What is TLS in trading? A comprehensive guide to TLS and its significance in trading

Understanding TLS in Trading: Explained Trading is a volatile and high-stakes world, where every second counts and security is of utmost importance. …

Read Article

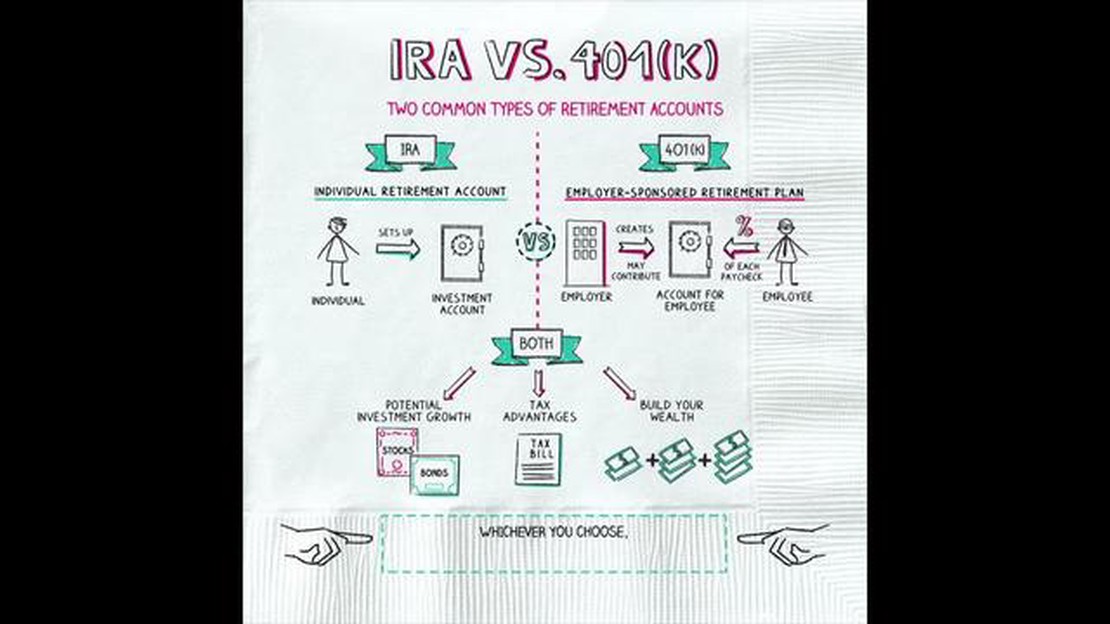

When it comes to planning for retirement, one of the most common investment options people consider is a 401K. However, some individuals may wonder if a 401K is a type of stock. Let’s explore what a 401K is and whether it involves investing in stocks.

A 401K is a retirement savings plan that is provided by an employer. It allows employees to contribute a portion of their pre-tax salary into an investment account. The funds in this account can then be invested in various financial instruments, such as stocks, bonds, and mutual funds. However, a 401K itself is not a type of stock.

While a 401K allows individuals to invest in stocks, it is not limited to stocks alone. Depending on the options provided by the employer, individuals can choose to allocate their contributions to a variety of investment vehicles. This includes stocks, bonds, and other assets that are considered appropriate for long-term retirement savings.

So, while a 401K can involve investing in stocks, it is not solely focused on stocks. It provides individuals with the flexibility to diversify their investments and choose from a range of financial instruments. This can help individuals create a well-rounded retirement portfolio that aligns with their risk tolerance and financial goals.

A 401K is a type of retirement savings plan that is offered by many employers in the United States. It is named after a section of the U.S. Internal Revenue Code, which outlines the rules and regulations for this type of retirement account.

With a 401K, employees can contribute a percentage of their salary to the plan on a pre-tax basis. This means that the money is taken out of their paycheck before taxes are deducted, which can help reduce their taxable income. The contributions are then invested in a variety of different assets, such as stocks, bonds, and mutual funds.

One of the main advantages of a 401K is that many employers offer matching contributions. This means that if an employee contributes a certain percentage of their salary to the plan, their employer will match that contribution up to a certain limit. This is essentially free money that can significantly boost the employee’s retirement savings.

Another benefit of a 401K is that the investments grow on a tax-deferred basis. This means that any earnings and gains on the investments are not taxed until they are withdrawn from the account, typically during retirement. This can help maximize the growth potential of the investments over time.

It’s important to note that a 401K is not a type of stock itself, but rather a retirement savings vehicle that can include stocks as part of its investment options. The exact investment options available in a 401K can vary depending on the plan and the employer.

Overall, a 401K is a valuable tool for individuals to save for retirement, offering tax advantages and the potential for employer matching contributions. It is important for individuals to carefully consider their investment options and contribution levels to make the most of their 401K savings.

A 401K is a type of retirement savings account that is offered by an employer to its employees. It is not a type of stock, but rather a tax-advantaged investment vehicle that allows individuals to save and invest for their retirement.

One of the key features of a 401K is that contributions made to the account are typically deducted from an employee’s salary on a pre-tax basis. This means that the money contributed to the 401K is not subject to income taxes in the year it is earned, allowing individuals to lower their taxable income.

Contributions to a 401K are then invested in a variety of financial instruments, such as stocks, bonds, and mutual funds. The investments are chosen by the individual within the options provided by the employer’s plan, and the returns on these investments are tax-deferred until they are withdrawn.

In addition to the tax advantages, many employers also offer a matching contribution to employees’ 401K accounts. This means that for every dollar an employee contributes to their 401K, the employer will also contribute a certain percentage, up to a specified limit. This is essentially free money that can significantly boost the growth of the account.

Read Also: Is Forex Trading a Skill or Pure Luck? Find Out Now

While a 401K is a powerful tool for retirement savings, there are some limitations and restrictions. For example, there are limits on how much an individual can contribute to their 401K each year. Additionally, there are penalties for withdrawing funds from a 401K before the age of 59 1/2, unless certain exceptions apply.

Overall, a 401K is an important component of many individuals’ retirement planning. It provides a tax-advantaged way to save for the future and can be a key source of income during retirement.

Read Also: Understanding the Distinctions Between Moving Average and Auto Regression Models

A 401K is a type of retirement savings plan offered by employers to their employees. It allows individuals to contribute a portion of their pre-tax income into the account, which can then be invested in various assets such as stocks, bonds, and mutual funds.

One of the main advantages of a 401K is that contributions are made on a pre-tax basis. This means that the money is deducted from the employee’s paycheck before taxes are calculated, reducing their taxable income. This can result in immediate tax savings for the contributor.

Typically, employers also offer a matching contribution, where they will match a certain percentage of the employee’s contributions, up to a certain limit. This is essentially free money that the employee can put towards their retirement savings.

Once the money is in the 401K account, it can be invested in a variety of investment options. This allows individuals to grow their savings over time, as the returns on these investments accumulate.

One important thing to note is that a 401K is subject to certain withdrawal restrictions. Generally, withdrawals cannot be made before the age of 59 1/2 without incurring a penalty. There are some exceptions to this rule, such as in the case of financial hardship or certain medical expenses.

When the individual reaches the age of 59 1/2, they can start making withdrawals from their 401K without incurring a penalty. However, these withdrawals are still subject to income taxes. The individual can choose to withdraw the money all at once, or they can opt for periodic withdrawals, depending on their needs and financial goals.

Overall, a 401K is a valuable retirement savings tool that provides individuals with the opportunity to save for their future while receiving tax benefits and potential employer contributions. It is an important part of a well-rounded retirement savings strategy.

No, a 401K is not a type of stock. It is a type of retirement savings account that allows individuals to contribute a portion of their income to save for retirement. The money in a 401K can be invested in different types of investment options, including stocks, bonds, and mutual funds, but the 401K account itself is not a stock.

Yes, in most cases, you can use your 401K to invest in stocks. Many 401K plans offer a variety of investment options, including stocks, bonds, and mutual funds. However, it’s important to note that investing in stocks carries risks, and past performance is not indicative of future results. It is always recommended to consult with a financial advisor before making any investment decisions.

There are several benefits to investing in stocks through a 401K. First, contributions to a 401K are made on a pre-tax basis, which means that you can reduce your taxable income and potentially lower your overall tax liability. Second, any earnings or growth on your investments within the 401K are tax-deferred until you withdraw the funds in retirement. Finally, investing in stocks allows you to potentially earn higher returns compared to other investment options over the long term. However, it’s important to remember that investing in stocks carries risks, and it’s important to diversify your portfolio and consider your risk tolerance.

Yes, you can roll over your 401K into an individual retirement account (IRA) and then invest in stocks through the IRA. This process is known as an indirect rollover. However, it’s important to consider the potential tax implications and any fees or penalties associated with the rollover. It’s recommended to consult with a financial advisor or tax professional to determine the best course of action for your specific situation.

Yes, there are restrictions on withdrawing stocks from a 401K. Generally, you cannot withdraw funds from a 401K before the age of 59 1/2 without incurring early withdrawal penalties and taxes. Additionally, some 401K plans may have specific rules or limitations on the withdrawal of stocks. It’s important to review your plan documents or consult with your plan administrator to understand the specific rules and restrictions that apply to your 401K.

Understanding TLS in Trading: Explained Trading is a volatile and high-stakes world, where every second counts and security is of utmost importance. …

Read ArticleTrading grains: An ultimate guide for beginners Welcome to the beginner’s guide on trading grains and maximizing profit! Trading grains can be a …

Read ArticleCan I withdraw money from demo account? Many beginners in the world of trading wonder: can I withdraw money from a demo account? It is a common …

Read ArticleTrading Currency Options: A Comprehensive Guide Currency options trading is a popular and widely used method for investors to speculate and profit …

Read ArticleHow to Find Average Code in Java Calculating the average value of a set of numbers is a common task in many programming languages, including Java. …

Read ArticleTrading EMA Pullbacks: A Comprehensive Guide Many traders rely on technical indicators to identify profitable trade opportunities. One popular …

Read Article