Forecasting the Forex Trends in 2023: Expert Insights and Predictions

What Will be the Trend in Forex in 2023? The foreign exchange market, or Forex, is a dynamic and ever-changing market that sees trillions of dollars …

Read Article

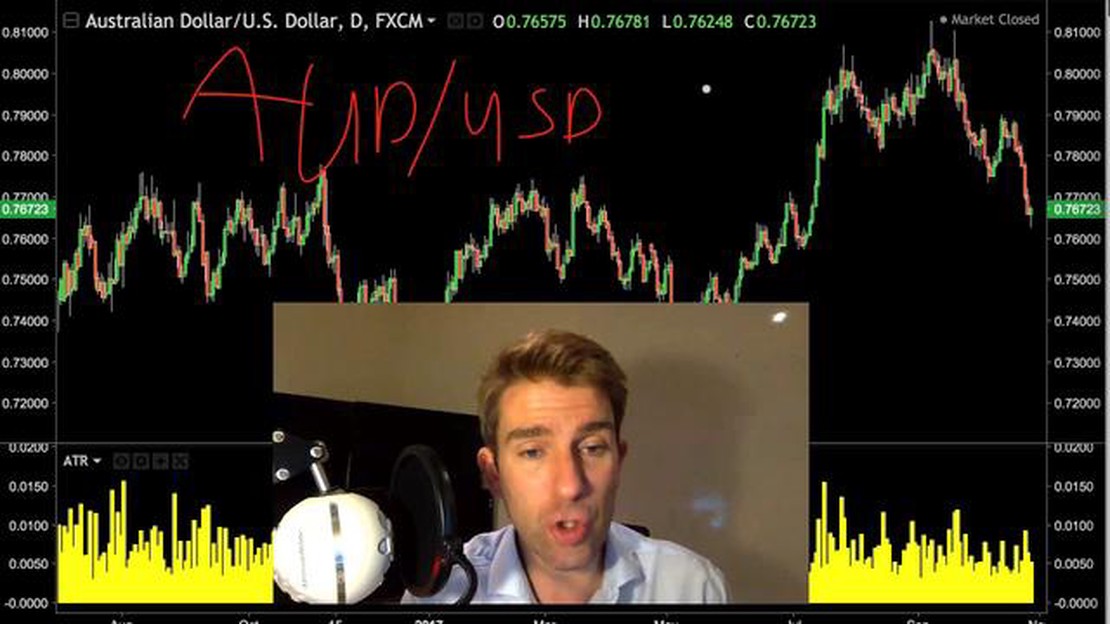

The Australian Dollar (AUD) has been under scrutiny in recent months as investors and analysts monitor its performance against the US Dollar (USD). Questions have arisen regarding whether the AUD is strengthening or weakening against the USD and what factors are driving this movement.

There are several economic indicators that can shed light on the strength of the Australian Dollar against the US Dollar. One important factor is the interest rate differential between the two countries. A higher interest rate in Australia compared to the US can attract foreign investors, leading to a stronger AUD. On the other hand, a lower interest rate in Australia can drive investors away, causing the AUD to weaken.

Another important factor to consider is the economic performance of both countries. Strong economic growth in Australia can boost investor confidence and lead to a stronger AUD. Conversely, economic downturns or negative developments can cause the AUD to weaken. In addition, fluctuations in commodity prices, particularly those of key Australian exports like iron ore and coal, can also impact the value of the AUD.

Geopolitical factors and global economic trends can also influence the AUD’s performance against the USD. For example, uncertainties surrounding trade tensions between the US and China can impact currencies worldwide, including the AUD. Similarly, global economic events, such as changes in monetary policy by major central banks, can have ripple effects on the value of the AUD relative to the USD.

In conclusion, various factors contribute to the strength or weakness of the Australian Dollar against the US Dollar. Interest rate differentials, economic performance, commodity prices, geopolitical factors, and global economic trends all play a role. Monitoring these indicators and understanding the underlying dynamics can help investors and analysts make informed predictions about the future movement of the AUD-USD exchange rate.

Over the past few months, the Australian Dollar (AUD) has shown significant strength against the United States Dollar (USD). This is largely due to several factors, including the country’s strong economic performance, increased commodity prices, and a relatively stable political climate.

One of the key drivers of the AUD’s strength against the USD has been Australia’s robust economic growth. The country has experienced consistent GDP growth, driven by strong consumer spending, solid business investment, and a booming housing market. This has boosted investor confidence in the Australian economy and led to an increase in demand for the AUD, pushing its value higher.

In addition, rising commodity prices, particularly for iron ore and coal, have had a positive impact on the AUD. Australia is one of the world’s largest exporters of these commodities, and as their prices have risen, so too has the demand for Australian exports. This has resulted in increased revenue for the country and a stronger currency.

The relative stability of Australia’s political climate has also contributed to the AUD’s strength against the USD. Unlike many other countries, Australia has enjoyed a prolonged period of political stability, with a strong and effective government. This has reassured investors and led to increased confidence in the country’s economy, pushing up the value of the AUD.

| Date | AUD/USD Exchange Rate |

|---|---|

| January 1, 2021 | 0.7652 |

| February 1, 2021 | 0.7768 |

| March 1, 2021 | 0.7776 |

| April 1, 2021 | 0.7604 |

| May 1, 2021 | 0.7732 |

Looking at the table above, we can see that the AUD/USD exchange rate has fluctuated over the past few months. However, overall, the AUD has remained relatively strong against the USD, indicating the continued strength of the Australian economy compared to the US.

Read Also: What does the AVG () function return? – Explanation and Examples

It’s important to note that exchange rates are influenced by a wide range of factors, including market sentiment, interest rates, and geopolitical events. These factors can cause fluctuations in exchange rates, so it’s always important to monitor the latest developments to stay informed about the AUD/USD exchange rate.

The Australian dollar has shown signs of strength against the US dollar in recent months. Several factors have contributed to this upward trend:

1. Strong Australian Economy: The Australian economy has exhibited resilience and steady growth, driven by factors such as robust export demand for commodities like iron ore and coal. This has bolstered investor confidence in the Australian dollar.

2. Interest Rate Differentials: The Reserve Bank of Australia (RBA) has maintained a relatively higher interest rate compared to the US Federal Reserve. This attracts foreign investors seeking higher returns on their investments, which in turn supports the Australian dollar.

Read Also: Limitations of the Method of Moving Average: Understanding Its Two Key Drawbacks

3. Global Risk Sentiment: Improvements in global risk sentiment can also contribute to the strength of the Australian dollar. When global markets exhibit optimism, investors tend to seek out riskier assets such as the Australian dollar instead of safe-haven currencies like the US dollar.

4. China’s Economic Performance: The Australian dollar’s strength is closely tied to China’s economic performance. As Australia’s largest trading partner, a strong Chinese economy translates to increased demand for Australian exports, which benefits the Australian dollar.

5. Market Speculation and Positioning: Market speculation and positioning can significantly impact currency strength. If traders anticipate continued strength in the Australian dollar, they may increase their positions, leading to further upward pressure on the currency.

6. Political Stability: Australia’s strong political stability relative to other countries can bolster investor confidence in the Australian dollar. Political stability lowers the perception of risk, attracting foreign capital and supporting the currency.

It is worth noting that currency markets are complex, and the Australian dollar’s strength against the US dollar can be influenced by various factors. It is important for investors and traders to closely monitor these factors and keep abreast of any developments that could affect the currency’s value.

The strengthening of the Australian dollar against the US dollar can be attributed to several factors. Firstly, Australia’s strong economic fundamentals, such as low unemployment rate and stable economic growth, have attracted foreign investors, leading to an increased demand for the Australian dollar. Additionally, the relatively high interest rates in Australia compared to the US have also made Australian assets more attractive, which has further boosted the value of the Australian dollar.

The strengthening of the Australian dollar can have both positive and negative impacts on the economy. On the positive side, it makes imported goods cheaper, which can help to lower inflation and improve the purchasing power of consumers. However, it can also make Australian exports more expensive, making them less competitive in the global market. This can negatively affect export-dependent industries, such as manufacturing and agriculture.

It is difficult to predict the future movements of currency exchange rates as they are influenced by a wide range of factors, including economic indicators, geopolitical events, and market sentiment. However, some analysts believe that the Australian dollar could continue to strengthen against the US dollar in the near term due to factors such as the recovering global economy and the ongoing demand for Australian commodities. It is always advisable to monitor the latest economic developments and seek guidance from a financial advisor when making currency-related decisions.

A strengthening Australian dollar can pose various risks to the economy. One major risk is the negative impact on export-oriented industries, as it makes their products more expensive in foreign markets, reducing their competitiveness. This can lead to job losses and decreased economic growth. Additionally, a strong currency can also attract speculative investments, potentially leading to asset bubbles and financial instability. It is important for policymakers to closely monitor the currency movements and implement appropriate measures to mitigate these risks.

The strength of the Australian dollar can have a significant impact on tourism. A stronger Australian dollar makes it more expensive for foreigners to visit Australia, as their currency has less purchasing power. This can discourage international tourists and lead to a decline in tourism revenues. On the other hand, a weaker Australian dollar can attract more tourists, as their money can go further in Australia. This can boost tourism-related industries and contribute to economic growth.

What Will be the Trend in Forex in 2023? The foreign exchange market, or Forex, is a dynamic and ever-changing market that sees trillions of dollars …

Read ArticleExchange rate: Uganda shilling to pound The Uganda shilling to pound exchange rate is something that many individuals, travelers, and businesses need …

Read ArticleWhere can I get money from Iremit? Are you tired of waiting days or even weeks to receive money from abroad? Look no further - Iremit is here to help. …

Read ArticleHow much money do you need to trade NAS100? Trading NAS100, also known as the Nasdaq 100, is an exciting and potentially profitable venture. This …

Read ArticleUnderstanding the Mechanics of CSOP Options CSOP options, also known as Company Share Option Plans, are a type of employee share scheme that allows …

Read ArticleCost of eSignal Exchange Fees: Everything You Need to Know When it comes to trading stocks, futures, options, and Forex, it is important to consider …

Read Article