What is the Purpose of Moving Average in Forex Trading?

Benefits of Using Moving Average in Forex Trading When it comes to forex trading, technical analysis plays a crucial role in making informed trading …

Read Article

The moving average method is a popular statistical technique used to analyze data over a certain period of time. It is commonly used in various fields such as finance, economics, and marketing. While this method has its merits, it is important to understand its limitations in order to make informed decisions based on the results.

Firstly, one of the key drawbacks of the moving average method is its sensitivity to outliers. When outliers are present in the dataset, they can significantly affect the calculated averages, leading to misleading results. This limitation is particularly relevant in situations where extreme values can occur, such as in financial market data. It is important for analysts to be aware of this limitation and consider alternative methods or adjust the dataset to mitigate the impact of outliers.

Secondly, the moving average method can potentially lag behind real-time changes in the data. This occurs because the moving average calculation involves averaging values over a specific period, which can cause a delay in reflecting the most recent changes. This drawback makes the method less suitable for analyzing rapidly changing data or making quick decisions based on real-time information. Analysts should take this into account and consider using other techniques, such as exponential moving averages, that can provide more timely insights.

In conclusion, while the moving average method is commonly used and has its benefits, it is important to be aware of its limitations. Sensitivity to outliers and potential lagging behind real-time changes are two key drawbacks that can impact the accuracy and effectiveness of the results. By understanding these limitations, analysts can make better informed decisions and explore alternative methods when necessary.

The method of moving average is a widely used tool for analyzing time series data. It is a simple and intuitive approach to determine the trend of a data set and to smooth out any noise or fluctuations. However, it is important to understand that this method has its limitations and may not always provide accurate results.

Lagging Indicator: One of the main limitations of the moving average method is that it is a lagging indicator. This means that it takes into account past data to calculate the average and provide a trend. As a result, the moving average may not reflect the current market conditions or provide accurate predictions for future values. It is especially ineffective in highly volatile markets or during periods of rapid changes.

Insensitive to Market Movements: Another limitation of moving average is that it is insensitive to sudden market movements. When there are significant changes in the data set, such as sharp spikes or drops, the moving average may not capture these changes accurately. It tends to smooth out the data and may not reflect the true magnitude of the market movements. This can lead to false signals or misinterpretations of the data.

Read Also: Is Bank of America a Good Investment? Pros and Cons of Investing in Bank of America

In conclusion, while the method of moving average is a popular and widely used tool, it is important to be aware of its accuracy limitations. It should be used with caution, especially in volatile markets or when there are sudden market movements. Traders and analysts should consider using other technical indicators or combining the moving average with other methods to obtain more accurate and reliable results.

One of the key drawbacks of using the method of moving average is the lag it introduces in the decision-making process. The moving average is a lagging indicator because it relies on past data to calculate the average, which means that it cannot predict or anticipate future changes or trends.

When using a moving average to analyze data, the lag becomes evident because the moving average reacts to changes in data only after they have occurred and have been included in the calculation. This lag can delay decision-making and prevent timely actions to be taken.

For example, let’s say you are using a 10-day moving average to analyze stock prices. If the stock suddenly starts increasing in value, the moving average will take several days to catch up and reflect this change. By the time the moving average indicates a rising trend, the stock price may have already increased significantly, causing a delay in taking action such as buying or selling the stock.

This lag in decision-making can be particularly problematic in fast-paced markets where prices can change rapidly. Traders and investors who rely solely on moving averages may miss out on profitable opportunities or be unable to react quickly enough to avoid losses.

It is important to be aware of this limitation of the moving average and consider it in conjunction with other analysis tools and indicators to make well-informed decisions in a timely manner.

Read Also: Understanding the Meaning of Clearing in Trading - All You Need to Know

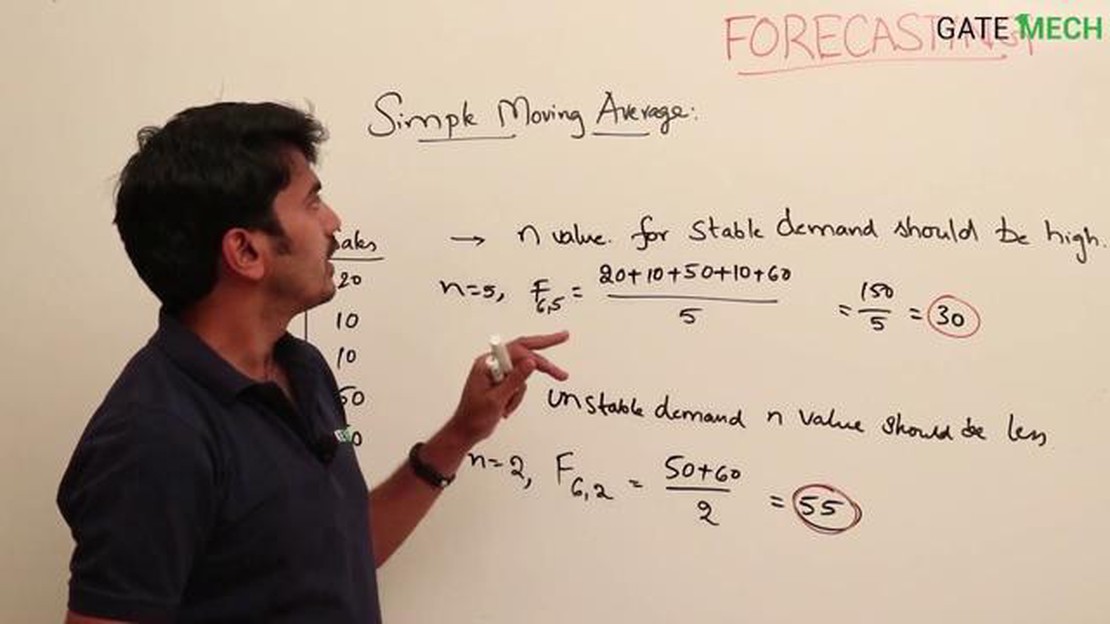

The method of moving average is a statistical technique used to analyze data points by calculating the average of a subset of data points within a given time period.

The two key drawbacks of the method of moving average are that it lags behind the actual data and it gives equal weight to all data points within the time period.

The method of moving average lags behind the actual data because it uses historical data to calculate the average, which means it cannot account for sudden changes or trends that may occur in the future.

The method of moving average gives equal weight to all data points within the time period because it calculates the average based on an arithmetic mean, which assigns equal importance to each data point.

The limitations of the method of moving average can affect data analysis by potentially providing inaccurate or delayed information about trends or changes in the data, especially in dynamic or volatile situations.

The method of moving average is a statistical technique used to analyze time series data by calculating the average value of a variable over a specified period of time.

Benefits of Using Moving Average in Forex Trading When it comes to forex trading, technical analysis plays a crucial role in making informed trading …

Read ArticleUnderstanding the Moving Average and CCI Indicators When it comes to trading in the financial markets, having a solid understanding of technical …

Read ArticleExchange Rate: How Much is $1 in US in India? The USD to INR exchange rate is the rate at which $1 US Dollar is currently traded for Indian Rupees. It …

Read ArticleIs New York Trading Session Open Now? The New York Stock Exchange (NYSE) is one of the world’s largest and most prestigious stock exchanges. It is …

Read ArticleWhat is another word for whipsaw? If you are looking for an alternative word to whipsaw, this article is for you. The term whipsaw is commonly used to …

Read ArticleCan chart patterns actually improve trading performance? Chart patterns have long been used by traders and investors as a tool to identify potential …

Read Article