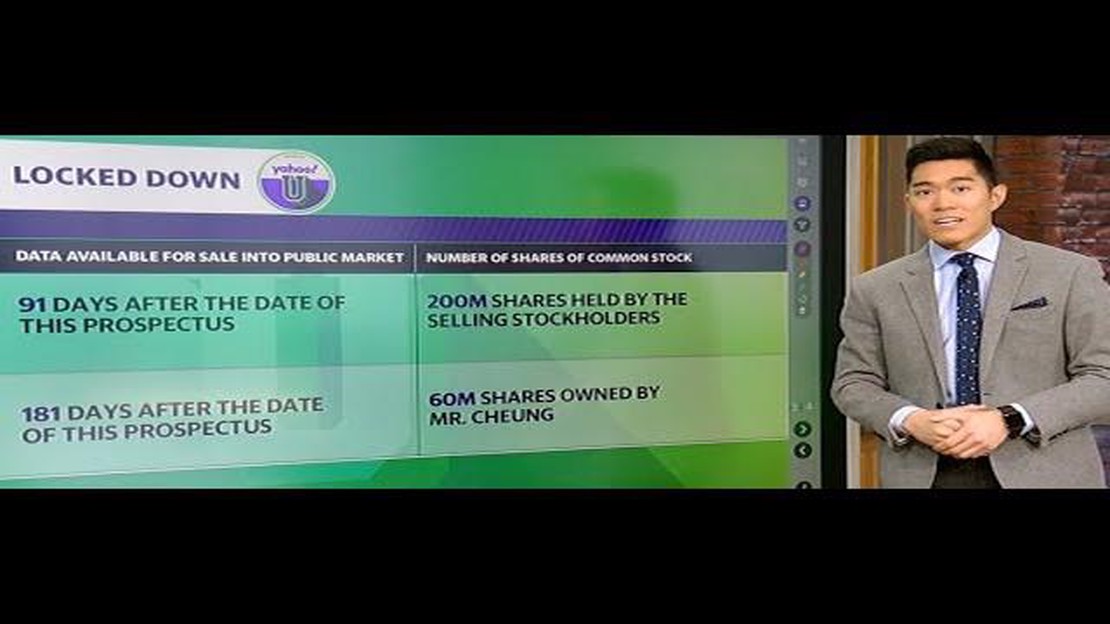

When a lock-up option is in effect, shareholders are prohibited from selling their shares for a period of time, typically 90 to 180 days after an IPO. This is done to prevent excessive selling pressure and to stabilize the stock price.

Companies use lock-up options to maintain price stability and prevent significant declines in their stock price after an IPO. It allows the company to control the supply of shares in the market and limit the potential negative impact of large-scale selling.

Once the lock-up period expires, shareholders are free to sell their shares on the open market. This can result in increased selling activity and potential downward pressure on the stock price.

Yes, in some cases, a lock-up option can be extended if the company and its shareholders agree to do so. This can be done to further stabilize the stock price or to prevent significant selling pressure during a sensitive time for the company.

When is the Best Time to Trade Euro Dollars? Trading euro dollars can be a lucrative endeavor, but like any investment strategy, timing is everything. …

Read ArticleUnderstanding the implications of a high RSI When it comes to analyzing stocks, one of the key indicators that investors use is the Relative Strength …

Read ArticleIs Binary Trading Halal or Haram? Binary trading, also known as digital options trading, has gained popularity in recent years as a method of …

Read ArticleCalculating Severance Pay: A Comprehensive Guide When it comes to navigating the world of employment termination, calculating severance pay can be a …

Read ArticleWhy do trading firms use FPGAs? Trading firms are constantly seeking innovative ways to gain a competitive edge in the fast-paced and dynamic world of …

Read ArticleWhat is the multiplier in Olymp trade? When it comes to trading on the Olymp Trade platform, one of the important features to understand is the …

Read Article