Gold Price in Singapore Today - Current Rates and Trends

Current Gold Price in Singapore Today The price of gold in Singapore today is an important topic for investors and consumers alike. As one of the …

Read Article

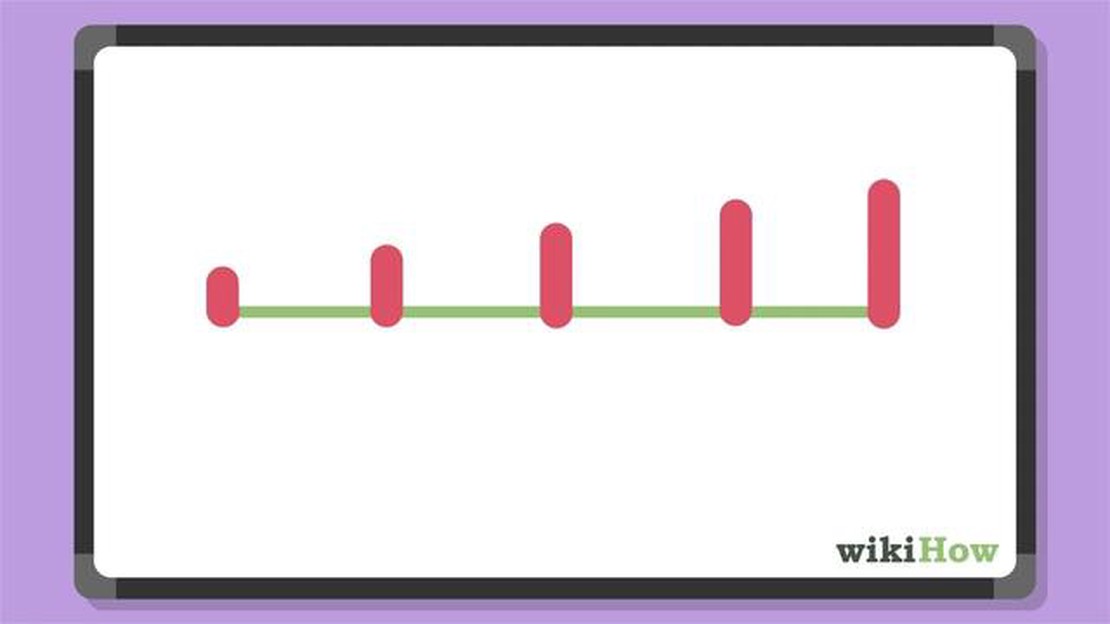

Calculating growth rate is an essential skill for individuals and businesses alike, as it provides valuable insights into the success and progress of an entity over a specific period of time. Whether you are analyzing the growth of a company, investment, population, or even personal savings, understanding how to calculate the growth rate allows you to make informed decisions and set realistic goals.

To calculate the growth rate, you need two pieces of information: the starting value and the ending value. The growth rate is typically expressed as a percentage. It measures how much the value has increased or decreased over a certain period. A positive growth rate indicates an increase, while a negative growth rate reflects a decrease.

One common method to calculate growth rate is the compound annual growth rate (CAGR), which takes into account the compounding effect of growth over multiple periods. CAGR smooths out the fluctuations and provides a more accurate representation of the average growth rate over time. This is particularly useful when analyzing investments or business performance over several years.

Another method to calculate growth rate is the simple growth rate, which measures the change in value over a single period. This method is useful for shorter timeframes or when comparing growth rates between different entities. It is calculated by subtracting the starting value from the ending value, dividing it by the starting value, and then multiplying by 100 to express it as a percentage.

Understanding how to calculate growth rate is essential for making informed decisions, evaluating investment opportunities, and tracking progress over time. By utilizing different methods such as CAGR and simple growth rate, you can gain a comprehensive understanding of how entities are growing and make strategic choices based on these insights.

In this comprehensive guide, we will dive deeper into the different methods of calculating growth rate, explore real-world examples, and provide step-by-step instructions to help you master this valuable skill. Whether you are a seasoned analyst or a beginner, this guide will equip you with the knowledge you need to calculate growth rates accurately and confidently.

Growth rate is a measure of the increase in a specific variable over time. It is a way to quantify the rate at which something is growing or changing. Understanding growth rate is important in many fields, including finance, economics, and biology.

When calculating growth rate, it’s important to consider the starting value and the ending value of the variable. The formula for calculating growth rate is:

Growth Rate = ((Ending Value - Starting Value) / Starting Value) * 100

This formula calculates the percentage increase or decrease in the variable over time. A positive growth rate indicates an increase, while a negative growth rate indicates a decrease.

It’s important to note that growth rate is a relative measure, meaning it’s always expressed as a percentage. This allows for easy comparison between different variables and time periods.

Read Also: Calculating Moving Weighted Average Inventory: A Step-by-Step Guide

Growth rate can be used to analyze various aspects, such as population growth, economic growth, revenue growth, and stock market performance. By understanding growth rate, individuals and businesses can assess the progress and make informed decisions.

There are different types of growth rates, such as compound annual growth rate (CAGR), which measures the average annual growth over a specified period. CAGR is commonly used in financial analysis to assess investment returns.

In conclusion, understanding growth rate is essential for analyzing and evaluating changes over time. By utilizing the formula and different types of growth rates, individuals and businesses can gain valuable insights and make informed decisions about their future plans and strategies.

There are several methods available for calculating growth rate, each with its own advantages and limitations. These methods can be used to analyze the growth of a variety of entities, including economies, populations, and businesses. Here are some common methods used to calculate growth rate:

1. Simple Growth Rate: The simple growth rate is calculated by subtracting the initial value from the final value, dividing the result by the initial value, and multiplying by 100. This method provides a basic way to measure growth but does not take into account any fluctuations or changes over time.

2. Compound Annual Growth Rate (CAGR): The compound annual growth rate considers the average annual growth of an entity over a specified period of time. It takes into account the compounding effect and is often used to calculate growth rates for investments and businesses. CAGR is calculated by dividing the final value by the initial value, raising the result to the power of 1 divided by the number of years, subtracting 1, and multiplying by 100.

Read Also: Discover the Price Action Pattern Indicator for MT4: A Powerful Tool for Traders

3. Exponential Growth Rate: The exponential growth rate is applicable when the growth of an entity is exponential, meaning it increases at an accelerating rate over time. This method is commonly used in biology and population growth analysis. It can be calculated by taking the natural logarithm of the final value divided by the initial value and dividing by the number of years.

4. Average Growth Rate: The average growth rate provides a measure of the overall growth of an entity over a specified period of time. It is calculated by dividing the final value by the initial value, subtracting 1, dividing by the number of years, and multiplying by 100. This method can be useful when comparing the growth rates of multiple entities.

5. Geometric Mean Growth Rate: The geometric mean growth rate calculates the average growth rate of an entity over multiple periods of time. It considers the compounding effect and is often used in financial analysis. This method is calculated by taking the nth root of the ratio of the final value to the initial value, subtracting 1, and multiplying by 100.

These methods provide different perspectives on growth rates and can be used depending on the specific needs and characteristics of the entity being analyzed. It is important to choose the appropriate method and carefully consider any assumptions or limitations associated with each method.

Growth rate is a measure that shows the increase or decrease in a variable over a period of time.

To calculate the growth rate, you need to know the starting and ending values of the variable. Subtract the starting value from the ending value, divide the result by the starting value, and multiply by 100 to get the percentage growth rate.

Sure! Let’s say a company’s revenue was $500,000 last year and $750,000 this year. To calculate the growth rate, subtract $500,000 from $750,000 to get $250,000. Divide $250,000 by $500,000 and multiply by 100 to get a growth rate of 50%.

Yes, there is! The formula for compound annual growth rate (CAGR) is [(Ending value / Starting value)^(1/number of years)] - 1. Multiply the result by 100 to get the CAGR as a percentage.

Calculating growth rate is important because it allows you to analyze the performance of a variable over time. It helps you understand whether the variable is increasing or decreasing, and by how much. This information is vital for making informed decisions in various fields like finance, business, and economics.

Growth rate is a measure of the increase in size, quantity, or value of something over a period of time. It is important because it helps us gauge the progress or decline of a particular variable and make informed decisions based on the trends.

Current Gold Price in Singapore Today The price of gold in Singapore today is an important topic for investors and consumers alike. As one of the …

Read ArticleRBI Exchange Rate for GBP Are you planning to travel to the United Kingdom or make international transactions involving British pounds? It’s essential …

Read ArticleAlligator Indicator with Fractals: A Comprehensive Guide The Alligator Indicator is a popular technical analysis tool used by traders to identify …

Read ArticleHow to Become a Sniper Trader Becoming a successful sniper trader requires more than just an understanding of the stock market - it requires a unique …

Read Article4 Indicators for Measuring the Sales Market Measuring the sales market and accurately assessing its performance is essential for any business. Having …

Read ArticleHow to Add a World Clock to Windows 7 Desktop Keeping track of time across different time zones can be a challenge, especially if you have friends or …

Read Article