Discover the Meaning of 459: Symbolism and Significance Explained

What does 459 mean? Have you ever noticed the number 459 repeatedly appearing in your life? Perhaps you see it on license plates, clocks, or even in …

Read Article

Forex trading, also known as foreign exchange trading, is a popular financial market where traders buy and sell different currencies. The goal is to profit from the fluctuations in exchange rates, which can be influenced by various factors such as economic news, political events, and market sentiment.

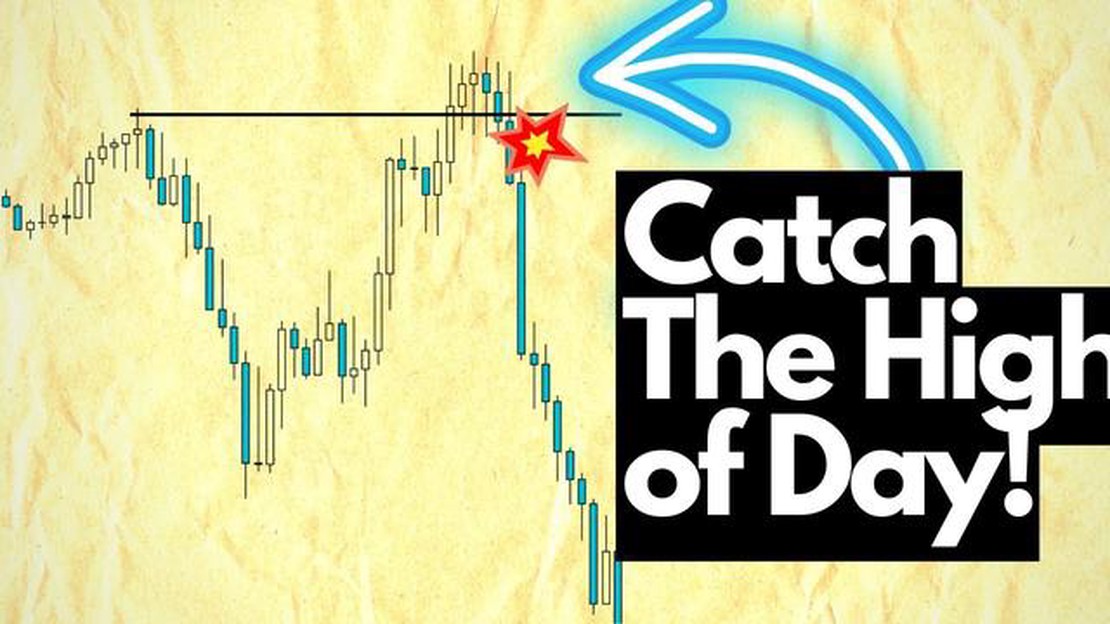

One of the key strategies in forex trading is trading high and low. This approach involves identifying the highest and lowest points in a currency pair’s price movement and taking advantage of these levels to enter and exit trades.

When the price of a currency pair reaches a high point, it may indicate that the market is overbought and due for a downward correction. Traders can take advantage of this by selling the currency pair, hoping to profit from the downward movement.

Conversely, when the price reaches a low point, it may suggest that the market is oversold and due for an upward correction. Traders can capitalize on this by buying the currency pair, aiming to profit from the subsequent upward movement.

It is important to note that trading high and low requires careful analysis and risk management. Traders should use technical indicators, chart patterns, and other tools to identify potential high and low points accurately. Moreover, it is crucial to set stop-loss orders to limit potential losses and take profit orders to secure profits.

Trading high and low in forex can be a profitable strategy if executed correctly. Traders must stay updated on market conditions, analyze price movements, and implement appropriate risk management techniques. By doing so, traders can increase their chances of success in the dynamic and exciting world of forex trading.

When it comes to forex trading, there are many different strategies and techniques that traders use to analyze the market and make profitable trades. Two common techniques used by experienced traders are high and low trading strategies. These strategies focus on identifying and taking advantage of price movements at key levels in the market.

High trading strategy

A high trading strategy involves buying a currency pair at a specific price level or above. Traders who use this strategy believe that when the price reaches a certain level, it is likely to continue rising. They aim to enter the trade at the right time to capture the potential upward movement.

To implement a high trading strategy, traders often use technical analysis tools such as support and resistance levels, trend lines, and Fibonacci retracements. These tools help them identify key price levels where the market is likely to reverse or continue its upward movement.

Low trading strategy

On the other hand, a low trading strategy involves selling a currency pair at a specific price level or below. Traders who use this strategy believe that when the price reaches a certain level, it is likely to continue falling. They aim to enter the trade at the right time to profit from the potential downward movement.

Similar to the high trading strategy, traders implementing a low trading strategy also rely on technical analysis tools to identify key price levels. By doing so, they can effectively determine when to enter the trade and maximize potential profits.

Note: Both high and low trading strategies are not limited to buying or selling at specific prices. Traders may also use other indicators or patterns to confirm their trading decisions.

When using high and low trading strategies, it’s essential for traders to conduct thorough market analysis and manage their risk properly. Both strategies require patience and discipline to wait for the right trading opportunities.

Read Also: The Ultimate Guide to Finding the Best Place to Exchange Currency

By learning and practicing high and low trading techniques, traders can enhance their ability to identify potential market movements and make informed trading decisions. These strategies can be applied to different timeframes and currency pairs, allowing traders to adapt to various market conditions.

In conclusion, mastering high and low forex trading strategies can be a valuable skill for any trader. By understanding the principles behind these techniques and practicing them consistently, traders can increase their chances of success in the forex market.

Forex trading is a highly profitable venture, but it requires the right knowledge and strategies to succeed. One of the most popular strategies in the forex market is the high and low strategy. This strategy involves taking advantage of the high and low points in currency pairs to make profitable trades.

Before diving into the high and low strategy, it’s important to understand what high and low mean in forex trading. The high represents the highest point that a currency pair has reached in a specific timeframe, while the low represents the lowest point it has reached.

Read Also: Disadvantages and Risks of Implementing Phantom Stock Plans

The high and low strategy focuses on identifying these points and using them to determine entry and exit points for trades. Traders often look for patterns or trends in the high and low points to make informed decisions.

There are several ways to implement the high and low strategy. One approach is to place a buy order when the price reaches a new high and a sell order when it reaches a new low. This allows traders to ride the upward or downward trend and maximize their profits.

Another approach is to wait for a retracement after a new high or low has been reached. Traders can then enter the market at a better price and increase their chances of making profitable trades.

To effectively implement the high and low strategy, traders need to have a solid understanding of technical analysis tools. These tools can help identify high and low points, as well as confirm potential trade setups.

Like any strategy, the high and low strategy has its risks. Traders must be aware of market volatility and be prepared for potential losses. It’s important to set stop-loss orders to limit risk and protect capital.

In conclusion, mastering the basics of high and low strategies is essential for successful forex trading. By identifying high and low points in currency pairs and using technical analysis tools, traders can increase their chances of making profitable trades in the forex market.

Forex trading is the act of buying and selling currencies in order to make a profit. It involves speculating on the price movements of various currency pairs.

In Forex trading, high refers to the highest price that a currency pair has reached during a given period of time, while low refers to the lowest price that a currency pair has reached during the same period of time. High and low prices are important indicators used by traders to make trading decisions.

One strategy is to wait for a currency pair to breach its previous high or low and then enter a trade in the direction of the breakout. Another strategy is to use support and resistance levels as a guide for placing trades when a currency pair reaches its high or low point. Additionally, traders can use technical indicators such as moving averages or oscillators to identify potential reversals or breakouts at high or low levels.

There are several ways to identify potential reversals at high or low levels. One approach is to look for chart patterns, such as double tops or double bottoms, which can indicate a potential reversal. Another approach is to use technical indicators that measure overbought or oversold conditions, such as the Relative Strength Index (RSI) or the Stochastic Oscillator. Additionally, monitoring the volume and price action at high or low levels can provide clues about potential reversals.

When trading high and low in Forex, it is important to consider the overall trend of the currency pair, as trading against the trend can be risky. Traders should also pay attention to key support and resistance levels, as they can act as barriers to price movement. Additionally, it is important to consider market sentiment and any relevant economic news or events that could impact the currency pair’s price.

Forex trading is the process of buying and selling currencies in the foreign exchange market. Traders aim to profit from changes in exchange rates between different currencies.

In Forex trading, high refers to the highest price reached by a currency pair during a specific time period, while low refers to the lowest price reached. Traders analyze these high and low levels to make informed trading decisions.

What does 459 mean? Have you ever noticed the number 459 repeatedly appearing in your life? Perhaps you see it on license plates, clocks, or even in …

Read ArticleWho is the owner of India cement capital? India Cement Capital is one of the leading players in the cement industry, but not much is known about the …

Read ArticleIs Learn to Trade Worth it? Honest Review and Analysis Learning to trade can be an exciting and potentially lucrative endeavor, but it’s important to …

Read ArticleDiscovering Maybank Forex: All You Need to Know When traveling to a foreign country, one of the most important things to consider is how you will …

Read ArticleMastering CFD Trading: A Comprehensive Guide Contracts for Difference (CFDs) have revolutionized the world of trading, offering individuals the …

Read ArticleWhat are R1, R2, R3, and Pivot Points? In the world of financial markets, trading is a complex and ever-evolving practice. Traders continuously look …

Read Article