What is the minimum deposit for Tifia? - All you need to know

What is the minimum deposit for Tifia? When trading in the financial markets, it is important to find a broker that suits your needs and offers …

Read Article

Technical analysis is a popular method used by traders and investors to predict future price movements in financial markets. One of the commonly used indicators in technical analysis is the Relative Strength Index (RSI). RSI divergence, a concept derived from the RSI indicator, is believed to be a reliable signal for predicting price reversals and trend changes.

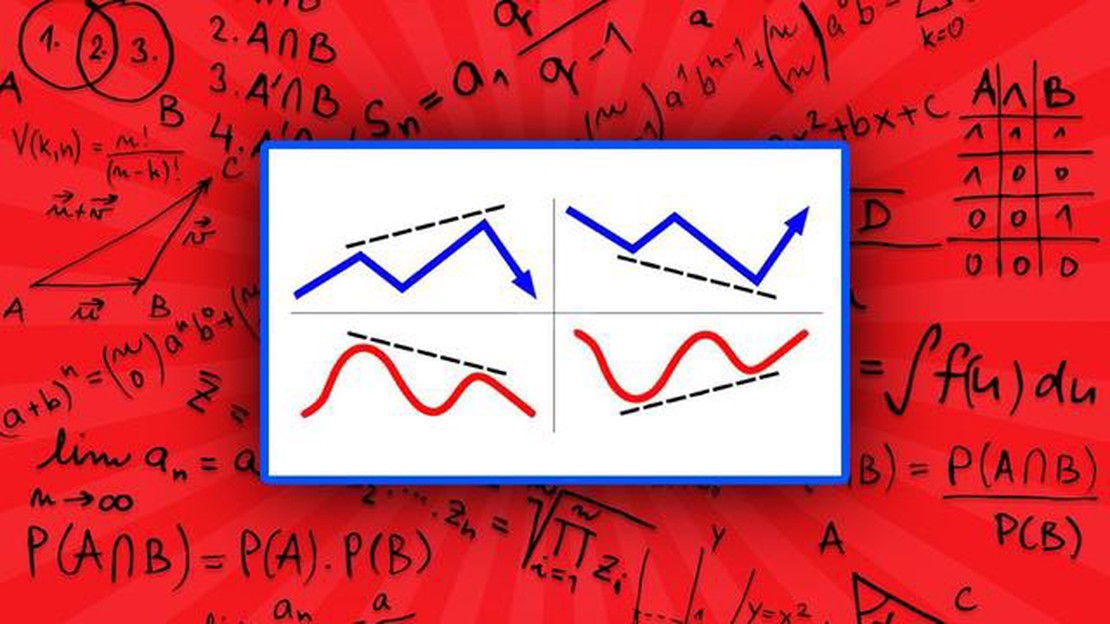

RSI divergence occurs when the price of an asset moves in one direction, while the RSI indicator moves in the opposite direction. This discrepancy is seen as a potential signal that the current trend may be weakening and a reversal is likely to occur. Traders often interpret RSI divergence as a confirmation to enter or exit a trade, depending on the direction of the divergence.

However, the reliability of RSI divergence as a predictive tool has been a topic of debate among traders and analysts. While some argue that RSI divergence is a strong signal for price reversals, others believe that it is not a reliable indicator and should be used in conjunction with other technical analysis tools.

It is important to note that no single indicator or method can guarantee accurate predictions of price movements. Market conditions are influenced by a wide range of factors, and price movements can be unpredictable. Traders should use RSI divergence as one of many tools in their technical analysis toolkit, and combine it with other indicators and strategies for more accurate and informed trading decisions.

Further research and analysis are needed to determine the effectiveness of RSI divergence in predicting price movements. Traders should also consider the limitations and drawbacks of using RSI divergence, such as false signals and lagging indicators. Developing a comprehensive understanding of technical analysis and regularly testing and adjusting trading strategies can help traders make more informed decisions and improve their overall trading performance.

The Relative Strength Index (RSI) is a popular technical indicator used by traders to analyze market movements and identify potential price reversals. One of the key concepts related to RSI is divergence, which occurs when the RSI indicator and the price movement of a security move in opposite directions.

RSI divergence can be categorized into two types: bullish divergence and bearish divergence. Bullish divergence occurs when the price of a security forms a lower low while the RSI indicator forms a higher low. This suggests that despite the downward price movement, the buying pressure is increasing. It can be an early indication of a potential trend reversal to the upside. On the other hand, bearish divergence occurs when the price of a security forms a higher high while the RSI indicator forms a lower high. This suggests that despite the upward price movement, the selling pressure is increasing. It can be an early indication of a potential trend reversal to the downside.

Understanding RSI divergence and its potential implications requires careful analysis and consideration of other factors. It is important to note that RSI divergence does not provide a guarantee of future price movements, but rather serves as a tool to help traders make informed decisions. It is crucial to take into account other technical indicators, fundamental analysis, and market conditions before making any trading decisions based on RSI divergence.

Traders should also be aware of the limitations of RSI divergence. Sometimes, false signals can occur, where RSI divergence is observed but no significant price movement follows. This emphasizes the importance of using RSI divergence in conjunction with other indicators and confirming signals from different sources to validate potential trade opportunities.

Despite its limitations, RSI divergence can be a valuable tool in a trader’s toolkit when used correctly. It can provide early indications of potential trend reversals and help traders identify possible trading opportunities. However, it is essential to exercise caution, conduct thorough analysis, and consider multiple factors before making trading decisions based on RSI divergence.

Predicting price movements is of paramount importance in financial markets. Traders and investors rely on accurate predictions to make informed decisions about buying or selling assets. The ability to accurately forecast price movements can greatly enhance profitability and minimize risks.

Read Also: A Brief History of Employee Stock Ownership Plans (ESOPs)

By accurately predicting price movements, traders can identify potential entry and exit points for their trades. This allows them to maximize their profits and minimize losses. Additionally, accurate predictions can help traders formulate effective trading strategies and improve their overall performance.

Price movements are influenced by various factors, including market trends, economic indicators, and news events. By predicting these movements, traders can stay ahead of market trends and take advantage of profitable opportunities. This can give them a competitive edge in the market and increase their chances of success.

Read Also: Using ChatGPT for Trading: Pros, Cons, and Potential Strategies

Furthermore, accurate predictions can help in risk management. By anticipating price movements, traders can implement appropriate risk management strategies, such as setting stop-loss orders or adjusting their position sizes. This can help protect their capital and minimize potential losses.

| Benefits of predicting price movements: |

|---|

| Maximizing profits |

| Minimizing losses |

| Formulating effective trading strategies |

| Staying ahead of market trends |

| Improved risk management |

| Increased chances of success |

In conclusion, predicting price movements is crucial for traders and investors in financial markets. Accurate predictions can lead to increased profitability, improved risk management, and better trading strategies. By understanding and utilizing predictive tools, such as RSI divergence, traders can gain a competitive edge and enhance their overall trading performance.

RSI divergence is a technical analysis tool that compares the price movements of a security with the Relative Strength Index (RSI) indicator. It works by looking for discrepancies between the price and the indicator, which could indicate potential trend reversals or continuations.

The reliability of RSI divergence in predicting price movements is a subject of debate among traders and analysts. Some believe that it can be an effective tool, while others are more skeptical. It is important to note that no single tool or indicator can accurately predict price movements with 100% certainty.

There are several potential limitations or drawbacks of using RSI divergence as a predictive tool. Firstly, it may generate false signals, leading to incorrect predictions. Additionally, it may not work as effectively in certain market conditions or for different types of securities. Finally, it is important to consider other factors and indicators when making trading decisions, as RSI divergence alone may not provide a complete picture of market dynamics.

There are several strategies that traders commonly use to improve the effectiveness of RSI divergence. One approach is to combine RSI divergence with other technical analysis tools or indicators, such as moving averages, trend lines, or volume indicators. Another strategy is to use multiple timeframes to confirm the signals generated by RSI divergence. Traders may also adjust the parameters of the RSI indicator to better suit the specific security or market being analyzed.

There are many alternative tools and indicators that traders can use alongside or instead of RSI divergence. Some popular options include moving averages, Bollinger Bands, MACD (Moving Average Convergence Divergence), and stochastic oscillators. The choice of which tool or indicator to use ultimately depends on the trader’s preferences and trading strategies.

RSI divergence refers to the discrepancy between price movements and the movements of the relative strength index (RSI) indicator. It is used to predict potential reversals or changes in price direction. When the price makes a new high or low, but the RSI fails to make a corresponding high or low, it signals a potential reversal or continuation of the current trend.

What is the minimum deposit for Tifia? When trading in the financial markets, it is important to find a broker that suits your needs and offers …

Read ArticleHow to Take Profit on MT5: A Comprehensive Guide Are you new to trading on the financial markets and want to learn how to make a profit on MT5? Look …

Read ArticleCalculating Growth Rate: A Step-by-Step Guide Calculating growth rate is an essential skill for individuals and businesses alike, as it provides …

Read ArticleHow many people lose in Forex trading? Why do so many people lose in Forex? Learn the key factors that contribute to Forex losses. Forex trading is a …

Read ArticleWhat is the difference between AXE and IOI? When it comes to understanding the technologies behind computing and electronic systems, two acronyms …

Read ArticleUnderstanding the Exponential Smoothing Factor Exponential smoothing is a popular statistical method used to forecast data, particularly time series …

Read Article