Is piranha real or a myth?

Is piranha real or fake? Piranhas have long fascinated and terrified people around the world. These sharp-toothed fish, known for their ferociousness …

Read Article

In the fast-paced world of binary options trading, it is crucial to understand how to effectively manage risk in order to maximize your profits. One of the most important tools in your trading arsenal is the stop loss order. This powerful tool allows you to set a predetermined price at which your trade will automatically close, preventing further losses.

A stop loss order helps you protect your investment by limiting potential losses if the market moves against you. By setting a stop loss, you define a specific level at which you are willing to exit the trade. This ensures that you don’t hold onto a losing position for too long, potentially avoiding a significant loss.

When setting a stop loss, it is important to consider the overall market conditions as well as your risk tolerance. Investing without a stop loss can be extremely risky, as it leaves your investment vulnerable to sudden market fluctuations. By setting a stop loss, you are able to mitigate this risk and protect your capital.

It is also crucial to consider the volatility of the market when setting your stop loss. If the market is highly volatile, you may need to set a wider stop loss to allow for greater fluctuations. Conversely, if the market is relatively stable, you may be able to set a tighter stop loss.

Remember, a stop loss is not a guarantee that you will avoid losses altogether, but rather a risk management tool that helps you limit potential losses. It is important to regularly review and adjust your stop loss levels as market conditions change.

By learning how to effectively use a stop loss in binary options trading, you can significantly enhance your trading strategy and increase your chances of success. So take the time to understand how to set and adjust your stop loss orders, and watch as your profits soar.

Before learning how to stop loss in binary options and maximize your profits, it’s important to understand the basic concepts of binary options trading.

Binary options are a type of financial instrument where traders bet on the outcome of a market event. The payout for a successful trade is a fixed monetary amount, while the loss for an unsuccessful trade is the entire investment made in the trade.

There are two possible outcomes in binary options trading: “in the money” and “out of the money”. If a trader’s prediction is correct and the market event occurs, the trade is considered “in the money” and the trader receives the predetermined payout. If the trader’s prediction is incorrect and the market event does not occur, the trade is considered “out of the money” and the trader loses the entire investment.

Stop loss is a risk management tool used in trading to limit the potential loss on a trade. By setting a stop loss level, traders can automatically exit a trade if the market moves against their prediction, reducing the potential loss.

Read Also: Discover an Example of a Reversal Trading Strategy

Understanding the basic concepts of binary options trading and stop loss will provide a solid foundation for learning how to effectively manage risk and maximize profits in this type of trading.

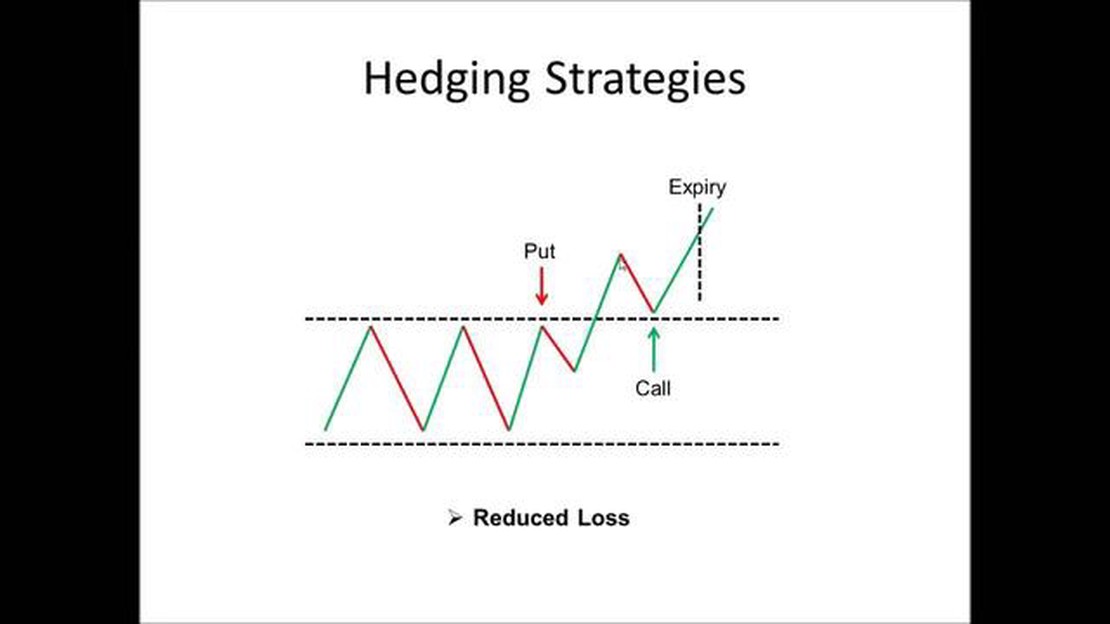

When it comes to trading binary options, having a solid strategy is essential for success. By exploring different strategies, you can increase your chances of maximizing your profits and minimizing your losses. Below are some popular strategies that you can consider:

Trend following: This strategy involves analyzing the market trends and identifying the direction in which the asset’s price is moving. Traders using this strategy will place a call option if they believe the price will go up or a put option if they believe the price will go down.

Breakout strategy: This strategy focuses on identifying key support and resistance levels. Traders will place a call option when the price breaks above a resistance level or a put option when the price breaks below a support level.

Reversal strategy: This strategy is based on the belief that after a significant price movement, the market will reverse its direction. Traders using this strategy will place a call option if they believe the price will reverse from a downtrend to an uptrend, or a put option if they believe the price will reverse from an uptrend to a downtrend.

Range trading: This strategy is suitable when the price of the asset is moving within a specific range. Traders using this strategy will place a call option when the price is near the lower range and a put option when the price is near the upper range.

News trading: This strategy involves trading based on news and economic events that may impact the market. Traders using this strategy will analyze the news and place trades accordingly, capitalizing on the volatility caused by the news.

It’s important to note that no strategy is foolproof, and it’s always advisable to practice risk management when trading. It’s recommended to test different strategies on a demo account before using them with real money.

Read Also: Mastering Stochastic Indicators in Forex Trading: A Comprehensive Guide

By exploring and experimenting with different binary options strategies, you can find the ones that work best for you. Remember to stay disciplined and continuously educate yourself to improve your trading skills.

Setting a stop loss is an essential risk management technique that traders should always employ when trading binary options. It is a predetermined price level at which a trader automatically exits a trade to limit potential losses.

Here are some reasons why setting stop losses is crucial in binary options trading:

In conclusion, setting stop losses in binary options trading is crucial for managing risk, protecting capital, and staying disciplined. It is a valuable tool that helps traders mitigate potential losses and maximize their profit potential.

A stop loss in binary options is an order placed by a trader to limit their potential losses on a trade. It is a predetermined level at which the trader’s position will be automatically closed if the market moves against them.

By setting a stop loss, traders can limit their potential losses and protect their capital. This allows them to stay in the game and continue trading, increasing their chances of making profitable trades and maximizing their overall profits.

When setting a stop loss in binary options, traders should consider their risk tolerance, the volatility of the market, the timeframe of their trade, and the overall trend. It is important to set a stop loss at a level that allows for potential market fluctuations while also protecting against significant losses.

Yes, a stop loss can be adjusted after it is set. Traders may choose to move their stop loss level if they believe the market conditions have changed or if new information becomes available. However, it is important to note that adjusting a stop loss should be done carefully and based on sound analysis to avoid unnecessary losses.

Using a stop loss strategy is generally recommended in binary options trading as it helps to manage risk and protect against significant losses. However, traders should also consider their individual trading style and risk appetite. Some traders may prefer to use other risk management techniques or have specific trading strategies that do not rely heavily on stop loss orders.

Is piranha real or fake? Piranhas have long fascinated and terrified people around the world. These sharp-toothed fish, known for their ferociousness …

Read ArticleGuide to Buying Wheat Options When it comes to trading options, wheat can be a highly lucrative commodity. Whether you’re a seasoned trader or just …

Read ArticleUnderstanding Forex Micro Accounts for Beginners In the world of foreign exchange trading, a Forex micro account has become increasingly popular among …

Read ArticleCurrency Traders: Who They Are and What They Do Currency trading, also known as forex trading, is a lucrative and dynamic market where traders buy and …

Read ArticleIs a 401K a type of stock? When it comes to planning for retirement, one of the most common investment options people consider is a 401K. However, …

Read ArticleUnderstanding the 1099 MISC for Stocks and Investments If you have recently received a 1099 MISC form for stocks, you may be wondering why and what it …

Read Article